Market Overview

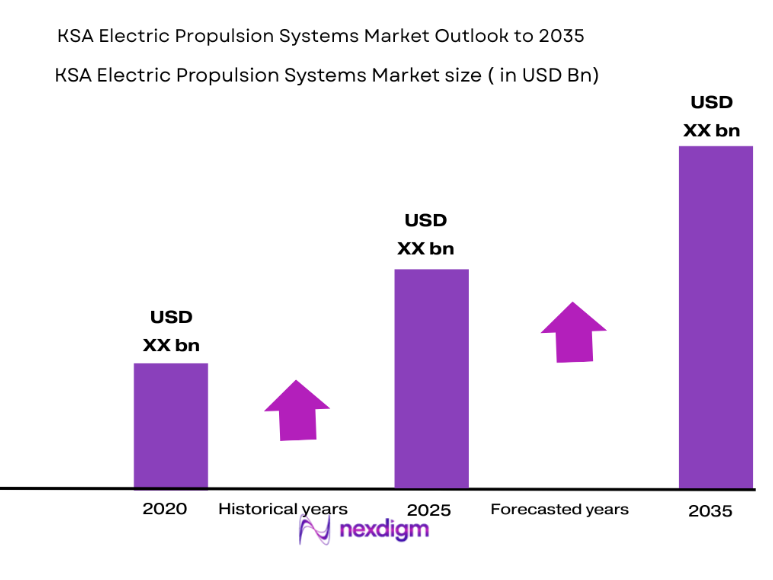

The KSA Electric Propulsion Systems market is driven by advancements in electric propulsion technology, with an estimated market size based on recent assessments at USD ~ billion. This market growth is primarily supported by increasing investments in clean energy solutions, aerospace innovation, and defense sector modernization. The shift toward sustainable technologies, along with the rising demand for energy-efficient systems, particularly in the aerospace and defense sectors, is contributing significantly to this market expansion.

The KSA region is leading the market, with key players benefiting from strong governmental support for technological advancements in both defense and commercial sectors. The dominance of KSA is attributed to its robust infrastructure, strategic geopolitical position, and substantial investments in defense and energy innovation. Moreover, the kingdom’s commitment to Vision 2030 is propelling the growth of electric propulsion systems, further enhancing its position as a regional leader in the sector.

Market Segmentation

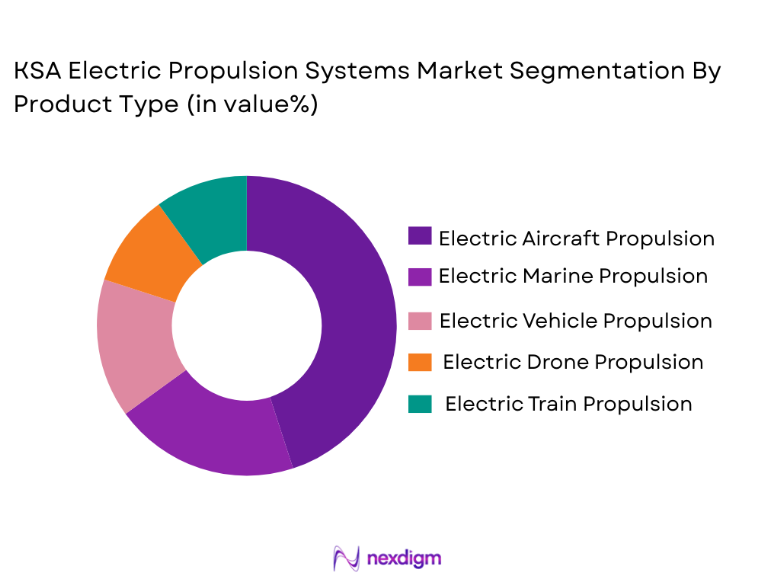

By Product Type

The KSA Electric Propulsion Systems market is segmented by product type into electric aircraft propulsion systems, electric marine propulsion systems, electric vehicle propulsion systems, electric drone propulsion systems, and electric train propulsion systems. The dominant sub-segment, electric aircraft propulsion systems, is leading the market due to increasing demand for sustainable solutions in commercial and military aviation. With global efforts to reduce emissions, electric propulsion systems in aircraft are gaining traction, particularly in regional airliners and UAVs. This growth is further supported by technological advancements that enhance the efficiency of electric motors and energy storage systems, making electric propulsion more viable in aviation Applications.

