Market Overview

The defense market in KSA and Eastern Europe is experiencing substantial growth, driven by geopolitical dynamics, defense modernization programs, and increasing military expenditure. In KSA, the defense sector’s expansion is supported by government initiatives aimed at strengthening national security and regional influence. Based on a recent historical assessment, the market size for defense systems in these regions has been estimated at approximately USD ~ billion. This is driven by technological advancements and significant investments in defense infrastructure, with a focus on air defense, naval capabilities, and cybersecurity solutions.

Dominant countries in this market include Saudi Arabia, Poland, and Ukraine, which have made notable investments in defense technologies to modernize their armed forces. Saudi Arabia is particularly influential due to its large defense budget, which is the highest in the Middle East, while Poland and Ukraine play central roles in Eastern Europe due to strategic positioning and defense collaboration with NATO. The region’s dominance is also fueled by increasing defense alliances and partnerships, both within the Middle East and with European Union member states, contributing to a more secure defense infrastructure across borders.

Market Segmentation

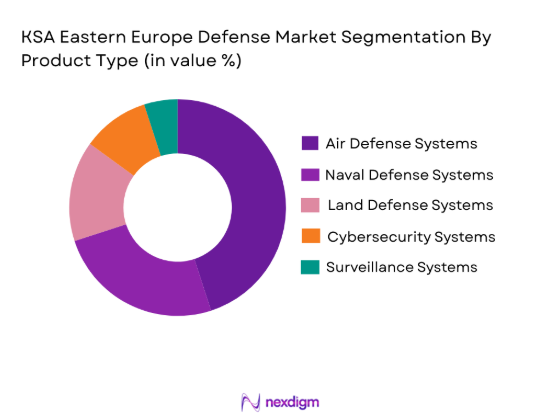

By Product Type

The defense market in KSA and Eastern Europe is segmented by product type into systems such as air defense, naval defense, land defense, cybersecurity, and surveillance systems. Recently, the air defense sub-segment has garnered a dominant market share due to heightened security concerns and investments in missile defense systems, particularly in KSA. The demand for advanced air defense systems has surged because of increased geopolitical tensions, particularly related to regional threats, and the modernization of military forces to counter emerging aerial threats. This trend is further supported by defense contracts and partnerships with global defense manufacturers, enhancing the accessibility of cutting-edge air defense technologies.

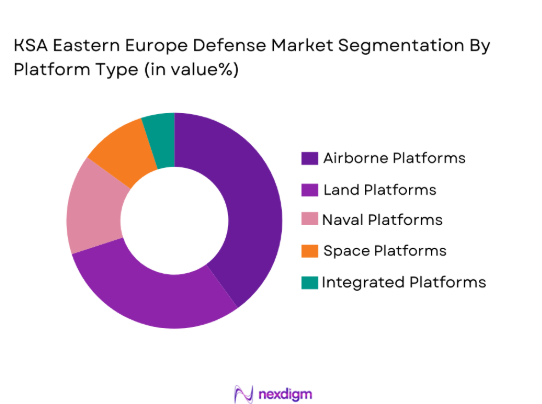

By Platform Type

The market is also segmented by platform type, with the key sub-segments being land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Recently, airborne platforms have dominated the market share due to the increasing demand for fighter jets, unmanned aerial vehicles (UAVs), and advanced reconnaissance aircraft. The rise in airborne platform investments is driven by the need for enhanced surveillance, intelligence gathering, and rapid deployment capabilities in defense strategies. Additionally, defense forces in the region are adopting advanced UAVs for surveillance, reconnaissance, and tactical operations, solidifying the dominance of airborne platforms in the defense sector.

