Market Overview

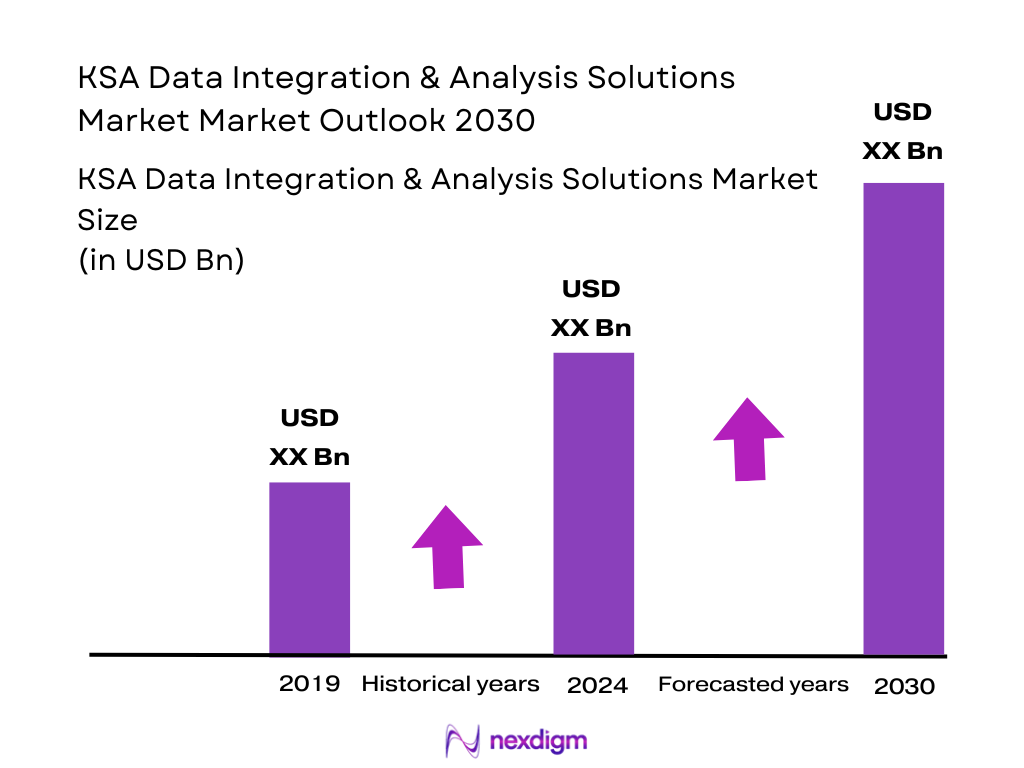

The KSA Data Integration and Analysis Solutions market is valued at USD ~ billion. The market has grown significantly, driven by the country’s increasing digital transformation and adoption of advanced data analytics, aligned with Saudi Arabia’s Vision 2030. The market is fueled by a demand for real-time decision-making capabilities and streamlined operations. The shift towards cloud-based solutions, coupled with the rise in government initiatives focused on data-driven technologies, has bolstered market growth. Integration solutions for managing large-scale data and analytics platforms have become essential across various sectors such as BFSI, healthcare, retail, and government.

Riyadh and Jeddah are the key cities driving the KSA Data Integration and Analysis Solutions market. Riyadh, as the capital, has been at the forefront of digital government initiatives, including the National Data Management Office (NDMO) and data governance regulations, spurring demand for data integration and analytics services. Jeddah follows closely with its expanding commercial sector, particularly in retail and logistics. These cities benefit from government investments in smart city projects and are central to the digital transformation strategies of various industries in Saudi Arabia.

