Market Overview

The KSA Electrical Weapons market is valued at approximately USD ~ billion based on a recent historical assessment. This market is driven by advancements in directed energy technologies, an increase in military spending, and rising demand for advanced weapon systems. The continuous focus on technological innovation, especially in electromagnetic railguns, directed energy weapons, and non-lethal weapons, supports the market’s growth. As nations invest in defense capabilities, the demand for electrical weapons is expected to expand across both military and law enforcement sectors.

The market’s dominance is primarily in regions with strong defense budgets and ongoing military modernization, with significant contributions from countries like Saudi Arabia. These nations prioritize military advancements, deploying electrical weapons to strengthen national security. The Saudi Arabian government’s push for defense innovation, coupled with geopolitical tensions in the Middle East, has further propelled demand for advanced defense technologies, positioning the country as a leader in electrical weapons development.

Market Segmentation

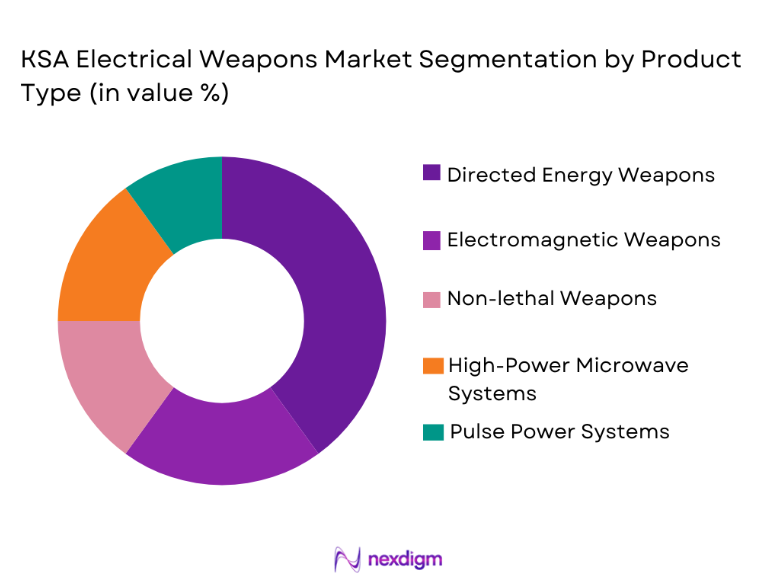

By Product Type

The KSA Electrical Weapons market is segmented by product type into electromagnetic railguns, directed energy weapons, high-power microwave systems, non-lethal weapons, and pulse power systems. The directed energy weapons sub-segment currently holds a dominant market share, driven by the growing focus on developing compact, efficient, and high-precision energy-based weapon systems. Their ability to deliver non-kinetic strikes and versatility in various military applications makes them highly preferred by defense agencies. This preference is amplified by the demand for systems that can neutralize threats without causing collateral damage, making them suitable for modern combat scenarios.

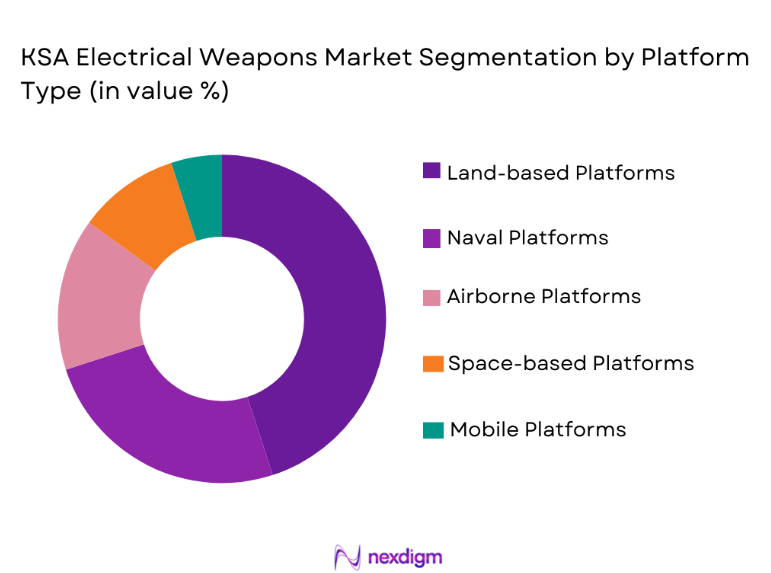

By Platform Type

The KSA Electrical Weapons market is segmented by platform type into land-based platforms, airborne platforms, naval platforms, space-based platforms, and mobile platforms. The land-based platforms sub-segment dominates due to their widespread usage in defense applications, including perimeter defense, anti-drone systems, and anti-vehicle defense. The integration of electrical weapons into land-based systems offers strategic advantages in securing borders, military installations, and sensitive infrastructures. These platforms’ versatility in deployment and cost-effectiveness compared to airborne and naval platforms contributes significantly to their leading market share.

