Market Overview

KSA digital therapeutics is valued at USD ~ million in 2024, rising from USD ~ million in 2023, as buyers shift from “engagement apps” to measurable outcomes programs tied to diabetes, obesity, sleep, and behavioral health care pathways. This expansion is being pulled by multi-condition cardiometabolic demand and the economics of scaling care teams via software-plus-coaching. The same source projects sustained growth through the forecast window, reflecting a fast-moving commercialization base.

Riyadh dominates commercialization because it concentrates national payer decision-makers, corporate headquarters, and the largest tertiary-care complexes—so provider-led ordering and insurer pathway pilots start there first. The Jeddah cluster follows due to dense private-provider networks and high outpatient traffic, which supports supervised non-Rx programs and specialist referrals. The Eastern Province stands out for employer-led procurement (large industrial workforces) that favors scalable chronic programs and bilingual coaching operations, accelerating B2B enrollments and renewals.

Market Segmentation

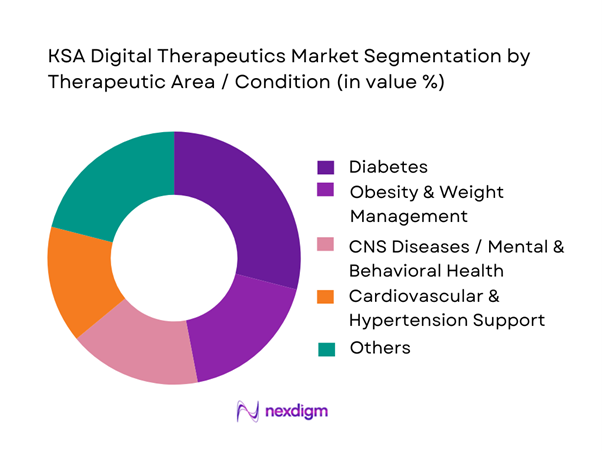

By Therapeutic Area / Condition

Diabetes is the dominant condition segment because DTx adoption in KSA is anchored to measurable biomarkers and repeatable care pathways (screen → enroll → coach → track outcomes → report), which diabetes supports better than most conditions. Diabetes is the largest segment with ~% revenue share in 2024 That leadership is reinforced by demand for structured, long-duration behavior change, medication adherence support, and device-linked feedback loops that keep patients engaged beyond a single consultation.

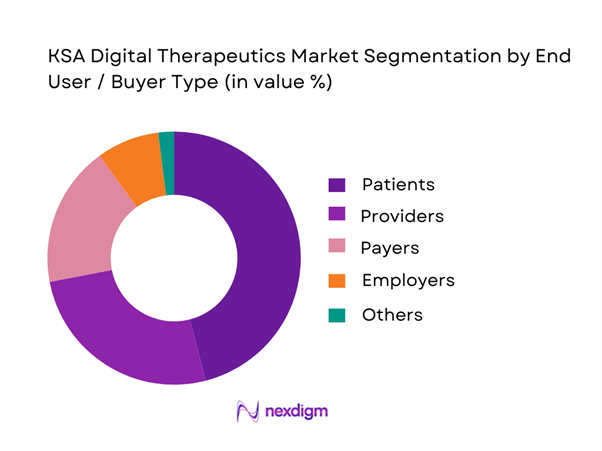

By End User / Buyer

Patients lead because most “entry” DTx programs start as app-first journeys (often DTC or clinician-recommended) that convert to supervised pathways once users show sustained engagement. Providers follow as they embed therapeutics into chronic clinics and virtual programs to reduce repeat visits while maintaining continuity via dashboards and coaching escalation. Payers are scaling selectively where outcomes reporting is strong and contracting can be bundled into care-management. Employers remain smaller but growing where workforce risk (cardiometabolic) and absenteeism economics justify multi-month programs.

