Market Overview

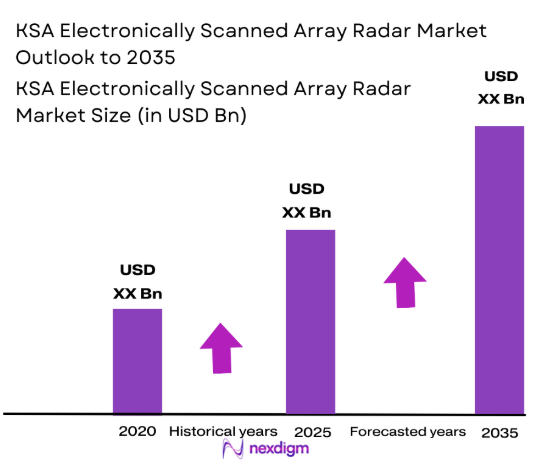

The KSA Electronically Scanned Array Radar market is valued at approximately USD ~ billion, driven primarily by rising defense expenditures and technological advancements in radar systems. The demand is fueled by the increasing need for advanced surveillance, threat detection, and military modernization initiatives across the region. Government investments in national security, coupled with advancements in AI-powered radar technologies, further accelerate market growth. In addition, the growing adoption of electronically scanned radar systems in military, defense, and aerospace sectors is a major driver of this expansion.

The Kingdom of Saudi Arabia, a key player in the Middle East, is witnessing a surge in demand for electronically scanned array radar systems, particularly due to its increasing focus on defense and national security. The country’s ongoing modernization of its military forces, including the integration of advanced radar technologies in its air defense systems, is a significant contributor. Moreover, the strategic importance of Saudi Arabia in the region’s defense landscape drives the need for cutting-edge radar solutions for surveillance and threat detection.

Market Segmentation

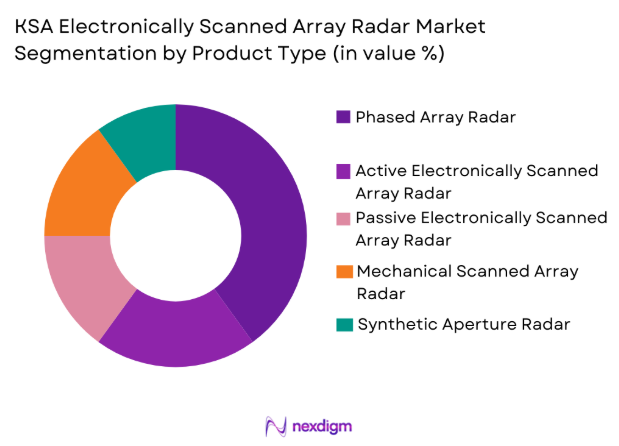

By Product Type:

The KSA Electronically Scanned Array Radar market is segmented by product type into phased array radar, active electronically scanned array radar, passive electronically scanned array radar, mechanical scanned array radar, and synthetic aperture radar. Recently, the active electronically scanned array radar sub-segment has dominated the market share due to its advantages, including higher resolution, faster scanning, and enhanced performance over traditional radar systems. The demand for AESA radars has surged in defense applications, particularly in air defense systems and surveillance operations, driving its leading position in the market.

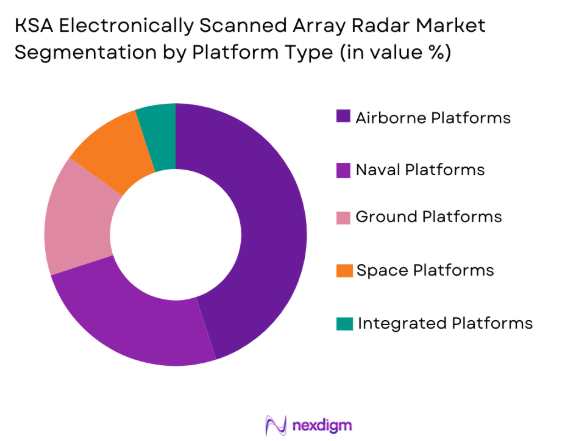

By Platform Type:

The KSA Electronically Scanned Array Radar market is segmented by platform type into airborne platforms, naval platforms, ground platforms, space platforms, and integrated platforms. Recently, airborne platforms have captured a dominant share of the market, driven by advancements in fighter jet and unmanned aerial vehicle (UAV) technology. The increasing demand for high-performance radar systems in air defense systems, particularly for military and surveillance aircraft, has fueled this growth. Airborne radars provide superior detection capabilities for air threats, making them the preferred choice in defense applications.