Competitive Landscape

The competitive landscape of the KSA Electrical Weapons market is marked by both global defense technology companies and regional players. There has been significant consolidation within the sector, with major players acquiring smaller firms to expand their technological capabilities. These companies are heavily investing in research and development to stay ahead of emerging threats and to develop more compact and energy-efficient systems. Strategic partnerships and government collaborations are crucial for market dominance, as defense contracts form the backbone of market growth.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Military Contracts |

| Lockheed Martin | 1912 | Bethesda, Maryland | ~

|

~

|

~

|

~

|

~

|

| Raytheon Technologies | 1922 | Waltham, Massachusetts | ~ | ~

|

~

|

~

|

~

|

| BAE Systems | 1999 | London, UK | ~ | ~

|

~

|

~

|

~

|

| Northrop Grumman | 1939 | Falls Church, Virginia | ~ | ~

|

~

|

~

|

~

|

| Thales Group | 2000 | La Défense, France | ~ | ~

|

~

|

~

|

~

|

KSA Electrical Weapons Market Analysis

Growth Drivers

Technological Advancements in Directed Energy Weapons

Directed energy weapons (DEWs) are rapidly transforming modern defense systems, with technological advancements making them more viable for military applications. The growth of these weapons is driven by innovations in laser, microwave, and high-energy pulse technologies, allowing for more precise and scalable solutions. DEWs offer non-kinetic methods of neutralizing threats, which is increasingly valuable in urban warfare or counter-terrorism operations. Their ability to engage targets at the speed of light, with minimal collateral damage, further enhances their appeal. Furthermore, their use in anti-drone systems is gaining traction, aligning with the growing security needs in the Middle East. As the technology matures, cost reductions and performance improvements will make DEWs more accessible to defense agencies globally, thereby significantly expanding their presence in the defense arsenals of nations like Saudi Arabia. These advancements are anticipated to be a key driver of market growth in the coming years.

Rising Defense Budgets in the Middle East

The Middle East, especially countries like Saudi Arabia, is experiencing a surge in defense spending, spurred by regional instability and security concerns. This increased budget allocation has directly impacted the demand for advanced weapon systems, including electrical weapons. With a strong emphasis on modernizing military capabilities, nations in the region are looking to leverage cutting-edge technologies, such as directed energy systems, to bolster their defense strategies. Saudi Arabia, in particular, is focusing on the acquisition of advanced weaponry as part of its Vision 2030 plan to strengthen national security. Rising geopolitical tensions, including conflicts in neighboring regions, further drive the need for robust and advanced defense systems. The growing investment in these high-tech weapons systems, fueled by defense budgets, is creating significant opportunities for market growth. Moreover, the strategic location of the Middle East as a defense hub for many international powers is enhancing its position in the electrical weapons market.

Market Challenges

High Development and Deployment Costs

The electrical weapons market faces significant challenges, particularly the high costs associated with the research, development, and deployment of advanced systems like directed energy weapons. The initial capital required for developing and testing these complex technologies can be prohibitively expensive, deterring smaller defense budgets from adopting them. Additionally, the continuous need for upgrades and performance enhancements increases long-term costs, making it difficult for many countries, especially those with limited defense expenditures, to justify the investment. While the operational costs of these systems may be lower in the long run, the upfront investment remains a key barrier for many nations looking to incorporate electrical weapons into their defense infrastructures. These high costs are further compounded by the technical challenges of ensuring that new technologies can integrate seamlessly into existing military frameworks. Consequently, the market faces a bottleneck in terms of affordability and scalability for broader adoption.

Technological Integration and Interoperability

Electrical weapons, particularly directed energy systems, need to be integrated into existing defense infrastructures, which often rely on older technologies. Ensuring compatibility and interoperability between cutting-edge electrical weapons and legacy systems poses significant challenges. These weapons must work seamlessly across a wide range of platforms, such as land-based, airborne, and naval systems, which often involve different operating systems, hardware, and software. The technical hurdles in ensuring that these advanced weapons function effectively with legacy systems can lead to delays in deployment and increased costs for defense agencies. Additionally, there are concerns about the vulnerability of these systems to hacking or other cyber threats, which can compromise their effectiveness. Integration also requires extensive testing and validation, adding further complexity to the process. These challenges must be addressed through continuous research and development, which can slow down the overall pace of market expansion and inhibit the adoption of electrical weapons on a global scale.

Opportunities

Integration of AI and Machine Learning in Electrical Weapons

The integration of artificial intelligence (AI) and machine learning (ML) into electrical weapons systems presents significant growth opportunities for the market. By incorporating AI, directed energy weapons can become more efficient and precise, enhancing their ability to engage targets quickly and accurately. AI can also enable these systems to make real-time decisions, improving performance in complex, high-pressure combat scenarios. This technological advancement is particularly valuable for applications such as anti-drone defense, where rapid decision-making is crucial. Moreover, the use of AI in electrical weapons allows for adaptive targeting, which can make systems smarter and more capable of responding to evolving threats. The growing adoption of AI and ML technologies across various industries, including defense, presents a unique opportunity for the electrical weapons market to leverage these technologies to enhance the capabilities and functionality of its systems. As AI continues to mature, its integration into directed energy systems will become increasingly vital for market growth.

