Market Overview

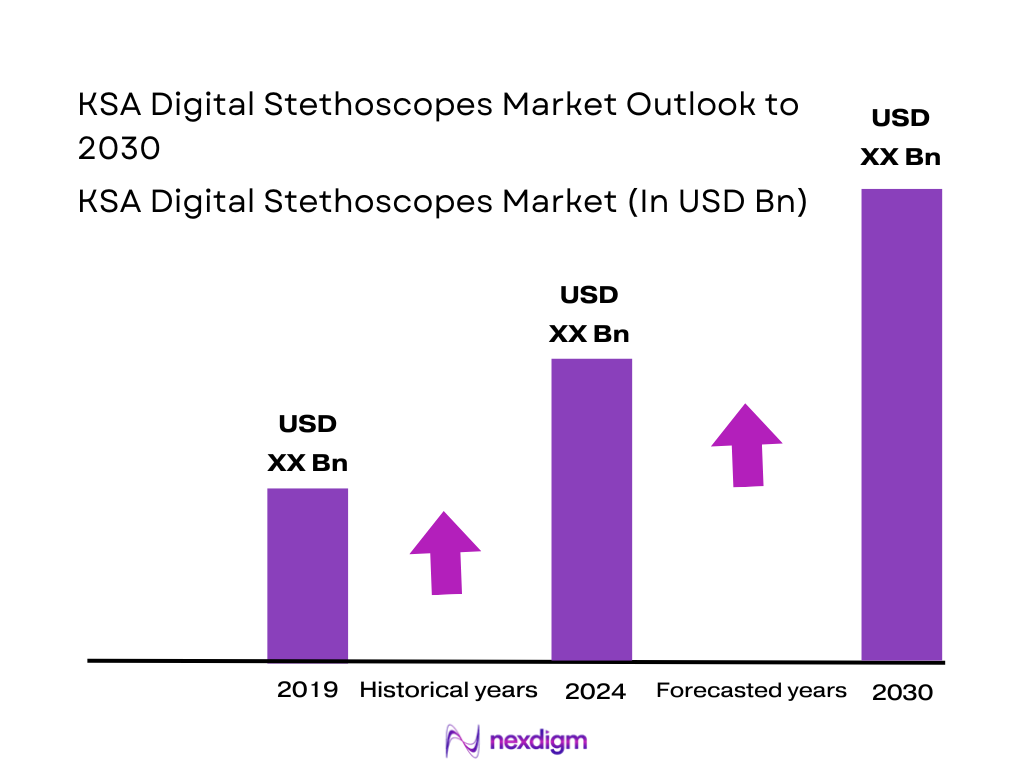

The KSA Digital Stethoscopes market is valued at USD ~ million, expanding from USD ~ million, supported by the rapid normalization of virtual-care workflows, growing use of connected diagnostics in large hospital groups, and procurement-led adoption of amplification + noise-cancellation devices for high-throughput OPD and inpatient rounds. The market’s forward trajectory is anchored by a forecast CAGR of 7.3%, reflecting steady institutional replacement cycles and gradual scaling of digitally enabled care pathways.

Riyadh and Jeddah dominate adoption because they concentrate tertiary/quaternary hospitals, specialist centers, corporate healthcare groups, and national reference facilities, which are the earliest buyers for devices requiring biomedical validation, clinician champions, and IT governance. Dammam/Khobar follows due to dense private-provider networks and higher concentration of employer-backed healthcare. From a supply side, KSA availability is shaped largely by U.S. and European premium ecosystems (clinical-grade acoustics + software platforms) alongside China-led value devices, because these vendors already have scalable distributor models and catalog breadth aligned to institutional procurement and private clinician purchasing.

