Market Overview

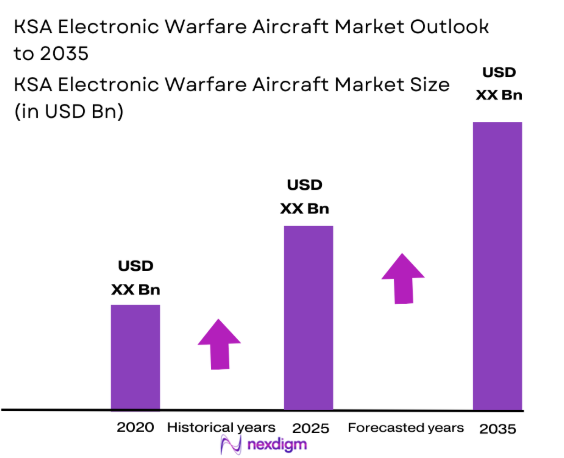

The market for electronic warfare aircraft in Saudi Arabia is projected to reach USD ~ billion by the end of the assessment period, driven by increasing defense budgets and regional security concerns. The demand for advanced surveillance and jamming systems, along with heightened interest in electronic countermeasure technologies, supports the market growth. Additionally, the Saudi government’s focus on modernizing its military infrastructure, bolstered by strategic defense collaborations, is influencing this surge. The market’s expansion is also linked to the growing need for defense systems that can counter asymmetric warfare and enhance national security.

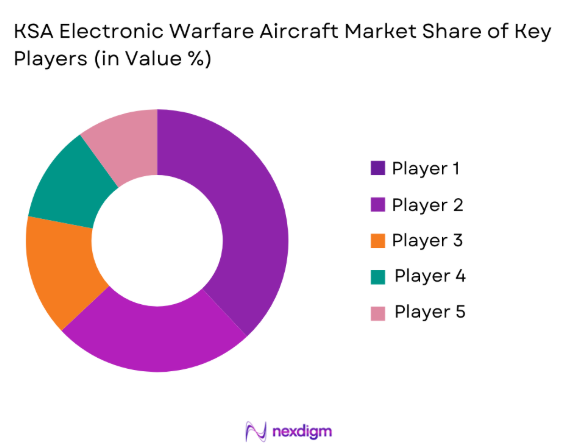

Dominant players in the Saudi electronic warfare aircraft market are concentrated in key regions like Riyadh, where government initiatives and military modernization programs drive investment. The Kingdom’s strategic location in the Middle East, with increasing geopolitical tensions, contributes to the dominance of defense hubs within the region. Saudi Arabia’s significant defense expenditure further supports the demand for advanced military technologies. Moreover, the establishment of domestic manufacturing capabilities, backed by partnerships with global defense contractors, strengthens its position in the electronic warfare sector.

Market Segmentation

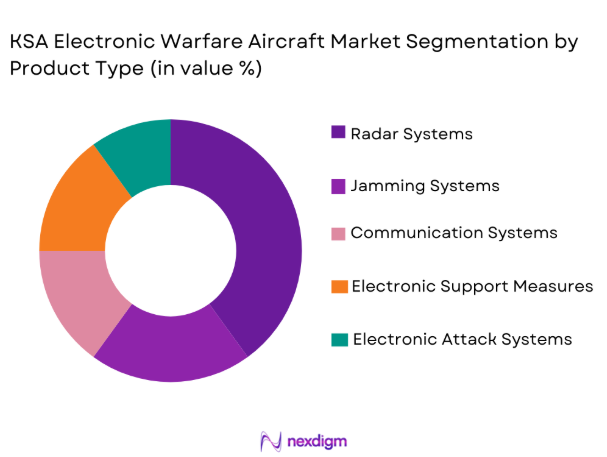

By Product Type:

The electronic warfare aircraft market is segmented by product type into radar systems, jamming systems, communication systems, electronic support measures, and electronic attack systems. Recently, radar systems have a dominant market share due to factors such as the growing need for advanced surveillance and detection capabilities. These systems are essential for identifying threats and providing situational awareness during operations. As the demand for more sophisticated reconnaissance and surveillance increases, radar systems continue to lead the market, especially in the Middle Eastern region, where regional security concerns have intensified. This demand is further supported by technological advancements in radar frequency and capabilities, such as multi-function phased-array radar systems, which have been integrated into modern electronic warfare aircraft for better efficiency and performance.

