Market Overview

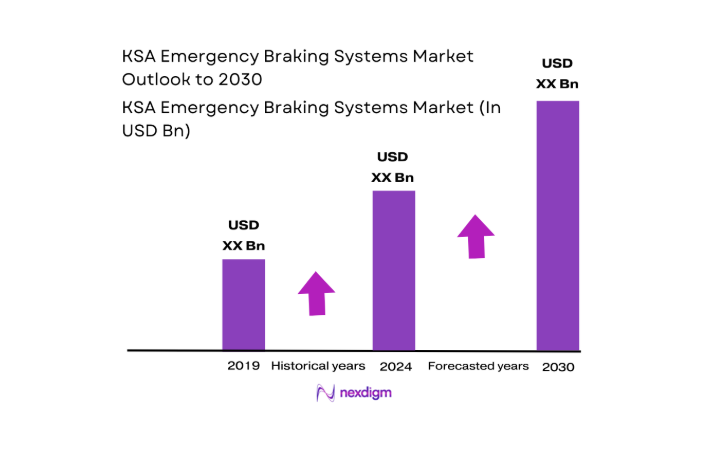

The KSA Emergency Braking Systems market is valued at USD ~ billion in 2024. This market growth is driven by both the adoption of advanced driver assistance systems (ADAS) and government mandates aimed at improving road safety. AEB systems are becoming a crucial part of new vehicle designs, propelled by technological advancements in sensor and algorithm development. This adoption is supported by the country’s Vision 2030 initiative, which is focused on enhancing traffic safety and promoting sustainable transport systems. The increased demand for enhanced vehicle safety features, coupled with regulatory pressures, is set to further drive the growth of this market.

The KSA Emergency Braking Systems market is primarily dominated by urban centers such as Riyadh, Jeddah, and Dammam. These cities represent key automotive manufacturing and consumption hubs. The market is also influenced by global leaders in automotive safety technologies, such as Bosch, Continental, and Mobileye. Their technological advancements and strategic partnerships with local OEMs and Tier-1 suppliers make them key players in the market. Additionally, the growing emphasis on ADAS in vehicles manufactured in these regions is further fostering the adoption of emergency braking systems across various vehicle types.

Market Segmentation

By Vehicle Type

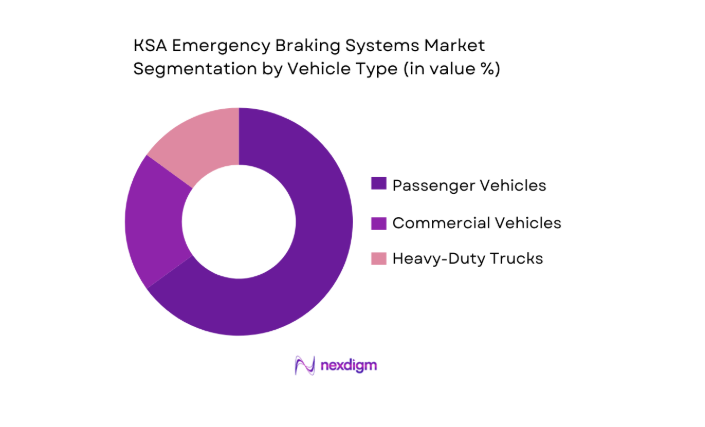

The KSA Emergency Braking Systems market is segmented by vehicle type into passenger vehicles, commercial vehicles, and heavy-duty trucks. Among these, passenger vehicles have the dominant market share due to the increasing demand for safety features in personal cars. With a significant rise in consumer awareness regarding road safety, coupled with government regulations promoting safety technologies, passenger vehicles have become the largest consumer of AEB systems. The growing trend of integrating ADAS features in high-end models and mass-market vehicles is further contributing to this segment’s dominance.

