Market Overview

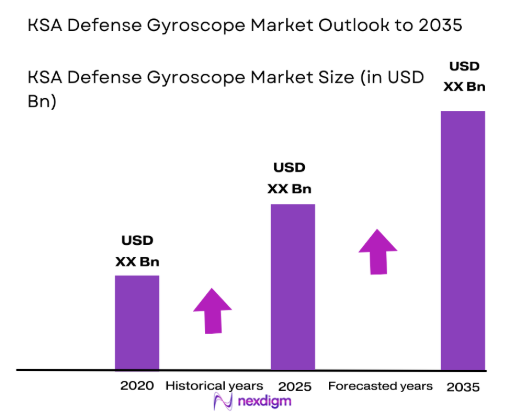

The KSA Defense Gyroscope market size is valued at approximately USD ~ billion based on a recent historical assessment. This market growth is primarily driven by the increasing demand for advanced navigation systems in the defense sector, particularly in military applications. With Saudi Arabia’s focus on modernizing its military capabilities, the demand for high-precision gyroscopes is anticipated to rise. Moreover, the integration of gyroscopes in a variety of defense systems, including inertial navigation, missile guidance, and military aircraft, continues to fuel this growth.

The market is dominated by countries such as Saudi Arabia, which remains at the forefront of military technology advancements in the Middle East. The country’s significant investments in defense technology and its strategic initiatives to enhance national security through advanced defense systems contribute to this dominance. Furthermore, with increased spending in defense infrastructure and collaboration with international defense contractors, Saudi Arabia is poised to remain a key player in the region’s defense technology market, including the gyroscope segment.

Market Segmentation

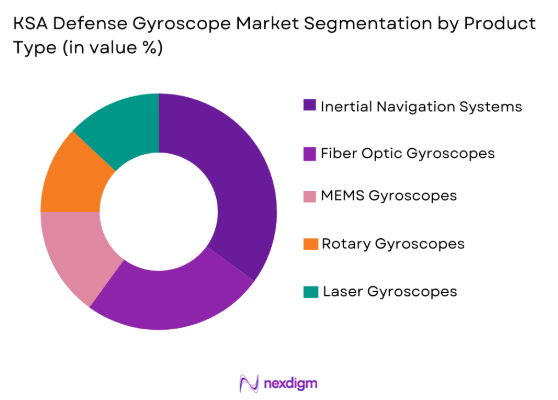

By Product Type

The KSA Defense Gyroscope market is segmented by product type into inertial navigation systems, fiber optic gyroscopes, MEMS gyroscopes, rotary gyroscopes, and laser gyroscopes. Recently, the fiber optic gyroscopes sub-segment has a dominant market share due to factors such as high precision, reliability in extreme conditions, and increasing demand for high-performance navigation systems. This segment is well-suited for military applications like missile guidance, surveillance, and other critical defense systems due to its accuracy and low drift over time.

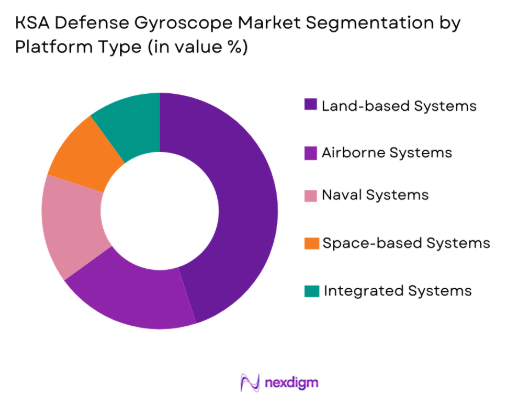

By Platform Type

The KSA Defense Gyroscope market is segmented by platform type into land-based systems, airborne systems, naval systems, space-based systems, and integrated systems. Among these, airborne systems have the largest market share. This dominance is attributed to the increasing reliance on gyroscopic systems for navigation and stability in various military aircraft, drones, and helicopters. Airborne platforms require precise navigation capabilities, which have made fiber optic gyroscopes particularly suitable for this segment due to their superior performance in aviation and aerospace applications.

