Market Overview

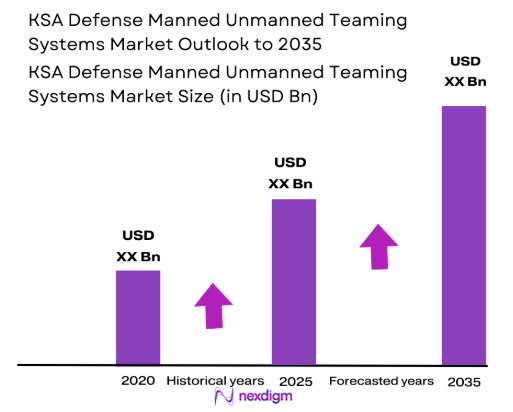

The KSA Defense Manned Unmanned Teaming Systems market is valued at approximately USD ~ billion, based on a recent historical assessment. This growth is driven by the increasing defense budget allocation towards technological advancements, strategic defense initiatives, and enhanced military capabilities. Rising demand for unmanned systems and their integration with manned platforms is expected to further fuel market expansion. The growing use of autonomous systems, especially in combat scenarios, has spurred investments in these advanced solutions, boosting the overall market.

The dominant markets in this space are primarily concentrated in the Kingdom of Saudi Arabia, driven by significant defense investments and strategic military modernization programs. The region’s military infrastructure is undergoing transformation, with focus on integrating autonomous and unmanned platforms. Saudi Arabia’s geopolitical positioning, its alliance with global defense contractors, and government-backed defense projects are central to its market dominance. These factors create an environment conducive to continuous growth and adoption of manned-unmanned teaming systems.

Market Segmentation

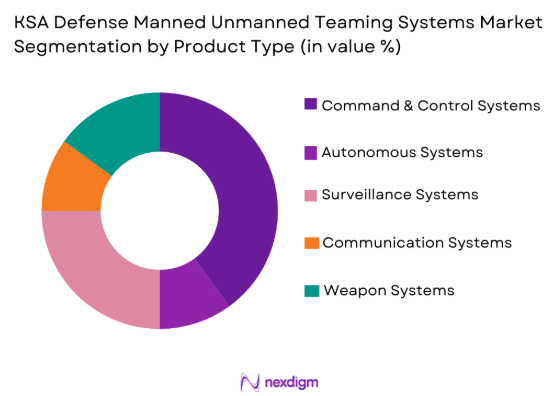

By Product Type

KSA Defense Manned Unmanned Teaming Systems market is segmented by product type into command and control systems, surveillance systems, weapon systems, communication systems, and autonomous systems. Recently, command and control systems have a dominant market share due to their crucial role in integrating unmanned systems with manned platforms. The demand for effective real-time decision-making and battlefield management drives the increased reliance on these systems, especially in advanced military operations. The growing complexity of modern warfare requires high-performance command and control systems that can support diverse unmanned and manned operations.

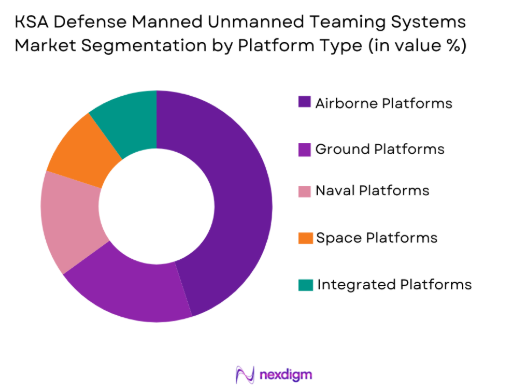

By Platform Type

KSA Defense Manned Unmanned Teaming Systems market is segmented by platform type into airborne platforms, ground platforms, naval platforms, space platforms, and integrated platforms. Airborne platforms dominate the market share due to the high demand for aerial surveillance, combat support, and reconnaissance missions. The strategic value of air superiority in combat situations makes airborne platforms an essential component of defense strategies, contributing to their market dominance. Increasing investments in unmanned aerial systems and their integration with manned aircraft further solidify the position of airborne platforms in the market.