By System Type

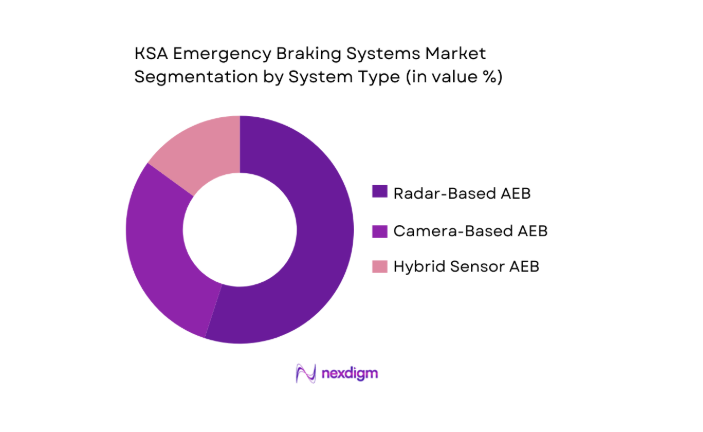

The KSA Emergency Braking Systems market is also segmented by system type, which includes radar-based AEB, camera-based AEB, and hybrid sensor AEB. Among these, radar-based AEB systems are the most dominant. This is primarily due to their high reliability in diverse weather conditions, such as sandstorms, common in the region. Radar-based systems are widely integrated into premium vehicles, making them the preferred choice for both OEMs and consumers. The ability of radar to function effectively in harsh environments makes it a robust and versatile solution for AEB systems in Saudi Arabia.

Competitive Landscape

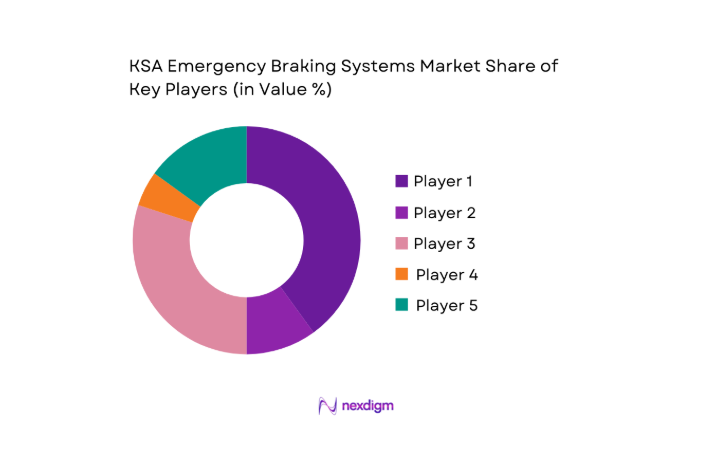

The KSA Emergency Braking Systems market is dominated by a few major players, including Bosch and global brands like Continental, Mobileye, and Denso. This consolidation highlights the significant influence of these key companies. Their global presence, continuous innovations in sensor technologies, and strategic collaborations with OEMs have allowed them to lead the market in terms of both supply and technology.

| Company | Establishment Year | Headquarters | Sensor Technology | Vehicle Type Coverage | Market Reach | Partnerships | OEM Integration |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ |

| Continental | 1871 | Germany | ~ | ~ | ~ | ~ | ~ |

| Mobileye | 1999 | Israel | ~ | ~ | ~ | ~ | ~ |

| Denso | 1949 | Japan | ~ | ~ | ~ | ~ | ~ |

| Autoliv | 1953 | Sweden | ~ | ~ | ~ | ~ | ~ |

KSA Emergency Braking Systems Market Analysis

Growth Drivers

National Road Safety Strategy and Vision 2030 Accident Reduction Targets

The Saudi government’s national road safety strategy, part of the Vision 2030 initiative, emphasizes reducing road accidents and fatalities, which aligns with the adoption of TPMS technologies. The Vision 2030 targets include improving road safety standards and enhancing traffic management systems. TPMS is a crucial component in achieving these goals, as it helps prevent tire-related accidents, ensuring safer driving conditions. As the government prioritizes road safety, stricter regulations and incentives for adopting safety technologies like TPMS will boost their penetration across all vehicle segments, contributing to the overall reduction in accidents.

