Market Overview

The KSA E-Call Systems Market values at USD ~ million, reflects the Kingdom’s accelerating transition toward connected, safety-oriented vehicle architectures. The market is supported by Saudi Arabia’s annual vehicle parc exceeding ~ registered vehicles, with new vehicle imports crossing ~ units, creating a strong installed base for embedded safety technologies. Road traffic incidents remain a national concern, with over ~ accidents recorded in recent reporting cycles, reinforcing the urgency for automated emergency notification systems. Growth is further driven by rising OEM adoption of telematics control units, regulatory alignment with international safety standards, and expanding ~ and ~ coverage enabling reliable emergency call connectivity.

The KSA E-Call Systems Market is primarily dominated by Riyadh, Jeddah, Dammam, and Mecca, supported by high vehicle density, advanced telecom infrastructure, and centralized emergency response capabilities. Riyadh leads due to its concentration of premium vehicle ownership, fleet operators, and government mobility programs. Jeddah benefits from port-led vehicle imports and dense urban traffic volumes. The Eastern Province drives adoption through corporate fleets and logistics vehicles, while Mecca sees growing safety technology deployment due to large-scale seasonal vehicle inflows and traffic safety enforcement initiatives.

Market Segmentation

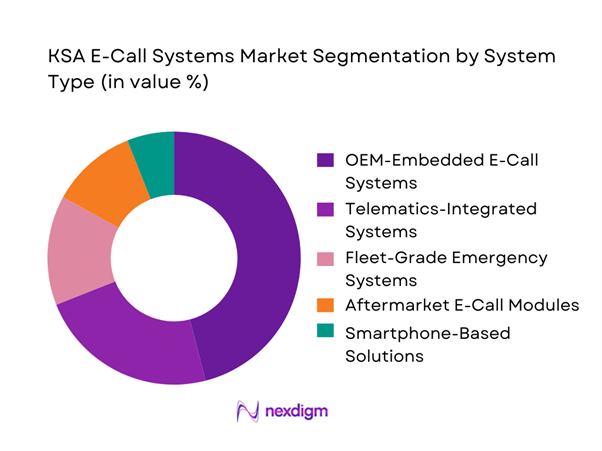

By System Type

The KSA E-Call Systems Market is segmented by system type into OEM-Embedded E-Call Systems, Aftermarket E-Call Modules, Telematics-Integrated Emergency Call Systems, Smartphone-Based Emergency Call Solutions, and Fleet-Grade Emergency Response Systems. OEM-Embedded E-Call Systems dominate this segmentation, accounting for the largest market share, due to increasing integration of e-call functionality into factory-installed telematics control units. Automotive manufacturers supplying the Saudi market are embedding emergency call systems as part of standardized safety packages, particularly in passenger vehicles, SUVs, and premium segments. OEM integration ensures superior reliability, direct linkage to airbag and crash sensors, and compliance with global safety standards. Additionally, embedded systems are favored by regulators and insurance stakeholders because they cannot be disabled or removed post-sale, ensuring consistent emergency response performance across the vehicle lifecycle.

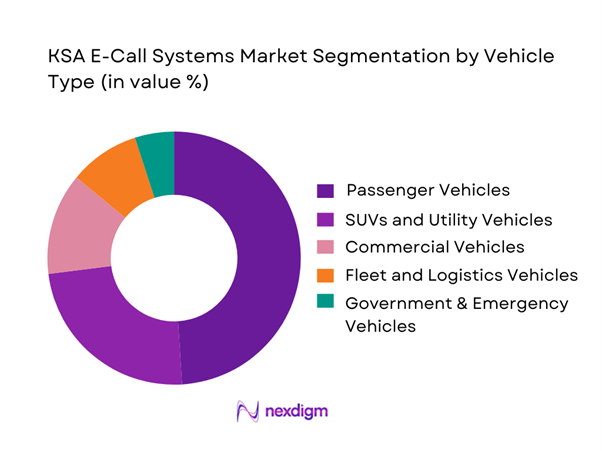

By Vehicle Type

The market is segmented into Passenger Vehicles, SUVs and Utility Vehicles, Commercial Vehicles, Fleet and Logistics Vehicles, and Government & Emergency Vehicles. Passenger vehicles dominate the vehicle-type segmentation, driven by their sheer volume within Saudi Arabia’s registered vehicle parc and faster adoption of connected safety features. Passenger cars account for the majority of new vehicle imports and are increasingly equipped with advanced safety technologies as standard features. Consumer preference for safety, rising insurance requirements, and OEM competition on technology differentiation have accelerated e-call deployment in this segment. Furthermore, passenger vehicles are more likely to operate in urban environments where emergency response integration is mature, maximizing the functional value of e-call systems and reinforcing dominance.