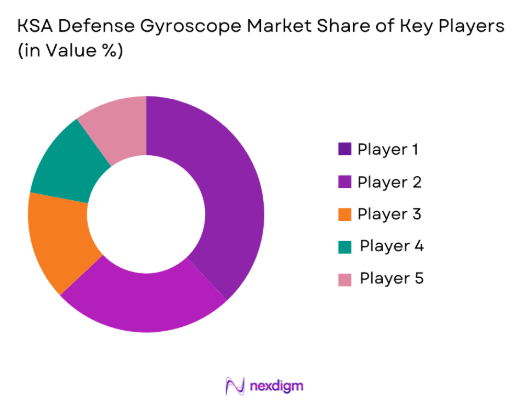

Competitive Landscape

The competitive landscape of the KSA Defense Gyroscope market is characterized by a blend of established defense contractors and newer entrants specializing in advanced technologies. Consolidation in the market is expected, as larger players are increasingly merging with smaller, innovative companies to diversify their portfolios. Major defense players like Lockheed Martin, Thales, and Raytheon Technologies lead in terms of technological innovation and product development, which significantly influence the market dynamics.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Key Applications |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

KSA Defense Gyroscope Market Analysis

Growth Drivers

Rising Demand for Advanced Navigation Systems

The primary growth driver for the KSA Defense Gyroscope market is the increasing demand for advanced navigation systems. With the rapid advancements in defense technology, military forces require highly precise and reliable systems for navigation, missile guidance, and surveillance. This has created a robust demand for gyroscopes, especially fiber optic gyroscopes, which offer low drift and high accuracy. The significant increase in defense budgets in Saudi Arabia is also propelling the growth of this market. Moreover, the rising geopolitical tensions in the Middle East have pushed countries to modernize their defense systems, thus creating further demand for gyroscopic technology. This has been accompanied by a strong push for the development of autonomous defense systems, which rely heavily on gyroscopic technology for navigation. As the military seeks more advanced capabilities, including precision-guided weapons, the need for gyroscopes is expected to continue rising.

Technological Advancements in Gyroscope Systems

Another major growth driver for the market is the technological advancements in gyroscope systems. Over the past decade, significant improvements in the design and functionality of gyroscopes have been witnessed, making them more efficient and capable of supporting complex defense applications. The development of fiber optic gyroscopes, MEMS gyroscopes, and advanced inertial navigation systems has enhanced the capabilities of military platforms, providing more precise and reliable navigation and guidance systems. Furthermore, ongoing research and development efforts in miniaturizing gyroscopes, along with reducing costs, have contributed to the widespread adoption of these systems across military platforms. With increasing military modernization programs in Saudi Arabia and neighboring regions, the demand for next-generation gyroscopes is expected to surge. The combination of technological innovation and strategic defense investments has paved the way for these systems to play a crucial role in the advancement of defense infrastructure.

Market Challenges

High Cost of Advanced Gyroscope Systems

The high cost of advanced gyroscope systems poses a significant challenge to the growth of the KSA Defense Gyroscope market. Despite their superior performance and reliability, these systems, particularly fiber optic gyroscopes, are expensive to develop and manufacture. The high upfront costs associated with the acquisition and installation of these systems can be a barrier for some defense contractors and government agencies, especially when compared to less expensive alternatives. Moreover, the cost of research and development for new gyroscopic technologies adds an additional financial burden on companies looking to introduce next-generation systems. These factors, while not insurmountable, can slow the pace of adoption in some sectors and limit the growth of the overall market. As such, overcoming the cost barriers through innovations in manufacturing and cost-effective alternatives is crucial to expanding the market in the coming years.

Regulatory and Compliance Barriers

Another significant challenge faced by the KSA Defense Gyroscope market is the complex regulatory and compliance landscape. Military technologies, especially those used in defense applications, are subject to stringent regulations and compliance requirements, including export control laws and security protocols. The regulation of sensitive technologies like gyroscopes, particularly when used in defense and aerospace applications, creates barriers for companies seeking to introduce new products or enter the market. Compliance with international standards and local regulations can be time-consuming and costly, particularly for smaller companies or startups trying to enter the market. This regulatory burden is further complicated by the differing rules and restrictions across regions, which can lead to delays in product development, distribution, and market penetration.

