Market Overview

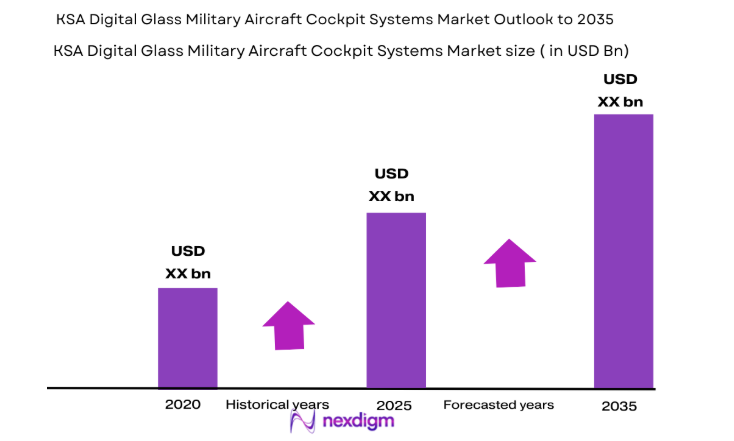

The KSA digital glass military aircraft cockpit systems market is expected to see significant growth, with its value driven by the increasing demand for advanced, efficient, and multifunctional cockpit systems in military aircraft. Based on a recent historical assessment, the market size is projected to reach USD ~ billion by 2024, spurred by factors such as rising defense spending and the demand for enhanced situational awareness in modern military operations. The market’s expansion is largely attributed to continuous technological advancements and increased investments in defense modernization initiatives by Saudi Arabia.

The dominant cities and countries driving this market include Saudi Arabia, with its extensive defense modernization efforts. The country’s strategic location in the Middle East, along with its growing defense budget, further strengthens its dominance in the market. Furthermore, Saudi Arabia’s ongoing collaborations with international defense contractors for the development and implementation of cutting-edge military technologies play a key role in the market’s growth. This market is also supported by the regional focus on military aircraft and defense capabilities within the Kingdom.

Market Segmentation

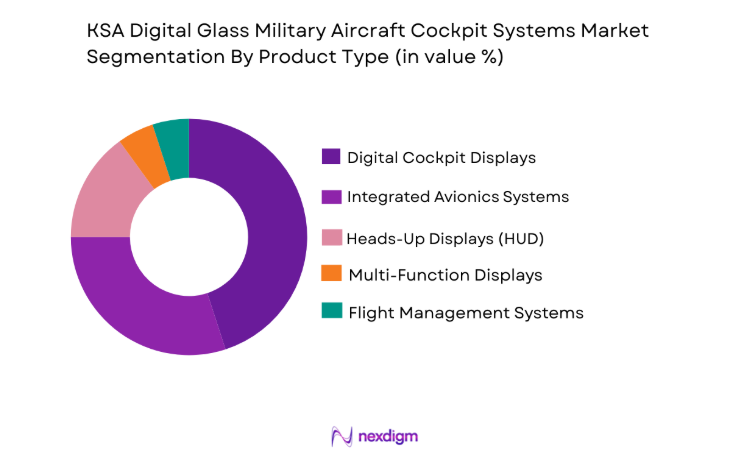

By Product Type

KSA digital glass military aircraft cockpit systems market is segmented by product type into various sub-segments. Recently, digital cockpit displays have dominated the market share due to the increasing demand for multifunctional and integrated systems in modern military aircraft. These displays offer enhanced situational awareness, which is crucial for tactical decision-making in combat situations. The integration of high-resolution, digital touchscreens, coupled with customizable configurations, enhances the flexibility and effectiveness of cockpit operations, contributing significantly to market growth.

