Market Overview

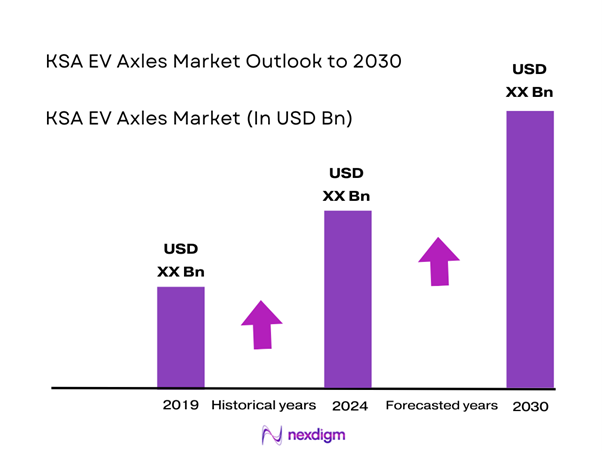

The KSA EV Axles Market is valued at USD ~ million. The market scale is directly tied to the country’s accelerating electric vehicle adoption across passenger, commercial, and public transport segments, where axles function as a mission-critical drivetrain component rather than a commoditized chassis part. Structural demand is driven by the shift toward integrated e-axle architectures that combine motor, inverter, and transmission into a single module, increasing value per vehicle. Electrification of government fleets, logistics vehicles, and urban mobility platforms is creating predictable, program-based demand for EV axles with higher torque density, thermal stability, and long duty cycles. In addition, OEM platform standardization strategies are elevating axle specifications from vehicle-specific designs to scalable modules, reinforcing consistent procurement volumes and longer supplier contracts. The market is therefore shaped more by system complexity and integration depth than by unit volumes alone.

Demand concentration is highest in the Central and Western regions due to the presence of vehicle assembly activities, fleet operators, and public transport electrification programs, which together account for the majority of early EV deployments. These regions also benefit from policy-driven pilot projects and centralized procurement frameworks, accelerating adoption of standardized axle platforms. From a supply perspective, global drivetrain specialists exert strong influence through homologated EV platforms supplied to vehicles assembled or imported into the country. Their dominance is rooted in advanced motor integration, software control, and proven durability under high-load conditions. Domestic participation remains limited but is growing through assembly, integration, and localization partnerships rather than full technology ownership, positioning local players as execution partners rather than core IP holders.

Market Segmentation

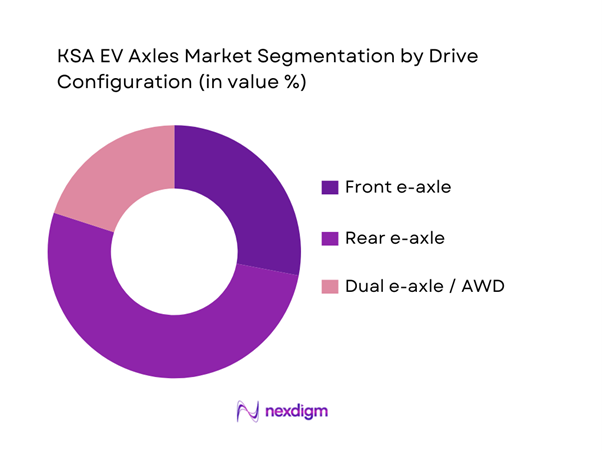

By Drive Configuration

KSA EV axles market is segmented by drive configuration into front e-axle, rear e-axle, and dual e-axle/AWD. Rear e-axle systems tend to dominate near-term fitment because many premium and performance-oriented EV architectures prioritize rear-drive packaging for better traction and driving dynamics, while keeping the front module optional for AWD variants. This also aligns with thermal and durability expectations in high-ambient operating conditions: rear modules can be engineered with more robust cooling and sealing strategies and validated for gradeability and long-distance cruising. As EV sales scale and model lineups diversify, rear e-axles remain the “default” configuration for many passenger platforms, with AWD growing in premium SUVs and performance trims.

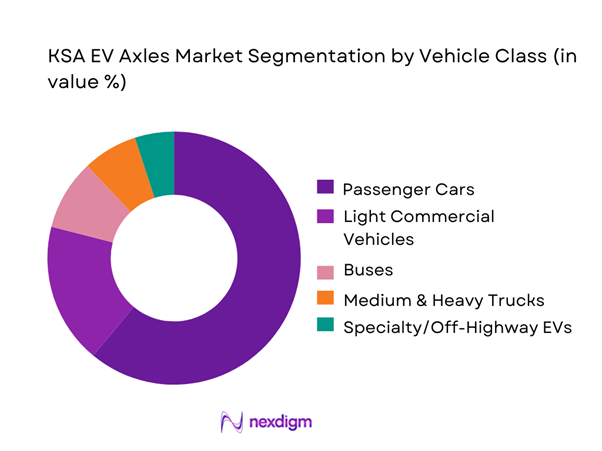

By Vehicle Class

Passenger electric vehicles account for the largest share of EV axle demand in the country due to their higher production volumes and faster adoption relative to other EV categories. Government incentives, urban mobility needs, and consumer adoption patterns support steady growth in this segment. Electric light commercial vehicles form the second-largest segment, driven by last-mile delivery electrification and fleet sustainability targets. Electric buses and trucks contribute a smaller but strategically important share, as these vehicles require high-torque and heavy-duty axle solutions. Off-highway and specialty EVs remain niche, primarily linked to industrial and utility applications, but they offer higher per-unit axle value due to specialized performance requirements.