Opportunities

Adoption of Autonomous Defense Systems

One of the key opportunities in the KSA Defense Gyroscope market is the increasing adoption of autonomous defense systems. With the rise of unmanned aerial vehicles (UAVs), autonomous vehicles, and robotic defense systems, there is a growing need for gyroscopes that can provide reliable navigation and stabilization for these platforms. As Saudi Arabia seeks to modernize its military infrastructure, the demand for gyroscopes in autonomous systems is expected to rise. These systems are integral to operations where human intervention is limited, such as in reconnaissance, surveillance, and air defense. As autonomous technologies continue to evolve, gyroscopes will play a crucial role in ensuring the accuracy and reliability of these systems. This trend presents a lucrative opportunity for companies specializing in gyroscopes, offering them the potential for long-term growth in the defense sector.

Strategic Collaborations with International Defense Contractors

Another promising opportunity for the KSA Defense Gyroscope market lies in strategic collaborations with international defense contractors. Saudi Arabia’s focus on modernizing its defense capabilities has led to increasing collaborations with global defense companies. These partnerships can lead to the transfer of advanced technologies, including state-of-the-art gyroscopes, to local manufacturers and defense contractors. Moreover, such collaborations will help enhance the technological capabilities of Saudi Arabia’s defense sector, providing opportunities for both local and international companies to expand their market reach. With strong government support for the defense industry and an emphasis on self-reliance, these strategic alliances can pave the way for increased domestic production and consumption of high-tech gyroscopes.

Future Outlook

The KSA Defense Gyroscope market is expected to experience robust growth in the coming years, driven by advancements in technology and increasing investments in defense modernization. Technological innovations, including miniaturization and cost reduction, will make gyroscopes more accessible and efficient for a variety of defense applications. Regulatory support for defense infrastructure and continued investments in autonomous systems will further propel demand. As geopolitical tensions persist in the region, Saudi Arabia’s focus on strengthening its military capabilities will continue to drive the need for cutting-edge gyroscope systems.

Major Players

- Lockheed Martin

- Thales Group

- Raytheon Technologies

- Northrop Grumman

- BAE Systems

- Honeywell International

- Safran

- Moog Inc.

- Leonardo

- Rockwell Collins

- Garmin Ltd.

- United Technologies Corporation

- Elbit Systems

- Saab Group

- Harris Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Aerospace and defense manufacturers

- Commercial aviation companies

- Military forces

- Private technology firms

- Autonomous systems developers

Research Methodology

Step 1: Identification of Key Variables

Identification of key factors such as technology trends, market drivers, and growth barriers that impact the defense gyroscope market in Saudi Arabia.

Step 2: Market Analysis and Construction

Analysis of market trends, economic indicators, and geopolitical factors that influence the demand for defense gyroscopes in KSA.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews and consultations with industry leaders and government officials to validate hypotheses and market assumptions.

Step 4: Research Synthesis and Final Output

Compilation of data, analysis, and expert insights into a final comprehensive market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Advanced Navigation Solutions

Rising Military Modernization Programs

Technological Advancements in Gyroscope Systems - Market Challenges

High Development and Production Costs

Technological Complexity and Integration Issues

Regulatory and Compliance Challenges - Market Opportunities

Adoption of Autonomous Defense Systems

Collaborations Between Defense and Technology Firms

Emerging Demand for Precision-guided Weapons - Trends

Integration of AI and Machine Learning in Gyroscope Systems

Increased Use of Gyroscopes in Autonomous Vehicles

Miniaturization and Cost Reduction in Gyroscope Technologies - Government Regulations

Defense Export Control Regulations

Safety Standards for Defense Systems

Cybersecurity and Data Protection Regulations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Inertial Navigation Systems

Fiber Optic Gyroscopes

MEMS Gyroscopes

Rotary Gyroscopes

Laser Gyroscopes - By Platform Type (In Value%)

Land-based Systems

Airborne Systems

Naval Systems

Space-based Systems

Integrated Systems - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

SWOT Analysis of Key Competitors

Pricing & Procurement Analysis

Porter’s Five Forces

Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Adoption of Advanced Navigation Solutions

- Growing Demand from Government Agencies for Reliable Systems

- Defense Contractors’ Shift Toward Precision Systems

- Private Sector Engagement in Technological Partnerships

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035