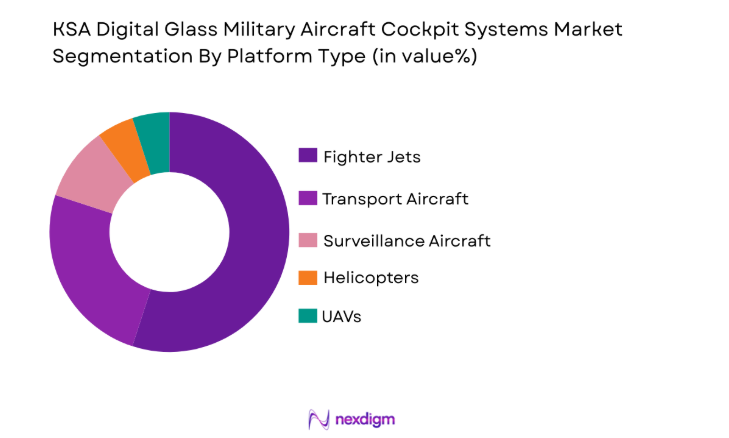

By Platform Type

KSA digital glass military aircraft cockpit systems market is also segmented by platform type, including various sub-segments. Among these, fighter jets hold a dominant market share due to their increasing deployment in high-intensity operations and combat missions. The demand for advanced cockpit systems in fighter jets is rising due to the need for enhanced pilot awareness, quick decision-making, and improved targeting systems, thereby driving their market share. Moreover, technological advancements such as HUDs and digital displays integrated into these aircraft systems contribute to the demand for these platforms in the military sector.

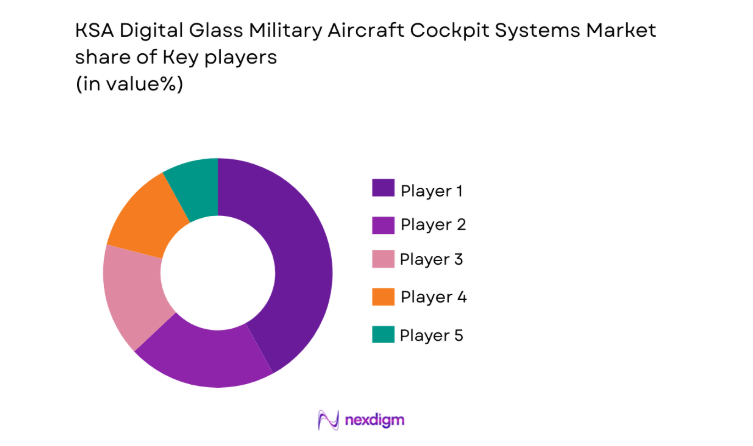

Competitive Landscape

The KSA digital glass military aircraft cockpit systems market is characterized by consolidation among major players, with a few companies dominating the market due to their advanced technological offerings and strong partnerships with defense agencies. The market is largely influenced by global defense giants and their local counterparts working in tandem to provide customized cockpit solutions. The competitive landscape also features increasing collaboration and innovation integrating new digital technologies into military aircraft.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Lockheed Martin | 1912 | Bethesda, Maryland | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, Illinois | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, Virginia | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, Massachusetts | ~ | ~ | ~ | ~ |

KSA Digital Glass Military Aircraft Cockpit System Market Analysis

Growth Drivers

Increased Defense Spending

Increased defense spending by Saudi Arabia remains a major growth driver for the KSA digital glass military aircraft cockpit systems market. Over the years, the Kingdom has significantly boosted its defense budget to strengthen its military capabilities, particularly within the air defense sector. This strategic shift is driven by a growing need for modernized military infrastructure in response to evolving regional security threats. As tensions rise within the Middle East, Saudi Arabia is prioritizing the enhancement of its military readiness, thus driving the demand for advanced technologies. Modern, efficient cockpit systems have become a focal point for this military expansion, as they improve situational awareness and decision-making during complex operations. The Kingdom’s vision to establish itself as a regional defense powerhouse accelerates this demand. Additionally, defense modernization projects are directly tied to this increased spending, with the Kingdom emphasizing the procurement of next-generation aircraft and military systems that require state-of-the-art cockpit technology. This surge in defense budgets further strengthens the position of high-tech cockpit solutions within the broader military upgrade initiatives, fueling continued growth in the digital glass cockpit systems market.

Technological Advancements in Avionics

The continuous advancements in avionics technology are transforming the digital glass military aircraft cockpit systems market, serving as another key driver. As aircraft manufacturers and defense agencies aim to integrate the latest technology into their fleets, the demand for digital glass displays, advanced heads-up displays (HUDs), and integrated avionics systems has increased significantly. These advancements facilitate smoother operations, offering enhanced visual displays, real-time data processing, and improved integration with other aircraft systems, ultimately increasing pilot control and reducing operational risks. Digital glass cockpit systems allow for greater customization, providing pilots with a high degree of flexibility, which is essential for responding to dynamic situations in combat. Additionally, avionics systems are now incorporating augmented reality (AR) and artificial intelligence (AI), which will further revolutionize the cockpit environment by offering intuitive, data-driven insights for pilots. As military aviation becomes more complex, these technological advancements offer a strategic advantage by improving the accuracy and effectiveness of military operations, strengthening mission success rates, and enhancing pilot performance under pressure. The demand for sophisticated cockpit systems equipped with cutting-edge technologies, such as real-time data integration and predictive maintenance, is expected to continue growing, pushing the boundaries of what modern military aircraft can achieve.

