Market Overview

The KSA deployable military shelters market is valued at USD ~ billion, driven by the growing need for mobile, rapid-deployment solutions in defense operations. Demand is fueled by increasing military budgets, ongoing modernization efforts, and the strategic necessity of deploying shelters in challenging environments. Moreover, the Saudi government’s emphasis on enhancing defense readiness, coupled with heightened defense spending, further accelerates the market’s growth, with military and humanitarian applications requiring advanced shelter technologies to ensure operational efficiency in remote locations.

The Kingdom of Saudi Arabia (KSA) remains a key player in the deployable military shelters market, with its strategic location in the Middle East and its heavy investments in defense and military infrastructure. The country’s large-scale defense modernization plans and its active involvement in regional military alliances drive its dominance in the sector. Additionally, KSA’s commitment to improving the welfare of its military personnel through modernized accommodations further supports the demand for advanced shelter solutions. International collaborations and access to cutting-edge technologies also contribute to Saudi Arabia’s position as a market leader.

Market Segmentation

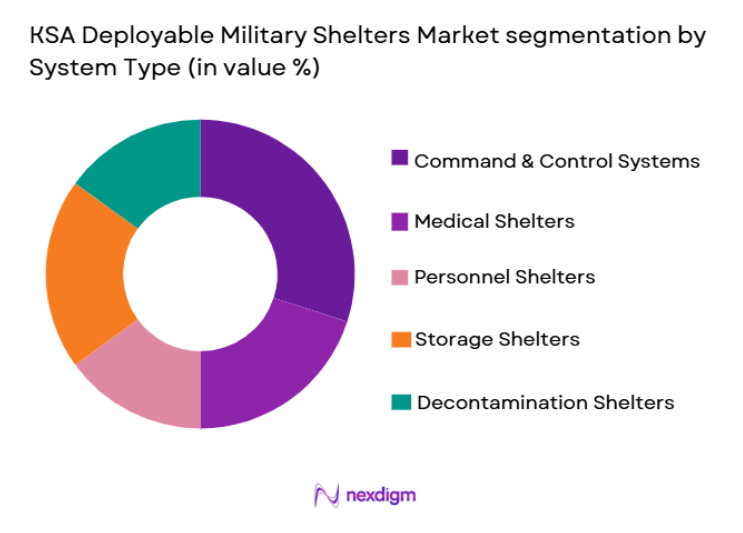

By System Type

The KSA deployable military shelters market is segmented by system type into command & control systems, medical shelters, personnel shelters, storage shelters, and decontamination shelters. Recently, the command & control systems sub-segment has a dominant market share due to the essential role these shelters play in military operations. Command & control shelters are integral for managing field operations, ensuring effective communication and coordination during military missions. The growing demand for mobile military headquarters and communication hubs has pushed this sub-segment to the forefront. These shelters not only provide secure and reliable infrastructure for military personnel but also facilitate critical decision-making processes, making them indispensable for modern defense strategies.

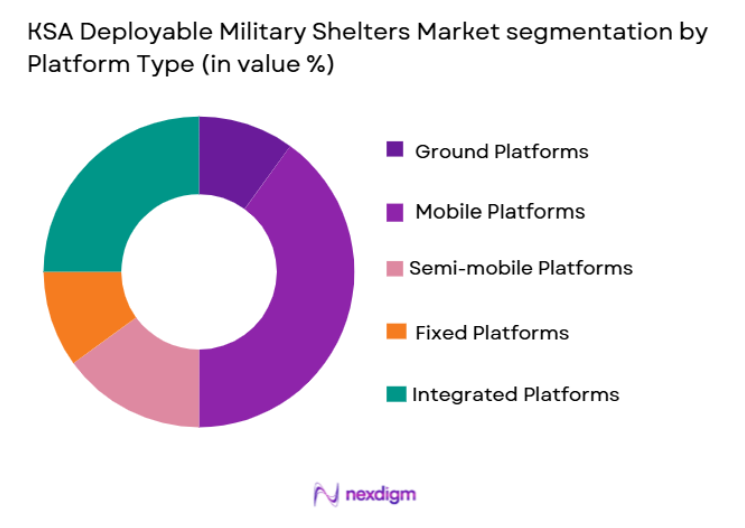

By Platform Type

The market is segmented by platform type into ground platforms, mobile platforms, semi-mobile platforms, fixed platforms, and integrated platforms. The mobile platforms sub-segment is currently dominating the market share due to their ability to be easily deployed and relocated in various operational environments. Mobile shelters are favored by military forces for their versatility and ability to quickly adapt to changing field conditions. These platforms provide rapid deployment capabilities, essential for military units engaged in dynamic and fluid operations, making them indispensable for the Saudi military’s operational readiness. As military needs evolve, the demand for mobile shelters is expected to continue increasing, ensuring their dominance in the market.

