Market Overview

The KSA Defense Tactical Video Data Link market is projected to reach a value of approximately USD ~ billion based on a recent historical assessment. This market is driven by rising defense investments, a growing need for modern communication systems, and advancements in tactical data link technologies. Additionally, the increase in military expenditures across defense sectors and the enhanced focus on national security are contributing to the market’s growth. The market is also being spurred by the demand for more integrated and secure communication channels in the defense industry.

The Middle East region, particularly Saudi Arabia, holds a dominant position in the defense tactical video data link market. This is primarily due to the country’s substantial investments in defense modernization and infrastructure development. Additionally, Saudi Arabia’s strategic military partnerships with global defense firms and its ongoing defense reforms are enhancing the adoption of advanced communication systems. These factors make Saudi Arabia a key player in the regional and global defense market.

Market Segmentation

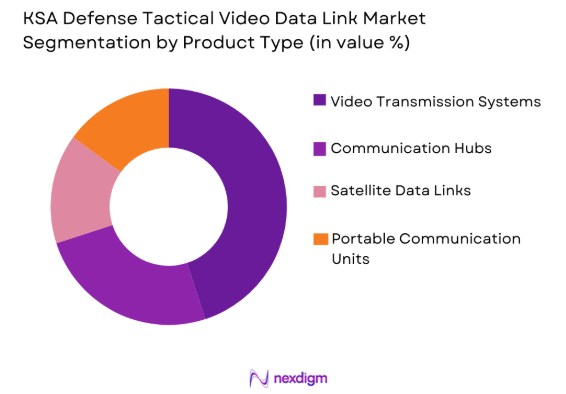

By Product Type

KSA Defense Tactical Video Data Link market is segmented by product type into video transmission systems, communication hubs, satellite data links, and portable communication units. Recently, video transmission systems have dominated the market share due to factors such as increasing demand for real-time video feeds for military operations, technological advancements in data compression, and the growing importance of intelligence, surveillance, and reconnaissance (ISR) systems. These systems are critical in enhancing situational awareness for military forces, which drives their dominance.

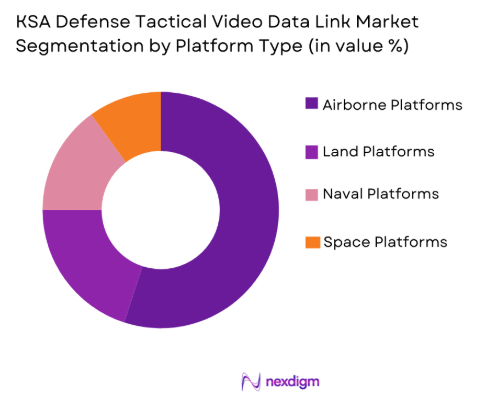

By Platform Type

KSA Defense Tactical Video Data Link market is segmented by platform type into land-based systems, airborne platforms, naval platforms, and space platforms. Airborne platforms have the dominant market share due to their critical role in surveillance, reconnaissance, and communication operations in military environments. The rising demand for unmanned aerial systems (UAS) and the integration of video data links in military drones are driving the rapid adoption of airborne platforms in defense operations.

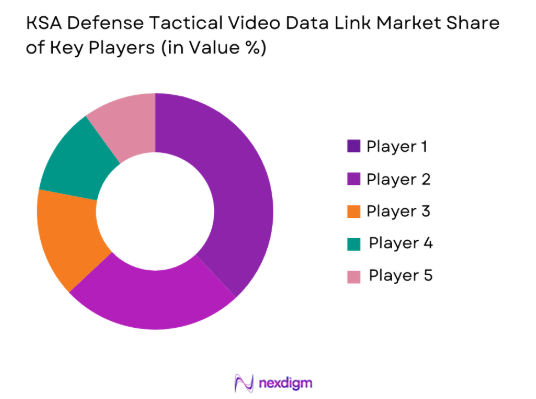

Competitive Landscape

The KSA Defense Tactical Video Data Link market is characterized by intense competition, with major global players consolidating their presence through strategic alliances and partnerships. Companies are leveraging technological advancements to offer integrated and secure communication solutions to meet the growing demands of defense forces. The market is driven by the need for real-time video surveillance and communication systems, and consolidation is observed as companies focus on enhancing product portfolios through mergers and acquisitions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Technology Partnerships |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

