Market Overview

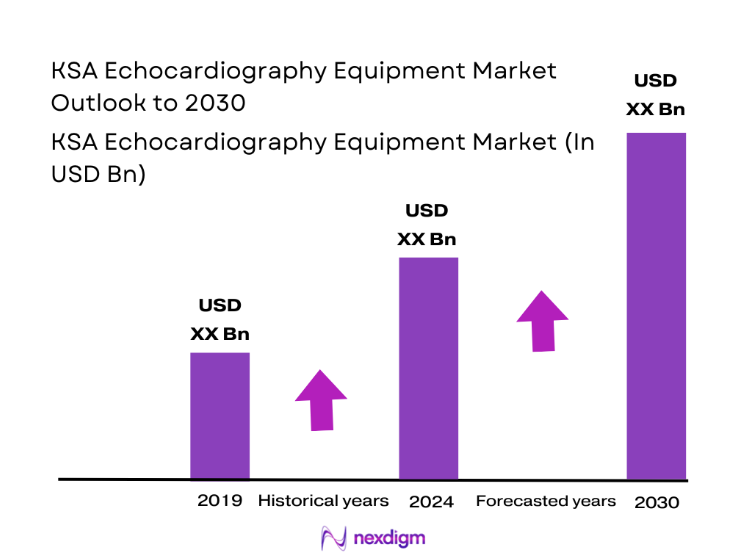

The KSA Echocardiography Equipment market is valued at USD ~, reflecting its position as a strategically important segment within the national diagnostic imaging ecosystem. The market scale is underpinned by sustained demand from tertiary hospitals, rising cardiovascular disease incidence, and continuous investment in advanced cardiac care infrastructure. Echocardiography has become a frontline diagnostic modality across public and private healthcare settings, supporting early detection, interventional planning, and long-term disease management. Structural importance is further reinforced by healthcare transformation initiatives that prioritize imaging modernization, clinical automation, and outcome-driven care delivery models.

Within the country, demand is concentrated in major metropolitan healthcare clusters where tertiary hospitals, cardiac specialty centers, and academic medical institutions are located. These cities dominate adoption due to higher patient throughput, stronger public and private healthcare investments, and the presence of national referral centers that require advanced echocardiography capabilities. On the supply and technology side, the market is influenced by global OEM innovation hubs that lead in imaging software, transducer design, and AI-driven diagnostic tools. Their technological leadership shapes procurement preferences in the Kingdom, driving demand toward premium and digitally integrated echocardiography platforms.

Market Segmentation

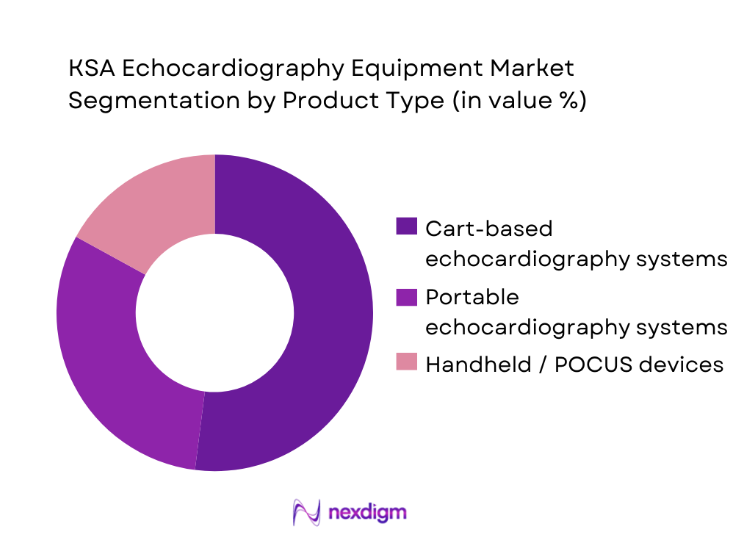

By Product Type

The KSA Echocardiography Equipment market is segmented by product type into cart-based systems, portable systems, handheld or point-of-care devices, stress echocardiography platforms, and fetal and pediatric systems. Among these, cart-based echocardiography systems dominate the market due to their entrenched role in high-volume hospitals and specialized cardiac centers. These platforms remain the clinical gold standard for complex diagnostic workflows, offering superior image resolution, advanced Doppler functionality, and seamless integration with hospital information systems. Public hospitals and large private healthcare groups continue to prioritize these systems in capital procurement because they support a wide range of cardiology applications, from routine assessments to interventional guidance. Their longer operational life cycles and strong vendor service support further reinforce their dominance, even as portable and handheld solutions gain traction in emergency and ambulatory care environments.