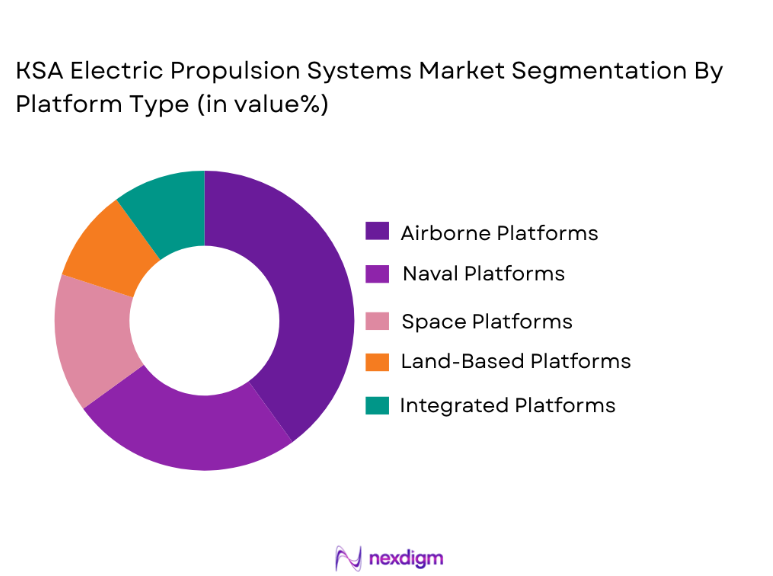

By Platform Type

The KSA Electric Propulsion Systems market is segmented by platform type into airborne platforms, naval platforms, space platforms, land-based platforms, and integrated platforms. Among these, airborne platforms dominate the market share due to the increasing demand for electric propulsion in unmanned aerial vehicles (UAVs) and eVTOL (electric vertical takeoff and landing) aircraft. The rising interest in reducing emissions from aircraft and the push for greener alternatives have made airborne platforms the most significant segment, with robust technological developments supporting this growth.

Competitive Landscape

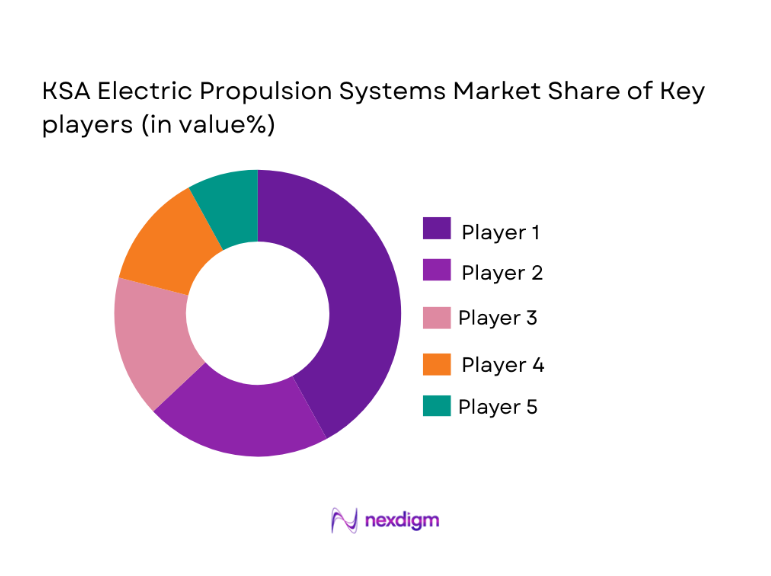

The competitive landscape of the KSA Electric Propulsion Systems market is characterized by strategic partnerships, technological innovation, and a growing number of companies entering the sector. Major players are consolidating their positions through acquisitions and collaborations to enhance their R&D capabilities and expand market reach. Government-backed initiatives also play a crucial role in shaping the competitive environment. Key players are investing heavily in advanced propulsion technologies and are focusing on enhancing system efficiency and sustainability.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| GE Aviation | 1917 | USA | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | UK | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

KSA Electric Propulsion Systems Market Analysis

Growth Drivers

Technological Advancements in Electric Propulsion Systems

The rapid development of electric propulsion technologies is a key growth driver for the KSA market. Recent advancements in electric motor design, battery technology, and power electronics have significantly enhanced the efficiency and performance of electric propulsion systems. With improvements in power density and the reduction in weight, these systems are now more feasible for a variety of applications, from aerospace to defense. Moreover, as the cost of electric propulsion components continues to decrease, adoption rates are expected to increase, thereby fueling the market’s growth. The integration of next-generation power sources such as lithium-sulfur and solid-state batteries will further contribute to the advancement of electric propulsion systems. In the aerospace sector, for example, the adoption of electric propulsion for commercial and military aircraft is expected to lower operating costs, which is a significant driver for demand. Additionally, the increase in UAV applications and the expansion of eVTOL technology, with electric propulsion systems as a core component, are poised to further boost market growth in the coming years. Furthermore, as governments worldwide focus on reducing carbon emissions, the demand for cleaner, more efficient propulsion systems is accelerating, which supports the overall growth of the market.