Market Segmentation

By Product Type

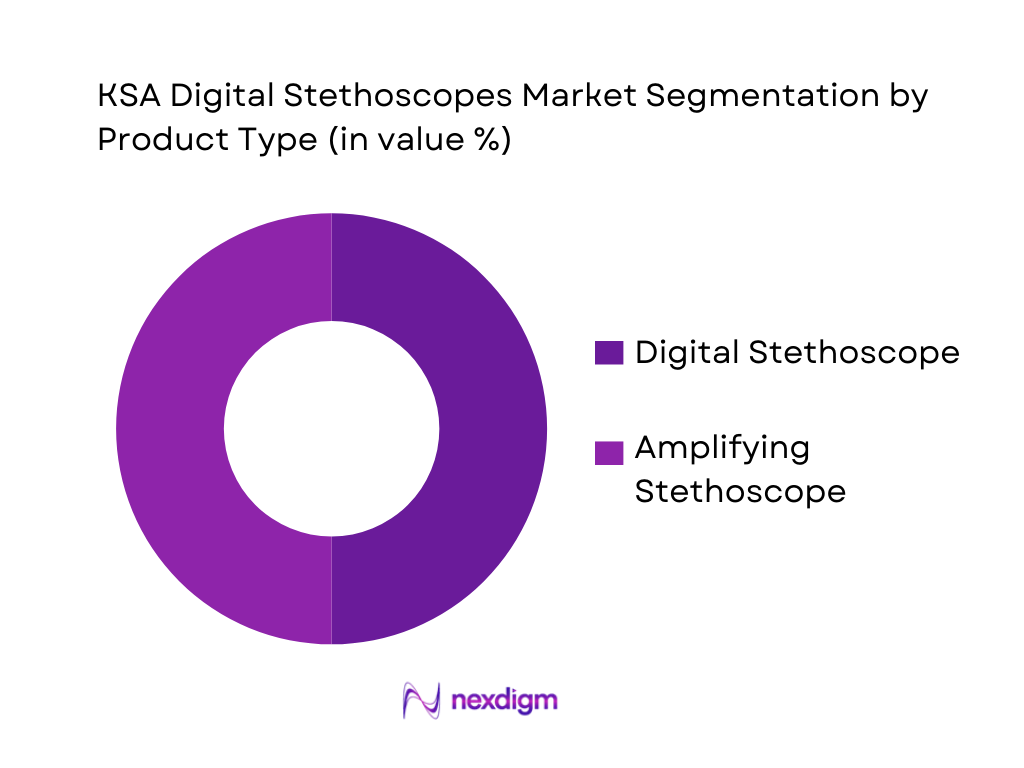

KSA Digital Stethoscopes market is segmented by product type into digital stethoscope and amplifying stethoscope. Recently, digital stethoscope holds a dominant position because it sits at the intersection of clinical workflow utility and software-led feature expansion—waveform visualization, exam recording, sharing for second opinions, and (in select ecosystems) optional AI overlays. In KSA hospitals, the “digital” category also fits better with structured programs such as tele-consult carts, hospital-at-home pilots, and remote specialty coverage where recordings and handoffs matter. By contrast, pure amplifying devices win in clinician-driven purchases, but digital devices scale more consistently in institutional deployments due to standardization, auditability, and training repeatability across departments.