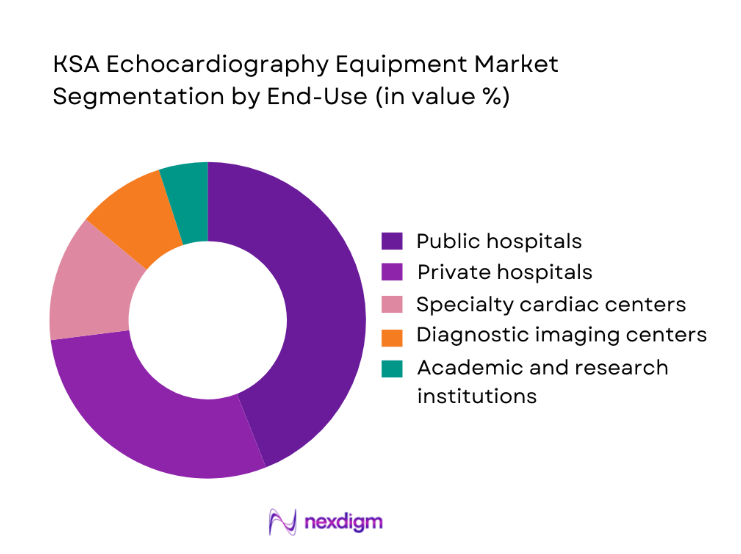

By End-Use

The market is segmented into public hospitals, private hospitals, specialty cardiac centers, diagnostic imaging centers, and academic and research institutions. Public hospitals hold the dominant position in this segmentation, driven by their extensive nationwide footprint and centralized procurement mechanisms. These institutions manage high patient volumes and complex referral cases, making echocardiography a core diagnostic requirement across departments. Structured capital funding programs ensure regular equipment upgrades, particularly in major tertiary hospitals and national referral centers. While private hospitals and specialty centers are increasingly investing in advanced and portable systems, public hospitals continue to lead in overall installed base and replacement cycles. Their dominance is further supported by long-term service contracts and standardized technology platforms that favor established OEM relationships.

Competitive Landscape

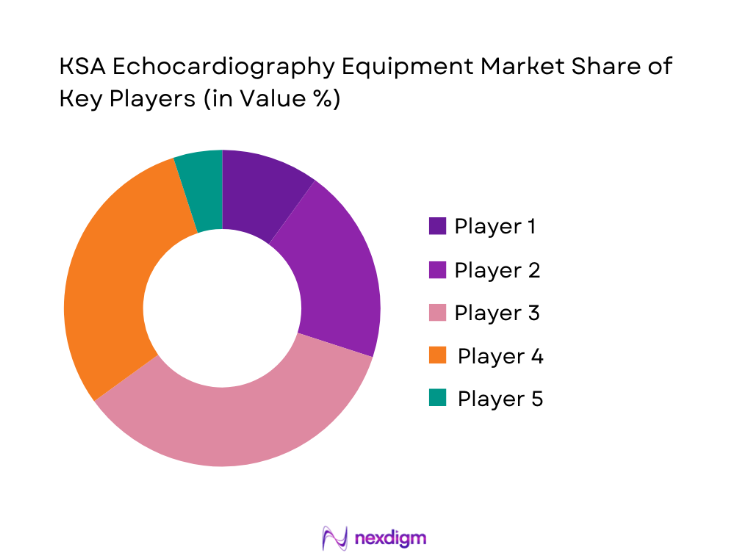

The KSA Echocardiography Equipment market is dominated by a few major players, including GE HealthCare and global or regional brands like Philips Healthcare, Siemens Healthineers, and Canon Medical Systems. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | KSA Market Presence | Product Portfolio Depth | AI-Enabled Platforms | Service Network Coverage | Public Tender Participation | Local Training Programs |

| GE HealthCare | 1892 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Canon Medical Systems | 1930 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Mindray Medical | 1991 | China | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Echocardiography Equipment Market Analysis

Growth Drivers

Rising cardiovascular disease burden

The increasing prevalence of cardiovascular conditions is creating sustained demand for advanced diagnostic imaging across the Kingdom. Echocardiography plays a central role in early detection, disease monitoring, and post-intervention follow-up, making it indispensable in both acute and chronic care pathways. As patient volumes rise in cardiology departments, hospitals are compelled to expand imaging capacity and upgrade to more efficient systems. This clinical necessity directly drives higher equipment procurement, encourages adoption of AI-enabled solutions that improve diagnostic accuracy, and strengthens the business case for continuous technology renewal across public and private healthcare providers.