Competitive Landscape

The KSA digital therapeutics market is evidence- and partnership-led: companies that win tend to demonstrate outcomes credibility, localize Arabic clinical experience, and integrate into provider and payer workflows rather than operating as standalone wellness apps. As a result, competition clusters into three groups—global DTx platforms expanding via partnerships, condition-specialists (sleep/respiratory/behavioral), and KSA/MENA digital health players adapting into therapeutics-like programs.

| Company | Est. year | HQ | Primary DTx focus | Access model | Evidence posture | Arabic localization | Integration depth | Typical buyer channel |

| Teladoc Health | 2002 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| ResMed | 1989 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Omada Health | 2011 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Noom | 2008 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| DarioHealth | 2011 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Digital Therapeutics Market Analysis

Growth Drivers

Chronic disease program intensity

Saudi Arabia’s Digital Therapeutics (DTx) pull starts with a very large, policy-visible chronic-care cohort that needs longitudinal behavior change and medication adherence support at scale. The country’s total population is ~, creating a high absolute base for chronic disease management programs. A key signal is diabetes: adult diabetes prevalence translates into ~ adults living with the condition, a workload that naturally expands structured digital pathways (CBT modules, lifestyle coaching, remote monitoring prompts, adherence nudges) beyond episodic clinic visits. On the “program rails” side, national digital health platforms already show large operational throughput that DTx can plug into, with ~ doctor appointments booked, ~ real-time consultations completed, and ~ sick-leave reports issued—high-frequency touchpoints where condition-specific DTx can be embedded. The government service layer also demonstrates sustained chronic-care demand intake, with ~ calls handled in a reported period, including ~ medical consultation calls, showing the size of care-navigation volume that can be diverted or supported through DTx-first triage and follow-up. Macro capacity to fund and prioritize chronic programs remains strong, with GDP at USD ~ trillion, supporting ongoing health-sector modernization budgets and payer focus on outcomes and utilization management.

Payer cost-of-care pressure

DTx demand in Saudi Arabia also rises from payer pressure to manage claims intensity while improving quality and right setting of care. The insured pool itself is expanding, with beneficiaries increasing from ~ million to ~ million, meaning more covered lives with standardized benefit rules and stronger incentives to manage utilization and outcomes. In parallel, visitor coverage volumes are large, with health insurance products for visitors reaching ~ beneficiaries, which increases system throughput needs for triage, documentation, and evidence-based pathways; DTx can reduce repeat consultations for guideline-driven conditions through structured digital protocols. Financial pressure signals are also visible in national accounting of insurance flows, with mandatory health insurance premiums totaling SAR ~ billion, indicating a sizable risk pool where payers increasingly demand measurable outcomes rather than open-ended service use. At the macro level, GDP remains high at USD ~ trillion, but fiscal prioritization increasingly rewards programs that show quantifiable health impact and reduced avoidable utilization, a fit for clinically validated DTx with outcomes reporting. Operationally, national call-center channels alone recorded ~ medical consultation calls in a reported period; for payers, such large demand volume translates into ongoing care episodes that can be stabilized through DTx follow-ups to reduce repeat contacts.

Challenges

Clinical validation burden

DTx in Saudi Arabia faces a high clinical-evidence and governance bar because the system is moving toward regulated, outcomes-based digital health, especially when DTx is positioned as therapy rather than wellness. The scale of covered lives, at ~ insured beneficiaries, increases scrutiny: when a therapeutic is rolled into benefits across millions, regulators and payers require stronger evidence packages, clear indications, and documented safety monitoring. The chronic disease base is also large, with ~ adults estimated to be living with diabetes, meaning any DTx claiming glycemic control or adherence gains must stand up to medical governance because even small protocol issues can affect large absolute numbers of patients. Digital scale magnifies governance risk as well, with ~ real-time consultations and ~ booked appointments indicating high-volume digital clinical channels where embedding DTx requires validation that content, escalation logic, and clinical alerts do not create unsafe care delays. Cyber and cloud assurance requirements further tighten validation scope through defined control sets for cloud-hosted solutions, requiring evidence of secure operation and auditability in addition to clinical efficacy. These requirements are intensified in a high-income macro context with GDP at USD ~ trillion, where the system expects medical-grade documentation rather than lightweight wellness claims.