Government Policies and Initiatives Supporting Clean Energy Transition

Government support for the clean energy transition is another major driver of growth in the KSA Electric Propulsion Systems market. KSA has set ambitious goals to reduce its carbon footprint as part of its Vision 2030 initiative, which includes a focus on green energy technologies and reducing reliance on fossil fuels. This commitment has resulted in increased investments in electric propulsion systems for both commercial and defense applications. For example, the KSA government has been promoting electric and hybrid-electric technologies to enhance the efficiency of aircraft and naval vessels, while also supporting the development of infrastructure needed to deploy these systems. Financial incentives, subsidies, and R&D grants for electric propulsion technology have led to rapid advancements and cost reductions in electric motors, batteries, and related technologies. These initiatives have made it increasingly economically viable for companies to adopt and integrate electric propulsion systems into their operations. As the Kingdom continues its push for sustainable development, policies promoting clean energy technologies will continue to play a pivotal role in driving the growth of electric propulsion systems, making the KSA a leading player in this emerging sector.

Market Challenges

High Capital Investment and Infrastructure Limitations

One of the most significant challenges facing the KSA Electric Propulsion Systems market is the high capital investment required for the development and deployment of electric propulsion systems. While the technology itself has advanced considerably, the initial costs associated with setting up manufacturing facilities, research and development (R&D) labs, and the required infrastructure remain high. These costs can deter potential market entrants, particularly smaller companies that may struggle to secure the necessary funding. The lack of a comprehensive electric infrastructure also hinders the widespread adoption of electric propulsion systems. For example, the absence of a robust network of charging stations and refueling infrastructure for electric aircraft or electric maritime vessels limits the applicability and convenience of electric propulsion. In addition, current electric propulsion systems are often designed for smaller applications, and scaling these systems to larger platforms such as commercial aircraft and naval vessels presents technical and financial challenges. Thus, despite significant technological advances, the high initial capital outlay for system development and the lack of supporting infrastructure are substantial barriers to the widespread adoption of electric propulsion systems in KSA.

Integration with Existing Systems and Technological Limitations

Another challenge is the integration of electric propulsion systems with existing platforms, particularly in the defense and aerospace sectors. Many military and commercial aircraft, as well as naval vessels, rely on traditional propulsion technologies that are not easily compatible with electric propulsion systems. Retrofitting these platforms with electric systems requires significant modifications, both to the powertrain and the overall architecture. Additionally, many electric propulsion systems still face limitations in terms of range, payload capacity, and reliability, particularly in high-performance applications such as military aircraft or long-haul flights. While improvements in battery technology and power electronics are addressing some of these issues, current electric propulsion systems still cannot match the energy density and operational performance of traditional combustion engines. As a result, the challenge of integrating electric propulsion into existing platforms without compromising operational capabilities remains a significant hurdle. Technological advancements must continue to address these limitations, but the slow pace of development in certain areas adds to the complexity of achieving large-scale adoption.

Opportunities

Expansion of Electric Propulsion in Commercial Aerospace

The expansion of electric propulsion in commercial aerospace presents significant growth opportunities for the KSA market. With increasing global emphasis on reducing carbon emissions and the rising demand for fuel-efficient aircraft, electric propulsion systems offer a promising solution. KSA, as a key player in the Middle Eastern aerospace industry, is well-positioned to leverage these advancements. The growing adoption of electric propulsion in small aircraft and regional airliners is expected to lead to further developments in larger commercial aircraft, particularly in the context of hybrid-electric and fully electric technologies. This shift is driven by the need to reduce operating costs and meet stringent environmental regulations. As electric propulsion systems become more efficient, their applications will expand to include short regional flights, with a potential roadmap for longer-haul flights in the future. KSA’s government support for clean energy technologies, combined with its strategic location as a key aviation hub, creates a conducive environment for the growth of electric propulsion systems in the commercial aerospace sector. This presents a unique opportunity for local companies to engage in the development and deployment of these systems, positioning the region as a leader in electric aviation technology.