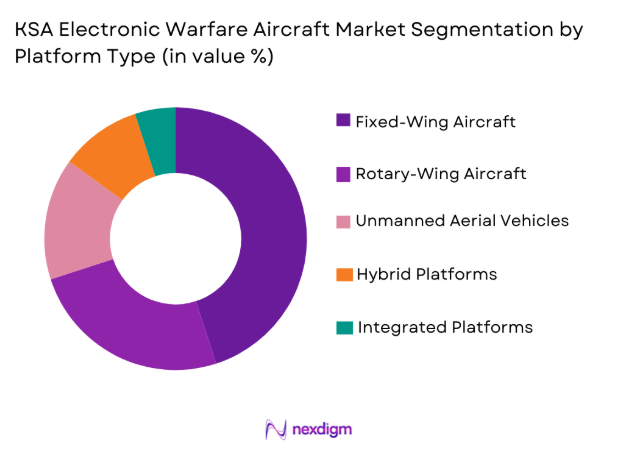

By Platform Type:

The electronic warfare aircraft market is segmented by platform type into fixed-wing aircraft, rotary-wing aircraft, unmanned aerial vehicles (UAVs), hybrid platforms, and integrated platforms. Fixed-wing aircraft have a dominant market share due to their superior range, payload capacity, and operational endurance, which make them ideal for electronic warfare missions. Their ability to carry large, advanced electronic systems, along with the flexibility to operate in various combat environments, contributes to their dominance. Furthermore, fixed-wing aircraft are typically integrated with multiple electronic warfare systems, enhancing their utility in tactical and strategic operations. Their proven effectiveness in both offensive and defensive roles continues to drive their adoption in the region, where the need for high-end military capabilities remains a priority.

Competitive Landscape

The competitive landscape in the Saudi electronic warfare aircraft market is characterized by the presence of several well-established global players and local firms. Major companies have consolidated their market positions through strategic partnerships with Saudi Arabia’s government. These partnerships aim to strengthen domestic manufacturing capabilities and enhance the overall defense ecosystem. With the rise in demand for electronic warfare solutions, companies focusing on innovation in radar and jamming systems are poised for growth. Moreover, the influence of regional players in the defense sector is becoming increasingly significant as they cater to the specific needs of the Saudi military and its allies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | R&D Investment |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

KSA Electronic Warfare Aircraft Market Analysis

Growth Drivers

Increasing Defense Budget:

Saudi Arabia’s defense budget is one of the largest in the Middle East and plays a crucial role in the growth of the electronic warfare aircraft market. The government’s consistent increase in military spending is driven by a strategic imperative to modernize defense systems and maintain regional security dominance. As a result, the demand for advanced military technologies, including electronic warfare solutions, is escalating. These systems are considered essential in countering modern warfare tactics, particularly in asymmetric conflicts where electronic warfare can play a decisive role. The kingdom’s focus on reducing dependency on foreign defense suppliers has led to investments in indigenous manufacturing capabilities for electronic warfare systems, creating a significant market for locally produced solutions. Furthermore, Saudi Arabia’s efforts to strengthen its air defense systems and enhance its capability to address emerging threats, such as cyber warfare and electronic attacks, have led to a sustained increase in the procurement of electronic warfare aircraft. This emphasis on defense modernization, coupled with a rising security threat landscape in the region, ensures that Saudi Arabia will remain a major driver of growth in the electronic warfare aircraft market.