Prescribing inertia

Even with digital readiness, DTx often stalls at the clinician adoption layer because therapy-as-software requires new prescribing habits, new follow-up workflows, and confidence in escalation rules. Clinician bandwidth constraints, with physician density at ~ per ~ people, make it harder to add new onboarding and monitoring tasks without clear time savings or reimbursement clarity, leading providers to default to familiar pharmacotherapy and in-person referrals. High-volume access channels show why inertia persists, with ~ medical consultation calls logged in a reported period; in such environments, clinicians and call-center physicians tend to favor known protocols that minimize training time. On the payer side, expansion to ~ insured beneficiaries increases standardization but can slow adoption when benefit rules, authorization logic, and documentation requirements are not fully aligned to DTx prescribing. Patient-side demand is real, with ~ real-time consultations recorded, but prescribing requires clinicians to trust that a digital module delivers outcomes comparable to conventional therapy, especially for mental health and chronic disease behavior change. In a large economy with GDP at USD ~ trillion, stakeholders often demand robust local evidence and platform integration before changing clinical routines, slowing early-stage prescribing despite long-term potential.

Opportunities

Outcomes-based contracting

Saudi Arabia is structurally set up to move DTx toward outcomes-based contracting because payer pools are large, digitized access is established, and policymakers emphasize measurable improvement rather than volume. The insured beneficiary base increased to ~, enabling payers to run standardized contracting models where reimbursement can be tied to objective endpoints rather than app downloads. Mandatory health insurance premiums of SAR ~ billion signal the financial scale at which payers will seek tools that reduce repeat utilization and improve health status for chronic disease cohorts, fitting DTx when it can produce auditable outcomes. Digital channels already generate measurable activity, with ~ real-time consultations and ~ booked appointments providing a trackable funnel for DTx onboarding, follow-up, and outcomes capture inside existing digital journeys. Macro capacity is strong with GDP at USD ~ trillion, but stakeholders increasingly demand proof for continued spend; outcomes-based contracts align incentives so vendors are paid for verified clinical benefit rather than mere engagement. With smartphone infrastructure at ~ subscriptions and high network performance, DTx vendors can instrument outcomes tracking without major technical constraints, making performance-linked contracting feasible in real operations.

Arabic-first therapeutics

Arabic-first DTx is a major whitespace in Saudi Arabia because language, cultural norms, and local clinical pathways strongly influence engagement and retention, which are critical for therapy outcomes. The scale case is clear: a population of ~ served by national digital platforms means localized content can convert into large absolute patient volumes when embedded into mainstream care access points. Saudi Arabia’s digital health front door already runs at national throughput, with ~ booked appointments and ~ real-time consultations, allowing Arabic-first DTx to be inserted as post-consult therapeutic follow-up with culturally adapted CBT language, diet and exercise modules aligned to local routines, and Ramadan-aware adherence pathways. The chronic disease burden is also large, with ~ adults estimated to be living with diabetes, making Arabic-first behavior-change modules a high-impact opportunity when tied to clinician oversight and payer programs. National campaigns show that large groups participate when messaging is locally resonant, with ~ participants and ~ enrollments indicating an addressable base for Arabic-first, metric-driven therapeutic journeys beyond one-off campaigns. With GDP at USD ~ trillion, the market can fund localized clinical content, medical writing, and governance, creating an advantage for vendors who build for Arabic-first outcomes rather than translating English-first products.

Future Outlook

KSA digital therapeutics is expected to scale through multi-condition cardiometabolic bundles, tighter provider workflow embedding, and more outcomes-linked contracting where payer care-management teams can operationalize dashboards and escalation protocols. Growth will also be shaped by the ability to localize Arabic clinical journeys, host and govern sensitive health data appropriately, and integrate with claims and care pathways so DTx shifts from engagement to verified impact at population scale.

Major Players

- Teladoc Health

- ResMed

- Omada Health

- Noom

- DarioHealth

- WellDoc

- Click Therapeutics

- Akili Interactive

- Kaia Health

- Wysa

- Headspace Health

- Vitality

- Fitbit / Google Health ecosystem

- Nala

Key Target Audience

- Government and regulatory bodies

- Private health insurers

- Large hospital groups and integrated providers

- Government and semi-government health systems

- Employer health-benefits decision makers

- Digital health and health IT platform owners

- Pharmacy and benefit ecosystem stakeholders

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

We build a KSA DTx ecosystem map covering providers, payers, employers, regulators, and platform operators. Desk research defines the market boundary, product taxonomy, and the key variables that drive revenue, including buyer type, access model, evidence level, and integration depth.

