Market Overview

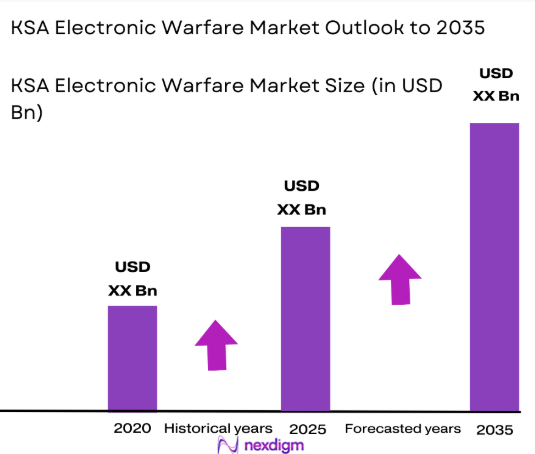

The KSA Electronic Warfare market is projected to grow significantly, driven by increasing investments in defense technologies and national security. With the rising demand for advanced defense systems, the market size has reached USD ~ billion based on a recent historical assessment. Key drivers include technological advancements in cybersecurity and the growing threat of electronic warfare. These factors, combined with government initiatives to modernize military infrastructure, are contributing to the market’s expansion, establishing it as a critical area of focus for defense contractors.

Saudi Arabia remains a dominant player in the electronic warfare sector due to its robust defense spending and strategic initiatives in modernizing its military capabilities. Cities like Riyadh and Dhahran lead the market due to their proximity to major military bases and defense-related infrastructure. The country’s geopolitical position also makes it a key player in the Middle East’s defense market. Increased collaboration with international defense firms and a strong push toward technological self-sufficiency are further strengthening the nation’s position as a leader in electronic warfare.

Market Segmentation

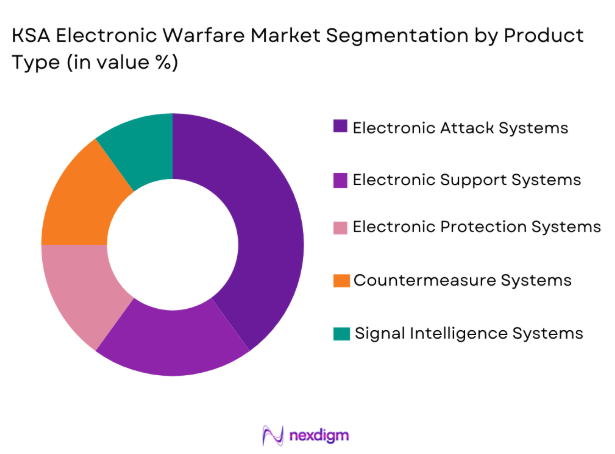

By Product Type:

The KSA Electronic Warfare market is segmented by product type into Electronic Attack Systems, Electronic Support Systems, Electronic Protection Systems, Countermeasure Systems, and Signal Intelligence Systems. Recently, Electronic Attack Systems have dominated the market share due to their growing importance in countering electronic threats from adversaries. With the rising sophistication of cyberattacks, demand for electronic attack systems has surged, supported by advancements in jamming, spoofing, and signal disruption technologies. These systems are critical for Saudi Arabia’s defense strategy, ensuring security against foreign threats. The increased spending on defense modernization and the need to neutralize emerging threats further boost their dominance.

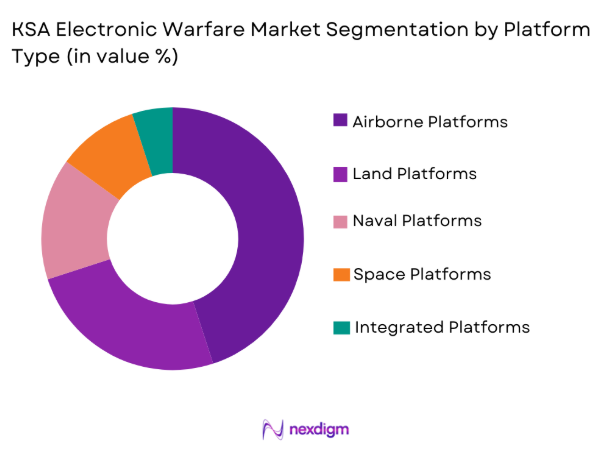

By Platform Type:

The KSA Electronic Warfare market is segmented by platform type into Land-Based Platforms, Naval Platforms, Airborne Platforms, Space Platforms, and Integrated Platforms. Recently, Land-Based Platforms have seen a dominant market share due to their extensive use in border defense and counterterrorism operations. The growing necessity to secure land-based assets from emerging threats like drone attacks and cyber intrusions has spurred investments in land-based electronic warfare platforms. This segment is expected to maintain its dominance due to the ongoing modernization efforts in Saudi Arabia’s military infrastructure and the country’s need for adaptable, reliable solutions for ground-based defense applications.