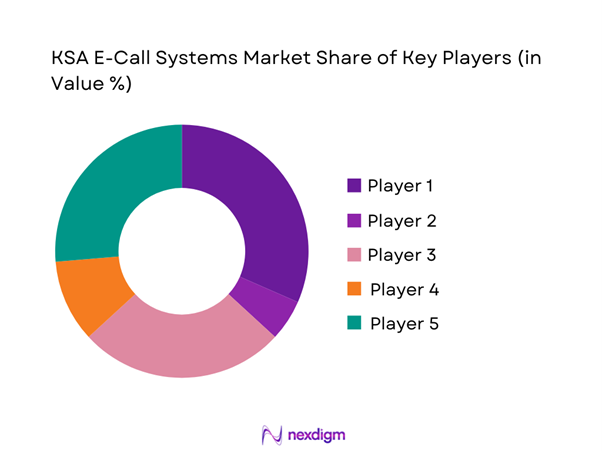

Competitive Landscape

The KSA E-Call Systems Market is moderately consolidated, dominated by global Tier-~ automotive electronics suppliers and telematics solution providers with strong OEM relationships. These companies leverage established technology platforms, regulatory compliance expertise, and regional partnerships to secure contracts with vehicle manufacturers supplying the Saudi market. Competition is centered on system reliability, connectivity redundancy, data security compliance, and seamless integration with emergency response authorities.

| Company | Establishment Year | Headquarters | OEM Partnerships | Connectivity Capability | Regulatory Readiness | Localization Presence | Emergency Integration |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ |

| Continental | 1871 | Germany | ~ | ~ | ~ | ~ | ~ |

| ZF Friedrichshafen | 1915 | Germany | ~ | ~ | ~ | ~ | ~ |

| Harman International | 1980 | USA | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ | ~ |

KSA E-Call Systems Market Analysis

Growth Drivers

Mandatory Vehicle Safety and Vision-Aligned Regulations

Saudi Arabia’s push to reduce the human and economic burden of road crashes makes automated emergency notification e-call increasingly policy-aligned even when adoption language is still evolving across agencies. The national road safety need is visible in official road transport statistics with ~ serious traffic accidents, ~ traffic-accident fatalities, and ~ injuries recorded in the latest reporting cycle, creating a clear case for faster crash detection, location pinpointing, and automated call initiation. The demand effect is amplified by the scale of the fleet with registered and roadworthy vehicles reaching ~ and newly registered vehicles exceeding ~ expanding the addressable base for embedded telematics and SOS modules. On the macro side, the Kingdom’s economic capacity to fund enforcement, digital emergency infrastructure, and safer mobility systems is supported by a GDP of USD ~ and GDP per capita of USD ~ which underpins public spending and OEM feature localization programs connected to national transformation goals.

Rising Road Accident Fatality Mitigation Focus

E-call systems are most compelling where minutes matter rapid notification can shorten discovery time speed dispatch and improve triage accuracy when a driver is incapacitated. Saudi road-safety indicators make this a priority at national scale. The government’s road transport publication records ~ fatalities and ~ injuries alongside ~ serious accidents reflecting the real operational load on emergency response systems and the opportunity for automated crash event reporting crash severity and location. Urban travel density also matters the same statistics show intracity accidents account for ~ out of each ~ serious accidents meaning e-call demand is naturally concentrated where traffic volumes and multi-vehicle incidents are frequent and where emergency services can integrate dispatch routing. Macroeconomic conditions support the investment environment with GDP of USD ~ and GDP growth of ~ sustaining corporate fleet refresh cycles insurance modernization and smart transport initiatives that favor automated emergency call functions. Together these numbers explain why fatality mitigation is a strong driver for OEMs and fleets to treat e-call as a must-have safety layer rather than an optional telematics feature.

Challenges

Regulatory Clarity on Mandatory Adoption

A key constraint for suppliers and OEMs is not whether safety matters but how fast mandates standardize requirements system triggers minimum datasets language routing and interoperability rules across agencies and homologation pathways. The market operates at scale already ~ registered vehicles and over ~ new registrations mean any mandate change creates immediate compliance and reengineering implications across a large installed base. Road safety urgency is clear ~ fatalities yet implementation details what constitutes compliant e-call certification pathways call center integration protocols often require multi-agency alignment which can slow standardized rollout. From the macro context GDP per capita of USD ~ supports rapid technology adoption once rules stabilize but ambiguity can delay OEM standard fitment decisions and keep e-call bundled only in higher trims. The result is a challenge environment where safety need is proven in official statistics but uncertainty in adoption framing and compliance mechanics can prolong decision cycles especially for high-volume vehicle lines where specification locking happens early.