Market Challenges

High Cost of Advanced Systems

A significant challenge facing the KSA digital glass military aircraft cockpit systems market is the high cost associated with the development and integration of these advanced systems. Digital glass cockpit systems, although technologically superior, require substantial financial investment for R&D, design, production, and deployment. The integration of advanced avionics, digital displays, and other cockpit technologies often comes with a hefty price tag, which poses a challenge for defense agencies with limited budgets. For Saudi Arabia, while the defense budget has been increasing, the cost of modernizing and equipping aircraft with these systems remains a significant portion of military expenditure. Furthermore, integrating these systems into existing fleets, especially older military aircraft, involves costly retrofitting, increasing both the upfront and long-term costs. Smaller nations or those with constrained defense budgets may struggle to justify such high expenditures, further limiting the broader adoption of these technologies. Consequently, cost remains a barrier, especially for non-defense-rich countries, as they balance between upgrading their military capabilities and controlling budget expenditures. To address this, industry players will need to explore cost-effective solutions and partnerships to make these systems more affordable while maintaining performance and quality.

Integration Challenges with Legacy Systems

Integrating new digital glass cockpit systems with legacy aircraft technologies is another prominent challenge facing the KSA digital glass military aircraft cockpit systems market. Many of the military aircraft currently in service in Saudi Arabia are equipped with older avionics systems that may not be compatible with the latest digital glass cockpit solutions. This integration issue requires extensive retrofitting and modification of existing aircraft, which can be both technically challenging and costly. The complexity arises from the need to ensure that the new systems are compatible with legacy avionics, communication systems, and flight controls, often leading to a lengthy and intricate installation process. The retrofitting of older systems also presents potential operational risks, as it can disrupt flight operations during the transition phase, leading to reduced efficiency. The requirement for specialized software updates and system testing further complicates the integration process, making it more resource intensive. Moreover, ensuring interoperability between newly integrated systems and existing hardware across different aircraft platforms is a substantial challenge. While integration is essential to modernize the fleet, addressing these technical challenges while minimizing operational downtime remains a critical issue for stakeholders in the KSA market.

Opportunities

Collaboration with International Defense Contractors

A prominent opportunity in the KSA digital glass military aircraft cockpit systems market lies in the potential for collaboration with international defense contractors. Such partnerships enable Saudi Arabia to access cutting-edge technologies, research, and expertise from global defense leaders, enhancing its indigenous capabilities and accelerating the development of next-generation military aircraft. By working with these contractors, Saudi Arabia can ensure that its air force is equipped with the latest cockpit systems, boosting operational efficiency and performance in the field. Furthermore, these collaborations foster technology transfer, empowering local companies, and defense contractors to develop their own innovations in digital glass cockpit systems. This growth in local capacity can be particularly beneficial for the Kingdom’s long-term defense strategy, as it reduces dependence on foreign suppliers while enhancing domestic industries. Additionally, these partnerships can drive the Kingdom’s economic growth by creating high-tech jobs, strengthening its position as a regional defense hub. As international defense contractors are increasingly drawn to the Saudi market due to its expanding defense budget and modernization initiatives, the prospects for successful collaborations remain high. Through these efforts, Saudi Arabia can not only modernize its military fleet but also build a sustainable, innovation-driven defense sector capable of meeting future challenges.

Rising Demand for Next-Generation Aircraft

The increasing demand for next-generation military aircraft presents a significant opportunity for the KSA digital glass military aircraft cockpit systems market. Saudi Arabia’s strategic defense initiatives emphasize acquiring advanced fighter jets, surveillance aircraft, and unmanned aerial vehicles (UAVs) that are equipped with cutting-edge cockpit systems. As the Kingdom seeks to enhance its military capabilities and defense of readiness, there is an escalating need for these aircraft to feature modern, multifunctional cockpit solutions. Digital glass cockpit systems, with their high-resolution displays, integrated avionics, and customizable functionalities, provide a technological edge that is essential for the next generation of military aircraft. The rising focus on improving air combat performance, situational awareness, and mission success rates in high-intensity operations drives the demand for these advanced systems. Additionally, the adoption of next-generation aircraft equipped with the latest cockpit technology aligns with the broader vision of modernization that is central to Saudi Arabia’s defense strategy. This demand presents a unique opportunity for manufacturers to offer tailored cockpit systems, further expanding their market share by meeting the specific needs of the Kingdom’s evolving military requirements. The focus on next-generation aircraft and their avionics systems will continue to shape the market, presenting significant opportunities for innovation and growth in the coming years.