Competitive Landscape

The defense market in KSA and Eastern Europe is highly competitive, with major defense contractors collaborating with local governments to provide state-of-the-art solutions. The landscape is characterized by increasing consolidation as regional defense firms partner with global manufacturers to offer advanced technologies, particularly missile defense, air defense systems, and cybersecurity solutions. The influence of key players in the market continues to shape the strategic direction, leading to innovations in defense capabilities.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ |

| General Dynamics | 1899 | USA | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ |

KSA Eastern Europe Defense Market Analysis

Growth Drivers

Increasing Defense Budgets

The growth of the defense market in KSA and Eastern Europe is significantly driven by increasing defense budgets. Saudi Arabia’s defense spending is among the highest in the region, with substantial investments in modernizing military equipment, from air defense systems to cybersecurity. Additionally, Eastern European countries such as Poland and Ukraine are ramping up their defense expenditures in response to growing geopolitical instability. The rising demand for advanced defense technologies, such as missile defense systems and UAVs, is directly linked to these increased budgets. As a result, the region has seen an influx of military modernization initiatives, with a focus on bolstering national security and enhancing operational efficiency across military branches.

Strategic Alliances and Defense Partnerships

Another key driver of market growth is the formation of strategic defense alliances and partnerships. KSA has entered into several defense contracts with Western manufacturers, while Eastern European nations are strengthening their military ties with NATO. These partnerships facilitate the transfer of advanced technologies and ensure the availability of sophisticated defense systems, particularly air defense and missile systems. Moreover, regional defense cooperation between countries in Eastern Europe is fostering innovation in defense systems. By leveraging international expertise and collaboration, KSA and Eastern Europe are enhancing their defense capabilities and accelerating the adoption of cutting-edge technologies. These alliances also provide access to the latest defense systems, which are crucial for maintaining a competitive edge in the evolving security landscape.

Market Challenges

Geopolitical Tensions and Security Risks

The defense markets in KSA and Eastern Europe face challenges due to the ongoing geopolitical tensions in the Middle East and Eastern Europe. For KSA, regional conflicts and security risks arising from neighboring states have led to increased demand for defense solutions. However, these conflicts also create challenges in terms of sustainability, costs, and strategic alignment with international partners. In Eastern Europe, the ongoing crisis in Ukraine and tensions with Russia have heightened security concerns. These geopolitical dynamics complicate defense procurement processes, as countries are forced to balance immediate security needs with long-term strategic goals. The fluctuating political landscape further adds complexity to defense planning and collaboration, leading to a volatile market environment.

Supply Chain Disruptions

Another significant challenge in the defense market is the vulnerability of global defense supply chains. Both KSA and Eastern Europe rely heavily on the import of high-tech defense systems from global manufacturers. However, disruptions in the global supply chain, such as those caused by geopolitical factors or the COVID-19 pandemic, have resulted in delays in the delivery of critical defense equipment. This has caused uncertainty in defense procurement timelines and has led to potential delays in military readiness. Additionally, the reliance on foreign suppliers makes KSA and Eastern Europe susceptible to price fluctuations and shortages of essential components. To mitigate these risks, there is an increasing focus on local manufacturing and the diversification of suppliers, although this presents its own set of challenges in terms of quality control and technological capabilities.

Opportunities

Investment in Cybersecurity

One of the prime opportunities in the defense market for KSA and Eastern Europe is the growing investment in cybersecurity solutions. Both regions are increasingly recognizing the importance of securing digital infrastructure against cyber threats. In KSA, the government has prioritized cybersecurity as part of its Vision 2030 initiative, leading to increased investments in cyber defense systems. Similarly, Eastern European countries are stepping up their cybersecurity capabilities in response to rising cyberattacks from state and non-state actors. This growing demand for cybersecurity solutions presents opportunities for both local and global players to introduce cutting-edge technologies in areas such as encryption, threat detection, and secure communications. By capitalizing on this opportunity, defense contractors can secure long-term contracts in this rapidly expanding segment.

Development of Autonomous Defense Systems

Another key opportunity lies in the development and deployment of autonomous defense systems. With the rise of advanced AI technologies, there is a growing trend toward the integration of unmanned aerial vehicles (UAVs), autonomous ground systems, and robotic systems into defense strategies. KSA and Eastern European countries are investing heavily in autonomous technologies to enhance surveillance, reconnaissance, and combat capabilities. This trend opens avenues for innovation and collaboration between defense firms, research institutions, and technology companies. The adoption of autonomous systems is expected to transform defense operations by reducing human risk, increasing efficiency, and providing advanced operational intelligence, presenting significant growth opportunities for companies in the sector.