Market Segmentation

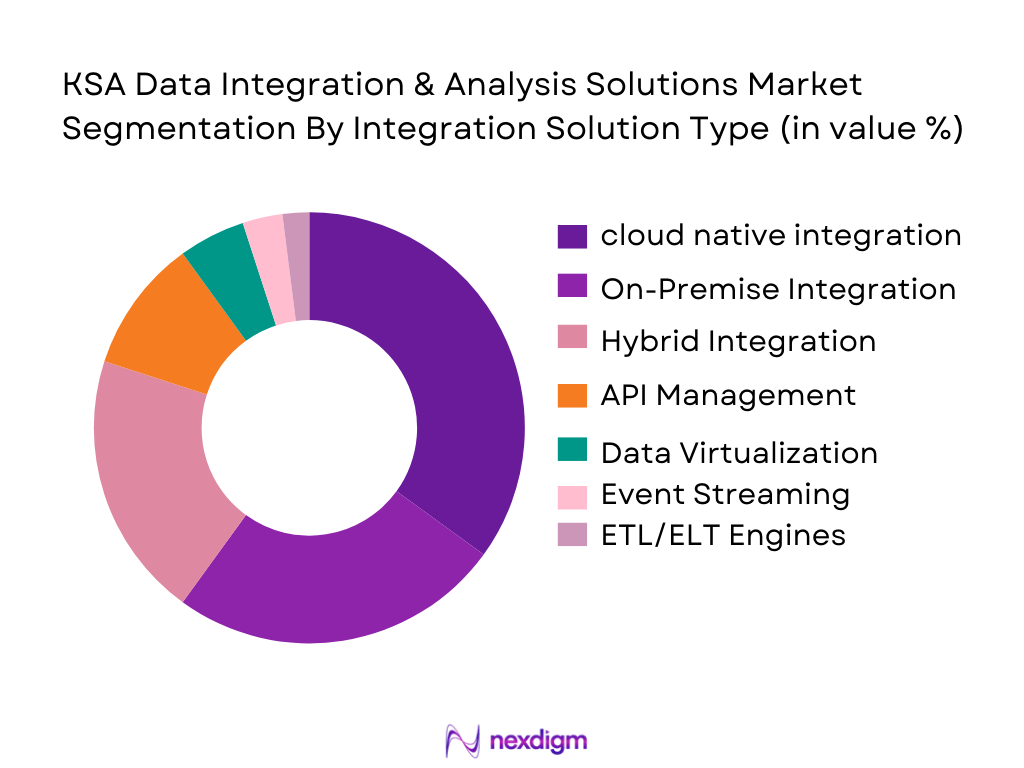

By Integration Solution Type

The market is segmented by integration solution type into cloud-native integration, on-premise integration, hybrid integration, API management, data virtualization, event streaming platforms, and ETL/ELT engines. Cloud-native integration dominates the market due to the increasing adoption of cloud computing in Saudi Arabia. This shift is primarily driven by organizations seeking scalability and flexibility, and cloud platforms like AWS, Azure, and Google Cloud enable seamless integration across business processes. Cloud-native solutions are favored as they reduce costs and improve agility for large enterprises and government organizations.