Step 2: Market Analysis and Construction

We compile historical revenue signals and commercialization pathways. We reconcile demand-side adoption with supply-side capability to construct the market baseline and segment structure.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses via interviews with provider digital health heads, payer care-management leaders, employer benefits teams, and DTx operators. Inputs focus on enrollment mechanics, retention patterns, procurement cycles, and which conditions convert from pilot to scaled rollout.

Step 4: Research Synthesis and Final Output

We triangulate outputs across secondary databases, operator inputs, and buyer interviews. We finalize sizing and segment insights, then stress-test conclusions against regulatory feasibility, integration realities, and partnership dependencies to ensure actionable, buyer-ready findings.

- Executive Summary

- Research Methodology (Market definition boundary for DTx vs digital health, inclusion/exclusion, assumptions, abbreviations, market sizing logic (bottom-up + top-down triangulation), primary interview design (providers/payers/employers), validation framework (clinical + regulatory), data limitations and confidence scoring)

- Definition and Scope

- Market Genesis and Adoption Arc

- Digital-Health-to-DTx Convergence Map

- DTx Business Cycle and Seasonality

- KSA Healthcare & Digital Health Ecosystem Context

- Value Chain and Stakeholder Flow

- Growth Drivers

Chronic disease program intensity

Payer cost-of-care pressure

Provider capacity constraints

Virtual care scale-up

Smartphone-led engagement - Challenges

Clinical validation burden

Prescribing inertia

Data hosting constraints

Engagement decay

Workflow integration gaps - Opportunities

Outcomes-based contracting

Arabic-first therapeutics

DTx and RPM bundles

AI triage orchestration

Employer chronic programs - Trends

Command-center care models

Hybrid care teams

Digital formularies

Pathway standardization

Device-linked nudging - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Revenue, 2019–2024

- By Active Patient Programs, 2019–2024

- By Contract Type, 2019–2024

- By Therapeutic Area / Condition (in Value %)

Diabetes

Obesity & Weight Management

CNS Diseases / Mental & Behavioral Health

Cardiovascular & Hypertension Support

Smoking Cessation

Respiratory Diseases - By End User / Buyer Type (in Value %)

Patients

Providers

Payers

Employers - By Access & Prescription Model (in Value %)

Prescription Digital Therapeutics (Rx-DTx)

Clinician-Recommended (non-Rx but supervised)

Direct-to-Consumer

Employer-Sponsored Enrollment

Insurer Care-Pathway Enrollment - By Intervention Modality (in Value %)

CBT / Behavioral Therapy Engines

Human Coaching + Care Team Layer

AI-Enabled Personalized Nudging & Triage

Gamified Cognitive Training

Remote Monitoring–Linked Therapeutic Pathways - By Platform & Integration Depth (in Value %)

Standalone App

Provider Workflow Embedded

Payer Care-Management Embedded

Employer Benefits Platform Embedded

Device Ecosystem Coupled - By Region (in Value %)

Riyadh Region

Makkah Region

Eastern Province

Madinah Region

Asir & Southern Cities

Northern & Emerging Giga-Project Corridors

- Market structure and competitive positioning

- Cross Comparison Parameters (Regulatory readiness for SaMD/Rx-DTx, Arabic clinical localization depth, payer-integration readiness, provider workflow integration, outcomes evidence strength, engagement retention, data hosting and cybersecurity posture, pathway breadth)

- Partnership ecosystem mapping

- SWOT Analysis of Key Players

- Evidence and clinical validation benchmarking

- Detailed Profiles of Major Companies

Teladoc Health

ResMed

Omada Health

Noom

DarioHealth

WellDoc

Click Therapeutics

Akili Interactive

Kaia Health

Wysa

Headspace Health

Vitality

Fitbit / Google Health

Nala

- Patient adoption and engagement mechanics

- Provider workflow fit

- Payer and employer ROI logic

- Decision-making unit mapping

- Key pain points

- By Revenue, 2025–2030

- By Active Patient Programs, 2025–2030

- By Contract Type, 2025–2030