Telecom Network Dependency in Remote Areas

E-call reliability depends on connectivity continuity especially outside dense city cores where high-speed networks are strongest. KSA’s accident distribution highlights why this is operationally important while intracity accounts for ~ out of ~ serious accidents that still leaves ~ out of ~ serious accidents outside cities where coverage variability and longer emergency response distances increase the value of reliable call initiation and accurate location transmission. The vehicle base is large ~ and road freight volumes are substantial road freight imports through land ports reached ~ tons implying frequent long-haul travel across highways and border corridors where dead zones matter more. Nationally connectivity is improving ~ mobile subscriptions and ~ median mobile internet speed but speed statistics do not guarantee coverage continuity along remote routes. Macroeconomic scale GDP of USD ~ supports further network investment yet for e-call vendors this remains a design challenge requiring redundancy strategies multi-operator SIM eSIM fallback routing robust GNSS and store-and-forward data packets to protect emergency call success rates in remote segments.

Opportunities

Integration with National Emergency Platforms

A major growth opportunity is to move from standalone SOS calling to deeper integration with national emergency access and dispatch platforms so the vehicle can transmit structured incident data precise GNSS location direction of travel time stamp crash confirmation while the call is routed to the right service. Saudi Arabia already has unified access points government channels list ~ and operator references list ~ as unified emergency numbers indicating that the access layer exists and can be enhanced with connected-vehicle protocols. The urgency is reinforced by incident load ~ serious accidents ~ fatalities and ~ injuries show why automation can reduce time-to-dispatch and improve triage quality. Digital readiness supports feasibility ~ mobile subscriptions and ~ median mobile internet speed enabling real-time data push alongside voice. With a macro base of USD ~ GDP the Kingdom has the institutional and investment capacity to standardize APIs routing logic and emergency center tooling creating a scalable pathway for e-call vendors and OEMs to grow through certified national integration rather than fragmented city-by-city implementation.

Fleet Safety Compliance and Insurance Use Cases

Fleets offer a high-velocity pathway for e-call growth because they operate under measurable safety KPIs duty-of-care requirements and insurability constraints making emergency automation easier to justify operationally than in individual consumer purchases. KSA’s road environment creates the use-case foundation ~ serious accidents and ~ injuries represent recurring incident exposure that fleets must manage through faster emergency response incident documentation and driver welfare actions. Freight and cross-border road activity is material road freight imports through land ports reached ~ tons implying extensive highway travel where e-call and telematics-based incident escalation provide tangible operational value. Connectivity scale supports fleet deployments ~ IoT M2M subscriptions signal that machine connectivity for tracking and event reporting is expanding while ~ mobile subscriptions strengthen service reliability for multi-vehicle rollouts. From a macro backdrop GDP per capita of USD ~ and GDP of USD ~ support modern fleet digitization investments enabling insurers and large fleet operators to use e-call data verified incident time and location for claims acceleration fraud reduction and safety compliance programs fueling future market expansion without relying on future-looking statistics.

Future Outlook

The KSA E-Call Systems Market is expected to experience sustained growth driven by regulatory alignment with international vehicle safety frameworks expansion of connected vehicle platforms and increasing government focus on reducing road fatalities. Advancements in AI-based crash detection integration with smart city command centers and expansion of ~ networks will further enhance system performance. Growing adoption of electric vehicles and fleet digitalization will also create new demand for advanced emergency call solutions tailored to battery safety and commercial operations.

Major Players

- Bosch

- Continental

- ZF Friedrichshafen

- Valeo

- Harman International

- LG Electronics Vehicle Solutions

- Panasonic Automotive

- Qualcomm Technologies

- Sierra Wireless

- Telit Cinterion

- Visteon

- Denso

- Autoliv

- Geotab

Key Target Audience

- Automotive OEMs and Vehicle Assemblers

- Tier-~ Automotive Electronics Suppliers

- Fleet Operators and Logistics Companies

- Insurance and Risk Management Firms

- Smart City and Mobility Platform Operators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Dealership and Importer Networks

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the full e-call ecosystem in Saudi Arabia covering OEMs Tier-~ suppliers telecom operators emergency authorities and fleet operators. Secondary research using government publications transport statistics and proprietary automotive databases is employed to identify critical market variables.