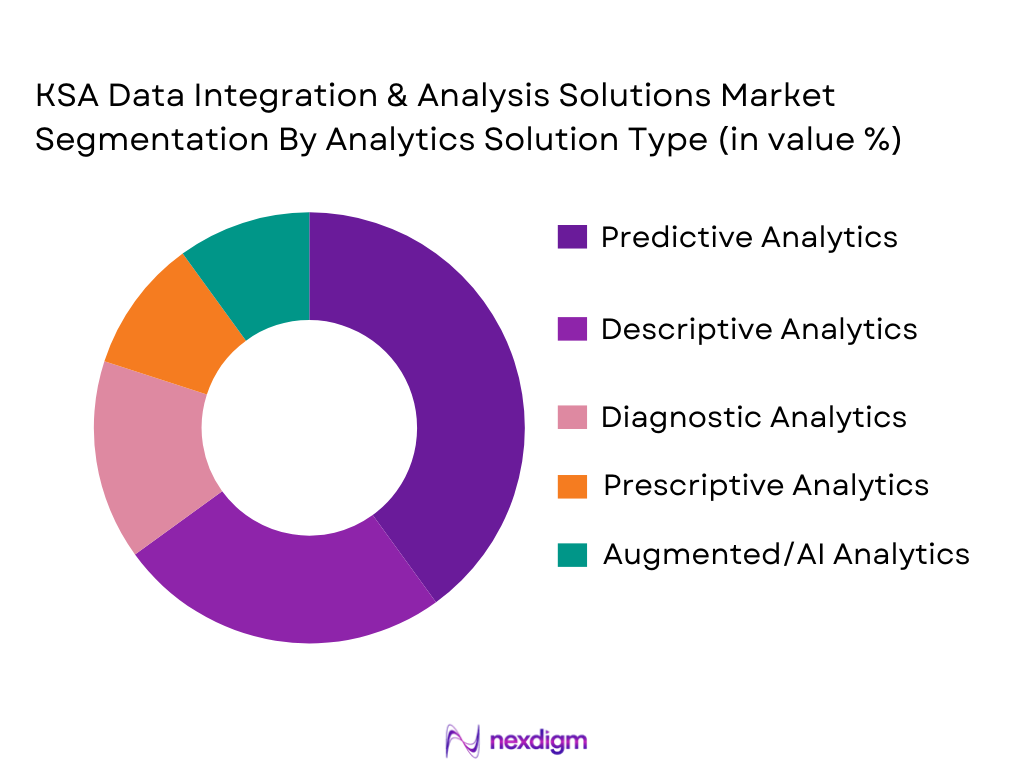

By Analytics Solution Type

The market is segmented by analytics solution type into descriptive analytics, diagnostic analytics, predictive analytics, prescriptive analytics, and augmented/AI analytics. Predictive analytics holds the dominant position, driven by the growing demand for actionable insights, forecasting, and risk management in sectors such as healthcare, finance, and retail. The adoption of AI and machine learning has enhanced the capabilities of predictive models, making them essential tools for decision-makers in KSA, especially within the government and enterprise sectors seeking to harness big data for strategic advantage.

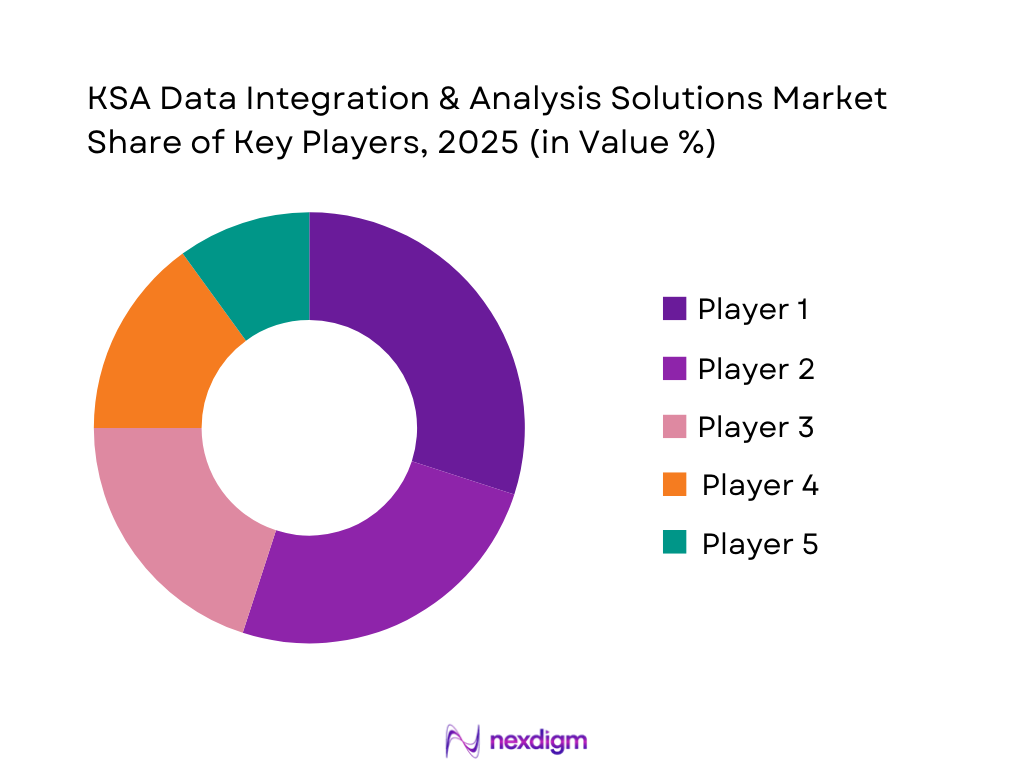

Competitive Landscape

The KSA Data Integration and Analysis Solutions market is dominated by a few key players, including global tech giants and local system integrators. Companies like SAP, Microsoft, Oracle, and IBM have a stronghold in the market due to their broad portfolio of data integration, cloud services, and AI analytics solutions. Local players, including Ejada Systems and STC Solutions, have also gained traction by focusing on customization to meet the needs of Saudi enterprises and government agencies.