Partnerships with Private Tech Firms for Innovation

Another significant opportunity lies in the collaboration between defense contractors and private technology firms. The rapid pace of innovation in the civilian tech sector, particularly in fields like AI, quantum computing, and nanotechnology, can be harnessed to accelerate the development of advanced electrical weapon systems. By partnering with tech startups and established players, defense agencies can gain access to cutting-edge technologies that would otherwise take years to develop in-house. These collaborations can reduce research and development costs, shorten product timelines, and ensure that electrical weapons incorporate the latest technological advancements. Additionally, private sector partnerships can provide valuable expertise in areas such as cybersecurity, software development, and materials science, which are crucial for the advancement of electrical weapons. By fostering stronger ties between the defense and technology sectors, these partnerships will drive innovation, helping the market keep pace with evolving threats and enabling the next generation of electrical weapons to be deployed more efficiently and effectively.

Future Outlook

The KSA Electrical Weapons market is set for significant growth, driven by advancements in directed energy technologies, an increase in defense spending, and the rising importance of non-kinetic weapons systems. Over the next five years, the market is expected to witness a surge in demand as countries like Saudi Arabia continue to prioritize military modernization, focusing on cutting-edge technologies to enhance national security. As technological developments such as AI and machine learning are integrated into electrical weapons systems, their effectiveness and operational efficiency will improve, providing greater value to defense agencies. Furthermore, the market will benefit from expanding geopolitical tensions, leading to more investments in advanced defense technologies. Regulatory support, especially in the Middle East, and collaboration with private tech firms will also foster innovation and facilitate the adoption of electrical weapons. These factors combined with continued investment in research and development will ensure a promising future for the KSA Electrical Weapons market.

Major Players

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Northrop Grumman

- Thales Group

- Leonardo

- Elbit Systems

- L3 Technologies

- General Dynamics

- Leonardo DRS

- Saab Group

- Rheinmetall AG

- Harris Corporation

- Kratos Defense & Security Solutions

- Textron Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense contractors

- National defense agencies

- International arms buyers

- Security and law enforcement agencies

- Aerospace manufacturers

- Technology innovators

Research Methodology

Step 1: Identification of Key Variables

The key variables influencing market trends, including technological advancements and defense budgets, are identified through a review of existing reports, expert consultations, and market data.

Step 2: Market Analysis and Construction

Data is gathered and segmented to define the market landscape, including product types, platform types, and geographical distribution, ensuring relevance to KSA.

Step 3: Hypothesis Validation and Expert Consultation

Expert insights are sought to validate hypotheses based on the latest technological trends and defense industry needs, ensuring the report reflects real-time market conditions.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a comprehensive report that provides insights into market trends, challenges, opportunities, and future growth expectations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Defense Budgets

Advancements in Directed Energy Technologies

Rising Geopolitical Tensions - Market Challenges

High Development Costs

Technological Limitations in Scaling

Regulatory and Compliance Barriers - Market Opportunities

Partnerships with Private Tech Firms for Innovation

Integration of AI with Directed Energy Systems

Emerging Demand for Non-Lethal Weapons - Trends

Development of Compact Energy Weapons

Integration of Artificial Intelligence in Weapons Systems

Rise of Anti-Drone and Countermeasure Technologies - Government Regulations

Export Control and Compliance Policies

Military Technology Export Restrictions

Data Protection and Privacy Regulations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Directed Energy Weapons

Electromagnetic Railguns

High-Power Microwave Systems

Pulse Power Systems

Non-Lethal Weapons - By Platform Type (In Value%)

Land-Based Platforms

Airborne Platforms

Naval Platforms

Space-Based Platforms

Mobile Platforms - By Fitment Type (In Value%)

On-premise Solutions

Portable Solutions

Integrated Solutions

Modular Solutions

Cloud-based Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Fitment Type, Material/Technology, Pricing Strategy, Market Reach, R&D Investment, Regulatory Compliance, Technology Adoption)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Raytheon Technologies

BAE Systems

Northrop Grumman

General Dynamics

L3 Technologies

Thales Group

Rheinmetall AG

Elbit Systems

Leonardo

Harris Corporation

Saab Group

Boeing

Textron Systems

Kratos Defense & Security Solutions

- Military Forces’ Increasing Demand for Advanced Weapons

- Defense Contractors’ Role in System Development

- Government Agencies’ Role in Regulating and Procuring Weapons

- Private Sector’s Growing Interest in Security Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035