Market Overview

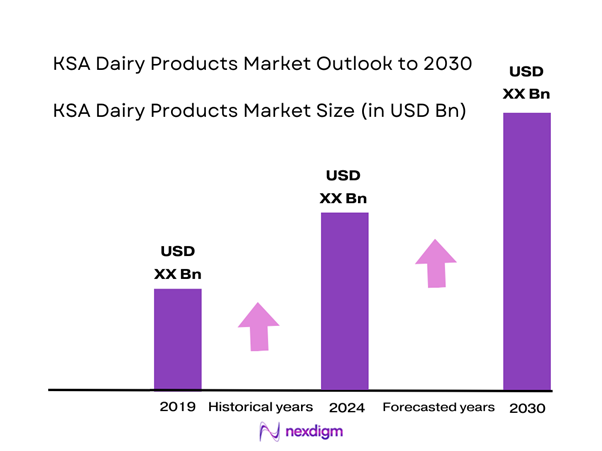

The KSA dairy product market is valued at USD 5.8 billion in 2024 with a Compound Annual Growth Rate of 4.05% from 2024 to 2030, driven primarily by the rising population and increasing health consciousness among consumers regarding dairy’s nutritional benefits. This growth is further supported by government policies aiming to enhance local dairy production to meet domestic demand. As a result, the sector has gained momentum, with a market size bolstered by ongoing investment in dairy production and distribution capabilities.

Significant urban centers such as Riyadh, Jeddah, and Dammam dominate the KSA dairy market, primarily due to these cities’ high population density and economic activity. Riyadh, being the capital, has substantial purchasing power, while Jeddah serves as a commercial hub for imports and consumer goods. Dammam’s strategic location near oil and transport routes also facilitates distribution, making these cities pivotal to the market’s growth.

The increasing population in Saudi Arabia is a significant driver for the dairy product market. As of 2023, the population is approximately 36 million, with a projected growth rate of about 1.49% annually. This demographic growth fuels higher demand for essential products like dairy, as the consumption patterns indicate a direct correlation between population size and agricultural demand.

Market Segmentation

By Product Type

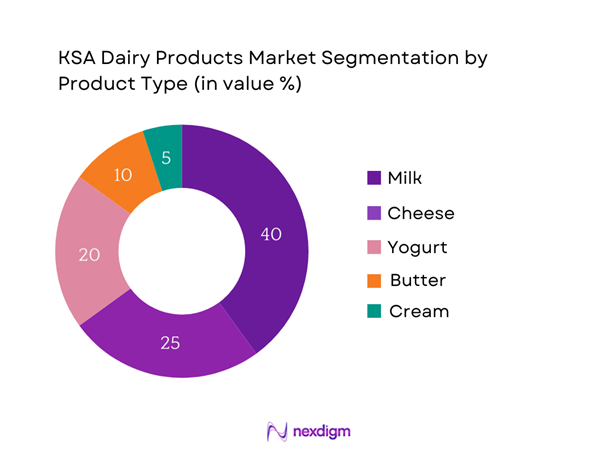

The KSA dairy product market is segmented by product type into milk, cheese, yogurt, butter, and cream. Milk holds a dominant market share due to its foundational role in Saudi households and its versatility across various consumption occasions. The tradition of milk consumption in the region, boosted by government initiatives promoting its health benefits, ensures its continued popularity. Additionally, brands are launching innovative value-added milk products, enhancing consumer preference and solidifying its market standing.

By Distribution Channel

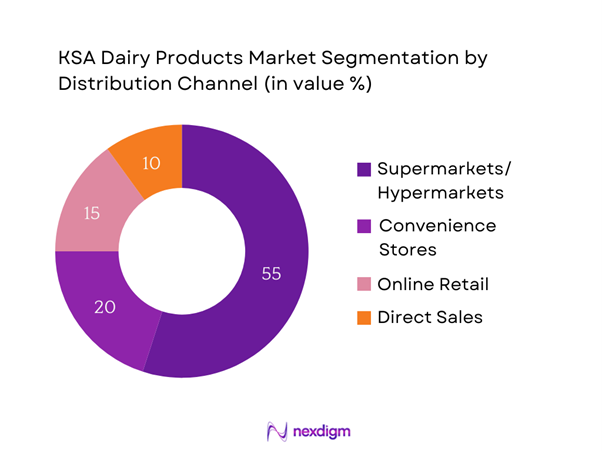

The KSA dairy product market is also segmented by distribution channel into supermarkets/hypermarkets, online retail, convenience stores, and direct sales. Supermarkets and hypermarkets dominate the market, representing the largest share due to their extensive product offerings and consumer convenience. These retail formats provide consumers with a one-stop shopping experience, thus encouraging bulk purchases. Additionally, the growing trend of lifestyle changes and increased consumption of dairy products among health-conscious consumers further solidifies the dominance of supermarkets/hypermarkets.

