Market overview

The Saudi Arabia driver monitoring/driver fatigue monitoring market is valued at USD ~ million in the base year, following a multi-year historical build that reflects accelerating fitment in fleets and new vehicles as safety features move from “premium add-on” to “risk-control requirement.” The prior-year value is referenced in the same five-year historical analysis that underpins the base-year estimate, and the step-up is primarily driven by enforcement-led road safety upgrades, fleet safety compliance, and increasing OEM adoption of in-cabin sensing (camera/IR + AI) for fatigue and distraction detection.

Adoption concentrates in Riyadh, Jeddah, and Dammam because these corridors combine high vehicle density, heavy commercial movement, and strong institutional procurement (government fleets, public transport authorities, and large enterprises). These cities also lead in technology-enabled mobility operations—logistics, ride-hailing, corporate fleets—where fatigue monitoring is justified through operational risk reduction, insurance/claims management, and KPI-driven driver performance programs. As a result, deployments cluster around major depots, highways, and urban mobility networks anchored in these metro areas.

Market segmentation

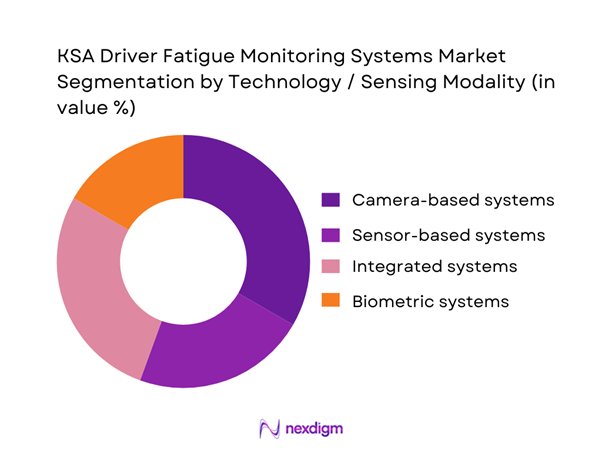

By Technology / Sensing Modality

The KSA driver fatigue monitoring market is segmented into camera-based, sensor-based, integrated, and biometric systems. In practice, camera-based (often IR-enabled) systems tend to dominate deployments because fleets and OEMs need direct visibility into driver state (eye closure, gaze, head pose, yawning) rather than indirect vehicle-behavior proxies alone. Vision-based stacks also support distraction monitoring and can be extended to identity verification, seatbelt usage, or in-cabin policy compliance when required by commercial operators. For Saudi fleets operating long-haul routes and high-temperature conditions, camera-led solutions are favored because they can be engineered for night driving and variable lighting while enabling event evidence, coaching workflows, and integration into broader fleet safety programs. This makes camera-based solutions the most scalable “single platform” entry point for fatigue risk management.

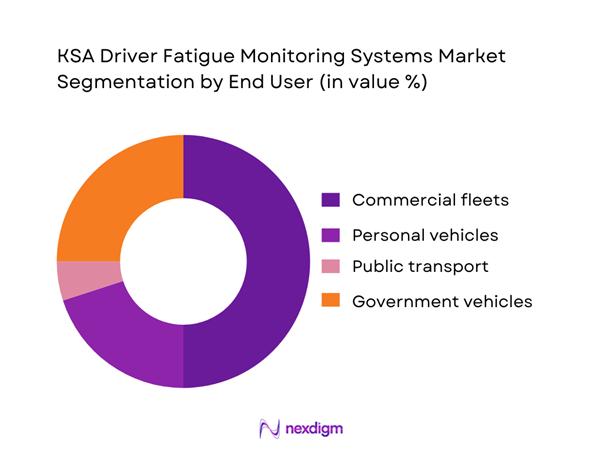

By End User

The market is segmented into commercial fleets, personal vehicles, public transport, and government vehicles. Commercial fleets typically lead adoption because the fatigue problem is operationally concentrated in high-utilization driving—long routes, shift work, and time-bound deliveries—where incidents have outsized cost impact (vehicle downtime, cargo loss, liability exposure, and reputational risk). Fleet operators also have clearer ROI levers: measurable reductions in harsh events, fewer fatigue alerts escalating to incidents, and better insurance/claims defensibility through event logs and in-cab video evidence. In Saudi Arabia, fleet modernization programs and compliance practices further strengthen demand for standardized, centrally managed systems that can be rolled out across mixed vehicle types. As a result, commercial deployments often become the “anchor demand” that drives distributor ecosystems, local integration capacity, and service/maintenance models for driver fatigue monitoring solutions.