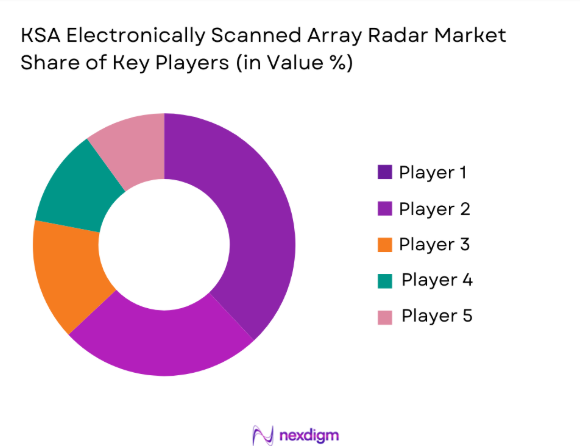

Competitive Landscape

The competitive landscape of the KSA Electronically Scanned Array Radar market is characterized by a mix of global defense contractors and regional suppliers. Major players are consolidating their positions through partnerships, mergers, and technological advancements to strengthen their market presence. These companies focus on cutting-edge radar technologies, including AESA, to maintain competitive advantage. The market is influenced by the expansion of defense contracts, technological innovation, and the growing demand for integrated defense solutions in Saudi Arabia.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

KSA Electronically Scanned Array Radar Market Analysis

Growth Drivers

Government Investment in National Security:

Government spending on national security has been a major growth driver for the KSA Electronically Scanned Array Radar market. The kingdom has prioritized enhancing its defense capabilities to safeguard against regional threats and bolster its strategic position. Saudi Arabia’s defense spending is one of the highest in the Middle East, and the country continues to modernize its military forces by integrating advanced radar systems into its air defense, naval, and surveillance platforms. The national defense strategy also focuses on reducing reliance on foreign defense systems and developing indigenous technological capabilities. The demand for AESA radars, in particular, has surged due to their advanced features such as fast scanning and higher resolution, which are essential for comprehensive defense operations. In addition to defense, the government’s focus on technology innovation and its Vision 2030 economic plan, which includes upgrading critical infrastructure, is expected to further propel radar market growth.

Technological Advancements in Radar Systems:

The continuous evolution of radar technologies, particularly AESA radar systems, has played a significant role in driving the growth of the KSA Electronically Scanned Array Radar market. AESA radars offer a variety of benefits, including enhanced detection and tracking capabilities, faster processing speeds, and improved reliability compared to traditional systems. The development of more compact, lightweight, and energy-efficient radar technologies has made them more suitable for a wider range of applications, from military aircraft to UAVs and naval platforms. As radar systems become more integrated with artificial intelligence, machine learning, and data analytics, their effectiveness in real-time decision-making and threat detection is further improved. These advancements are also contributing to the growing demand for radar systems in civilian applications such as weather forecasting, air traffic control, and security monitoring, expanding the market opportunities for electronically scanned array radars.

Market Challenges

High Capital Expenditure and Integration Costs:

One of the key challenges faced by the KSA Electronically Scanned Array Radar market is the high capital expenditure associated with radar system procurement and integration. Developing and deploying cutting-edge radar technology requires significant investment, particularly in defense applications. AESA radars, for example, are more costly than traditional radar systems due to their advanced components and integration complexities. In addition to the procurement cost, the installation and integration of these systems into existing military platforms require additional resources, training, and infrastructure development. Many countries, including Saudi Arabia, face budgetary constraints, which may limit the pace at which radar systems can be deployed across various sectors. Furthermore, integrating radar systems with other defense technologies, such as command and control systems and communications networks, adds to the complexity and cost, slowing market growth.

Technological Integration and Compatibility Issues:

The integration of advanced radar systems with existing platforms presents another challenge for the KSA Electronically Scanned Array Radar market. While AESA radar technology offers numerous advantages, integrating these advanced systems into older platforms can be difficult due to compatibility issues. The need for extensive upgrades to infrastructure, software, and hardware to accommodate these new systems is both costly and time-consuming. Additionally, ensuring seamless interoperability with other defense technologies, such as communication and surveillance systems, adds to the challenge. This issue is particularly pronounced for military organizations with legacy systems that are not designed to work with modern radar technologies. Moreover, the rapid pace of technological advancements in radar systems means that these systems quickly become outdated, requiring further investments to stay up-to-date with the latest innovations.

