Market Overview

The KSA Driver Monitoring Systems (DMS) market is expected to reach a valuation of approximately USD ~million in 2024. This growth is primarily driven by the increasing adoption of advanced driver assistance systems (ADAS) in vehicles, propelled by regulatory requirements for enhanced vehicle safety and rising consumer awareness regarding road safety. Additionally, the push toward autonomous vehicles and the need for compliance with global safety standards are driving the demand for driver monitoring solutions in KSA. Government initiatives, such as Vision 2030, which emphasize technological advancement and the automotive sector’s modernization, are further fueling this market’s expansion.

The KSA market is dominated by cities like Riyadh, Jeddah, and Dammam due to their status as key automotive hubs with a high concentration of vehicle sales, automotive OEMs, and infrastructure development. The country’s focus on reducing road accidents and promoting smart cities under Vision 2030 has resulted in substantial investments in advanced safety features, including driver monitoring systems. Furthermore, the growing demand for luxury and commercial vehicles, especially in Riyadh and Jeddah, further contributes to the dominance of these regions in the DMS market.

Market Segmentation

By Product Type

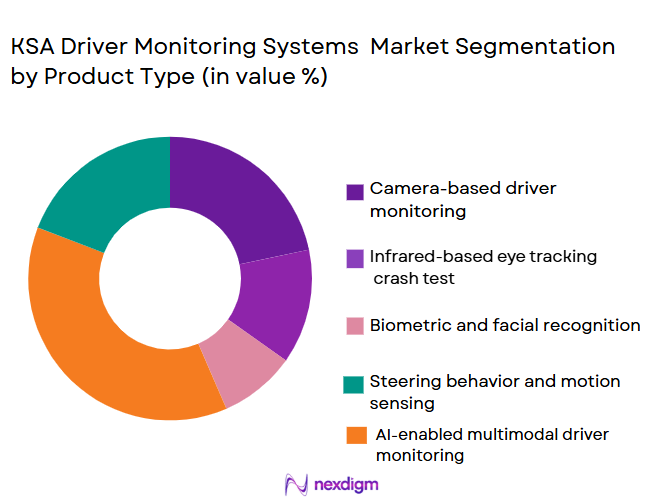

The KSA Driver Monitoring Systems market is segmented by product type into infrared-based systems, camera-based systems, radar-based systems, and hybrid systems. Among these, camera-based systems have gained significant traction in 2024 due to their affordability, ease of integration, and proven effectiveness in detecting driver behavior, such as distraction and fatigue. The integration of machine learning algorithms has enhanced the capabilities of camera-based systems, making them more reliable and scalable, further driving their dominance in the market. These systems are especially favored by OEMs for their ability to offer real-time feedback, enhancing overall road safety.

By Application

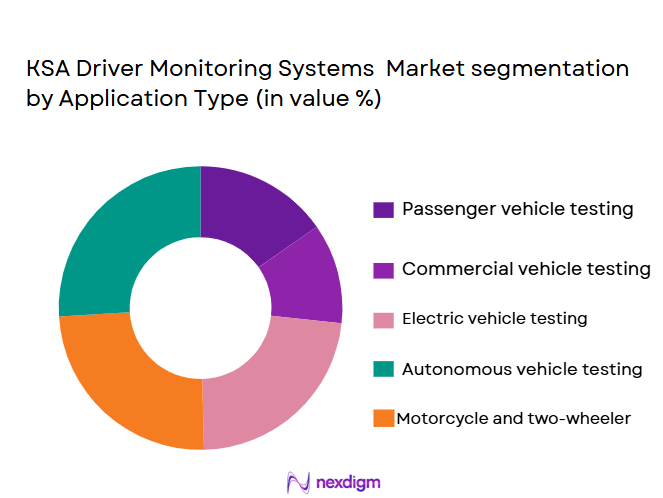

The market is segmented by application into passenger vehicles, commercial vehicles, and electric vehicles. Passenger vehicles account for the largest share in 2024 due to the increasing demand for safety features among consumers. As the KSA automotive market shifts toward a higher number of luxury and mid-range vehicles, OEMs are incorporating advanced DMS to meet regulatory standards and enhance safety. Additionally, consumer awareness regarding the importance of driver alertness and fatigue monitoring has further fueled the demand for DMS in this segment. With advancements in vehicle safety technology, this trend is expected to grow stronger in the coming years.