Competitive landscape

The KSA driver fatigue monitoring ecosystem features a blend of global Tier-1 automotive suppliers, AI-vision specialists, and fleet telematics/video safety platforms. Market activity is shaped by OEM integration cycles, local distributor capability, and fleet procurement requirements (installation support, Arabic dashboards, data hosting preferences, and after-sales SLAs).

| Company | Est. Year | HQ | Primary DMS approach | KSA fitment route | Fleet-use strength | Analytics stack | Integration depth | Typical buyer focus |

| Seeing Machines | 2000 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Smart Eye | 1999 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| Continental | 1871 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Nauto | 2015 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Driver Fatigue Monitoring Systems Market Analysis

Growth Drivers

Commercial Fleet Safety Compliance Pull

Saudi Arabia’s road-risk and fleet-exposure baseline is large enough that fatigue monitoring is increasingly treated as a compliance-grade control for heavy users of roads (logistics, staff transport, oilfield mobility). The Kingdom has ~ registered and roadworthy vehicles in use, up from ~ the prior year, while newly registered vehicles exceeded ~ in the same period—expanding the addressable installed base for factory-fit and retrofit fatigue solutions. On the risk side, “serious” traffic accidents totaled ~, with ~ fatalities and ~ injuries recorded in the same reporting cycle, reinforcing why commercial operators align to formal safety programs and digital monitoring. The broader macro runway (capacity to fund compliance tech) is supported by an economy measured at USD ~ trillion and USD ~ GDP per capita—enabling fleets to justify safety capex as part of operational resilience rather than discretionary spend.

Long-Haul Mileage Intensity

KSA’s logistics footprint and cross-border road throughput create fatigue risk concentrations on long-haul corridors (Eastern Province industrial clusters, Riyadh distribution, northern/western routes). Government road-transport indicators show road freight exports through land ports at ~ tons and road freight imports at ~ tons in the latest annual snapshot—evidence of sustained heavy-truck activity that typically drives extended shift patterns, night driving, and multi-stop routes. Passenger movement through land ports exceeded ~ trips (arrivals ~, departures ~), adding long-distance private and commercial driving density around key crossings. When these throughput numbers sit alongside ~ serious accidents and ~ injuries, fatigue detection shifts from a “nice-to-have” telematics add-on to a core control for operators whose business models depend on high utilization, fast turnaround, and long duty cycles.

Challenges

False Alerts in Harsh Environmental Conditions

Saudi operating conditions can degrade camera/sensor reliability, increasing false positives (nuisance alarms) and false negatives (missed fatigue events) if systems are not tuned for KSA’s heat, glare, and dust. During documented heat events, maximum temperatures reached ~°C in locations including Al-Ahsa and Sharurah, with ~°C reported in Dammam and ~°C recorded in Al-Madinah and other areas—conditions that can stress in-cabin electronics, increase cabin thermal load, and affect IR/NIR camera performance if cooling and lens design are inadequate. Dust and particulate exposure is another confounder; global meteorological reporting notes that sand and dust storm impacts remained elevated in recent cycles, which can reduce visibility and contaminate lenses/sensors—raising the probability of spurious drowsiness and distraction triggers. The technical burden on vendors is therefore higher in KSA: robust thermal management, lens protection, calibration stability, and model performance under glare and dust become decisive, not optional.