Expansion of tertiary care infrastructure

Ongoing development of large-scale hospitals, specialty cardiac centers, and integrated medical cities is significantly expanding the installed base of diagnostic equipment. These facilities are designed to deliver high-complexity care, requiring state-of-the-art echocardiography platforms capable of supporting interventional cardiology and advanced imaging workflows. As new facilities become operational, demand increases not only for initial equipment installation but also for long-term service contracts and technology upgrades. This infrastructure-driven growth reinforces market stability and supports sustained revenue streams for leading OEMs and service providers.

Challenges

High capital equipment costs

Advanced echocardiography systems require substantial upfront investment, which can strain capital budgets, particularly for mid-sized private hospitals and diagnostic centers. Even in well-funded public institutions, competing priorities for imaging, laboratory, and surgical equipment can delay procurement cycles. High acquisition costs are compounded by long-term service and maintenance expenses, making total cost of ownership a critical concern. These financial barriers can slow technology adoption and limit the pace at which facilities upgrade to next-generation platforms, particularly in secondary and peripheral care settings.

Skilled workforce availability gaps

The effective use of echocardiography equipment depends heavily on trained sonographers and cardiologists with advanced imaging expertise. In several healthcare facilities, shortages of skilled professionals constrain optimal utilization of installed systems. This gap affects throughput, diagnostic quality, and return on investment for hospitals that have invested in premium platforms. Additionally, the learning curve associated with AI-enabled and automated systems necessitates continuous training programs, which adds operational complexity and cost for healthcare providers and OEMs alike.

Opportunities

Point-of-care ultrasound expansion

The growing adoption of point-of-care ultrasound presents a significant opportunity for the echocardiography equipment market. Handheld and portable devices are enabling cardiac imaging in emergency departments, ambulatory clinics, and remote care settings, expanding the addressable user base beyond traditional cardiology units. This shift supports faster clinical decision-making and aligns with broader healthcare goals of accessibility and efficiency. Vendors that develop robust, easy-to-use, and connected portable platforms are well positioned to capture incremental demand from new care environments.

Managed equipment service adoption

Hospitals are increasingly exploring managed equipment service models that bundle hardware, software, maintenance, and upgrades into long-term contracts. This approach reduces upfront capital burden and provides predictable operating costs, making advanced echocardiography systems more accessible to a wider range of healthcare facilities. For OEMs and service providers, these models create recurring revenue streams and strengthen long-term customer relationships. As value-based care principles gain prominence, managed services are likely to become a key differentiator in procurement decisions.

Future Outlook

The KSA Echocardiography Equipment market is positioned for steady strategic growth as healthcare providers continue to prioritize cardiac diagnostics, digital transformation, and operational efficiency. Investment momentum in tertiary care, coupled with rising preventive screening initiatives, will sustain baseline demand, while innovation in AI and portable imaging will unlock new use cases across emergency and ambulatory care. Over time, purchasing decisions are expected to shift toward total value delivered, favoring vendors that combine clinical performance, service reliability, and long-term cost efficiency.

Major Players

- GE HealthCare

- Philips Healthcare

- Siemens Healthineers

- Canon Medical Systems

- Fujifilm Healthcare

- Mindray Medical

- Esaote

- Hitachi Healthcare

- Samsung Medison

- Butterfly Network

- Clarius Mobile Health

- Chison Medical

- SonoScape

- Edan Instruments

- Shenzhen Wisonic

Key Target Audience

- Hospital groups and healthcare networks

- Specialty cardiac centers

- Diagnostic imaging chains

- Group purchasing and centralized procurement bodies

- Medical device distributors and importers

- Investments and venture capitalist firms

- Government and regulatory bodies Saudi Food and Drug Authority Ministry of Health National Unified Procurement Company

- Healthcare infrastructure developers and public private partnership operators

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the full ecosystem of the KSA Echocardiography Equipment market, covering OEMs, distributors, healthcare providers, and regulators. Extensive desk research is conducted using secondary and proprietary sources to identify critical demand and supply variables that influence market performance.

Step 2: Market Analysis and Construction

Historical data on equipment installations, procurement cycles, and service contracts is analyzed to construct the market framework. This phase integrates bottom-up and top-down approaches to ensure alignment between revenue estimates and real-world industry dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured interviews with clinicians, biomedical engineers, and procurement leaders. These consultations provide operational insights that refine market sizing logic and competitive positioning assessments.