By End User

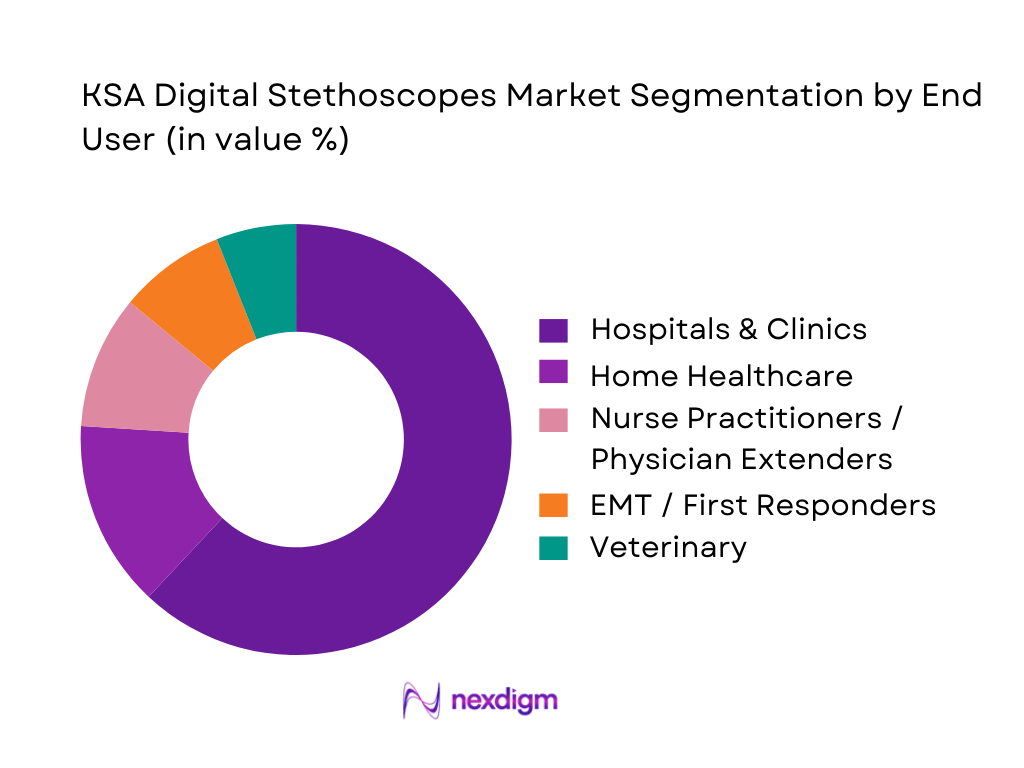

KSA Digital Stethoscopes market is segmented by end user into hospitals & clinics, home healthcare, nurse practitioners/physician extenders, EMT/first responders, and veterinary. Recently, hospitals & clinics dominate because they combine highest patient throughput, multi-specialty use-cases and organizational ability to fund devices through departmental capex/opex pools while also enforcing standardized device protocols. Hospitals also have stronger pull for features like noise cancellation, better signal clarity, and documentation-friendly workflows (record, review, share), which creates repeat orders as more departments adopt. Other end users remain meaningful but more fragmented: home healthcare depends on program maturity, EMT use is scenario-based, and veterinary volumes are comparatively smaller in KSA’s clinical device purchasing mix.