Future Outlook

The future outlook for the KSA digital glass military aircraft cockpit systems market is optimistic, driven by ongoing defense modernization programs, increased investments in advanced technologies, and the continuous evolution of digital cockpit systems. With a strong focus on enhancing air combat capabilities, Saudi Arabia is poised to adopt even more advanced technologies, such as artificial intelligence, augmented reality, and predictive maintenance, within its military aircraft. The demand for multifunctional cockpit systems is expected to rise in line with the Kingdom’s increasing focus on technological innovation in defense.

Major Players

- Lockheed Martin

- Thales Group

- Boeing

- Northrop Grumman

- Raytheon Technologies

- General Dynamics

- L3 Technologies

- Leonardo

- BAE Systems

- Elbit Systems

- Harris Corporation

- Saab Group

- Rheinmetall AG

- Israel Aerospace Industries

- Mitsubishi Heavy Industries

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military equipment manufacturers

- Aircraft and avionics companies

- Aircraft integrators

- Aerospace research organizations

- Military personnel and defense analysts

Research Methodology

Step 1: Identification of Key Variables

We identify the key market variables such as product types, technologies, and market demands influencing the digital glass military aircraft cockpit systems market in KSA.

Step 2: Market Analysis and Construction

The market structure and the growth of drivers, challenges, and opportunities are analyzed based on data collected from government reports, industry publications, and expert consultations.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses related to market trends, growth forecasts, and technological advancements through consultations with industry experts and stakeholders in the defense sector.

Step 4: Research Synthesis and Final Output

The findings are synthesized into a final report, providing insights, forecasts, and actionable recommendations for stakeholders in the KSA digital glass military aircraft cockpit systems market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Advanced Military Aviation Systems

Government Investment in Defense and Aerospace Modernization

Technological Advancements in Display and Sensor Systems

Increased Focus on Pilot Safety and Operational Efficiency

Growth in Military Aircraft Fleet Expansion - Market Challenges

High Initial Investment Costs in Digital Systems

Complexity of Integration with Existing Aircraft Systems

Cybersecurity Threats and System Vulnerabilities

Regulatory and Compliance Barriers in Defense Technologies

Limited Availability of Skilled Technicians for Maintenance - Market Opportunities

Increasing Adoption of Augmented Reality in Cockpit Systems

Partnerships Between Aerospace Companies for Technological Innovations

Growth of Military Exports and International Demand for Aircraft - Trends

Integration of Artificial Intelligence in Flight Control Systems

Advancement in HUD (Heads-Up Display) Technologies

Rise in Adoption of Modular and Scalable Systems

Increased Use of Lightweight Composite Materials in Manufacturing

Collaboration Between Civil and Military Aviation for Technology Transfer - Government Regulations & Defense Policy

Defense Export Control Regulations

National Security and Data Protection Policies

Funding for Military Aerospace Modernization Programs - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Digital Cockpit Displays

Glass Cockpit Systems

Cockpit Control Systems

Flight Instrumentation Systems

Advanced Sensor Systems - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

Unmanned Aircraft Systems

Combat Aircraft

Transport Aircraft - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Integrated Fitment

Modular Fitment

Hybrid Fitment - By EndUser Segment (In Value%)

Military Aviation Forces

Defense Contractors

Government Agencies

Private Sector / Aerospace Firms

Aviation Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Glass Composite Materials

Digital Display Technologies

Touchscreen Interfaces

Electromagnetic Shielding Materials

Advanced Optics Technologies

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Material/Technology)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Thales Group

Honeywell Aerospace

Rockwell Collins

Garmin Ltd.

L3 Technologies

General Electric Aviation

Boeing

Lockheed Martin

Raytheon Technologies

Northrop Grumman

Saab Group

Sikorsky Aircraft

BAE Systems

Leonardo

Elbit Systems

- Military Aviation Forces’ Preference for Advanced Cockpit Systems

- Defense Contractors’ Focus on Upgrading and Innovating Systems

- Government Agencies Driving Procurement of Cutting-Edge Aviation Technologies

- Aerospace Firms Focusing on Collaboration for Technological Development

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035