| Company | Establishment Year | Headquarters | Revenue | Number of Employees | Technology Offerings | Key Regions Served |

| SAP | 1972 | Walldorf, Germany | ~ | ~ | ~ | ~ |

| Microsoft | 1975 | Redmond, USA | ~ | ~ | ~ | ~ |

| Oracle | 1977 | Redwood City, USA | ~ | ~ | ~ | ~ |

| IBM | 1911 | Armonk, USA | ~ | ~ | ~ | ~ |

| STC Solutions | 2002 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ |

KSA Data Integration & Analysis Solutions Market Analysis

Growth Drivers

Urbanization

Urbanization in Saudi Arabia is a critical driver of data integration and analysis solutions. With over ~% of the population living in urban areas as of 2024, cities like Riyadh, Jeddah, and Dammam have become hubs for digital infrastructure development. According to the Saudi Arabian General Authority for Statistics, the country’s urban population is expected to grow by ~ million. This rapid urbanization creates an increasing demand for smart infrastructure, integrated data systems, and analytics platforms to support urban management and services, driving the market for data solutions.

Industrialization

Saudi Arabia’s industrialization is a significant contributor to the growth of data integration solutions. As part of its Vision 2030, the country has heavily invested in modernizing its manufacturing and industrial sectors. By 2025, the industrial sector is expected to contribute ~% to Saudi Arabia’s GDP, according to the Saudi Arabian Ministry of Industry and Mineral Resources. This growing industrial base demands robust data integration and analytics solutions for process optimization, predictive maintenance, and supply chain management, significantly boosting the adoption of data platforms.

Restraints

High Initial Costs

The high initial costs of implementing data integration and analytics solutions act as a restraint to market growth in Saudi Arabia. Many enterprises face challenges in adopting these technologies due to the significant upfront investment required for software, infrastructure, and skilled personnel. According to the World Bank, in 2025, capital expenditure on ICT infrastructure in the region is expected to exceed USD ~ billion. The capital-intensive nature of these solutions discourages some small and mid-sized

Technical Challenges

The technical challenges associated with integrating new data platforms into existing infrastructure are another barrier to adoption in Saudi Arabia. Many businesses still rely on legacy systems that are not compatible with modern data integration solutions. According to a 2025 survey by the Saudi Arabian General Investment Authority, ~% of companies in KSA reported difficulties in integrating new technologies with their existing systems. This mismatch leads to delays, additional costs, and a lack of scalability, hindering the growth of the data integration market.

Opportunities

Technological Advancements

Technological advancements present significant growth opportunities for the data integration and analysis market in Saudi Arabia. The rapid evolution of AI, machine learning, and cloud technologies is opening new avenues for businesses to optimize data processing and decision-making. In 2025, Saudi Arabia’s government allocated USD ~ billion to AI research and development as part of Vision 2030, aiming to position the nation as a leader in AI technologies by 2030. These advancements are expected to drive demand for data integration solutions to harness AI and machine learning capabilities.

International Collaborations

International collaborations provide a significant opportunity for the KSA data integration and analysis solutions market. As Saudi Arabia increasingly engages in partnerships with global tech firms, local businesses benefit from exposure to cutting-edge technologies and expertise. For instance, in 2025, Saudi Arabia signed agreements with global tech giants like Microsoft and IBM to advance the country’s digital infrastructure. These collaborations are expected to lead to the adoption of modern data platforms, boosting the market for data integration solutions.

Future Outlook

Over the next six years, the KSA Data Integration and Analysis Solutions market is expected to experience significant growth, primarily driven by government-led initiatives such as the National Data Management Office (NDMO) and the broader push for digitalization under Saudi Vision 2030. Continuous advancements in AI, machine learning, and cloud computing will further catalyze this growth. Furthermore, industries like healthcare, BFSI, and government will see increased adoption of predictive analytics and integrated data platforms to streamline operations and enhance decision-making capabilities.

Major Players in the Market

- SAPMicrosoft

- Oracle

- IBM

- STC Solutions

- MuleSoft (Salesforce)

- Talend S.A.

- Informatica LLC

- SnapLogic Inc.

- Dell Boomi

- TIBCO Software Inc.

- Astera Software

- Ejada Systems Ltd.

- Reachware

- Amazon Web Services (AWS)

Key Target Audience

- Government and Regulatory Bodies:

- Enterprises and Large Corporations:

- Investments and Venture Capitalist Firms

- System Integrators and Solution Providers

- Technology Providers and Data Solution Developers

Research Methodology

Step 1: Identification of Key Variables

The first step involves understanding the market dynamics through extensive secondary research, focusing on industry databases and reports. This helps identify key variables that influence the KSA Data Integration and Analysis Solutions market, such as technology adoption, regulatory frameworks, and customer behavior.