Competitive Landscape

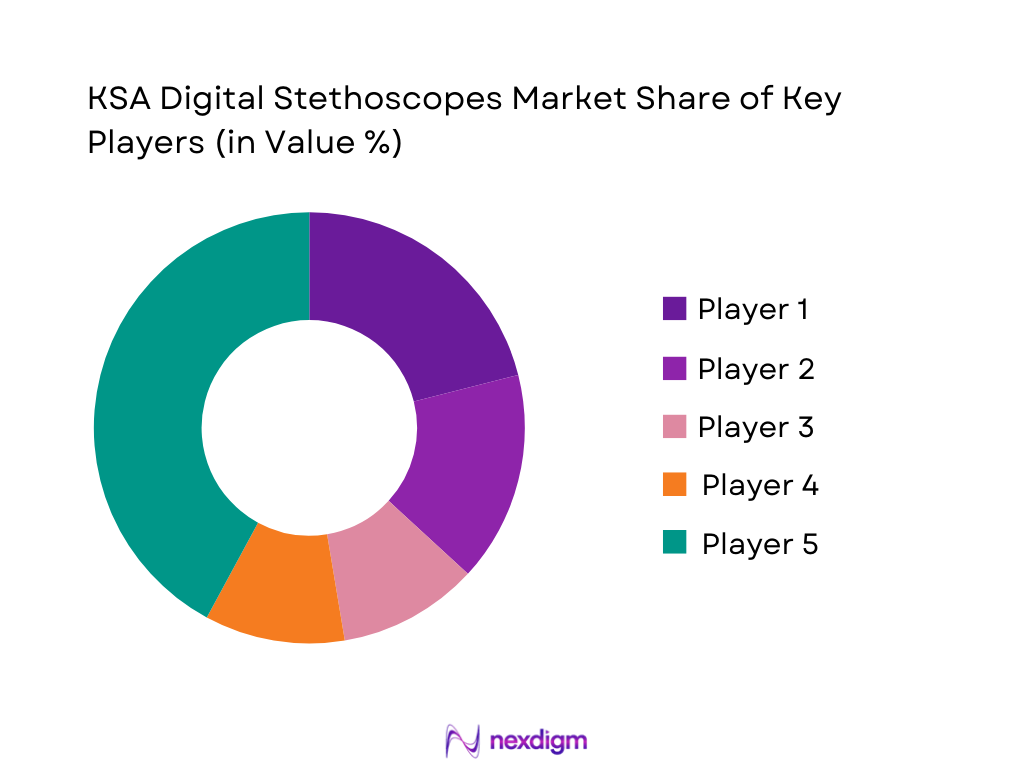

The KSA Digital Stethoscopes market is moderately consolidated at the premium end (driven by entrenched clinical preference and brand trust) while remaining competitive in the value tier where distributors and online channels offer multiple alternatives. Premium ecosystems typically win in KSA’s specialist-heavy settings because they pair strong acoustics with workflow features (visualization/recording and optional analytics). Value-tier devices compete on accessibility and rapid availability, particularly for individual clinician purchases and small-clinic settings, but face greater scrutiny in institutional standardization decisions.

| Company | Establishment Year | Headquarters | Core Device Focus in KSA | AI / Analytics Layer | App / Platform Strength | Integration Readiness (Telehealth/EHR) | KSA Channel Strength | Localization / Training Readiness |

| 3M Littmann / Solventum | 1902 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Eko Health | 2013 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thinklabs Medical | 1991 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| CONTEC Medical Systems | 1996 | China | ~ | ~ | ~ | ~ | ~ | ~ |

| Ekuore | 2011 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Digital Stethoscopes Market Analysis

Growth Drivers

Vision-Aligned Digital Health Adoption

Saudi Arabia’s push to modernize care delivery is supported by the scale of its economy and public-sector capacity to fund digital health transformation across providers. The country’s GDP is USD ~ trillion and GDP per capita is USD ~, creating fiscal headroom for health system digitization, procurement modernization, and multi-facility standardization programs that favor digitally enabled diagnostics (including digital auscultation) over purely analog tools. The addressable clinical environment is also large and expanding: population is ~, increasing the volume of cardiopulmonary encounters that benefit from clearer signal capture and documentation-ready workflows. On the delivery side, national-level virtualization is no longer theoretical—MOH’s Seha Virtual Hospital supports ~ hospitals, delivers ~ core specialized services plus ~ sub-specialty services, employs 150 doctors, and is designed for more than ~ patients annually capacity. This kind of hub-and-spoke capability directly increases the operational value of digital stethoscopes because remote consult pathways need consistent sound quality, repeatable capture, and shareable recordings to reduce rework and improve case handover between peripheral hospitals and tertiary centers. For device vendors and distributors, the combined macro capacity and scaled national tele-specialty infrastructure materially increases institutional willingness to trial and then standardize digital auscultation tools—especially where they align with care continuity, documentation discipline, and specialist coverage models across regions.