Competitive Landscape

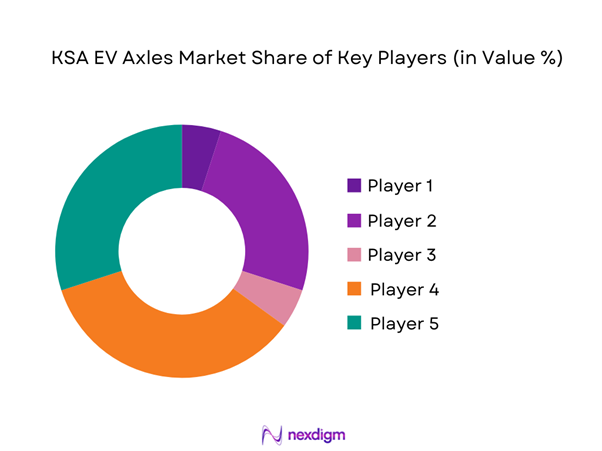

The KSA EV Axles market is dominated by a few major players, including Dana Incorporated and global or regional brands like ZF Friedrichshafen, Bosch Mobility, and BorgWarner. This consolidation highlights the significant influence of these key companies.

| Company | Established | HQ | e-Axle/EDS Portfolio Breadth | Peak Torque Coverage | Thermal Strategy for High Ambient | Local Service/Partner Footprint | OEM/Fleet Program Readiness | Localization Pathway |

| ZF | 1915 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Dana | 1904 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Magna | 1957 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| GKN Automotive | 1759 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

KSA EV Axles Market Analysis

Growth Drivers

localization and manufacturing alignment

The alignment of EV adoption with national manufacturing and localization objectives is a primary growth driver for the KSA EV axles market. As electric vehicle assembly scales domestically, OEMs increasingly prioritize drivetrain components that can support local integration without compromising global platform standards. EV axles sit at the center of this requirement, as they directly influence vehicle efficiency, reliability, and homologation timelines. Localization policies encourage suppliers to establish assembly and testing capabilities within the country, which in turn lowers logistical risk and improves response times for OEM production schedules. This dynamic reinforces long-term supply agreements rather than spot procurement, increasing market stability. As localization progresses beyond vehicle assembly into subsystem integration, EV axles transition from imported components to strategic enablers of domestic EV value chains, strengthening sustained demand.

Fleet and public transport electrification

Electrification of commercial fleets and public transport systems is significantly accelerating EV axle demand. Fleet operators prioritize total cost of ownership, uptime, and durability, which shifts purchasing decisions toward higher-quality axle systems with integrated thermal and torque management. Electric buses and delivery vehicles require axles capable of sustained high loads and stop-start duty cycles, increasing average system value compared to passenger applications. Government-backed procurement programs further amplify this effect by standardizing vehicle platforms and axle specifications across large fleet orders. This creates volume visibility for suppliers and reduces demand volatility. As fleet electrification expands beyond pilot deployments into multi-year replacement cycles, EV axles become a repeat-purchase component rather than a one-time adoption, structurally strengthening market growth.

Challenge

Limited domestic drivetrain engineering depth

A key challenge for the KSA EV axles market is the limited depth of local engineering and manufacturing capabilities specific to advanced electric drivetrains. EV axles require precision machining, power electronics integration, and software calibration, capabilities that are still emerging domestically. As a result, critical subsystems such as motors, inverters, and control algorithms remain imported, constraining full localization. This dependency increases lead times and exposes OEMs to external supply chain disruptions. It also limits the ability of local suppliers to move beyond assembly into higher-margin design and validation roles. Until domestic engineering ecosystems mature, the market’s growth will remain closely tied to the strategic priorities and capacity decisions of global Tier-1 suppliers.

Long qualification and validation cycles

EV axles are safety-critical and performance-defining components, leading to extended qualification and validation cycles with OEMs and fleet operators. These processes include durability testing, thermal validation, and software integration checks, which significantly lengthen time-to-market for new suppliers. For newer or localized players, this creates a barrier to entry, as capital must be committed long before revenue materializes. The challenge is particularly acute in commercial and public transport applications, where failure risks carry operational and reputational consequences. As a result, buyers exhibit strong preference for proven platforms, slowing supplier diversification and reinforcing market concentration despite rising demand.