Step 2: Market Analysis and Construction

Historical data on vehicle imports connected vehicle penetration telematics installations and safety system revenues is compiled. Bottom-up market sizing is performed by aggregating system shipments and service revenues across vehicle categories.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured interviews with automotive electronics suppliers telematics providers and fleet technology managers operating in Saudi Arabia. These consultations refine adoption trends pricing structures and regulatory impacts.

Step 4: Research Synthesis and Final Output

Insights from OEM interactions emergency response stakeholders and telecom providers are consolidated to validate system deployment rates and future growth expectations ensuring robust and triangulated market conclusions.

- Executive Summary

- Research Methodology (Market Definitions and Scope Boundary, E-Call Architecture Assumptions, Regulatory Interpretation Framework, Market Sizing Logic for Embedded vs Aftermarket Systems, Data Triangulation Approach, OEM–Telecom–Emergency Authority Interview Framework, Primary Validation Methodology, Data Gaps and Limitations)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Regulatory and OEM Adoption Milestones

- Business and Technology Adoption Cycle

- End-to-End Value Chain and Stakeholder Mapping

- Growth Drivers

Mandatory Vehicle Safety and Vision-Aligned Regulations

Rising Road Accident Fatality Mitigation Focus

OEM Push for Advanced Safety Feature Differentiation

Growth of Connected and Software-Defined Vehicles

Smart City and Emergency Response Digitization - Challenges

Regulatory Clarity on Mandatory Adoption

Telecom Network Dependency in Remote Areas

System Cost and ASP Sensitivity

Interoperability with Emergency Call Centers

Data Privacy and Localization Constraints - Opportunities

Integration with National Emergency Platforms

Fleet Safety Compliance and Insurance Use Cases

AI-Driven Predictive Emergency Systems

EV-Specific Safety and Battery Incident E-Call

Export-Oriented KSA Vehicle Assembly Adoption - Trends

Shift from Hardware-Centric to Software-Defined E-Call

AI-Based Crash Severity Assessment

Integration with ADAS and Vehicle Data Buses

Cloud-Based Emergency Response Routing

Voice-to-Data Emergency Communication - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base Enabled with E-Call Systems, 2019–2024

- Connectivity and Subscription Revenue Contribution, 2019–2024

- By Fleet Type (in Value %)

Passenger Vehicles

SUVs and Premium Utility Vehicles

Commercial Vehicles

Fleet and Logistics Vehicles

Government and Emergency Vehicles - By Application (in Value %)

Automatic Crash Notification

Manual SOS Emergency Calling

Fleet Safety and Monitoring

Insurance and Telematics Use Cases

Smart City Emergency Integration - By Technology Architecture (in Value %)

Embedded OEM-Fitted E-Call Systems

Aftermarket Retrofit E-Call Modules

Telematics-Integrated E-Call Platforms

Smartphone-Linked E-Call Solutions

AI and Sensor Fusion-Based Systems - By Connectivity Type (in Value %)

Cellular-Based Connectivity

5G-Ready Architectures

GNSS-Integrated Location Systems

Satellite-Fallback Emergency Systems

Hybrid Connectivity Architectures - By End-Use Industry (in Value %)

Automotive OEMs

Fleet Operators

Ride-Hailing and Mobility Platforms

Government and Smart City Authorities

Individual Vehicle Owners - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share Analysis by Installed Base and System Revenue

- Cross Comparison Parameters (System Architecture Type, Trigger Accuracy and Latency, Connectivity Redundancy, Emergency Response Integration Depth, Regulatory Readiness in KSA, OEM Partnerships, Localization Capability, Data Security and Compliance Posture)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Analysis

- Detailed Company Profiles

Bosch

Continental

ZF Friedrichshafen

Valeo

Harman International

LG Electronics Vehicle Solutions

Panasonic Automotive

Qualcomm Technologies

Sierra Wireless

Telit Cinterion

Visteon

Denso

Autoliv

Geotab

Trimble

- Adoption Drivers by End User Category

- Safety Budget Allocation and ROI Expectations

- Regulatory Exposure and Compliance Risk

- Pain Points and Operational Gaps

- Decision-Making and Vendor Selection Criteria

- By Value, 2025–2030

- Installed Base Expansion, 2025–2030

- Connectivity and Service Revenue Mix, 2025–2030