Market Overview

The defense market in Saudi Arabia is projected to witness significant growth, with a market size estimated at USD ~ billion, driven by robust government spending on defense and military modernization. This surge is largely attributed to the Kingdom’s strategic geopolitical positioning and its ongoing efforts to enhance defense capabilities through investments in advanced technologies, such as missile defense, UAV systems, and cybersecurity. Saudi Arabia is also modernizing its military infrastructure, which has fueled demand across various sub-segments.

Dominant countries such as Saudi Arabia are leading the Middle East’s defense market due to their large-scale defense budgets and strategic military initiatives. Saudi Arabia’s dominance is driven by its Vision 2030 initiative, which places considerable emphasis on defense and security to ensure national sovereignty and regional stability. The Kingdom is also leveraging its partnerships with global defense contractors to enhance military capabilities, focusing on air defense systems, drones, and advanced naval platforms, thereby solidifying its position as a regional leader in defense technology.

Market Segmentation

By Product Type

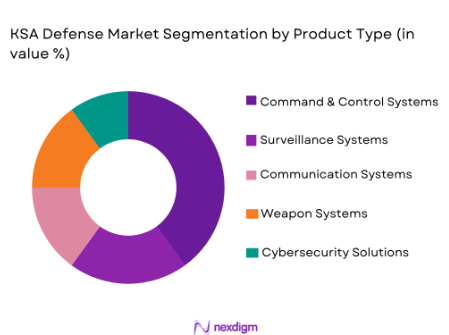

The defense market is segmented by product type into various systems, including command and control systems, surveillance systems, weapon systems, and cybersecurity solutions. Recently, command and control systems have seen the highest market share due to rising demand for integrated defense networks and real-time battlefield management. These systems provide an essential role in enhancing situational awareness, enabling more effective coordination across military platforms, and improving operational efficiency. Moreover, growing security concerns and advancements in communication technologies have bolstered their adoption, particularly among military forces. The market for command and control systems is expanding as the Kingdom focuses on fortifying its national security strategy through high-tech solutions.

By Platform Type

The Saudi Arabian defense market is also segmented by platform type into land, air, sea, and space platforms. Airborne platforms, particularly fighter jets and drones, hold a dominant position due to their versatility and ability to provide strategic advantages in defense operations. These platforms have become integral to modern defense strategies, offering rapid deployment and precision strikes. Saudi Arabia’s ongoing investments in advanced airborne systems, such as the F-15 fighter jets and drones for surveillance and reconnaissance, have driven demand in this category. Furthermore, the focus on autonomous systems and UAVs has positioned airborne platforms as a central component of the Kingdom’s military modernization efforts.

Competitive Landscape

The competitive landscape of the Saudi Arabian defense market is highly dynamic, with major global players competing for contracts and technological partnerships. Market consolidation is evident, with large defense contractors forming strategic alliances with local players to enhance their market reach. The Kingdom’s defense procurement is also influenced by geopolitical factors and regional security dynamics. Key players such as Lockheed Martin, Raytheon Technologies, and Boeing dominate the market, but several other companies are also vying for a piece of the rapidly expanding defense sector.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Regional Partnerships |

| Lockheed Martin | 1912 | Bethesda, MD, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, MA, USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, IL, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | Farnborough, UK | ~ | ~ | ~ | ~ | ~ |

KSA Defense Market Analysis

Growth Drivers

Government Investment in National Security

Government investment in national security plays a critical role in driving the defense market in Saudi Arabia. With the country facing regional security threats, defense spending has surged in response to the need for advanced military systems and technologies. Saudi Arabia’s Vision 2030 has further amplified this growth by emphasizing modernization across sectors, including defense. The substantial allocation of funds to defense procurement is aimed at strengthening military capabilities, particularly in air defense and surveillance systems, ensuring the Kingdom’s ability to protect its borders and national interests. Additionally, rising geopolitical tensions in the region have driven the need for high-tech defense solutions to ensure strategic deterrence and military superiority. In this environment, government policy has acted as a powerful catalyst for the expansion of the defense market.

Technological Advancements and Modernization

Another key growth driver in the Saudi Arabian defense market is the ongoing technological advancements and military modernization programs. Saudi Arabia has increasingly invested in cutting-edge technologies such as unmanned aerial vehicles (UAVs), advanced radar systems, and cybersecurity solutions. These technologies are being integrated into the Kingdom’s defense infrastructure to ensure operational superiority and security. The rapid evolution of defense technologies, coupled with the Kingdom’s focus on adopting the latest innovations, positions it as a leading player in the Middle East defense sector. The demand for autonomous systems, such as drones for reconnaissance and surveillance, is growing rapidly, further driving investments in these technologies. The Kingdom is also focusing on enhancing interoperability among its defense systems, which is pushing demand for integrated platforms and advanced cybersecurity measures.

Market Challenges

High Capital Expenditure in Defense Projects

A significant challenge facing the Saudi defense market is the high capital expenditure required for defense projects. The cost of acquiring and maintaining advanced military equipment, such as fighter jets, surveillance systems, and missile defense systems, places a considerable strain on defense budgets. Additionally, the long procurement cycles and maintenance costs of high-tech equipment add another layer of financial pressure. While the government continues to prioritize defense spending, the sheer cost of modernization and expansion has led to financial constraints in certain areas, making it challenging for smaller local players to compete with global defense contractors. This challenge is further exacerbated by the need for continuous upgrades to stay ahead of emerging threats, driving up the cost of technology and infrastructure development.