Opportunities

Emerging Demand for Autonomous Systems and Robotics:

One of the key opportunities in the KSA Electronically Scanned Array Radar market is the growing demand for autonomous systems and robotics. With increasing investments in unmanned aerial vehicles (UAVs), autonomous vehicles, and robotic platforms, there is a rising need for sophisticated radar systems that can provide real-time, high-resolution surveillance and detection capabilities. Electronically scanned array radars, with their ability to detect multiple targets simultaneously, are well-suited for use in autonomous systems. As the KSA defense sector focuses on modernizing its military with cutting-edge technologies, the demand for radar systems that can support autonomous operations will continue to rise. Furthermore, the growing interest in autonomous commercial applications, such as drone-based delivery systems and surveillance, is expected to drive the need for advanced radar solutions across a variety of sectors.

Strategic Defense Partnerships and Technology Transfer:

Another significant opportunity in the KSA Electronically Scanned Array Radar market lies in the expansion of strategic defense partnerships and technology transfer agreements. Saudi Arabia has been increasingly focused on reducing its dependence on foreign suppliers and enhancing its domestic defense capabilities. This has led to numerous collaborations with global defense contractors, where knowledge transfer, joint ventures, and local manufacturing initiatives are becoming key components of defense procurement strategies. These partnerships provide opportunities for Saudi companies to acquire cutting-edge radar technologies and develop locally-produced solutions. As the kingdom moves toward fulfilling its Vision 2030 goals, strengthening these collaborations will not only enhance the radar market but also bolster its defense infrastructure.

Future Outlook

The KSA Electronically Scanned Array Radar market is expected to continue its growth trajectory over the next five years, driven by increasing demand for advanced defense technologies and the ongoing modernization of Saudi Arabia’s military. Technological advancements in radar systems, coupled with strategic defense partnerships and increasing investments in national security, will support the market’s expansion. Moreover, growing demand for radar systems in autonomous platforms and integrated defense systems offers substantial opportunities for market players. Continued regulatory support and infrastructure growth will likely drive demand across both military and civilian sectors, ensuring the market remains competitive and innovative.

Major Players

- Raytheon Technologies

- Northrop Grumman

- Thales Group

- Lockheed Martin

- Leonardo

- BAE Systems

- L3Harris Technologies

- Elbit Systems

- Saab Group

- Harris Corporation

- General Dynamics

- Kongsberg Gruppen

- Rheinmetall AG

- Rockwell Collins

- Daimler AG

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense contractors

- Aerospace & aviation companies

- Homeland security agencies

- Technology integrators and system developers

- Private sector defense technology buyers

- Telecommunications and surveillance firms

Research Methodology

Step 1: Identification of Key Variables

The key variables driving the KSA Electronically Scanned Array Radar market are identified based on market trends, technological advancements, and defense sector requirements.

Step 2: Market Analysis and Construction

An in-depth analysis of market dynamics, including supply-demand factors and competitive landscape, is conducted to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted to validate the market assumptions and provide industry insights, refining the market model.

Step 4: Research Synthesis and Final Output

The data collected is synthesized to deliver a well-rounded market report, summarizing key findings and providing actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Geopolitical Tensions

Technological Advancements in Radar Systems

Increased Government Investment in National Security

Military Modernization Programs

Enhanced Defense and Surveillance Capabilities - Market Challenges

High Capital Expenditure in Radar Systems

Cybersecurity and Data Protection Issues

Technological Integration Complexities

Political and Social Resistance to Military Expansion

Environmental Impact and Sustainability Challenges - Market Opportunities

Growing Demand for Advanced Surveillance Systems

Technological Collaboration Between Defense Contractors and Private Sector

Emerging Need for Autonomous Radar Systems - Trends

Increased Integration of Artificial Intelligence in Radar Systems

Growth in Hybrid and Modular Radar Systems

Surge in Demand for Radar Systems in Naval Platforms

Focus on Miniaturization of Radar Systems

Rise of Advanced Threat Detection Systems - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Phased Array Radar

Active Electronically Scanned Array Radar

Passive Electronically Scanned Array Radar

Mechanical Scanned Array Radar

Synthetic Aperture Radar - By Platform Type (In Value%)

Airborne Platforms

Naval Platforms

Ground Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Gallium Arsenide

Silicon

Indium Phosphide

Carbon Nanotube

Graphene

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

SWOT Analysis of Key Players

Pricing & Procurement Analysis

Key Players

Raytheon Technologies

Northrop Grumman

Thales Group

Lockheed Martin

Leonardo

BAE Systems

L3Harris Technologies

Elbit Systems

Saab Group

Harris Corporation

General Dynamics

Kongsberg Gruppen

Rheinmetall AG

Rockwell Collins

Daimler AG

- Increasing Demand for Enhanced Surveillance Capabilities

- Government Agencies’ Role in Regulating and Procuring Radar Systems

- Military Forces’ Shift Towards Modernized Defense Technology

- Private Sector’s Interest in Integration of Advanced Radar Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035