Step 2: Market Analysis and Construction

Market size, penetration rates, and growth trajectories are analyzed, focusing on integration solutions, cloud adoption, and analytics capabilities. This phase utilizes historical data to construct the current market landscape and estimates future market behavior based on data-driven insights.

Step 3: Hypothesis Validation and Expert Consultation

Expert opinions are gathered through interviews with top executives and decision-makers in the KSA data solutions space. These interviews help validate the hypotheses and provide insight into operational realities, growth challenges, and innovation trends.

Step 4: Research Synthesis and Final Output

Finally, data gathered from interviews, secondary research, and market analysis is synthesized into a comprehensive report. The final output is cross-verified with stakeholders to ensure the reliability and accuracy of the market assessment.

- Executive Summary

- Research Methodology (Market Definitions and Scope, Research Design and Data Sources (Primary + Secondary), Top‑Down & Bottom‑Up Sizing Approach, Data Validation and Triangulation, Industry Expert Interviews & Advisory Inputs, Assumptions, Limitations, and Sensitivity Analysis

- Meaning & Scope of Data Integration & Analytics Solutions

- Market Genesis & Evolution in KSA

- Strategic Importance under Saudi Vision 2030 (National Data Governance, NDMO)

- Technology Enablement Trends (IoT, Cloud, AI, Big Data)

- Market Dynamics Glossary

- Growth Drivers

Cloud Adoption & Scalable Architectures (Cloud Integration)

Strategic Digital Transformation (Vision 2030 Technology Agenda)

Demand for Real‑Time Data Processing & Insights

Regulatory Compliance & Data Governance Mandates

AI & ML Adoption Driving Predictive Insights - Market Challenges

Legacy System Complexity & Integration Costs

Data Security & Privacy Constraints

Skill Shortages in Data Engineering & Data Science

Fragmented Data Governance Practices - Market Opportunities

Growth of AI‑Augmented Analytics Solutions

Public Sector Modernization Projects

Smart City & IoT Infrastructure Data Platforms

SME Adoption Tailwinds - Emerging Trends

AI/ML‑Powered Integration & Analytics

Low‑Code/No‑Code Data Orchestration

Data Monetization Strategies

Embedded Analytics in Business Applications - Regulatory and Compliance Framework

National Data Governance Regulations

Personal Data Protection Law (PDPL)

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Integration Solution Type (In Value %)

Cloud‑Native Integration (iPaaS)

On‑Premise Integration

Hybrid Integration

API Management

Data Virtualization

Event Streaming Platforms (e.g., Kafka)

ETL/ELT Engines - By Analytics Solution Type (In Value %)

Descriptive Analytics

Diagnostic Analytics

Predictive Analytics

Prescriptive Analytics

Augmented/AI Analytics - By Deployment Mode (In Value %)

On‑Premises

Public Cloud

Private Cloud

Hybrid Cloud - By Industry Vertical (In Value %)

BFSI (Banking, Financial Services & Insurance)

Healthcare & Life Sciences

Government & Public Sector

Retail & E‑Commerc

Energy & Utilities

IT & Telecom

Manufacturing

Transportation & Logistics - By Enterprise Size (In Value %)

Large Enterprise

Mid‑Market

SMEs6. Market Dynamics and Trend Analysis

- Market Share by Value & Deployments

Market Share (Top Providers by Revenue)

Share by Integration vs Analytics vs Hybrid Solutions - Cross Comparison Parameters (Market Share %, Solution Portfolio Breadth, Cloud Leadership, AI/ML Capabilities, Enterprise Penetration, Compliance & Security Features, Partner Ecosystem Strength, Deployment Footprint in KSA)

- SWOT Analysis – Major Competitors

- Pricing & Contract Benchmarking

- SKU‑Based Pricing Comparisons

- Subscription vs On‑Demand Cost Breakdown

- Detailed Profiles of Major Players

SAP SE

Oracle Corporation

Microsoft Corporation

IBM Corporation

Informatica LLC

MuleSoft (Salesforce)

Talend S.A.

TIBCO Software Inc.

Dell Boomi

SAS Institute Inc.

SnapLogic Inc.

Astera Software

Ejada Systems Ltd. (Regional Integrator)

STC Solutions (Telecom‑led Integrator)

Reachware (Saudi Systems Integrator)

- Demand & Utilization Patterns by Industry

- Buying Committee and Decision Factors (ROI, Security, Integration Complexity)

- Budget Allocation & Procurement Cycles

- Pain Points & Purchase Drivers

- Customer Retention & Expansion Metrics

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030