Expansion of Telemedicine & Virtual Care

Telemedicine scale is now measurable in Saudi Arabia’s national infrastructure, and that matters because digital stethoscopes become more valuable when clinicians must assess cardiopulmonary status without being physically co-located with the patient. MOH’s Seha Virtual Hospital connects ~ hospitals, provides ~ core specialized services and ~ sub-specialty services, and operates with ` doctors with designed capacity for more than ~ patients annually—a configuration that increases demand for peripheral sites to have reliable front-line exam tools that can feed remote decision-making. This driver is reinforced by macro capacity and connectivity readiness: Saudi Arabia’s GDP is USD ~ trillion and population is ~, which increases both the fiscal ability to roll out virtual pathways and the absolute number of potential encounters that can be managed remotely when appropriate. Digital stethoscopes fit telemedicine not as “gadgets” but as workflow enablers: higher-quality sound capture in noisy settings, repeatable recordings for escalation, and faster triage support for emergency and respiratory cases. As virtual care expands across public and private systems, procurement committees increasingly evaluate devices for “tele-consult readiness” (recording, sharing, compatibility with carts and remote rounds), which structurally favors digital over conventional stethoscopes in hospitals participating in national virtual-care programs.

Challenges

Clinical Validation & Acceptance

Even with strong digital-health momentum, clinical adoption of digital stethoscopes requires validation against real KSA workflows—noisy wards, high patient throughput, and mixed-acuity environments—before broad standardization occurs. The healthcare system’s scale makes this non-trivial: GASTAT reports ~ hospitals, which means any device category shift must work across heterogeneous facility types and clinical cultures. Workforce structure amplifies the importance of acceptance: ~ medical doctors are active in the system, and changing a ubiquitous tool like a stethoscope requires aligned training, biomedical endorsement, infection control sign-off, and clinical champions across specialties. At the macro level, the country’s GDP is USD ~ trillion supports procurement, but clinical governance remains the gating factor—institutions need evidence that digital amplification, noise filtering, and recording workflows improve clinical confidence without adding friction. Acceptance is also influenced by specialty distribution: where tertiary centers are concentrated (Riyadh/Jeddah), clinicians may have stronger exposure to digital tools, while peripheral facilities may prioritize simplicity and durability. As a result, KSA adoption is often staged: pilot programs in high-acuity or tele-consult enabled units first, then expansion after clinician feedback, protocol creation, and training material localization. This slows scale-up timelines and makes vendor support capability a key determinant of success.

Data Privacy & Hosting Constraints

Connected digital stethoscopes face stricter governance requirements in KSA because health data handling must align with national privacy and hosting expectations. The regulatory compliance timeline is explicit: the Personal Data Protection Law with organizations expected to be fully aligned, which forces hospitals and digital health programs to evaluate device ecosystems for data processing, storage location, access controls, and vendor obligations before scaling. At the infrastructure layer, KSA’s digital environment is strengthening—World Bank data reports ~ secure internet servers per ~ million people, indicating improving national capacity for secure connectivity, but provider procurement teams still require clarity on where audio files and metadata reside, and how access is controlled across clinicians, hospitals, and vendors. These constraints interact with system scale: a country of ~ people and ~ hospitals will not tolerate fragmented governance models across multiple device apps and cloud backends. Macro capacity supports investment in compliant architectures, but compliance readiness becomes a gating factor for any platform-led digital stethoscope deployment, especially in government-linked programs. The practical challenge for vendors is to provide enterprise-grade controls, clear data-flow documentation, and deployment options aligned to KSA requirements; otherwise adoption remains confined to “offline-only” workflows or individual clinician purchases.