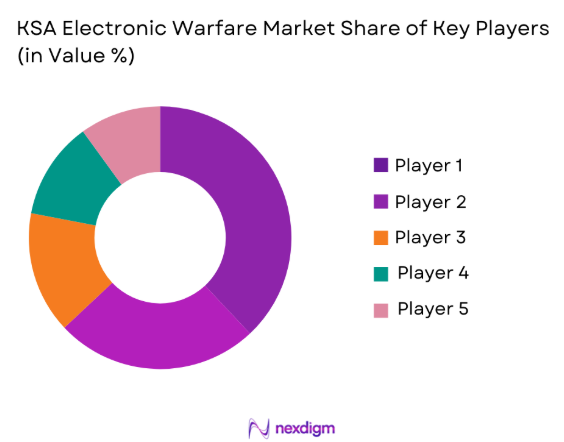

Competitive Landscape

The competitive landscape in the KSA Electronic Warfare market is marked by consolidation as major players increase their market presence through strategic collaborations and mergers. Key players are focusing on acquiring advanced technologies, expanding their product offerings, and establishing a stronger foothold in the defense sector. Companies with robust technological portfolios and extensive experience in the defense industry are well-positioned to dominate the market. As the market continues to expand, partnerships with government agencies and defense contractors are becoming increasingly important for gaining market access.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2000 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1994 | USA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1980 | USA | ~ | ~ | ~ | ~ | ~ |

KSA Electronic Warfare Market Analysis

Growth Drivers

Increased Defense Budget:

Saudi Arabia’s commitment to increasing defense spending has significantly contributed to the growth of the electronic warfare market. With a rapidly evolving security landscape, the country has emphasized strengthening its defense capabilities, including enhancing its electronic warfare systems. This heightened expenditure on defense modernization programs directly benefits the electronic warfare sector. The government’s strategic focus on reducing dependence on foreign technologies by investing in homegrown solutions has fostered growth. Additionally, the increased political tensions in the region and the necessity to safeguard critical infrastructure have further driven investments. The Saudi Arabian government has continuously prioritized national security, channeling substantial resources into defense technology, especially electronic warfare systems. As a result, the defense budget has consistently supported cutting-edge advancements in countermeasures and electronic protection. These factors continue to make the country one of the largest investors in electronic warfare technology.

Technological Advancements in Electronic Warfare:

Another key growth driver is the rapid technological advancements within the electronic warfare sector. Innovations in radar systems, signal intelligence, and communication technologies have greatly enhanced the effectiveness of electronic warfare solutions. Saudi Arabia’s efforts to modernize its military and defense infrastructure align with the global trend of incorporating advanced technologies such as artificial intelligence (AI), machine learning, and cybersecurity into defense systems. The incorporation of AI has led to smarter, faster, and more effective electronic warfare systems capable of detecting and neutralizing threats in real time. As these systems evolve, they become increasingly crucial in countering sophisticated threats such as cyberattacks and unmanned aerial vehicle (UAV) threats. The push for technological innovation has further accelerated the market’s growth, as electronic warfare systems become more adaptable and efficient in responding to emerging security challenges.

Market Challenges

High Initial Capital Investment:

One of the primary challenges hindering the expansion of the KSA electronic warfare market is the high capital investment required for advanced systems. Electronic warfare solutions, particularly in areas such as radar systems, jamming technologies, and countermeasures, necessitate significant upfront investment in both hardware and software. While the return on investment (ROI) in terms of national security and defense is clear, the costs involved in acquiring and maintaining such systems can be prohibitive for some stakeholders. This high capital outlay has slowed down the adoption of these advanced technologies, particularly among smaller defense contractors or those with limited government contracts. Additionally, the ongoing costs of upgrading existing systems to meet evolving threats further strain budgets, making it a key challenge for the market’s expansion. However, despite these challenges, the market is still expected to grow, driven by the increasing prioritization of defense technology in the region.

Regulatory and Compliance Barriers:

Another significant challenge for the KSA electronic warfare market is the complex regulatory and compliance landscape surrounding the acquisition and deployment of defense technologies. Saudi Arabia’s government enforces stringent regulations to ensure that electronic warfare systems are compliant with international defense standards and aligned with national security policies. These regulations, while ensuring safety and security, can delay the procurement process and complicate system integration. The complexities surrounding the approval processes for new technologies also make it difficult for companies to quickly introduce innovative solutions into the market. As a result, delays in the adoption of electronic warfare systems may slow the market’s growth and reduce the flexibility of defense strategies. Navigating these regulatory challenges requires considerable expertise, which could pose difficulties for smaller firms attempting to enter the market.