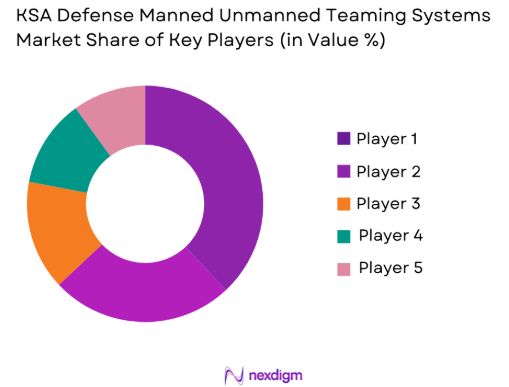

Competitive Landscape

The KSA Defense Manned Unmanned Teaming Systems market exhibits significant consolidation, with several major defense contractors shaping the competitive landscape. Leading global players dominate the market, driving innovation in autonomous systems and manned-unmanned integration. Strong government collaborations, military modernization programs, and a growing focus on next-generation defense technologies have further solidified the presence of these players in the region. The market remains competitive, with companies striving to integrate AI, robotics, and real-time data processing into their offerings.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Technology Integration |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | Waltham, MA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

KSA Defense Manned Unmanned Teaming Systems Market Analysis

Growth Drivers

Increasing Government Investment in National Defense

The Kingdom of Saudi Arabia has significantly increased its defense budget over recent years, prioritizing technological advancements in unmanned and autonomous systems. This investment is driven by the need to enhance national security amidst growing geopolitical tensions in the Middle East. The Saudi government’s focus on modernizing its military forces has led to a surge in demand for integrated manned-unmanned teaming systems. Furthermore, with ongoing defense contracts and collaborations with global defense contractors, the government’s strategic initiatives are accelerating the deployment of these advanced systems. This robust financial backing is driving market expansion and fostering innovation in the sector. The Saudi vision for transforming its military capabilities by incorporating cutting-edge technologies further reinforces the demand for manned-unmanned teaming solutions in the defense market.

Technological Advancements in Autonomous Systems

The rapid evolution of autonomous technologies is a significant growth driver for the KSA Defense Manned Unmanned Teaming Systems market. Advances in artificial intelligence (AI), machine learning, and robotics have made unmanned systems more reliable and capable of working seamlessly alongside manned platforms. Saudi Arabia’s investments in these areas have been pivotal, driving the adoption of autonomous systems in military operations. As autonomous systems become more sophisticated, they are being increasingly deployed for surveillance, reconnaissance, and even combat roles. These technological developments not only enhance operational efficiency but also reduce human risk, making autonomous systems indispensable to modern defense strategies. This trend is expected to continue to accelerate, contributing to the market’s growth trajectory.

Market Challenges

High Capital Expenditure in Defense Systems

One of the significant challenges in the KSA Defense Manned Unmanned Teaming Systems market is the high capital expenditure required for the acquisition and integration of these advanced systems. The cost of deploying cutting-edge autonomous systems and integrating them with manned platforms requires substantial financial investments from both the government and private contractors. While Saudi Arabia has increased its defense spending, the initial setup costs for these technologies can be a barrier to widespread adoption. This high capital expenditure, coupled with the need for continuous upgrades and maintenance, presents a challenge for ensuring long-term sustainability and return on investment for stakeholders in the defense sector. The financial burden on military budgets may slow the pace at which these systems are deployed, limiting the growth potential of the market.

Integration Challenges Between Manned and Unmanned Platforms

The integration of manned and unmanned platforms remains a complex challenge in the KSA Defense Manned Unmanned Teaming Systems market. While both manned and unmanned systems offer unique advantages, creating seamless interoperability between the two is critical for mission success. However, technical difficulties in communications, data exchange, and operational coordination can impede the efficient functioning of these integrated systems. Furthermore, the integration of AI-driven autonomous systems with existing defense infrastructure poses its own set of challenges, requiring significant adjustments to legacy systems and processes. These challenges could slow the adoption of fully integrated defense solutions, limiting the overall market growth.

