Market Overview

The KSA Eastern Europe C4ISR market is valued at approximately USD ~ billion, with continuous growth driven by increased defense spending, technological advancements, and rising geopolitical tensions in key regions. The market is primarily fueled by innovations in AI, cybersecurity, and advanced communication systems. The demand for enhanced command, control, communication, computers, intelligence, surveillance, and reconnaissance systems is contributing to the rapid market expansion, as nations prioritize defense infrastructure modernization.

The market is led by countries such as Saudi Arabia, Poland, and the Czech Republic, driven by strategic defense investments and the adoption of state-of-the-art C4ISR technologies. Saudi Arabia has seen notable growth due to its Vision 2030 initiative, which includes significant investments in modernizing defense capabilities. Eastern European nations, particularly Poland, have been strengthening their military capabilities amid growing concerns over regional security, contributing to their dominance in the C4ISR sector.

Market Segmentation

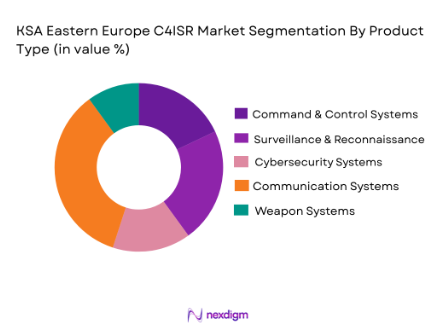

By Product Type

The KSA Eastern Europe C4ISR market is segmented by product type into command and control systems, surveillance and reconnaissance systems, cybersecurity systems, communication systems, and weapon systems. Among these, communication systems hold the dominant market share due to the increasing reliance on secure and efficient communication platforms within defense operations. The growing demand for real-time data sharing, improved decision-making capabilities, and seamless integration between various defense platforms has led to communication systems being the key driver of market growth in this sector.

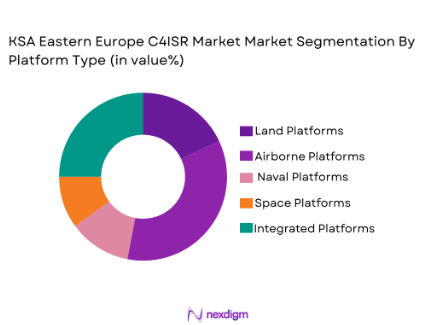

By Platform Type

The market is also segmented by platform type, with land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms being key sub-segments. Among these, airborne platforms dominate the market due to their increasing utilization in surveillance and reconnaissance activities, offering high mobility and operational flexibility. Airborne platforms, including unmanned aerial vehicles (UAVs) and manned aircraft, are integral to modern C4ISR systems, contributing significantly to the market’s growth.

Competitive Landscape

The competitive landscape of the KSA Eastern Europe C4ISR market is characterized by the presence of several major global defense companies. These players are actively involved in technological advancements, with a strong focus on AI, machine learning, and cybersecurity integration into C4ISR solutions. Market consolidation is evident as companies collaborate with regional defense contractors and invest in local production to meet growing demands. The presence of key industry players with a robust technological portfolio and a global reach enhances market competition and offers diverse solutions to defense forces.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Key Military Application |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

KSA Eastern Europe C4ISR Market Analysis

Growth Drivers

Technological Advancements in C4ISR Systems

The demand for advanced technologies like artificial intelligence, machine learning, and autonomous systems has significantly propelled the growth of the KSA Eastern Europe C4ISR market. As militaries seek to improve their surveillance, reconnaissance, and communication capabilities, the integration of cutting-edge technologies is becoming increasingly essential. This technological evolution enhances real-time decision-making processes and optimizes mission execution. The ability to process vast amounts of data quickly and accurately is crucial for modern defense forces, leading to substantial investments in C4ISR systems that incorporate AI and automation to reduce response times. The integration of AI-driven platforms into the battlefield allows for autonomous vehicles and systems, thus improving operational efficiency and reducing human error in critical scenarios. Additionally, advancements in cybersecurity measures have reinforced the need for secure and resilient communication networks. These innovations have made C4ISR solutions indispensable for military operations in both land and air sectors, further driving market growth.

