Market Overview

The market is projected to experience substantial growth driven by the increasing demand for high-performance defense electronics solutions. Based on a recent historical assessment, the defense electronics sector is anticipated to be valued at approximately USD ~ billion, supported by innovations in radar, communication, surveillance, and electronic warfare systems. Factors such as government defense budgets, technological advancements, and the growing need for national security infrastructure are significant drivers for this expansion. Furthermore, the rise of cyber threats and the integration of cutting-edge AI technologies into military systems further boost the demand for sophisticated electronics in the defense sector.

The dominant players in this market are primarily based in countries with robust defense programs, including the United States, Russia, and the European Union, with a growing influence in the Middle East, specifically Saudi Arabia. These regions benefit from advanced technological capabilities, well-established military frameworks, and strong government funding dedicated to defense modernization. Furthermore, these areas hold strategic importance, driving continuous investments in defense electronics. Countries with ongoing geopolitical tensions are also contributing to the dominance of these regions by prioritizing defense technology in their national security agendas.

Market Segmentation

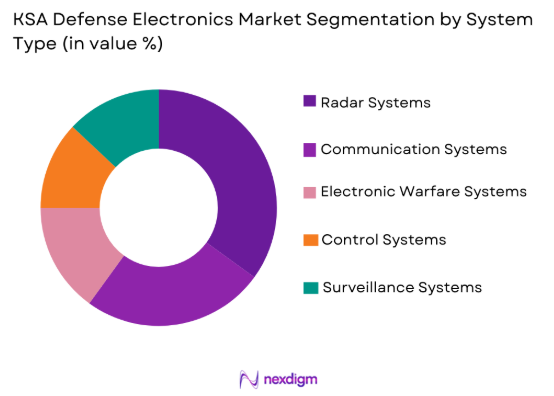

By System Type

The defense electronics market is segmented by system type into radar systems, communication systems, surveillance systems, electronic warfare systems, and control systems. Recently, radar systems have the largest market share due to their increasing application in both defense and civilian sectors. Technological advancements such as active electronically scanned arrays (AESA) and phased array radar systems have driven demand across naval, airborne, and land-based platforms. Radar systems are crucial in surveillance, target tracking, and providing real-time situational awareness. Additionally, the integration of AI into radar technology has allowed for more efficient detection and tracking, boosting their adoption in military defense applications.

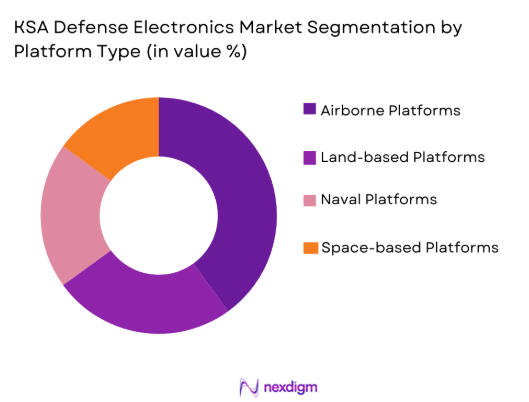

By Platform Type

The market is divided by platform type into land-based platforms, airborne platforms, naval platforms, and space-based platforms. Airborne platforms have seen the most dominance in recent years, owing to their crucial role in surveillance, reconnaissance, and communication. The rapid advancements in unmanned aerial vehicles (UAVs) and unmanned combat aerial vehicles (UCAVs) have bolstered this platform’s share in the market. These systems, powered by advanced radar and communication systems, are widely used in intelligence, surveillance, and reconnaissance (ISR) missions, making them an essential part of modern defense infrastructure. \

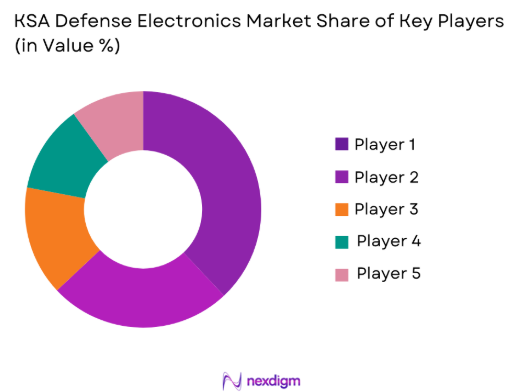

Competitive Landscape

The competitive landscape of the defense electronics market is characterized by heavy consolidation, with key players dominating the market through technological leadership, strong brand presence, and strategic defense contracts. Major players in the market are involved in continuous innovation, focusing on electronic warfare, radar, and communication systems, which are critical to military operations. These companies are also engaging in partnerships and acquisitions to expand their technological offerings and reach. Additionally, they are heavily investing in R&D to meet the increasing demand for next-generation defense electronics solutions, such as AI-powered systems, cybersecurity measures, and autonomous platforms.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Lockheed Martin | 1995 | Bethesda, Maryland | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | La Défense, France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2019 | Waltham, Massachusetts | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1994 | Falls Church, Virginia | ~ | ~ | ~ | ~ | ~ |

KSA Defence Electronics Market Analysis

Growth Drivers

Government Spending on Defense Modernization

The increasing geopolitical tensions and the need for enhanced national security have driven substantial government spending on defense. Countries around the world, particularly in the Middle East and Asia-Pacific regions, are allocating more resources to modernizing their defense infrastructure. The Saudi Arabian government, for example, has been consistently increasing its defense budgets to strengthen its military capabilities. This has led to a surge in the demand for advanced defense electronics, including radar systems, electronic warfare technologies, and surveillance solutions, further propelling market growth. This driver is expected to continue to dominate as nations continue to focus on bolstering their defense capabilities in response to emerging threats.