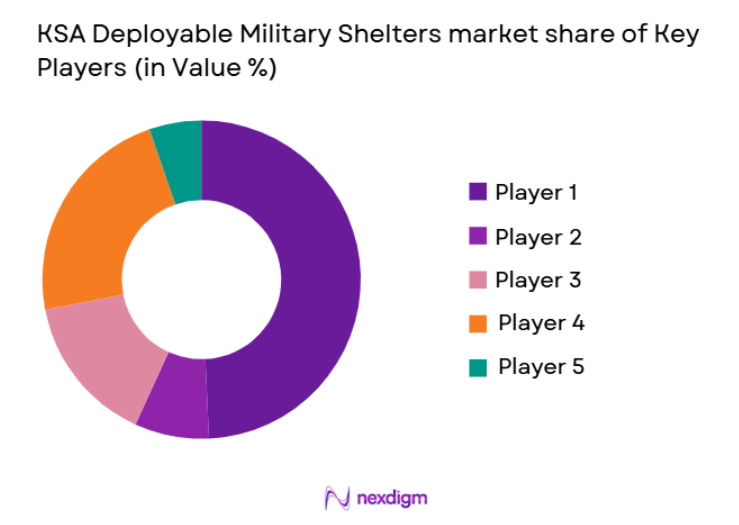

Competitive Landscape

The competitive landscape of the KSA deployable military shelters market is characterized by consolidation and strong competition among global defense and technology companies. Major players continue to expand their capabilities and influence through partnerships, acquisitions, and technological advancements. The Saudi Arabian government’s ongoing defense projects, which prioritize operational efficiency and rapid mobilization, attract these key players, allowing them to maintain a competitive edge in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

KSA Deployable Military Shelters Market Analysis

Growth Drivers

Increased Government Investment in National Defense

One of the major growth drivers for the KSA deployable military shelters market is the substantial increase in government investment in national defense. The Saudi Arabian government has consistently focused on modernizing its military infrastructure, with an emphasis on deploying advanced, rapidly mobile shelters that can be easily set up in various field conditions. The country’s robust defense spending is aimed at ensuring a strong and operationally ready military force capable of responding quickly to regional threats. As part of this modernization, the demand for advanced deployable shelters that provide secure living, operational spaces, and medical facilities has risen. Furthermore, this investment supports the local defense ecosystem, encouraging technological advancements and collaborations with international partners to enhance the capabilities of these shelters. With the Kingdom’s defense budget projected to remain high, the market for deployable military shelters is expected to witness sustained growth.

Technological Advancements in Shelter Designs

Technological advancements in shelter design and materials are driving the growth of the KSA deployable military shelters market. Innovations such as lightweight, durable materials, modular systems, and integrated energy-efficient technologies are making shelters more versatile, secure, and cost-effective. The integration of renewable energy solutions, such as solar panels and wind turbines, into these shelters is a key advancement that meets the growing demand for sustainable military solutions. Moreover, advancements in mobile technologies and communications systems allow deployable shelters to serve as fully functional command centers in remote locations. As the Saudi Arabian military increasingly relies on high-tech solutions for operations in diverse and challenging environments, the demand for state-of-the-art deployable shelters is expected to grow, contributing significantly to the market’s expansion.

Market Challenges

High Development and Production Costs

The high development and production costs associated with deployable military shelters represent a significant challenge for the KSA market. Developing and manufacturing shelters that meet the stringent requirements of military operations, such as durability, security, and rapid deployment, requires substantial investment in research, design, and materials. Additionally, the complexity of designing shelters that can function in extreme weather conditions and provide both protection and operational capabilities increases the cost further. Although Saudi Arabia’s defense budget is among the highest in the region, the cost of procuring and maintaining these advanced shelters poses a challenge, especially when weighed against other pressing defense needs. This high cost factor may limit the number of shelters that can be procured or delayed in the implementation of large-scale projects.

Logistical Constraints in Harsh Environments

Deploying shelters in challenging environments, such as deserts and conflict zones, presents logistical difficulties. These environments often present issues such as difficult terrain, extreme temperatures, and limited infrastructure, which complicate the deployment and setup of military shelters. The need for shelters to be highly mobile, easily transported, and rapidly deployed in these conditions adds complexity to the supply chain and operational efficiency. Additionally, logistical challenges in delivering essential materials, equipment, and fuel to remote locations can impact the overall effectiveness of military operations. While technological advancements have improved the capabilities of deployable shelters, overcoming these logistical constraints remains a significant challenge in ensuring the readiness and effectiveness of shelters in real-world military scenarios.