Geopolitical Instability and Security Concerns

The rising geopolitical tensions and security concerns in both the Middle East and Eastern Europe are major growth drivers in the C4ISR market. Countries in these regions are investing heavily in their defense capabilities to safeguard against external threats and internal instability. As a result, nations are modernizing their defense infrastructures and integrating advanced C4ISR technologies to enhance situational awareness and strengthen their defense mechanisms. The increasing frequency of military conflicts and the threat of terrorism have pushed governments to prioritize national security, especially in border areas and critical infrastructure. These factors have significantly impacted defense budgets, with more funds allocated to advanced technologies like C4ISR systems. Consequently, the growing threat landscape in the Middle East and Eastern Europe has spurred demand for next-generation military solutions that can address emerging challenges in real-time. This shift is expected to continue as defense forces look to upgrade their capabilities to better respond to evolving threats.

Market Challenges

High Cost of Advanced C4ISR Systems

One of the major challenges facing the KSA Eastern Europe C4ISR market is the high cost of implementing advanced systems. The development and deployment of state-of-the-art technologies such as artificial intelligence, advanced communication systems, and cybersecurity solutions require substantial financial investments. For many defense contractors and government agencies, the cost of acquiring and maintaining these systems can be prohibitive, especially in regions where military budgets are already under pressure. These costs are not only related to the initial procurement of systems but also to ongoing maintenance, upgrades, and staff training. Moreover, as the complexity of C4ISR systems increases, so does the need for specialized technical support and infrastructure. This can limit the ability of smaller defense forces or less economically developed nations to invest in and integrate these systems. In such cases, countries may prioritize more cost-effective alternatives, potentially hindering the market’s growth. Furthermore, economic instability and shifting national priorities in certain regions may impact government spending on defense, further delaying C4ISR adoption.

Cybersecurity Risks and Vulnerabilities

The growing reliance on digital technologies for defense and surveillance has introduced significant cybersecurity risks and vulnerabilities. As C4ISR systems become more interconnected, they become prime targets for cyber-attacks, which could compromise sensitive military data and disrupt operations. This is especially concerning for defense systems that rely on real-time data processing and secure communications. Hackers and hostile entities may attempt to exploit weaknesses in C4ISR networks, potentially leading to system failures or data breaches. The challenge of ensuring robust cybersecurity protocols for these complex systems is compounded by the rapid pace of technological advancements. While cybersecurity technologies are also advancing, the increasing sophistication of cyber threats presents a constant challenge for defense forces. As a result, significant resources must be allocated to securing C4ISR systems, diverting funds from other areas of defense spending. Moreover, cybersecurity measures must be continually updated to stay ahead of emerging threats, further increasing the financial and operational burdens on defense agencies.

Opportunities

Integration of Commercial Technologies into Military C4ISR Solutions

An emerging opportunity within the KSA Eastern Europe C4ISR market is the integration of commercial technologies into military applications. As the commercial tech sector has developed advanced systems in artificial intelligence, machine learning, and data analytics, there is growing potential for defense forces to adopt these innovations for military C4ISR systems. Commercial solutions, particularly those developed by major tech firms, often offer cost-effective alternatives to custom-built military systems, allowing for faster deployment and greater operational flexibility. These technologies also benefit from continuous innovation in the commercial sector, meaning that military applications can benefit from the latest advancements without having to invest in lengthy and costly research and development processes. By leveraging the private sector’s expertise in cloud computing, AI-driven analytics, and data security, defense forces can enhance the capabilities of their C4ISR systems without significantly increasing their budgets. This trend is expected to grow as both military and civilian sectors collaborate on developing and deploying advanced defense technologies.