Driver Acceptance and Privacy Concerns

Fatigue monitoring often requires inward-facing cameras or driver biometrics proxies, and acceptance can stall if drivers perceive monitoring as punitive or invasive. This is amplified by legal accountability for data misuse: the Saudi data protection framework explicitly references penalties including fines up to SAR ~ in relevant violation contexts, making fleets cautious about deploying systems that capture identifiable video without strong governance (role-based access, masking, retention limits, and documented lawful basis). Adoption is also shaped by workforce scale: authorities record ~ first-time driving licenses issued and ~ renewals within the same reporting cycle, reflecting a very large driver ecosystem where word-of-mouth perceptions can spread quickly across subcontractors and fleet communities. In practice, vendors and fleet operators must invest in change management and privacy-by-design configurations, otherwise opt-out behavior can undermine effectiveness and ROI.

Opportunities

Unified IVMS and Fatigue Monitoring Bundles

A strong near-term opportunity in KSA is consolidation: buyers increasingly want one unified in-vehicle safety stack—IVMS (speeding, harsh events, location) plus driver-state (fatigue and distraction) plus coaching—rather than stitching multiple vendors. The safety case is visible in national reporting: ~ serious accidents, ~ fatalities, and ~ injuries create a high-severity risk landscape where a single integrated platform can simplify compliance reporting, reduce alert fragmentation, and standardize corrective actions across subcontractors. The commercial incentive is reinforced by financial-sector scale: insurance gross written premiums reported at SAR ~ billion indicate a growing environment for measurable risk controls and loss-prevention programs. Operationally, road freight flows of ~ tons (exports) and ~ tons (imports) through land ports create heavy utilization contexts where integrated bundles can reduce incident frequency without adding operational complexity. Vendors that package fatigue monitoring as a native module inside broader IVMS—rather than as a bolt-on—can win on procurement simplicity and total cost of ownership.

Arabic-First User Interfaces and Coaching

KSA’s scale of driver onboarding and licensing activity creates a clear opportunity for Arabic-first UX and coaching flows (alerts, training prompts, escalation scripts) that reduce friction and improve behavior change. Official reporting shows ~ first-time licenses issued and ~ renewals, evidence of a large driver lifecycle where comprehension and consistent coaching can materially affect outcomes. At the same time, the road-safety burden remains significant (serious accidents ~, fatalities ~, injuries ~), meaning incremental improvements in driver responsiveness to alerts can translate into meaningful risk reduction at fleet scale. Data governance is also a differentiator: with national rules referencing fines up to SAR ~ in relevant breach contexts, Arabic-first systems that clearly communicate privacy notices, consent steps, and coaching purpose statements can reduce resistance and improve compliance behavior. In short, local language and local context coaching is not a cosmetic feature in KSA—it is a conversion lever for adoption and sustained use.

Future outlook

Over the next planning cycle, the KSA driver fatigue monitoring market is expected to expand as fleet safety becomes more compliance-driven, and as in-cabin sensing becomes a standard layer in broader ADAS and connected fleet stacks. Deployment momentum should remain strongest in commercial fleets (logistics, construction support fleets, public transport) due to measurable safety and insurance benefits. Technology directionally shifts toward camera-first plus AI, richer event classification (fatigue vs distraction vs phone use), and tighter integration with dispatch, route risk scoring, and driver coaching programs.

Major players

- Valeo S.A.

- Continental AG.

- Denso Corporation.

- Bosch Mobility Solutions.

- Aptiv PLC.

- Nauto, Inc.

- Seeing Machines Ltd.

- Smart Eye AB.

- Omnicomm.

- Mobileye N.V.

- ZF Friedrichshafen AG.

- Veoneer, Inc.

- Aisin Seiki Co., Ltd.

- Hyundai Mobis Co., Ltd.

Key target audience

- Commercial fleet operators

- Public transport operators and intercity coach/bus operators

- Ride-hailing and corporate mobility operators

- Automotive OEMs and authorized distributor networks

- Fleet leasing and asset finance companies

- Motor insurance providers and fleet underwriting teams

- Investments and venture capitalist firms

- Government and regulatory bodies

Research methodology

Step 1: Identification of Key Variables

We begin by mapping the Saudi driver fatigue monitoring ecosystem across OEMs, Tier-1s, telematics and video safety vendors, distributors, installers, and fleet buyers. Desk research is used to define variables such as fitment route (OEM vs retrofit), fleet adoption triggers, and compliance requirements, forming the baseline for market measurement.