KSA Defense Tactical Video Data Link Market Analysis

Growth Drivers

Increased Defense Investments

The KSA Defense Tactical Video Data Link market is primarily driven by Saudi Arabia’s increased defense budget, which is in line with its Vision 2030 initiative. This initiative aims to enhance the country’s defense infrastructure and technological capabilities, with a specific focus on modernizing its military forces. These investments are particularly focused on upgrading communication and surveillance systems, which include the integration of advanced tactical video data links. The growing need for secure and real-time communication systems in defense operations is significantly driving market growth. Saudi Arabia’s commitment to boosting its defense sector through local and international partnerships with defense technology providers further accelerates this trend. The modernization of Saudi Arabia’s military forces includes the procurement of cutting-edge technologies, enhancing the efficiency and capabilities of its defense systems. The investment in defense technologies is expected to continue to grow, sustaining demand for advanced tactical video data links.

Technological Advancements

The rapid advancements in communication technologies, such as high-bandwidth video transmission, AI-powered surveillance, and the integration of cloud-based systems, are fueling the growth of the KSA Defense Tactical Video Data Link market. These technologies enhance the performance and efficiency of video data link systems, making them essential for real-time surveillance, reconnaissance, and communication in military operations. The integration of AI allows for improved data analysis and decision-making, while cloud-based solutions offer enhanced flexibility and scalability for managing large volumes of video and communication data. Additionally, the development of unmanned systems, including drones and autonomous vehicles, is driving the demand for more advanced tactical video data links. The ability to transmit high-quality video and data from remote, mobile platforms increases the need for these systems. As these technologies continue to evolve, the market will see further advancements in tactical communication systems, improving operational effectiveness in defense.

Market Challenges

High Capital Investment

One of the significant challenges faced by the KSA Defense Tactical Video Data Link market is the high initial capital investment required for the adoption and deployment of advanced communication systems. These systems, such as video transmission hubs and secure communication platforms, often require significant upfront costs. This can be a barrier for smaller defense organizations or subcontractors looking to upgrade their systems. Furthermore, the ongoing maintenance, support, and infrastructure costs associated with these systems can add to the financial burden. While larger defense contractors may have the resources to absorb these costs, smaller firms may struggle to make the necessary investments in advanced technology. The high costs of these systems also make it challenging for defense departments to scale operations, particularly in less economically developed areas. To overcome this challenge, defense departments and contractors are looking for cost-effective solutions, such as modular systems, and seeking to leverage existing infrastructure to minimize overall costs.

Interoperability Issues

Interoperability issues present a significant challenge to the KSA Defense Tactical Video Data Link market. As military forces upgrade their communication systems, ensuring compatibility between new technologies and legacy systems remains a critical obstacle. Older systems may not be fully compatible with newer video data link technologies, creating difficulties in integrating the two. This lack of standardization can lead to communication breakdowns, particularly in joint operations where different military branches or allied forces must work together. Additionally, the complexity of integrating diverse technologies—such as video transmission, satellite communication, and AI-powered systems—adds further hurdles. The integration process can be time-consuming, costly, and resource-intensive, which may delay the implementation of modern systems and limit operational efficiency. To address these issues, defense agencies are focusing on developing standardized protocols and interoperable solutions that allow seamless integration between various communication systems and platforms, ensuring smooth operations across multiple domains.