Opportunities

Growing Demand for Autonomous Systems:

The increasing demand for autonomous systems presents a significant opportunity for the KSA electronic warfare market. Saudi Arabia is actively investing in unmanned systems for military applications, including drones, which require robust electronic warfare capabilities to counteract electronic threats. These systems are expected to become an integral part of defense operations, with the Saudi government emphasizing the development of autonomous platforms that can operate without human intervention. To address the security risks posed by these systems, the need for advanced electronic warfare technologies such as electronic countermeasures and signal jamming will rise significantly. The increasing reliance on drones and other autonomous platforms opens up numerous opportunities for growth in the electronic warfare sector, providing a profitable avenue for companies to explore and invest in.

Integration of AI in Defense Systems:

Another promising opportunity lies in the integration of artificial intelligence (AI) and machine learning into electronic warfare systems. AI has the potential to significantly enhance the effectiveness of electronic warfare by enabling systems to detect, identify, and neutralize threats more rapidly and accurately. In the KSA electronic warfare market, this technological shift is expected to drive innovation, as the demand for AI-powered electronic systems continues to grow. The ability of AI to adapt to emerging threats and provide real-time responses gives it a crucial advantage in modern defense strategies. As the market evolves, the adoption of AI-driven solutions is poised to be a key factor in shaping the future of electronic warfare, providing a competitive edge for companies that can integrate these technologies into their offerings.

Future Outlook

Over the next five years, the KSA Electronic Warfare market is expected to experience steady growth, driven by technological advancements, increased defense spending, and geopolitical security concerns. As Saudi Arabia continues its military modernization efforts, demand for advanced electronic warfare systems is set to rise. The integration of AI and machine learning technologies will further boost the efficiency and adaptability of defense systems, while the growth of autonomous systems will present new opportunities for electronic warfare applications. Government policies supporting the defense sector will play a key role in maintaining market growth, particularly through funding and regulatory support for the development of cutting-edge technologies. Technological innovation and strategic partnerships with global defense companies will ensure that Saudi Arabia remains at the forefront of electronic warfare capabilities in the Middle East.

Major Players

- Thales Group

- BAE Systems

- Raytheon Technologies

- Northrop Grumman

- General Dynamics

- Lockheed Martin

- L3 Technologies

- Leonardo

- Rheinmetall AG

- Elbit Systems

- Harris Corporation

- Saab Group

- Hewlett Packard Enterprise

- Boeing

- Sikorsky Aircraft

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Security services

- Aerospace companies

- Private sector / technology firms

- Electronic warfare technology suppliers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that influence the electronic warfare market, such as technological advancements, defense spending, geopolitical factors, and regulatory policies.

Step 2: Market Analysis and Construction

In this step, data collection is conducted to understand market trends, demand patterns, and market sizing. Analysis of primary and secondary sources helps to build the market model.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted to validate assumptions and hypotheses. Insights from defense experts and industry leaders help refine the market model and its accuracy.

Step 4: Research Synthesis and Final Output

The final output involves synthesizing data and insights into a comprehensive report, ensuring all key variables are factored in, and presenting actionable insights to stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Military Modernization Programs

Rising Geopolitical Tensions

Technological Advancements in Cybersecurity

Government Investment in Defense Technology

Increasing Threats from Electronic Warfare - Market Challenges

High Capital Expenditure

Complexity in System Integration

Cybersecurity Threats

Regulatory and Compliance Barriers

Political Resistance to Increased Defense Spending - Market Opportunities

Emerging Demand for Autonomous Systems

Integration of AI and Machine Learning

Collaboration with Private Tech Firms - Trends

Rise in Demand for Cyber Warfare Capabilities

Increased Investment in AI-Driven Defense Systems

Integration of Commercial Technologies in Defense Solutions

Shift Toward Autonomous Defense Systems

Growth in Satellite and Space-Based Electronic Warfare - Government Regulations & Defense Policy

Export Control and Compliance Policies

Data Protection and Privacy Regulations

Government Funding and Grants for Defense Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electronic Attack Systems

Electronic Support Systems

Electronic Protection Systems

Countermeasure Systems

Signal Intelligence Systems - By Platform Type (In Value%)

Land-Based Platforms

Naval Platforms

Airborne Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Government Agencies

Defense Contractors

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Radar Systems

Communication Systems

Jamming Technologies

Electronic Sensors

Counterintelligence Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Thales Group

BAE Systems

Raytheon Technologies

Northrop Grumman

General Dynamics

Lockheed Martin

L3 Technologies

Leonardo

Rheinmetall AG

Elbit Systems

Harris Corporation

Saab Group

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Growing Investment in Electronic Warfare

- Government Agencies’ Strategic Role in National Security

- Private Sector’s Interest in Cybersecurity Solutions

- Technology Firms’ Increasing Collaboration with Defense Contractors

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035