Rising Vehicle Parc and Urban Traffic Density

The growing vehicle fleet in KSA, coupled with increasing urbanization and traffic density in cities, drives the demand for vehicle safety technologies like TPMS. As more vehicles are on the road, tire-related issues become more prevalent, contributing to accidents and maintenance costs. The expansion of urban areas and high traffic density further intensify the need for efficient monitoring systems to prevent accidents caused by tire failures. As the vehicle parc continues to rise, TPMS becomes a vital component in maintaining road safety and ensuring the reliability of vehicles in densely populated regions, driving market growth.

Challenges

High System Cost Limiting Penetration in Entry-Level Vehicles

The high cost of TPMS systems, particularly direct TPMS, remains a significant barrier for their adoption in entry-level vehicles. The additional cost for sensors, installation, and associated components can make TPMS an expensive feature for budget-conscious consumers. This limits its adoption in lower-priced vehicle segments, where cost is a critical factor in purchasing decisions. Manufacturers of entry-level vehicles often struggle to include TPMS due to the increased vehicle price, limiting market penetration in this segment and reducing the potential for widespread adoption across all vehicle types in the KSA market.

Calibration and Maintenance Complexity in Service Networks

The complexity involved in calibrating and maintaining TPMS systems presents a challenge, particularly in service networks. The system requires periodic calibration and maintenance to ensure accurate tire pressure readings and proper functionality. However, service centers may face challenges in keeping up with the required tools, trained personnel, and technology needed to properly service TPMS-equipped vehicles. This creates a barrier in terms of scalability, especially for smaller workshops that may lack the infrastructure to maintain and repair these systems effectively. As a result, TPMS adoption may be hindered in regions or service networks with limited technical support capabilities.

Opportunities

Localization of Sensor Assembly and System Calibration Services

One of the key opportunities in the KSA TPMS market is the localization of sensor assembly and system calibration services. By establishing local manufacturing and calibration facilities, TPMS systems can become more cost-effective, reducing import costs and increasing accessibility to a wider range of consumers. Additionally, local service centers can improve calibration turnaround times and reduce maintenance costs, enhancing the overall customer experience. Local production and support also provide opportunities for job creation and technological innovation within the country, aligning with the Vision 2030 objectives of diversifying the economy and fostering local industries.

Integration of Emergency Braking with Fleet Telematics Platforms

Another opportunity lies in integrating TPMS with emergency braking systems and fleet telematics platforms. Commercial fleets, in particular, are focusing on enhancing safety and operational efficiency. Integrating TPMS with telematics allows real-time monitoring of tire conditions, which can be used to trigger emergency braking in case of detected tire failure, improving overall fleet safety. This integration also allows fleet managers to track tire health and optimize maintenance schedules, reducing downtime and operational costs. As the demand for smart fleet management systems grows, this integration presents a major opportunity for TPMS providers to expand their market presence in the fleet sector.

Future Outlook

In the coming years, the KSA Emergency Braking Systems market is expected to experience significant growth due to increasing regulatory mandates, technological advancements, and the expanding adoption of ADAS across both passenger and commercial vehicles. As safety becomes a higher priority for consumers and regulators alike, AEB systems will play a pivotal role in improving road safety standards. The market will continue to evolve with innovations in sensor technologies and smarter, more integrated systems.

Major Players

- Bosch

- Continental

- Mobileye

- Denso

- Autoliv

- Aisin Seiki

- Hyundai Mobis

- Valeo

- Magna International

- ZF Friedrichshafen

- Aptiv

- Delphi Technologies

- Calsonic Kansei

- Jtekt Corporation

- Pioneer Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- OEM Manufacturers

- Tier-1 Suppliers

- Fleet Operators

- Vehicle Dealerships

- Automotive Aftermarket Providers

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

In this phase, an ecosystem map is constructed to identify all major stakeholders, including automotive OEMs, suppliers, and regulatory bodies. Extensive secondary research is employed to gather insights into technological trends, market demand, and supply chain dynamics.