Cybersecurity and Technology Integration Issues

As the Saudi defense sector modernizes, the integration of new technologies into existing systems poses a considerable challenge. Cybersecurity threats, in particular, have become a growing concern as more defense systems become interconnected. Ensuring the security of sensitive military data and maintaining the integrity of mission-critical systems is a top priority. However, as the sector adopts more advanced technologies, the risk of cyberattacks increases, especially given the rise of state-sponsored cyber threats. The integration of autonomous systems, drones, and artificial intelligence into defense operations also presents challenges in terms of compatibility with legacy systems. As the demand for cutting-edge technology grows, the Kingdom faces the complex task of maintaining cybersecurity while ensuring smooth technological integration across its military infrastructure.

Opportunities

Expansion in Artificial Intelligence (AI)-Driven Defense Solutions

One of the most promising opportunities in the Saudi defense market is the growing demand for AI-driven defense solutions. AI technologies are increasingly being utilized in surveillance, cybersecurity, and autonomous systems, offering the potential to enhance operational efficiency and strategic decision-making in real-time. The use of AI-powered drones and robots for reconnaissance, surveillance, and even combat operations is expected to revolutionize defense capabilities. The Saudi government’s focus on technological modernization, as part of its Vision 2030 strategy, is paving the way for increased investment in AI technologies for military applications. As AI capabilities continue to evolve, Saudi Arabia is poised to become a regional leader in implementing advanced AI-driven defense systems, providing a competitive edge in both defense and national security.

Partnerships with Private Sector for Cybersecurity Innovations

Another significant opportunity in the Saudi defense market is the potential for partnerships with private technology firms, particularly in the field of cybersecurity. As threats to national security become increasingly digital, the need for robust cybersecurity solutions has never been greater. Saudi Arabia is looking to bolster its defense infrastructure by incorporating cutting-edge cybersecurity measures to safeguard its military operations. Collaborating with private sector technology companies that specialize in cybersecurity will enable the Kingdom to access the latest innovations and enhance the security of its defense systems. This partnership model offers mutual benefits, with private companies gaining access to a growing defense market and the Kingdom strengthening its defense capabilities through advanced cybersecurity solutions.

Future Outlook

The future outlook for the Saudi Arabian defense market over the next five years is expected to be marked by continuous growth and innovation, driven by an emphasis on technological advancements, increased defense spending, and strategic regional partnerships. The Kingdom is likely to continue focusing on enhancing its military capabilities, particularly in the fields of air defense, missile systems, and unmanned technologies, aligning with its broader national security objectives. Additionally, growing demand for integrated platforms, cybersecurity systems, and advanced surveillance technologies will drive market expansion, underpinned by government investments and a strategic shift toward defense modernization. With Saudi Arabia increasingly relying on partnerships with global defense contractors, the Kingdom’s defense market will remain competitive, positioning it as a regional powerhouse in military innovation and technology.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Boeing

- Northrop Grumman

- BAE Systems

- Thales Group

- General Dynamics

- Leonardo

- Saab Group

- L3 Technologies

- Rheinmetall AG

- Elbit Systems

- Harris Corporation

- Sikorsky Aircraft

- Honeywell Aerospace

Key Target Audience

- Government and regulatory bodies

- Military forces

- Investments and venture capitalist firms

- Aerospace and defense contractors

- Defense technology companies

- Security agencies

- Private sector firms in defense

- Defense policy and strategy think tanks

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology involves identifying key variables such as defense expenditure trends, technological innovations, and geopolitical influences affecting the Saudi defense market.

Step 2: Market Analysis and Construction

Market analysis is conducted by evaluating current defense spending, technological advancements, and procurement strategies employed by the Saudi government.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and interviews are conducted with industry leaders, defense contractors, and government officials to validate hypotheses and refine market forecasts.

Step 4: Research Synthesis and Final Output

The final research synthesis integrates data collected from various sources to create a comprehensive market report, focusing on both qualitative and quantitative insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in Defense Systems

Rising Geopolitical Tensions

Growing Military Modernization Programs

Partnerships with International Defense Contractors - Market Challenges

High Capital Expenditure in Defense Projects

Cybersecurity Vulnerabilities

Regulatory and Compliance Barriers

Integration of New Technologies into Existing Systems

Political and Social Resistance to Military Expansion - Market Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

Emerging Demand for Autonomous Systems

Partnerships with Private Sector for Cybersecurity Innovations - Trends

Increased Use of Unmanned Aerial Systems

Integration of AI in Defense Operations

Surge in Cybersecurity Investments for Military

Military Collaboration with Tech Firms

Growth in Autonomous Weapon Systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Surveillance Systems

Cybersecurity Systems

Weapon Systems

Communication Systems - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Modular Solutions

Hybrid Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Security Services

Government Agencies

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Electronics

Optical Technology

Communication Technology

Artificial Intelligence

Robotics

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Pricing Strategy, Regional Presence, Technological Capabilities, Production Capacity)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Demand for Advanced Technology

- Government Agencies’ Role in Defense Procurement

- Security Services’ Adoption of New Defense Systems

- Private Sector’s Contribution to Research & Development

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035