Competitive Landscape

The KSA dairy product market is characterized by several key players, including major companies such as Almarai, Nadec, and SADAFCO. These companies have a significant influence on shaping market trends and consumer preferences, as they leverage their extensive distribution networks, brand loyalty, and diverse product ranges to dominate the market.

| Company | Establishment Year | Headquarters | Product Range | Market Focus |

| Almarai | 1977 | Riyadh | – | – |

| Nadec | 1981 | Riyadh | – | – |

| SADAFCO | 1976 | Jeddah | – | – |

| Al Safi Danone | 1981 | Riyadh | – | – |

| United Dairy Farmers | 1997 | Qassim | – | – |

KSA Dairy Product Market Analysis

Growth Drivers

Increasing Health Consciousness

There is a marked increase in health consciousness among Saudi consumers, leading to heightened demand for dairy products perceived as healthy. Recent studies indicate that 88% of individuals in Saudi Arabia consider nutritional content while making food choices, which significantly shifts product demand towards fortified and low-fat dairy options. Furthermore, the country’s health initiatives promote the consumption of dairy as a key source of calcium and protein, essential for both children’s and adults’ health.

Urbanization Trends

Urbanization in Saudi Arabia is rapidly accelerating. This trend corresponds to lifestyle changes, where convenience becomes a priority. Urban centers are experiencing a higher demand for packaged and ready-to-eat dairy products, such as cheese and yogurt. Increased disposable income in urban areas also contributes to this growth, as families opt for higher-quality dairy products for better health outcomes. This urban shift not only affects consumption patterns but also influences the retail and distribution landscape in dairy.

Market Challenges

Fluctuating Milk Prices

Fluctuating milk prices pose a challenge for the dairy market in Saudi Arabia, affecting profitability and pricing strategies. Milk prices have shown significant variance, with an average fluctuation between USD 0.48 and USD 0.54 per liter in recent quarters. External factors such as global feed prices, weather conditions, and import tariffs influence these fluctuations. Such inconsistencies can lead to volatility in the market, causing concerns among producers about sustainability and long-term investment prospects in dairy farming.

Supply Chain Disruptions

Supply chain disruptions continue to be a significant concern for the dairy industry in Saudi Arabia. Factors such as logistical issues, particularly during the COVID-19 pandemic, have led to difficulties in milk collection, processing, and distribution. To illustrate, reports indicated that approximately 30% of dairy producers experienced increased transportation costs in 2022. Such disruptions not only affect the availability of products but can also lead to increased prices for consumers. Addressing these supply chain vulnerabilities is crucial for ensuring stability in the dairy market.

Opportunities

Export Potential

The KSA dairy product market holds significant export potential, particularly as the country ramps up its production capabilities. For instance, in 2022, Saudi Arabia exported dairy products valued at USD 1.4 billion, with key markets including the UAE, Qatar, and Kuwait. With ongoing investments in dairy production and processing facilities, the country aims to increase its export volumes significantly. The recent trade agreements and partnerships with Gulf Cooperation Council (GCC) countries provide additional avenues for expanding exports, supporting local producers in reaching international markets while promoting economic growth.

Product Diversification

The KSA dairy market presents abundant opportunities for product diversification to meet evolving consumer preferences. A notable trend is the introduction of flavored yogurts and functional dairy products fortified with vitamins, minerals, and probiotics. In 2023, it was reported that nearly 40% of consumers show a preference for dairy products with added health benefits. Innovations such as lactose-free and organic milk are also gaining traction, catering to niche markets within the broader dairy sector. This diversification not only enhances consumer engagement but also allows producers to target new demographics effectively.

Future Outlook

The KSA dairy product market is projected to witness significant growth in the coming years, driven by factors such as continued urbanization, increasing awareness of health benefits, and robust government support promoting local dairy production. As consumer preferences evolve towards more nutritious and fortified dairy options, innovation within the industry is likely to deepen, leading to a diversification in product offerings. Additionally, advancements in distribution channels, particularly through e-commerce, will further enable market penetration.