Technological Advancements in Electronic Warfare:

Technological innovation is a key driver for the electronic warfare aircraft market in Saudi Arabia. The development of advanced radar, jamming systems, and communication technologies has made electronic warfare more effective in countering modern threats. As military strategies evolve to include more asymmetric and cyber-related warfare, Saudi Arabia has focused on integrating the latest advancements in artificial intelligence and machine learning into its electronic warfare systems. These innovations provide the ability to conduct real-time analysis and decision-making, enhancing the effectiveness of electronic warfare operations. Moreover, developments in miniaturization technologies allow for the integration of advanced systems into smaller, more agile platforms, such as unmanned aerial vehicles (UAVs), which are increasingly being used for electronic warfare missions. The ability to track, jam, and spoof enemy communications and radar systems has become a vital component of the Kingdom’s military doctrine, further propelling the demand for state-of-the-art electronic warfare aircraft and systems.

Market Challenges

High Capital Investment:

One of the main challenges facing the electronic warfare aircraft market in Saudi Arabia is the high capital investment required for advanced systems. The cost of developing and deploying sophisticated electronic warfare technologies is substantial, often limiting the accessibility of these solutions to only the most advanced defense sectors. Additionally, the procurement and maintenance of high-tech systems require a continuous financial commitment from the government. Although defense spending in Saudi Arabia is significant, the allocation for electronic warfare may compete with other priorities, such as air defense and missile defense systems. Moreover, the complex nature of electronic warfare systems necessitates significant investment in research and development, which adds to the overall costs. The long lifecycle and ongoing maintenance requirements of these systems further increase the total expenditure involved in equipping the Saudi military with cutting-edge electronic warfare capabilities. This high capital investment challenge could delay the widespread adoption of electronic warfare aircraft, especially in times of fiscal constraints.

Technological Integration:

The integration of electronic warfare systems into existing aircraft and platforms remains a significant challenge. Saudi Arabia’s military modernization efforts depend heavily on the seamless integration of new electronic warfare technologies into legacy aircraft and systems. This process requires overcoming compatibility issues between older platforms and modern electronic systems. Additionally, there is a lack of standardized communication protocols across various platforms, which can hinder the overall effectiveness of electronic warfare operations. The complexity of integrating cutting-edge radar and jamming systems into older platforms can lead to delays in procurement and increase the risk of technological obsolescence. Furthermore, the integration of electronic warfare systems requires highly skilled personnel and specialized training, which presents an ongoing challenge for the Kingdom’s armed forces. Addressing these integration challenges requires substantial investment in training, infrastructure, and development, all of which contribute to the cost and complexity of implementing electronic warfare solutions.

Opportunities

Partnerships with International Technology Providers:

One of the key opportunities in the Saudi Arabian electronic warfare aircraft market lies in the formation of strategic partnerships with international defense contractors and technology providers. These partnerships allow Saudi Arabia to access the latest technologies and expertise while also boosting local defense capabilities. By collaborating with established global players in the electronic warfare sector, Saudi Arabia can enhance its technological capabilities and accelerate the deployment of advanced systems. Furthermore, these partnerships often come with knowledge transfer agreements, enabling local defense companies to acquire the necessary skills to develop and manufacture electronic warfare systems indigenously. This collaboration not only strengthens Saudi Arabia’s defense infrastructure but also positions the Kingdom as a key player in the Middle East’s growing defense market. The emphasis on local production in partnership with international firms can drive cost efficiencies, increase competition, and reduce reliance on foreign suppliers.

Emerging Demand for Autonomous Systems:

The increasing demand for autonomous systems in electronic warfare presents a significant opportunity for the market in Saudi Arabia. Autonomous unmanned aerial vehicles (UAVs) equipped with electronic warfare systems offer a flexible and cost-effective solution for modern military operations. These systems can perform surveillance, jamming, and reconnaissance missions without exposing human operators to danger, making them ideal for high-risk environments. As the technology surrounding autonomous systems continues to advance, Saudi Arabia is well-positioned to capitalize on this trend by integrating autonomous electronic warfare platforms into its military arsenal. These systems can operate more efficiently than manned platforms, reducing operational costs and enabling more frequent deployment. Furthermore, the ability to deploy multiple autonomous platforms for coordinated electronic warfare operations provides strategic advantages in complex military scenarios. This growing demand for autonomous systems represents a pivotal opportunity for Saudi Arabia to modernize its electronic warfare capabilities and strengthen its position in regional security dynamics.