Competitive Landscape

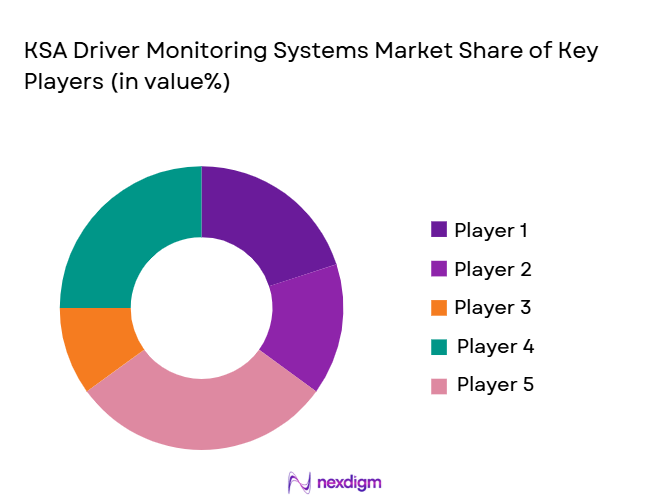

The KSA Driver Monitoring Systems market is dominated by a mix of global automotive giants and specialized technology providers. Major players include Valeo, Aptiv, Denso, Bosch, and Magna International. These companies dominate the market due to their extensive experience in the automotive sector, strong relationships with OEMs, and advanced technological capabilities in driver monitoring and ADAS integration. Their deep investments in research and development, particularly in artificial intelligence and sensor technology, position them as key players in the growing KSA DMS market.

| Company Name | Establishment Year | Headquarters | Product Focus | Key Partnerships | Market Reach | Revenue (2024) |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ |

| Aptiv | 1994 | Ireland | ~ | ~ | ~ | ~ |

| Denso | 1949 | Japan | ~ | ~ | ~ | ~ |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ |

KSA Driver Monitoring Systems Market Dynamics

Growth Drivers

Government Regulations on Vehicle Safety

The Saudi Arabian government has implemented several regulations to enhance vehicle safety, contributing to the growing demand for Driver Monitoring Systems (DMS). In 2024, the Saudi Arabian Standards Organization (SASO) has introduced new road safety standards that mandate the installation of advanced safety technologies, including driver assistance systems, in new vehicles. These regulatory changes align with Vision 2030’s goal of improving road safety and reducing traffic fatalities. In 2024, Saudi Arabia experienced over 9,000 fatalities from traffic accidents, prompting further regulatory push for safety technologies like DMS to reduce human error and enhance road safety.

Rising Road Safety Awareness Among Consumers

Consumer awareness about road safety has significantly increased in Saudi Arabia, which has led to a surge in demand for Driver Monitoring Systems (DMS). With rising road fatalities in the country, the government has ramped up public safety campaigns, highlighting the importance of both vehicle safety features and responsible driving. In 2024, the Saudi Ministry of Interior reported that approximately 40% of road accidents were attributed to driver fatigue, distractions, and impaired attention. As consumers become more educated on the importance of safety technology, the demand for DMS that monitors driver alertness and fatigue has surged, especially among luxury and high-end vehicle owners.

Market Challenges

High Costs of Advanced Systems

A key challenge in the adoption of Driver Monitoring Systems (DMS) in Saudi Arabia is the high cost of these advanced technologies. As of 2024, the cost of integrating DMS, which includes sophisticated AI algorithms and high-resolution cameras, remains a barrier for many automotive manufacturers and consumers. The implementation of these technologies in high-end vehicles makes them less affordable for mass-market adoption. While the cost of components such as sensors and cameras has been declining, the complexity of integrating DMS into existing vehicle architectures still requires significant investments. This creates an obstacle to widespread adoption, particularly for lower-priced vehicles.

Integration Issues with Existing Vehicle Architectures

The integration of Driver Monitoring Systems (DMS) with existing vehicle architectures presents a significant challenge for automakers in Saudi Arabia. Many vehicles currently on the road do not have the necessary infrastructure to support advanced DMS technologies. The systems require extensive modifications to vehicle electronics and sensor configurations, which can lead to compatibility issues. As a result, retrofitting existing vehicles with these advanced systems can be both costly and technically challenging. The lack of standardization in vehicle architectures further complicates the seamless integration of DMS technologies across various car models and manufacturers.

Market Opportunities

Partnerships Between OEMs and Tech Providers

One of the key opportunities for growth in the KSA Driver Monitoring Systems (DMS) market lies in the formation of partnerships between Original Equipment Manufacturers (OEMs) and technology providers. In 2024, leading automakers in Saudi Arabia have started collaborating with tech companies specializing in AI, sensors, and camera systems to enhance the functionality and accuracy of DMS. This partnership model has allowed manufacturers to adopt cutting-edge technologies, reduce R&D costs, and expedite the integration of DMS into their vehicles. These collaborations not only offer a path to market expansion but also help to meet regulatory requirements, making DMS more accessible to a wider range of consumers.

Government Incentives for Safety Features

The Saudi Arabian government offers several incentives aimed at encouraging the adoption of safety technologies, including Driver Monitoring Systems (DMS). In 2024, the government’s Vision 2030 initiative, which focuses on sustainable development and road safety, includes tax benefits and subsidies for vehicles equipped with advanced safety systems. These incentives are designed to accelerate the adoption of DMS across all vehicle categories, from luxury cars to commercial fleets. With these initiatives, the cost burden on consumers and manufacturers is reduced, making DMS a more attractive option. This government support is expected to play a key role in driving the growth of DMS in Saudi Arabia in the coming years.