Opportunities

Expansion in Artificial Intelligence Integration

The integration of AI into defense systems offers a significant opportunity for the KSA Defense Manned Unmanned Teaming Systems market. AI-driven technologies such as machine learning, predictive analytics, and real-time decision-making tools can enhance the capabilities of both manned and unmanned systems. This integration allows for more efficient and adaptive military operations, improving the overall effectiveness of defense strategies. As Saudi Arabia continues to invest in AI, the defense sector stands to benefit from enhanced automation, improved threat detection, and more accurate data analysis. These developments create a strong market opportunity for companies involved in the development and deployment of AI-based manned-unmanned teaming solutions, offering the potential for faster growth and innovation.

Collaborations with Private Tech Firms

Another significant opportunity lies in the potential for collaborations between defense contractors and private technology firms, particularly those in the fields of AI, cybersecurity, and robotics. These partnerships allow for the integration of cutting-edge commercial technologies into military platforms, improving the performance and versatility of unmanned systems. By tapping into private sector innovations, the KSA Defense Manned Unmanned Teaming Systems market can benefit from faster technological advancements and more cost-effective solutions. These collaborations are essential for accelerating the development of next-generation defense technologies and ensuring the Kingdom remains at the forefront of military modernization efforts.

Future Outlook

The KSA Defense Manned Unmanned Teaming Systems market is expected to experience steady growth over the next five years, driven by technological advancements and increasing defense budgets. The continued integration of AI and robotics into military operations, coupled with strategic defense investments, will likely lead to greater adoption of unmanned systems. Furthermore, the government’s commitment to national security and military modernization will support the development of next-generation defense technologies. Regulatory support and international collaborations will also play a crucial role in shaping the market’s future. Overall, the market is poised for sustained growth, with technological developments and strategic investments leading the way.

Major Players

- Lockheed Martin

- BAE Systems

- Northrop Grumman

- Raytheon Technologies

- General Dynamics

- Thales Group

- L3 Technologies

- Leonardo

- Rheinmetall AG

- Saab Group

- Elbit Systems

- Harris Corporation

- L3 Communications

- Sikorsky Aircraft

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense technology developers

- Aerospace companies

- System integrators

- Military and defense agencies

- National security institutions

Research Methodology

Step 1: Identification of Key Variables

In this step, key variables that influence the market are identified, such as government defense budgets, technological trends, geopolitical factors, and market demand for unmanned systems.

Step 2: Market Analysis and Construction

This step involves gathering primary and secondary data sources, analyzing market trends, competitive dynamics, and identifying key drivers of demand in the KSA Defense Manned Unmanned Teaming Systems market.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts, defense contractors, and military personnel validate the findings and hypotheses, ensuring the accuracy of the insights.

Step 4: Research Synthesis and Final Output

This final step synthesizes all the research and insights, producing a comprehensive market report detailing the current and future outlook for the KSA Defense Manned Unmanned Teaming Systems market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Government Investment in National Defense

Technological Advancements in Autonomous Systems

Rising Geopolitical Tensions - Market Challenges

High Capital Expenditure in Defense Systems

Integration Challenges Between Manned and Unmanned Platforms

Cybersecurity Threats - Market Opportunities

Expansion in Artificial Intelligence Integration

Collaborations with Private Tech Firms

Rising Demand for Autonomous Combat Solutions - Trends

Integration of AI and Machine Learning in Military Operations

Increase in Autonomous and Unmanned Systems

Focus on Cybersecurity and Data Protection in Defense Systems - Government Regulations

Export Control and Compliance Policies

Data Protection and Privacy Regulations

Government Funding for Defense Technology

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Systems

Surveillance Systems

Weapon Systems

Communication Systems

Autonomous Systems - By Platform Type (In Value%)

Airborne Platforms

Ground Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Material/Technology)

SWOT Analysis of Key Competitors

Pricing & Procurement Analysis

Porter’s Five Forces

Key Players

Lockheed Martin

BAE Systems

Northrop Grumman

Raytheon Technologies

General Dynamics

Thales Group

L3 Technologies

Leonardo

Rheinmetall AG

Saab Group

Elbit Systems

BAE Systems

Harris Corporation

L3 Communications

Sikorsky Aircraft

- Military Forces’ Growing Demand for Integrated Defense Systems

- Government Agencies’ Role in Procuring and Regulating Defense Systems

- Defense Contractors’ Focus on Technological Innovation

- Private Sector’s Investment in Autonomous Defense Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035