Technological Advancements in Defense Electronics

Continuous advancements in defense electronics technologies such as radar, communication, and electronic warfare systems are propelling the market forward. The development of active electronically scanned arrays (AESA) radar, improved signal processing technologies, and the incorporation of artificial intelligence (AI) into defense systems have revolutionized the defense electronics sector. The integration of AI into radar systems, for instance, allows for better target tracking and detection in real-time. The rapid evolution of unmanned systems and autonomous vehicles is also driving the demand for innovative defense electronics, as these platforms require more sophisticated sensors, communication systems, and control systems to operate efficiently in dynamic environments. As these technologies continue to mature, they will further fuel the growth of the defense electronics market.

Market Challenges

High Cost of Advanced Defense Electronics

The high cost of advanced defense electronics presents a significant barrier to the widespread adoption of these systems. Technologies such as radar systems, electronic warfare solutions, and advanced communication networks require substantial investment in both R&D and manufacturing. As a result, defense contractors face challenges in cost-effectively producing these technologies at scale. Furthermore, governments with limited budgets or those prioritizing other sectors may find it difficult to justify such high expenditures, which could limit the market’s growth in certain regions. This challenge is especially pronounced in developing countries, where defense budgets are often constrained.

Cybersecurity Threats to Defense Electronics

As defense systems become more interconnected and reliant on digital technologies, cybersecurity threats pose a significant challenge to the defense electronics market. Hackers and state-sponsored cyberattacks are increasingly targeting military systems, seeking to disrupt operations or steal sensitive information. The increasing integration of AI and other digital technologies into defense systems further exposes these platforms to cyber vulnerabilities. This growing threat requires constant upgrades to security protocols, which in turn increases the overall cost and complexity of deploying defense electronics. Companies must invest heavily in robust cybersecurity measures to protect their systems, which could pose significant challenges for market players.

Opportunities

Emerging Demand for Autonomous Defense Systems

The growing interest in autonomous vehicles, drones, and unmanned aerial systems (UAS) presents significant opportunities for defense electronics manufacturers. These platforms require advanced communication systems, radar, and electronic warfare capabilities to operate effectively in modern battlefields. The demand for such systems is particularly pronounced in regions with ongoing conflicts, such as the Middle East and Southeast Asia, where military forces are increasingly deploying UAVs and UAS to carry out surveillance and reconnaissance missions. The development of autonomous defense systems, coupled with improvements in AI and machine learning, provides a promising opportunity for growth in the defense electronics market. Companies that can successfully integrate these technologies into their offerings will likely see significant market share growth in the coming years.

Strategic Partnerships with Tech Firms

Defense contractors are increasingly seeking partnerships with private tech firms to integrate the latest commercial technologies into defense systems. These partnerships enable defense companies to leverage advancements in areas such as AI, machine learning, and big data analytics, which can significantly enhance the capabilities of defense electronics. The collaboration between traditional defense contractors and emerging tech companies presents an opportunity for rapid innovation and the development of next-generation systems. This trend is already evident in the growing number of defense companies investing in partnerships with Silicon Valley firms to incorporate cutting-edge technologies into their defense electronics offerings.

Future Outlook

The defense electronics market is expected to continue growing over the next five years, driven by technological advancements and an increasing focus on national security. With governments around the world investing in modernizing their defense infrastructure, demand for radar, surveillance, and electronic warfare systems is projected to increase. Technological developments in AI, cybersecurity, and autonomous systems are also expected to drive innovation, creating new opportunities for market players. The demand for integrated and cost-effective defense solutions will push for further consolidation among key industry players, leading to the continued evolution of the defense electronics market.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- Raytheon Technologies

- Northrop Grumman

- Leonardo

- Harris Corporation

- Saab Group

- Rheinmetall AG

- Elbit Systems

- General Dynamics

- L3 Technologies

- Honeywell

- Boeing

- Sikorsky Aircraft

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace manufacturers

- Research organizations

- Private sector / technology firms

- International defense agencies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the primary variables influencing the defense electronics market, such as government spending, technological advancements, and defense infrastructure needs.

Step 2: Market Analysis and Construction

In this step, detailed analysis is conducted to assess market size, growth potential, and segmentation based on primary and secondary research.

Step 3: Hypothesis Validation and Expert Consultation

Experts in the defense electronics field are consulted to validate hypotheses regarding market trends and growth drivers, ensuring the accuracy of the analysis.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all collected data and expert insights into a comprehensive report that provides actionable insights into the defense electronics market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in AI and Cybersecurity

Growing Military Modernization Programs - Market Challenges

High Capital Expenditure in Defense Projects

Cybersecurity Threats and Vulnerabilities

Technological Integration and Interoperability Issues - Market Opportunities

Emerging Demand for Autonomous Systems and Robotics

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Expansion in Artificial Intelligence-Driven Defense Solutions - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in Battlefield Operations

Surge in Cybersecurity Investments for Defense Systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Radar Systems

Electronic Warfare Systems

Surveillance & Reconnaissance Systems

Weapon Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Sector / Technology Firms

Security Services - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Pricing Strategy, Market Share, Technological Advancements, Regulatory Compliance, Distribution Channels)

SWOT Analysis of Key Competitors

Pricing & Procurement Analysis

Porter’s Five Forces

Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Increasing Demand for Digital Systems

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035