Opportunities

Artificial Intelligence Integration

One of the key opportunities for growth in the KSA Defense Tactical Video Data Link market lies in the integration of artificial intelligence (AI) into communication systems. AI has the potential to revolutionize tactical video data links by enabling automated decision-making and real-time data processing, which is crucial for military operations. By integrating AI algorithms into video transmission systems, military forces can improve situational awareness, reduce decision-making time, and enhance operational effectiveness. AI-powered systems can process and analyze large volumes of video and communication data to identify patterns, predict outcomes, and provide actionable insights to commanders on the ground. This technology can also enhance security by detecting potential cyber threats and preventing unauthorized access to sensitive information. As AI continues to evolve, the demand for AI-integrated tactical video data links will increase, providing significant growth opportunities for companies that can develop and deliver these advanced solutions to the defense sector.

Growth in Military Drones

The increasing adoption of unmanned aerial systems (UAS), or drones, presents a substantial opportunity for the KSA Defense Tactical Video Data Link market. Drones are being increasingly used for surveillance, reconnaissance, and communication tasks in modern military operations. These unmanned platforms rely heavily on secure and reliable video data links for transmitting real-time video feeds, sensor data, and communication signals back to command centers. The demand for drones, both manned and unmanned, is expected to grow rapidly as militaries continue to seek ways to enhance surveillance and reconnaissance capabilities without risking human lives. As drones become more integrated into defense strategies, the need for robust tactical video data links will continue to rise. The ability to transmit high-quality video data over long distances, especially in challenging environments, will be a key factor driving the demand for advanced tactical communication systems. This growing demand offers lucrative opportunities for technology providers in the video data link market.

Future Outlook

The future of the KSA Defense Tactical Video Data Link market looks promising, with significant technological advancements expected in the next five years. Emerging trends such as AI integration, the growing reliance on unmanned aerial systems, and the expansion of cloud-based communication systems will drive demand for tactical video data links. Additionally, government initiatives and defense modernization efforts will provide further impetus for the market’s growth. With ongoing investments and technological developments, the market is poised for steady expansion.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- General Dynamics

- Raytheon Technologies

- L3 Technologies

- Leonardo

- Harris Corporation

- Saab Group

- Rheinmetall AG

- Elbit Systems

- Hewlett Packard Enterprise

- Boeing

- Sikorsky Aircraft

- Northrop Grumman

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military forces

- Defense contractors

- Technology firms specializing in defense

- Aerospace and defense manufacturers

- System integrators

- Intelligence agencies

Research Methodology

Step 1: Identification of Key Variables

Identify the major factors that influence the KSA Defense Tactical Video Data Link market, including technological advancements, government investments, and defense industry needs.

Step 2: Market Analysis and Construction

Conduct in-depth analysis on market trends, technologies, competitive landscape, and regional dynamics to build a comprehensive understanding of market structure.

Step 3: Hypothesis Validation and Expert Consultation

Validate the hypotheses derived from the market analysis by consulting industry experts, key stakeholders, and market participants.

Step 4: Research Synthesis and Final Output

Synthesize research findings into a final report, highlighting key insights, growth opportunities, challenges, and future outlook for the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in Communication Systems

Rising Military Modernization Efforts - Market Challenges

High Capital Expenditure in Defense Systems

Interoperability and System Integration Issues

Cybersecurity Threats to Tactical Systems - Market Opportunities

Adoption of AI-Powered Video Data Links

Partnerships with Private Tech Firms

Growth in Autonomous and Unmanned Systems - Trends

Advancements in Real-Time Video Processing

Integration of AI and Machine Learning in Tactical Systems

Increased Use of Cloud-Based Communication Platforms - Government Regulations

Export Control and Compliance Policies

Government Funding for Defense Projects

Data Protection and Privacy Regulations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Systems

Surveillance and Reconnaissance Systems

Communication Systems

Signal Processing Systems

Weapon Control Systems - By Platform Type (In Value%)

Airborne Platforms

Land Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-Premise Solutions

Cloud-Based Solutions

Modular Solutions

Hybrid Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-Party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Growing Demand for Tactical Data Links

- Government Agencies’ Role in Regulating Defense Technology

- Defense Contractors’ Increasing Focus on Advanced Systems

- Private Sector’s Interest in Enhanced Communication Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035