Opportunities

AI-Enabled Screening Workflows

The near-term opportunity is to embed digital stethoscopes into structured screening and triage workflows where KSA faces high cardiopulmonary burden and specialist concentration in major hubs. The burden signal is tangible: the World Heart Federation dashboard reports ~ cardiovascular deaths, indicating large volumes of patients where earlier recognition of abnormal heart/lung sounds can improve referral quality and reduce repeated encounters. The delivery infrastructure to scale such workflows is also real: MOH’s Seha Virtual Hospital supports ~ hospitals, provides ~ core specialized services and ~ sub-specialty services, and is designed for more than ~ patients annually capacity—creating a national pathway where captured exam findings can be escalated for remote review. Macro conditions support programmatic deployment: GDP is USD ~ trillion, GDP per capita is USD ~, and population is ~, enabling national programs to standardize tools across high-volume sites. The opportunity is not “future AI projections”; it is current operational feasibility—deploying AI-ready auscultation capture today so hospitals can progressively add advanced decision support modules within compliant governance frameworks. This aligns with KSA’s program model: start with high-acuity and referral-heavy departments, then scale through standardized protocols across facilities connected to virtual specialty hubs.

National Preventive Care Programs

Preventive care expansion increases the operational value of digital stethoscopes because early cardiopulmonary risk identification requires high-volume frontline assessments that are consistent, documentable, and scalable across many sites. Saudi Arabia’s system scale supports this: GASTAT reports ~ hospitals, and workforce capacity includes ~ medical doctors, which reflects a delivery footprint capable of running screening and risk management pathways—if equipped with standardized tools and protocols. Preventive care is also tightly linked to chronic disease burden management; WHO-supported reporting on NCD priorities in Saudi Arabia underscores the centrality of cardiovascular and chronic respiratory conditions in national health outcomes, reinforcing why better auscultation and triage tools matter at the primary and secondary care levels. Macro capacity provides the enabling environment: GDP is USD ~ trillion, GDP per capita is USD ~, and population is ~, which together support large-scale program delivery and procurement standardization across regions. The market opportunity is therefore immediate and execution-driven: embedding digital auscultation into preventive care pathways for high-risk cohorts so that referrals are cleaner, repeat visits reduce, and remote specialist input (where needed) becomes more efficient—especially in facilities connected to national virtual-care infrastructure.

Future Outlook

Over the next five to six years, the KSA Digital Stethoscopes market is expected to expand steadily as hospitals and large provider groups formalize digitally enabled care pathways and standardize diagnostic workflows across departments. Growth will be driven by broader acceptance of connected diagnostics in routine clinical practice, gradual scaling of remote and hybrid care models, and continued replacement/upgrade cycles as clinicians move from basic amplification toward devices that support documentation, collaboration, and integration. The market is forecast to grow at a CAGR of 7.3% during 2024–2030.

Major Players

- 3M Littmann / Solventum

- Eko Health

- Thinklabs Medical

- Welch Allyn

- Cardionics

- Ekuore

- CONTEC Medical Systems

- American Diagnostic Corporation

- Heine Optotechnik

- Riester

- Mindray

- Philips

- GE HealthCare

- CliniCloud

Key Target Audience

- Hospitals & healthcare systems procurement heads

- Biomedical engineering & clinical engineering departments

- Hospital CIO / Digital Health / Health Informatics leadership

- Telemedicine providers and virtual-care platform operators

- Home healthcare operators and RPM program owners

- Medical device distributors & tender-focused channel partners

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We construct a KSA ecosystem map covering hospital groups, distributors, regulators, telehealth stakeholders, and key device categories. Desk research is performed using secondary sources and proprietary frameworks to define variables influencing adoption—procurement pathways, clinical workflows, and integration expectations.

Step 2: Market Analysis and Construction

We compile historical market signals and map them to real procurement behavior across institutions and clinician-led channels. The market is constructed by triangulating device category performance, channel movement, and end-user adoption logic to build a consistent view of demand.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated via structured interviews with stakeholders across distribution, hospital procurement, biomedical teams, and clinical users. These consultations provide operational and commercial insights to refine assumptions around product mix, end-use splits, and adoption drivers.

Step 4: Research Synthesis and Final Output

Findings are synthesized through reconciliation of bottom-up and top-down views, ensuring that segmentation logic, competitive positioning, and adoption narratives align with KSA’s healthcare delivery realities and institutional procurement standards.