Step 4: Research Synthesis and Final Output

All qualitative and quantitative findings are synthesized into a cohesive analytical framework. Continuous cross-verification ensures the final output delivers a consistent, accurate, and decision-oriented market perspective.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, echocardiography equipment taxonomy and clinical workflow mapping, market sizing logic by installed base and procedure volume, revenue attribution across systems probes software and service contracts, primary interview program with hospitals cardiac centers distributors and regulators, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Echocardiography in KSA

- Cardiovascular Disease Burden and Imaging Demand Drivers

- Care Pathway Mapping Across Cardiology Clinics Hospitals and ICUs

- Public Procurement and Private Provider Adoption Dynamics

- Import Dependence and Authorized Distributor Ecosystem

- Growth Drivers

High cardiovascular disease burden and rising imaging demand

Expansion of tertiary hospitals and cardiac care programs

Growing adoption of portable ultrasound in critical care settings

Demand for advanced imaging in structural heart interventions

AI driven workflow efficiency and reporting standardization - Challenges

High capital cost and tender driven procurement cycles

Shortage of trained sonographers and cardiologists

Probe replacement and maintenance cost burden

Workflow bottlenecks in high volume echo labs

Dependence on imported spare parts and service support - Opportunities

Replacement demand for aging installed base in public hospitals

Portable and handheld growth for point of care applications

AI enabled automation for faster throughput and lower operator variability

Service contract expansion with uptime and training differentiation

Growth of echo use in outpatient and ambulatory cardiology clinics - Trends

Shift toward portable and handheld echocardiography adoption

Expansion of 3D imaging for valve assessment and interventions

Integration of echo with structured reporting and cardiology IT systems

Rising demand for strain imaging and advanced quantification

Increasing focus on lifecycle service and probe management - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Installed Base and New Installations, 2019–2024

- By Procedure Volume, 2019–2024

- By Systems vs Probes vs Service Revenue Split, 2019–2024

- By Fleet Type (in Value %)

Government hospitals and medical cities

Private hospital networks

Cardiology specialty centers

Independent diagnostic imaging centers

Ambulatory and outpatient clinics - By Application (in Value %)

Transthoracic echocardiography

Transesophageal echocardiography

Stress echocardiography

Pediatric and congenital heart imaging

Intraoperative and critical care echocardiography - By Technology Architecture (in Value %)

Cart based premium echocardiography systems

Mid range cart based systems

Portable and handheld ultrasound systems

3D and 4D echocardiography platforms

AI assisted automated measurement software suites - By Connectivity Type (in Value %)

Standalone ultrasound workstations

PACS integrated echo reporting workflows

EHR integrated cardiology imaging platforms

Cloud enabled image sharing and archiving

Remote service monitoring and uptime analytics - By End-Use Industry (in Value %)

Cardiology departments and heart centers

Radiology departments supporting echo services

ICU and emergency departments

Surgical theaters and hybrid operating rooms

Training institutes and academic hospitals - By Region (in Value %)

Riyadh Region

Makkah Region

Eastern Province

Madinah Region

Asir and Southern Regions

- Competitive ecosystem structure across ultrasound OEMs distributors and service partners

- Positioning driven by image quality clinical applications and service footprint

- Partnership models between OEMs hospital groups and distributor networks

- Cross Comparison Parameters (image quality and resolution performance, probe portfolio breadth and durability, AI automation and measurement capability, 3D and strain imaging readiness, workflow integration with PACS and reporting, service response time and uptime SLA, training and clinical education support, lifetime cost of ownership)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

GE HealthCare

Philips

Siemens Healthineers

Canon Medical Systems

Fujifilm Healthcare

Mindray

Samsung Medison

Esaote

Hitachi Healthcare

Konica Minolta Healthcare

Butterfly Network

Clarius Mobile Health

SonoSite by Fujifilm

Chison Medical Technologies

Wisonic Medical

- Clinical priorities for image quality and diagnostic confidence

- Procurement models in public hospitals and private networks

- Decision criteria for cart based versus portable systems

- Service expectations for uptime training and probe support

- Total cost of ownership drivers across system software and probes

- By Value, 2025–2030

- By Installed Base and New Installations, 2025–2030

- By Procedure Volume, 2025–2030

- By Systems vs Probes vs Service Revenue Split, 2025–2030