Major Players

- Almarai

- Nadec

- SADAFCO

- Al Safi Danone

- United Dairy Farmers

- Al Jazeera Dairy Company

- Tarboush Dairy

- Al-Bait Al-Farakh Dairy

- Rahman Dairy Products

- Qassim Agricultural Products Co.

- Al-Othaim Dairy

- Farm Fresh Dairy

- Baladna

- Milko Dairy

- Aseer Dairy

Key Target Audience

- Retail Chains

- Wholesalers and Distributors

- Food Service Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Food and Drug Authority)

- Health and Wellness

- Dairy Industry Associations

- Large Agricultural Producers

Research Methodology

Step 1: Identification of Key Variables

The research process begins with constructing an ecosystem map that identifies all significant stakeholders within the KSA dairy product market. This is accomplished through extensive desk research, leveraging both secondary and proprietary databases to compile comprehensive industry-level information, aiming to identify and define critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data concerning the KSA dairy product market is compiled and analyzed. This includes examining market penetration rates, the ratio of supplier to consumer dynamics, and the associated revenue generation from these interactions. An assessment of quality metrics is also undertaken to ensure the reliability and accuracy of the market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through consultations with industry experts via telephone interviews. These experts represent a diverse range of entities within the market, offering valuable operational and financial insights that will be critical in refining and corroborating the market data collected earlier.

Step 4: Research Synthesis and Final Output

The final phase of the research involves direct engagement with multiple dairy manufacturers to gain in-depth insights regarding product segments, sales performance, consumer behaviors, and other pertinent factors. This interaction directly complements the statistics derived from previous phases, ensuring a comprehensive, accurate, and validated analysis of the KSA dairy product market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Timeline of Major Players

- Business Cycle

- Value Chain and Supply Chain Analysis

- Growth Drivers

Rising Health Consciousness

Increasing Urbanization

Expanding Distribution Networks - Market Challenges

Regulatory Compliance

Supply Chain Issues - Opportunities

Health-Focused Product Innovation

Sustainable Packaging Solutions - Trends

Rise in Plant-Based Alternatives

E-commerce Growth - Government Regulation

Food Safety Standards

Import Regulations - SWOT Analysis

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Milk

– Fresh Milk

– Long-Life (UHT) Milk

– Flavored Milk

– Lactose-Free Milk

– A2/Organic Milk

Cheese

– Processed Cheese

– Natural Cheese

– Cream Cheese

– White Cheese

– Shredded/Sliced Cheese

Yogurt

– Plain Yogurt

– Flavored Yogurt

– Greek Yogurt

– Drinking Yogurt

– Probiotic/Functional Yogurt

Butter

– Salted Butter

– Unsalted Butter

– Clarified Butter (Ghee)

– Organic Butter

Cream

– Fresh Cream

– Whipping Cream

– Cooking Cream

– UHT Cream - By Distribution Channel (In Value %)

Supermarkets/Hypermarkets

Convenience Stores

Online Platforms

Direct Sales - By Packaging Type (In Value %)

Rigid Packaging

– HDPE Bottles

– Tetra Pak Cartons

– Plastic Cups & Tubs

– Glass Jars

Flexible Packaging

– Sachets & Pouches

– Vacuum-Sealed Film

– Foil & Laminated Wrappers

– Multi-layered bags - By Region (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Makkah - By Consumer Demographics (In Value %)

Age Group

– Children (0–14)

– Youth (15–34)

– Adults (35–59)

– Seniors (60+)

Socioeconomic Status

– Upper-Income Households

– Middle-Income Households

– Low-Income Households - By Usage (In Value %)

Household

Commercial - By Organic vs. Conventional (In Value %)

Organic Dairy Products

– Organic milk

– Organic yogurt and probiotic drinks

– Organic cheese and butter

Conventional Dairy Products

– Mass-market milk

– Cheese

– Butter

– Yogurt

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Dairy Products Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Organizational Structure, Revenues, Revenues by Type of Dairy Products, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Unique Value Proposition, Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Almarai

National Agricultural Development Company (Nadec)

Al Safi Danone

Saudia Dairy & Foods Company (SADAFCO)

Al-Othaim Foods

FrieslandCampina

Lactalis Group

Dairy Farmers of America

Al Ain Dairy

Tetra Pak

Danone

Arla Foods

Organic Valley

Hochland

Savencia

- Market Demand and Utilization

- Purchasing Power and Spending Patterns

- Consumer Preferences

- Needs and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030