- Executive Summary

- Research Methodology (Market Definition & Scope, Device Taxonomy & Inclusion Criteria, Abbreviations, Market Engineering Approach, Primary Interview Coverage Across MOH / NHIC / Private Hospital Chains / Distributors, Bottom-Up & Top-Down Validation, Assumptions & Sensitivity Checks, Limitations)

- Definition and Scope

- Evolution of Auscultation and Digital Diagnostics in KSA Healthcare

- Alignment with Vision-Led Digital Health Transformation

- Business Cycle Analysis

- Digital Stethoscopes Positioning within KSA Diagnostic & Monitoring Device Portfolio

- Growth Drivers

Vision-Aligned Digital Health Adoption

Expansion of Telemedicine & Virtual Care

Cardiovascular & Respiratory Disease Burden

Clinician Shortages & Task Shifting

Hospital-at-Home & RPM Programs - Challenges

Clinical Validation & Acceptance

Data Privacy & Hosting Constraints

Budget Allocation vs Conventional Devices

Integration with Hospital IT Systems - Opportunities

AI-Enabled Screening Workflows

National Preventive Care Programs

Remote Diagnostics for Peripheral Regions

Digital Teaching Hospitals - Trends

AI-Assisted Auscultation

Cloud Sound Libraries

Multilingual Clinical Interfaces

Interoperability with Tele-ICU Platforms - Regulatory & Compliance Landscape

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- SWOT Analysis – Market Level

- Competitive Intensity & Technology Differentiation Mapping

- By Value, 2019-2024

- By Volume, 2019-2024

- Installed Base vs New Procurements vs Replacement Demand, 2019-2024

- By Product Architecture (in Value %)

Handheld Digital

AI-Enabled Digital

Hybrid Acoustic-Digital

Multi-Sensor Diagnostic Combos - By Connectivity & Intelligence Layer (in Value %)

Bluetooth-Only

Cloud-Connected

AI-Assisted Auscultation

EHR-Integrated Systems - By Clinical Application (in Value %)

Cardiology, Pulmonology

Emergency & ICU

Primary Care & Family Medicine

Pediatrics & Neonatal Care - By End User (in Value %)

Government Hospitals

Military & Security Forces Hospitals

Private Hospital Groups

Diagnostic Centers

Telehealth Providers - By Care Delivery Model (in Value %)

In-Hospital Use

Telemedicine & Virtual Clinics

Remote Patient Monitoring Programs

Medical Education & Training - By Procurement Channel (in Value %)

NUPCO Tenders

Direct Hospital Procurement

Distributor-Led Sales

OEM-Partnered Digital Health Programs - By Region (in Value %)

Central

Western

Eastern

Southern

Northern

- Market Share Analysis of Major Players

- Cross Comparison Parameters (Product Architecture Depth, AI & Algorithm Readiness, Clinical Validation & Regulatory Standing, EHR / Telehealth Integration Capability, Data Hosting & Cybersecurity Compliance, Distributor & Tender Strength in KSA, Localization & Arabic Interface Readiness, Enterprise / Government Program Fit)

- Competitive Benchmarking Matrix

- Pricing & Commercial Models (Device-Only vs Subscription-Linked Platforms)

- Strategic Alliances, Distribution Partnerships & Recent Developments

- Detailed Profiles of Major Companies

3M Littmann / Solventum

Eko Health

Thinklabs Medical

Welch Allyn

Cardionics

Meditron

Fetal Instruments

CliniCloud

Contec Medical Systems

Riester

Heine Optotechnik

ADC

Philips

GE Healthcare

- Government & Public Healthcare Systems

- Private Hospital Groups & Specialty Clinics

- Telemedicine & Virtual Care Providers

- Medical Education & Training Institutions

- Decision-Making Unit & Buying Process Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- Installed Base vs New Procurements vs Replacement Demand, 2025-2030