Opportunities

Expansion in Smart and Autonomous Shelter Solutions

The expansion of smart and autonomous shelter solutions represents a significant opportunity for the KSA deployable military shelters market. These advanced shelters are equipped with automated systems that can adapt to changing environmental conditions and military requirements. For example, autonomous shelters that can self-assemble and adjust their internal temperature, lighting, and ventilation systems offer significant advantages in terms of operational efficiency and resource management. The incorporation of IoT (Internet of Things) technologies allows military personnel to monitor and control shelter systems remotely, enhancing flexibility and reducing the need for manual intervention. Saudi Arabia’s focus on technological innovation and its desire to maintain cutting-edge defense capabilities provide a favorable environment for the development and adoption of these smart shelters. This opportunity aligns with the Kingdom’s broader goals of modernizing its military and incorporating more automated and efficient solutions.

Collaborations with Private Sector for Advanced Materials

Collaborations between the defense sector and private technology companies present a major opportunity for the KSA deployable military shelters market. By working with private sector companies that specialize in materials science, energy solutions, and automation, Saudi Arabia can enhance the performance and cost-effectiveness of its deployable shelters. For example, partnerships with companies specializing in lightweight composite materials or advanced insulation technologies could lead to the development of shelters that are more durable, cost-effective, and suitable for extreme environmental conditions. These collaborations also enable the integration of the latest innovations in energy efficiency and sustainability, helping to meet both military needs and environmental goals. As Saudi Arabia continues to strengthen its defense sector, this collaboration offers the potential for cutting-edge technologies and improved operational capabilities in deployable military shelters.

Future Outlook

The future outlook for the KSA deployable military shelters market is optimistic, with expectations of continued growth driven by advancements in technology and increasing defense investments. Over the next five years, the demand for deployable shelters is expected to increase as the Saudi military continues to modernize and adapt to evolving threats. Technological developments in smart shelters, renewable energy solutions, and autonomous systems will enhance the versatility and efficiency of these shelters. The KSA government’s strategic focus on enhancing military readiness, coupled with international collaborations, will also provide a strong foundation for the market’s expansion.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- Northrop Grumman

- Rheinmetall AG

- Raytheon Technologies

- L3 Technologies

- General Dynamics

- Leonardo

- Saab Group

- Elbit Systems

- Harris Corporation

- Hewlett Packard Enterprise

- Boeing

- Sikorsky Aircraft

Key Target Audience

- Military Forces

- Defense Contractors

- Government and Regulatory Bodies

- Security Services

- Private Sector / Technology Firms

- Investment Firms

- Aerospace Manufacturers

- Defense R&D Agencies

Research Methodology

Step 1: Identification of Key Variables

The key variables that influence the market were identified, including technological advancements, regulatory changes, and defense spending patterns.

Step 2: Market Analysis and Construction

The market was analyzed using both primary and secondary research, focusing on trends, drivers, and challenges.

Step 3: Hypothesis Validation and Expert Consultation

The initial market model was validated by consulting industry experts, including military professionals and technology specialists.

Step 4: Research Synthesis and Final Output

The final report synthesizes the research findings, providing a comprehensive overview of the market, key drivers, challenges, and opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Defense

Technological Advancements in Shelter Designs

Rising Demand for Field-Deployable Solutions - Market Challenges

High Development and Production Costs

Regulatory and Compliance Barriers

Logistical Constraints in Harsh Environments - Market Opportunities

Expansion in Smart and Autonomous Shelter Solutions

Collaborations with Private Sector for Advanced Materials

Growing Demand from International Military Alliances - Trends

Integration of Renewable Energy Solutions

Surge in Demand for Multi-Function Shelters

Rising Usage of Automated Systems in Military Shelters - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Military Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Medical Shelters

Personnel Shelters

Storage Shelters

Decontamination Shelters - By Platform Type (In Value%)

Ground Platforms

Mobile Platforms

Semi-mobile Platforms

Fixed Platforms

Integrated Platforms - By Fitment Type (In Value%)

Modular Systems

Portable Solutions

Expandable Solutions

Hard-shell Shelters

Tent Systems - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Forces

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Aluminum Materials

Canvas and Fabric Materials

Composite Materials

Steel Materials

Inflatable Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Market Value, Installed Units, Average System Price, System Complexity Tier, Technology Integration)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Thales Group

BAE Systems

Northrop Grumman

Rheinmetall AG

Raytheon Technologies

L3 Technologies

General Dynamics

Leonardo

Saab Group

Elbit Systems

Harris Corporation

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Growing Demand from Military Forces for Rapid Deployments

- Government Agencies’ Role in Regulating and Procuring Defense Shelters

- Defense Contractors Driving Technological Innovation

- Private Sector’s Growing Interest in Advanced Shelter Technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035