Step 2: Market Analysis and Construction

Historical market construction is performed using a triangulation of supplier revenues, deployment footprints, and fleet procurement patterns, separating OEM-installed volumes from aftermarket and retrofit deployments. The objective is to build an internally consistent market model aligned to Saudi operating realities (fleet mix, utilization intensity, and procurement structure).

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on adoption drivers, dominant use-cases, and vendor positioning are validated via structured expert consultations with fleet safety heads, integrators, and vendor leadership. These interviews refine assumptions on buyer decision criteria, implementation barriers, and pricing and packaging practices.

Step 4: Research Synthesis and Final Output

We synthesize findings into segment frameworks, competitor benchmarking, and forward outlook. The final output is validated through cross-checks against vendor solution documentation and Saudi market references to ensure strategic coherence and practical usability for go-to-market decisions.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Boundary Conditions, Market Sizing Approach, Bottom-Up Build, Top-Down Validation, Primary Research Approach, Secondary Research Approach, Data Triangulation and Validation, Bias Control in Interview Inputs, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Adoption Context

- Ecosystem Timeline

- Demand Cycle and Buying Triggers

- Supply Chain and Value Chain Analysis

- Growth Drivers

Commercial Fleet Safety Compliance Pull

Long-Haul Mileage Intensity

Insurance-Driven Risk Controls

Vision-Aligned Road Safety Initiatives

Post-Incident HSE Governance Maturity - Challenges

False Alerts in Harsh Environmental Conditions

Driver Acceptance and Privacy Concerns

Multi-Vehicle Brand Integration Complexity

Data Retention and Governance Issues

Retrofit Installation Downtime - Opportunities

Unified IVMS and Fatigue Monitoring Bundles

Arabic-First User Interfaces and Coaching

Edge-AI Privacy-Preserving Deployments

High-Risk Corridor Fleet Rollouts

Safety Score Monetization via Insurers - Trends

IR-Based Monitoring Adoption

On-Device AI Processing

Video Telematics Integration

AI-Based Driver Coaching

Predictive Fatigue Risk Scoring - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base, 2019–2024

- Average Selling Price Mix, 2019–2024

- By Fleet Type (in Value %)

Heavy Trucks and Long-Haul Logistics

Buses and Intercity Passenger Transport

Light Commercial Vehicles

Industrial Fleets

Passenger Vehicles - By Application (in Value %)

Drowsiness Detection

Distraction Detection

Driver Identification and Seatbelt Monitoring

Event Video Telematics

ADAS-Linked Alerts - By Technology Architecture (in Value %)

Camera-Based RGB Systems

IR and NIR Camera Systems

Behavior-Based Analytics

Wearables-Linked Monitoring

Multi-Sensor Fusion Systems - By Connectivity Type (in Value %)

Standalone Offline Systems

Device with Basic Fleet Portal

Full IVMS Integrated Systems

API-Enabled Enterprise Systems

Centralized SOC-Based Monitoring - By End-Use Industry (in Value %)

Logistics and Express Delivery

Oil and Gas Contracting Fleets

Mining and Construction Fleets

Government and Municipal Fleets

Private Passenger Transport - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region

- Market Share Assessment

- Cross Comparison Parameters (Detection Modality Coverage, Alerting and HMI Effectiveness, Robustness in Desert Conditions, Edge-AI vs Cloud Processing Mix, PDPL-Ready Data Handling, Platform Integration Depth, Localization Readiness, Total Cost of Ownership)

- SWOT of Major Players

- Pricing and Packaging Benchmarking

- Strategic Moves and Partnership Tracking

- Detailed Profiles of Major Companies

Seeing Machines

Smart Eye

Cipia

Bosch

Continental

Valeo

Denso

Aptiv

Magna International

ZF Group

Mobileye

Lytx

Nauto

Tracking

- Demand and Utilization Mapping

- Budget Allocation Logic

- Compliance and Audit Requirements

- Fleet Decision-Making Unit

- Pain Points and Adoption Barriers

- By Value, 2025–2030

- Installed Base, 2025–2030

- Average Selling Price Mix, 2025–2030