Rise of Autonomous and Unmanned Systems in C4ISR

The increasing use of autonomous and unmanned systems represents another significant opportunity for the KSA Eastern Europe C4ISR market. These systems, including unmanned aerial vehicles (UAVs) and ground robots, are becoming essential components of modern military operations. Autonomous systems can perform tasks such as surveillance, reconnaissance, and logistics, which were traditionally handled by manned units. By integrating these systems into C4ISR networks, defense forces can extend their operational reach, reduce the risk to human life, and improve the efficiency of military operations. These systems can operate in hazardous environments where human presence is limited or too dangerous, such as conflict zones or disaster-stricken areas. Additionally, the increasing miniaturization and affordability of unmanned systems are making them more accessible to defense agencies of all sizes, further driving their adoption. As technology continues to evolve, autonomous systems are expected to play a larger role in the C4ISR landscape, offering defense forces new opportunities to enhance their capabilities.

Future Outlook

The KSA Eastern Europe C4ISR market is expected to experience robust growth over the next five years, driven by advancements in AI, machine learning, and autonomous systems. Technological developments will continue to enhance the capabilities of command, control, and communication systems. Governments are anticipated to increase their investments in defense technologies due to ongoing geopolitical tensions, while regulatory support will boost the adoption of cybersecurity measures. Demand from both military and defense contractors will fuel the market’s expansion, with increased integration of commercial technologies in military applications.

Major Players

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- Raytheon Technologies

- Thales Group

- General Dynamics

- Leonardo

- Elbit Systems

- L3 Technologies

- Harris Corporation

- Rheinmetall AG

- Saab Group

- Hewlett Packard Enterprise

- Boeing

- Sikorsky Aircraft

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace and defense technology firms

- Cybersecurity solution providers

- Intelligence agencies

- Private sector defense technology firms

Research Methodology

Step 1: Identification of Key Variables

Key variables such as defense spending, geopolitical tensions, and technological advancements were identified to set the foundation for the research.

Step 2: Market Analysis and Construction

Market data was gathered from primary and secondary sources to evaluate the market size, trends, and forecasts based on historical assessments.

Step 3: Hypothesis Validation and Expert Consultation

Interviews and consultations with industry experts validated the initial assumptions and findings, refining the research model.

Step 4: Research Synthesis and Final Output

The collected data was synthesized into actionable insights, and the final report was prepared with conclusions and recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Military Spending in Key Regions

Advancements in AI and Autonomous Systems

Rising Security Threats and Terrorism

Government Investments in National Defense Infrastructure

Technological Innovations in Satellite Communications - Market Challenges

High Capital Costs of C4ISR Systems

Interoperability Issues Between Different Platforms

Regulatory Hurdles in Defense Procurement

Cybersecurity Vulnerabilities

Political Instability Affecting Defense Policies - Market Opportunities

Integration of Artificial Intelligence in C4ISR Solutions

Growth in Civilian Use of C4ISR Technologies

Collaboration with Private Tech Firms for Cybersecurity Enhancements - Trends

Increase in Use of Unmanned Systems for Surveillance

Advances in Data Encryption for Secure Communications

Adoption of Cloud-Based Solutions for Real-Time Data Sharing

Integration of Blockchain Technology for Secure Defense Operations

Surge in Investment for Cyber-Defense Technologies - Government Regulations & Defense Policy

Data Protection and Security Standards

Defense Procurement Policies in the Middle East

Export Control and International Collaboration Agreements - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command & Control Systems

Cybersecurity Systems

Surveillance & Reconnaissance Systems

Communication Systems

Weapon Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Electronics

Software & Applications

Sensors & Surveillance Devices

Integrated Technologies

Cybersecurity Solutions

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

BAE Systems

Raytheon Technologies

Thales Group

General Dynamics

Leonardo

Elbit Systems

L3 Technologies

Harris Corporation

Rheinmetall AG

Saab Group

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Increasing Demand for Modern C4ISR Solutions in Military Forces

- Government Agencies’ Increasing Role in Security Technology Procurement

- Private Sector Engagement in Cybersecurity Innovations

- Growing Focus on Defense Contractors to Integrate Advanced Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035