Step 2: Market Analysis and Construction

Historical market data is analyzed, including the adoption rates of AEB systems in different vehicle types and regions. Market data from OEMs, Tier-1 suppliers, and other key stakeholders are used to construct a reliable market size estimate.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through expert interviews with industry practitioners, such as automotive engineers, government officials, and safety technology developers. These consultations validate key assumptions and provide detailed insights into market dynamics.

Step 4: Research Synthesis and Final Output

The final research output synthesizes data from various sources, including expert interviews, industry reports, and market analysis. This ensures a comprehensive, accurate, and validated assessment of the KSA Emergency Braking Systems market.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, emergency braking system taxonomy, market sizing logic by system value per vehicle, OEM and fleet fitment assessment framework, primary interview design with OEMs Tier-1 suppliers regulators and fleet operators, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Emergency Braking in KSA

- Road Safety Context and Accident Reduction Imperatives

- Integration of Emergency Braking within ADAS and Vehicle Safety Stack

- Automotive OEM and Tier 1 Supplier Ecosystem in the Kingdom

- Growth Drivers

National road safety strategy and Vision 2030 accident reduction targets

Rising vehicle parc and urban traffic density

OEM shift toward standardization of active safety systems - Challenges

High system cost limiting penetration in entry level vehicles

Calibration and maintenance complexity in service networks

Limited technical capability in independent workshops - Opportunities

Localization of sensor assembly and system calibration services

Integration of emergency braking with fleet telematics platforms

Retrofitting opportunities in commercial and government fleets - Trends

Transition from reactive to predictive braking intelligence

Increasing reliance on multi sensor fusion architectures - Regulatory & Policy Landscape

- SWOT Analysis

- Porter’s Five Forces

- By System Value Contribution, 2019–2024

- By Vehicle Fitment Penetration, 2019–2024

- By OEM vs Aftermarket Revenue Split, 2019–2024

- By Fleet Type (in Value %)

Passenger vehicles

Light commercial vehicles

Heavy commercial vehicles - By Application (in Value %)

Forward collision mitigation

Pedestrian and cyclist detection braking

Urban low speed autonomous braking

Highway emergency braking assistance - By Technology Architecture (in Value %)

Camera based emergency braking systems

Radar based emergency braking systems

Sensor fusion emergency braking platforms - By Connectivity Type (in Value %)

Standalone vehicle safety systems

Telematics integrated braking systems

Cloud connected safety analytics platforms - By End-Use Industry (in Value %)

Passenger vehicle OEMs

Commercial fleet operators

Public transport authorities

Vehicle inspection and safety agencies

- Market Share of Major Players

- Cross Comparison Parameters (AEB trigger speed range, braking intervention accuracy, sensor fusion capability, system response latency, calibration complexity, performance in high temperature conditions, telematics and data integration readiness, lifetime cost of ownership)

- SWOT analysis of major players

- Detailed Profiles of Major Companies

Bosch

Continental AG

ZF Friedrichshafen AG

Denso Corporation

Aisin Corporation

Autoliv

Valeo

Magna International

Hyundai Mobis

Hitachi Astemo

Nissin Kogyo

Mando Corporation

Aptiv

Mobileye

Veoneer

- Fleet safety compliance requirements and procurement logic

- OEM specification criteria and supplier selection dynamics

- Aftermarket adoption drivers and service barriers

- Insurance led demand for crash avoidance technologies

- Total cost of ownership and ROI perception among buyers

- By System Value Contribution, 2025–2030

- By Vehicle Fitment Penetration, 2025–2030

- By OEM vs Aftermarket Revenue Split, 2025–2030