Future Outlook

Over the next five years, the KSA Driver Monitoring Systems market is expected to grow significantly due to ongoing developments in the automotive sector, especially in the areas of vehicle safety and automation. As the country focuses on adopting smart city technologies under Vision 2030, the demand for advanced driver monitoring systems is projected to rise. Factors such as the increased adoption of ADAS, stricter safety regulations, and growing consumer awareness regarding driver fatigue and distraction will continue to fuel market growth. Additionally, the introduction of more electric vehicles and autonomous driving technologies will further drive the need for robust driver monitoring solutions.

Major Players in the Market

- Valeo

- Aptiv

- Denso

- Bosch

- Magna International

- Continental AG

- ZF Friedrichshafen

- Autoliv

- Mobileye

- Veoneer

- Omron Corporation

- Ficosa

- Smart Eye

- LiDAR Technologies

- LeddarTech

Key Target Audience

- Automotive OEMs

- Tier 1 Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Fleet Management Companies

- Technology Providers for ADAS and DMS Solutions

- Automotive Safety Standard Agencies

- Automotive R&D and Innovation Departments

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping out all critical variables influencing the KSA Driver Monitoring Systems market, including technology trends, government regulations, and consumer preferences. A combination of secondary data sources, industry reports, and expert interviews is used to gather comprehensive insights into the market’s dynamics.

Step 2: Market Analysis and Construction

Historical data on DMS adoption, regulatory frameworks, and technology penetration is compiled and analyzed. This phase aims to evaluate market penetration, the role of ADAS technologies, and the resultant impact on the overall DMS market size. A deep analysis of pricing trends, consumer preferences, and technological advancements is also conducted.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with key industry experts, including OEMs, Tier 1 suppliers, and regulatory bodies. These consultations provide valuable insights into the operational and financial challenges faced by industry stakeholders and help refine the market data further.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with DMS manufacturers and automotive experts to verify the research findings. This helps ensure the accuracy and completeness of the market analysis and provides a validated outlook for future growth.

- Executive Summary

- KSA Driver Monitoring Systems Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government initiatives to improve road safety and reduce traffic fatalities

Rising adoption of ADAS and connected vehicle technologies

Growing commercial fleet sizes and fleet safety mandates - Market Challenges

High system costs limiting penetration in entry-level vehicles

Data privacy and driver consent concerns

Limited awareness and standardization across vehicle segments - Market Opportunities

Integration of driver monitoring with smart mobility platforms

Expansion of aftermarket solutions for existing vehicle fleets

Adoption of AI-driven analytics for fleet performance optimization - Trends

Increased deployment of camera and infrared-based monitoring

Integration of driver monitoring with in-cabin sensing systems

Growing use of real-time alerts and cloud-based reporting - Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value 2019–2024

- By Installed Units 2019–2024

- By Average System Price 2019–2024

- By System Complexity Tier 2019–2024

- By System Type (In Value%)

Camera-based driver monitoring systems

Infrared-based eye tracking systems

Biometric and facial recognition systems

Steering behavior and motion sensing systems

AI-enabled multimodal driver monitoring systems - By Platform Type (In Value%)

Passenger vehicles

Commercial vehicles

Heavy-duty trucks

Public transportation vehicles

Autonomous and semi-autonomous vehicles - By Fitment Type (In Value%)

Factory-fitted OEM systems

Aftermarket retrofit systems

Embedded cockpit-integrated systems

Dashboard-mounted monitoring units

Cloud-connected monitoring solutions - By EndUser Segment (In Value%)

Automotive OEMs

Fleet operators and logistics companies

Public transport authorities

Ride-hailing and mobility service providers

Government and defense transport fleets - By Procurement Channel (In Value%)

Direct OEM supply agreements

Aftermarket distributors and installers

Fleet-level bulk procurement contracts

Government and public sector tenders

Technology partnership and licensing models

- Market Share Analysis

- Cross Comparison Parameters

(Detection accuracy, AI capability, Integration ease, Cost efficiency, After-sales support) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Bosch

Continental

Denso

Valeo

Aptiv

Magna International

Seeing Machines

Smart Eye

Gentex

Visteon

OmniVision Technologies

Mobileye

Harman International

NXP Semiconductors

Panasonic Automotive Systems

- OEMs focus on compliance with safety regulations and vehicle differentiation

- Fleet operators prioritize fatigue detection and accident reduction

- Public transport agencies emphasize driver behavior monitoring

- Mobility service providers seek scalable and data-driven safety solutions

- Forecast Market Value 2025–2030

- Forecast Installed Units 2025–2030

- Price Forecast by System Tier 2025–2030

- Future Demand by Platform 2025–2030