Future Outlook

The Saudi Arabian electronic warfare aircraft market is poised for significant growth in the next five years, driven by advancements in technology, a rising demand for integrated defense systems, and increasing defense budgets. The continued focus on modernizing military infrastructure and the need to counter emerging threats will support market expansion. Moreover, regulatory support and strategic partnerships with international technology providers will enhance the Kingdom’s electronic warfare capabilities. Technological developments in radar and jamming systems, along with innovations in autonomous platforms, will further drive the growth of the market. As Saudi Arabia enhances its air defense strategies, the demand for cutting-edge electronic warfare systems will continue to rise, positioning the market for sustained growth.

Major Players

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- Raytheon Technologies

- Thales Group

- Elbit Systems

- L3 Technologies

- Harris Corporation

- General Dynamics

- Saab Group

- Rheinmetall AG

- Israel Aerospace Industries

- Sikorsky Aircraft

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace companies

- Security and defense agencies

- Technology integrators

- Military procurement departments

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that affect the electronic warfare aircraft market, including technology trends, regulatory frameworks, market drivers, and challenges.

Step 2: Market Analysis and Construction

Next, a comprehensive market analysis is conducted, utilizing both primary and secondary data sources, to build a detailed view of market trends, customer segments, and competitive dynamics.

Step 3: Hypothesis Validation and Expert Consultation

In this step, the hypotheses are validated through consultation with industry experts and stakeholders to ensure the market insights are grounded in real-world observations and expert opinions.

Step 4: Research Synthesis and Final Output

Finally, all collected data is synthesized into a cohesive market report, ensuring that the conclusions drawn are robust and actionable for decision-makers in the sector.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Defense Spending by the Government

Rising Security Threats in the Region

Advancements in Electronic Warfare Technologies

Integration of AI and Machine Learning in EW Systems

Development of Advanced Countermeasure Systems - Market Challenges

High Capital Investment in EW Aircraft Systems

Technological Complexity in Integration

Cybersecurity Threats to Sensitive Systems

Regulatory and Compliance Barriers

Dependency on International Suppliers - Market Opportunities

Collaboration with International Technology Providers

Emerging Demand for Autonomous EW Platforms

Expansion of EW Capabilities in Regional Conflicts - Trends

Adoption of Artificial Intelligence in Electronic Warfare

Increased Use of UAVs for EW Missions

Growth of Counter-UAV Systems

Advances in Low-Observable Technology

Deployment of EW Systems for Cyber Warfare - Government Regulations & Defense Policy

Export Control Regulations

National Defense Funding Initiatives

Regional Security Treaties and Alliances - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Jamming Systems

Electronic Support Measures

Electronic Attack Systems

Radar Systems

Communication Systems - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

Unmanned Aerial Vehicles

Hybrid Platforms

Integrated Platforms - By Fitment Type (In Value%)

Onboard Systems

Pod-Based Systems

Integrated Systems

Modular Systems

Portable Systems - By EndUser Segment (In Value%)

Military Forces

Government Agencies

Defense Contractors

Private Contractors

International Defense Alliances - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

High-Frequency Materials

Electronic Components

Sensor Technology

Software & Signal Processing

Power Management Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology Integration, Price Point, System Complexity, Development Time, Regional Availability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

BAE Systems

Raytheon Technologies

Thales Group

Leonardo

Elbit Systems

L3 Technologies

Harris Corporation

General Dynamics

Saab Group

Rheinmetall AG

Israel Aerospace Industries

Sikorsky Aircraft

Boeing

- Military Forces’ Demand for Advanced EW Capabilities

- Government Agencies Increasing Investment in Cyber Defense

- Defense Contractors’ Focus on Technology Integration

- Private Contractors Seeking Enhanced Defense Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035