Future Outlook

The defense market in KSA and Eastern Europe is expected to continue its upward trajectory over the next five years, supported by increasing defense budgets, technological advancements, and growing demand for sophisticated defense systems. Both regions are likely to see further investments in cybersecurity, air defense, and autonomous systems, driven by the need for enhanced security and operational capabilities. Additionally, regulatory support for defense modernization and increasing collaboration with international defense contractors will further bolster market growth.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- General Dynamics

- Rheinmetall AG

- Raytheon Technologies

- L3 Technologies

- Leonardo

- Harris Corporation

- Saab Group

- Northrop Grumman

- MBDA

- Elbit Systems

- Leonardo DRS

- Rheinmetall Defence

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors and manufacturers

- Military and security agencies

- Aerospace and defense technology firms

- Research and development institutions

- Strategic defense alliances

- Private sector technology firms

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying key market drivers, trends, and variables that influence the defense market in KSA and Eastern Europe, including geopolitical factors, technological developments, and defense budget allocations.

Step 2: Market Analysis and Construction

The market analysis phase focuses on assessing the current market dynamics, demand-supply relationships, and future growth potential. Market construction includes segmenting the defense sector into relevant categories such as product type, platform type, and geographical segmentation.

Step 3: Hypothesis Validation and Expert Consultation

This step involves validating the initial market hypothesis through consultations with industry experts, defense consultants, and key stakeholders to ensure the research findings align with current market realities.

Step 4: Research Synthesis and Final Output

The final output is derived by synthesizing the data collected from various sources, ensuring the market analysis is comprehensive and reflects the evolving nature of the defense industry in KSA and Eastern Europe.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Spending on National Defense

Rising Geopolitical Tensions in Eastern Europe and KSA

Technological Advancements in Defense Systems

Growing Need for Border Security and Surveillance

Strategic Partnerships Between KSA and Eastern European Nations - Market Challenges

High Costs Associated with Advanced Defense Technologies

Geopolitical Instability in Certain Regions

Supply Chain Disruptions in Defense Equipment

Regulatory and Compliance Barriers

Resistance to Military Expansion from Civilian Groups - Market Opportunities

Integration of AI and Cybersecurity in Defense Solutions

Rising Demand for Autonomous Defense Systems

Collaborations Between Private Tech Firms and Military Contractors - Trends

Increasing Use of Autonomous Defense Systems

Integration of AI in Surveillance and Reconnaissance Systems

Expansion of Cybersecurity Solutions for Military Systems

Growth of Integrated Defense Platforms

Focus on Sustainability and Energy Efficiency in Defense Equipment - Government Regulations & Defense Policy

Export Control Regulations

Data Protection and Privacy Concerns

Government Investments in Modernizing National Defense - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Land Defense Systems

Air Defense Systems

Naval Defense Systems

Surveillance & Reconnaissance Systems

Weapon Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Integrated Platforms

Hybrid Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Modular Solutions

Hybrid Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Sector / Technology Firms

Security Services - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Advanced Materials

Electronics & Communication Technologies

AI and Automation Technologies

Sensors & Surveillance Technologies

Cybersecurity Solutions

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, End User Segment, Procurement Channel, Material/Technology)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

BAE Systems

Thales Group

General Dynamics

Northrop Grumman

Rheinmetall AG

Raytheon Technologies

Leonardo

L3 Technologies

Saab Group

Harris Corporation

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Growing Demand from Military Forces for High-Tech Solutions

- Defense Contractors Focused on Cost-Effective and Advanced Systems

- Private Sector Increasing Investment in Cybersecurity for Defense

- Government Agencies Playing a Crucial Role in Procurement and Regulation

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035