Strategic Partnerships and Collaborations for Technological Advancements

Another promising opportunity in the KSA Electric Propulsion Systems market lies in strategic partnerships and collaborations with global technology leaders. By forming alliances with established players in the electric propulsion industry, local firms can gain access to advanced technologies, expertise, and production capabilities. These collaborations can help overcome the technological and infrastructure challenges currently facing the market, such as improving energy density in batteries and scaling electric propulsion for larger platforms. In addition, partnerships with research institutions and government agencies focused on clean energy solutions can drive innovation and expedite the adoption of electric propulsion systems in the region. As KSA continues to invest in its Vision 2030 agenda, there is ample opportunity for local and international companies to collaborate on research and development projects, contributing to the growth of the electric propulsion market. By leveraging these partnerships, KSA can further enhance its competitive position in the global market and accelerate the transition to sustainable propulsion systems.

Future Outlook

The future outlook for the KSA Electric Propulsion Systems market looks promising, with continued technological advancements and government backing driving growth. Over the next few years, the market is expected to see significant developments in battery technology, which will enhance the range and efficiency of electric propulsion systems. Increased investments in infrastructure will help address current limitations, enabling broader adoption across various sectors, including aerospace and defense. With growing global emphasis on sustainability, KSA’s push for clean energy technologies will likely make it a key player in the electric propulsion industry, setting the stage for long-term growth.

Major Players

- Honeywell Aerospace

- GE Aviation

- Rolls-Royce

- Safran

- BAE Systems

- Thales Group

- General Electric

- Lockheed Martin

- Northrop Grumman

- L3 Technologies

- Rheinmetall

- Harris Corporation

- Raytheon Technologies

- Elbit Systems

- Collins Aerospace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Defense contractors

- Aviation technology developers

- Automotive propulsion developers

- Electric vehicle manufacturers

- Airlines and commercial aviation operators

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the primary factors that affect the market, including technological advancements, regulations, and demand drivers.

Step 2: Market Analysis and Construction

Market data is gathered from both primary and secondary sources to build a comprehensive model of the market structure and dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Experts in the field are consulted to validate the assumptions made during market analysis and to refine predictions.

Step 4: Research Synthesis and Final Output

The research is synthesized into a final report, with conclusions drawn and insights shared based on the analysis and expert feedback

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for energy-efficient propulsion systems

Government initiatives supporting clean energy technology

Advancements in battery storage systems

Increasing defense investments in advanced propulsion technologies

Growing adoption of electric propulsion in the aerospace and defense sector - Market Challenges

High capital investment required for electric propulsion systems

Limited infrastructure for electric propulsion systems in certain regions

Regulatory hurdles in adopting new technologies

Technical challenges in scaling electric propulsion for large platforms

Integration and interoperability issues with existing systems - Market Opportunities

Expansion of electric propulsion technology in commercial aerospace

Collaborations between defense and technology companies for advanced propulsion

Development of hybrid propulsion systems for versatile applications - Trends

Increase in demand for greener propulsion alternatives

Focus on enhancing energy storage and efficiency in electric propulsion

Growing interest in electric vertical take-off and landing (eVTOL) aircraft

Emergence of electric propulsion in maritime applications

Continuous improvements in system integration for hybrid propulsion - Government Regulations & Defense Policy

Incentives for adopting electric propulsion technologies

Focus on reducing carbon emissions in transportation and defense sectors

Support for research and development of electric propulsion systems in defense - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric Motors

Power Electronics

Energy Storage Systems

Electric Thrusters

Control Systems - By Platform Type (In Value%)

Airborne Platforms

Naval Platforms

Space Platforms

Land-Based Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Modular Solutions

Integrated Solutions

Hybrid Solutions - By End User Segment (In Value%)

Aerospace Industry

Defense Contractors

Space Agencies

Private Sector Technology Firms

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Lithium-ion Batteries

Permanent Magnet Motors

Superconducting Materials

High-efficiency Power Electronics

Electric Thrusters

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

GE Aviation

Rolls-Royce

Safran

BAE Systems

Thales Group

General Electric

Lockheed Martin

Northrop Grumman

L3 Technologies

Rheinmetall

Harris Corporation

Raytheon Technologies

Elbit Systems

Collins Aerospace

- Growing demand from the aerospace and defense industries

- Government procurement policies driving innovation in propulsion systems

- Increased interest from private tech firms investing in electric propulsion

- Expansion of electric propulsion systems into commercial transport sectors

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035