Opportunity

Localization of integrated e-axle assembly

The transition from discrete motor-axle systems to fully integrated e-axles presents a major localization opportunity. Integrated assemblies reduce part counts, simplify vehicle integration, and align with OEM modular platform strategies. Establishing local assembly and testing for these systems allows suppliers to capture value without fully replicating global R&D functions. This creates a realistic pathway for domestic participation in the EV axle value chain. Localized assembly also improves customization for regional operating conditions, such as high ambient temperatures and heavy-load use cases. As demand shifts toward integrated solutions, suppliers with local assembly capabilities can differentiate on responsiveness, service support, and compliance alignment.

Heavy-duty and specialty EV applications

Heavy-duty EVs, including buses, trucks, and industrial vehicles, offer a high-value growth avenue for the KSA EV axles market. These applications require specialized axle designs with higher torque ratings, reinforced housings, and advanced thermal management. Unit volumes may be lower than passenger vehicles, but system values are significantly higher, improving supplier margins. Electrification of mining, utility, and municipal vehicles further expands this opportunity set. As these segments are often driven by government or industrial procurement rather than consumer adoption, demand visibility is stronger, making them attractive targets for focused axle platform development.

Future Outlook

The KSA EV axles market is expected to evolve from import-reliant supply toward selective localization, driven by OEM platform expansion and fleet electrification. Integrated e-axle solutions will gain prominence as efficiency and packaging become critical differentiators. Strategic partnerships between global Tier-1 suppliers and local manufacturing entities will shape the market’s medium-term structure.

Major Players

- Dana Incorporated

- ZF Friedrichshafen

- Schaeffler Group

- Nidec Corporation

- BorgWarner

- GKN Automotive

- Bosch Mobility

- Aisin Corporation

- Hyundai Mobis

- Magna International

- Sona BLW Precision Forgings

- Meritor

- AVL List

Key Target Audience

- EV and automotive OEMs

- Tier-1 drivetrain suppliers

- Fleet operators and logistics companies

- Public transport authorities

- Industrial and utility vehicle operators

- Component distributors and integrators

- Investments and venture capitalist firms

- Government and regulatory bodies in KSA

Research Methodology

Step 1: Identification of Key Variables

Core variables included EV production volumes, drivetrain configurations, axle technology types, and end-use demand drivers specific to the country.

Step 2: Market Analysis and Construction

Segment-level analysis was conducted across vehicle categories, axle configurations, and deployment models to construct a coherent market framework.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through structured consultations with industry participants across OEMs, suppliers, and fleet operators.

Step 4: Research Synthesis and Final Output

All findings were synthesized into an integrated market narrative, ensuring internal consistency and alignment with client decision-making needs.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- EV Axles Usage and Value-Chain Mapping

- Business Cycle and Demand Seasonality

- KSA Automotive and EV Manufacturing Architecture

- Growth Drivers

EV localization and Vision-aligned manufacturing mandates

Commercial fleet electrification programs

Public transport electrification initiatives

Platform modularization by global OEMs

Thermal efficiency and drivetrain integration needs - Challenges

Limited local drivetrain manufacturing depth

High dependence on imported core components

Cost sensitivity in commercial EV adoption

Talent and engineering capability gaps

Long qualification cycles with OEMs - Opportunities

Localization of integrated e-axle assembly

Heavy-duty and off-highway EV axles

Platform-sharing across vehicle categories

Strategic OEM–Tier-1 partnerships

Aftermarket and remanufacturing potential - Trends

Integrated e-axle architectures

High-voltage drivetrain standardization

Lightweight material adoption

Digital monitoring of axle performance

Platform-based EV chassis design - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Unit Price, 2019–2024

- By Axle Configuration (in Value %)

Front e-axle

Rear e-axle

All-wheel-drive dual e-axle

Integrated axle-drive module

Independent suspension e-axle - By Vehicle Category (in Value %)

Passenger electric vehicles

Electric light commercial vehicles

Electric buses

Electric trucks

Off-highway and specialty EVs - By Technology / Product Type (in Value %)

Integrated motor-drive axle

Motor + reducer axle

Motor + inverter + reducer axle

High-torque heavy-duty axle

Lightweight compact axle - By Deployment / Distribution Model (in Value %)

OEM factory-installed

Tier-1 supplier integration

Aftermarket replacement

Fleet retrofit programs - By End-Use Customer Type (in Value %)

OEMs

Public transport operators

Logistics and fleet operators

Government and municipal bodies

Industrial and utility operators - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Competition ecosystem overview

- Cross Comparison Parameters (traction torque density, axle load rating, thermal management integration, inverter compatibility, voltage architecture support, localization readiness, OEM homologation depth, lifecycle durability, modular scalability)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Dana Incorporated

ZF Friedrichshafen

Schaeffler Group

Nidec Corporation

BorgWarner

GKN Automotive

Bosch Mobility

Aisin Corporation

Hyundai Mobis

Magna International

Sona BLW Precision Forgings

Meritor

AVL List

Valeo

JTEKT Corporation

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Unit Price, 2025–2030