Market Overview

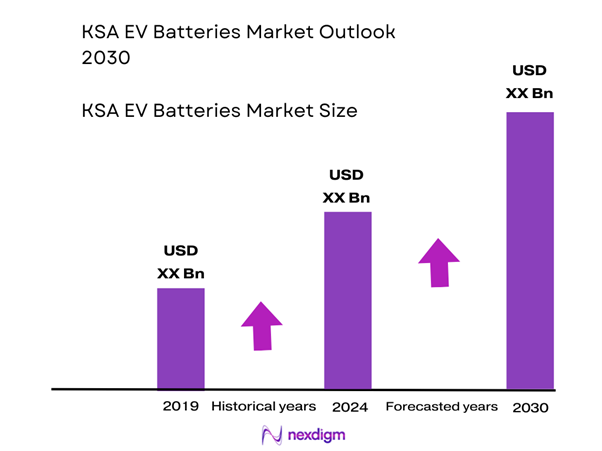

The KSA EV batteries market is valued at USD ~ million in 2024, based on a recent country-level assessment. Growth is driven by ambitious government electrification targets under National Vision 2030, large-scale investment in domestic battery manufacturing, rising EV adoption tied to fleet electrification and charging-infrastructure expansion. The prior year (2023) saw the market at approximately USD 818.4 million in revenue per another source.

Major Saudi Arabian cities – notably the capital Riyadh, the coastal hub Jeddah and the Eastern Province (Dammam/Al-Khobar) – dominate deployment of EV-battery systems. Riyadh benefits from concentrated government procurement and fleet electrification programs, Jeddah offers logistical/port access for imports and industrial activity, while the Eastern Province anchors battery-making ecosystems and supply-chain infrastructure.

Market Segmentation

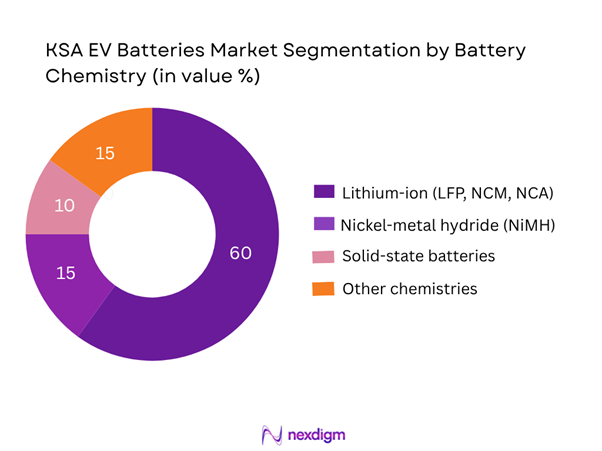

By Battery Chemistry

In this chemistry segmentation, the lithium-ion (LFP/NCM/NCA) sub-segment dominates the KSA EV batteries market share. This dominance is due to its combination of higher energy density, longer cycle life and an established manufacturing base globally which is starting to localise in the Kingdom. Manufacturers are focusing on lithium-ion given cost declines per kWh, proven performance in automotive EV applications, and compatibility with Saudi Arabia’s climate and fleet-electrification ambitions. Alternative chemistries such as NiMH or solid-state remain niche or future-looking, but currently their commercial scale is limited in the Kingdom.

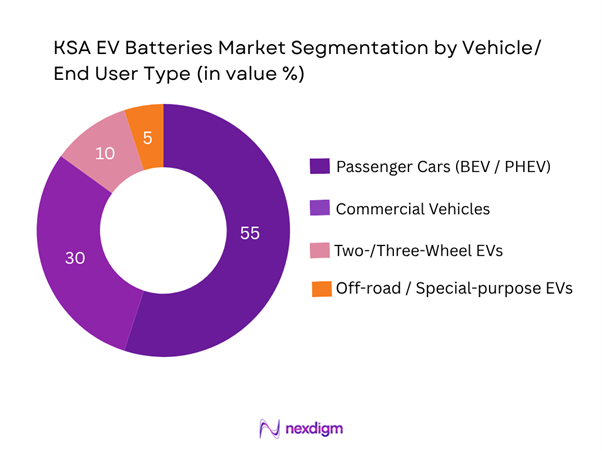

By Vehicle Type / End-Use

Under the vehicle-type/end-use segmentation, the passenger-car category holds the dominant market share in KSA. This is driven by rising consumer demand, government incentives targeted at personal mobility electrification, and the introduction of new EV‐models suited to Saudi urban and suburban driving. The infrastructure roll-out – including charging stations in Riyadh and major cities – has favoured passenger EVs, making them the early adoption segment. Commercial vehicle electrification, although growing rapidly, remains behind passenger cars due to higher capex and infrastructure needs. Two-/three-wheel EVs and off-road categories are smaller but have potential in niche fleet and industrial contexts.

Competitive Landscape

The KSA EV batteries market is shaped by a mix of global cell/pack manufacturers, regional assemblers, and battery-ecosystem integrators seeking localisation within the Kingdom. A small number of major players exert outsized influence, reflecting the capital-intensive nature of battery production, supply-chain constraints and strategic partnerships with OEMs and government-backed programmes.

| Company | Establishment Year | Headquarters | Battery Production Capacity (GWh p.a.) | Energy Density (Wh/kg) | Localisation/Manufacturing in KSA | OEM Partnerships in KSA/GCC |

| Contemporary Amperex Technology Co. (CATL) | 2011 | China (Ningde) | – | – | – | – |

| LG Energy Solution | 2020 | South Korea | – | – | – | – |

| Samsung SDI Co., Ltd. | 1970 | South Korea | – | – | – | – |

| BYD Company Ltd. | 1995 | China | – | – | – | – |

| Panasonic Corporation | 1918 | Japan | – | – | – | – |

KSA EV Batteries Market Analysis

Growth Drivers

National electrification targets & fleet mandates

Saudi Arabia’s push to electrify mobility is anchored in strategic national goals: the Kingdom’s GDP stood at USD 1.14 trillion in current prices. As part of its autonomous efforts under its Vision 2030 agenda, the capital city of Riyadh is targeting that 30 % of all vehicles will be electric, aiming to ramp up by 2030. Such mandates create a strong pull for EV battery demand, especially in fleet and government procurements where battery systems dominate cost structure and operational lifecycle considerations.

Localization of battery manufacturing (raw material processing, cell fabrication)

Saudi Arabia is actively developing domestic battery-value-chain capacity to reduce reliance on imports. For example, the Kingdom recently increased its estimate of untapped mineral resources up to USD 2.5 trillion, significantly boosting its upstream potential. Additionally, a country-level study reports that Saudi Arabia’s share of the Middle East lithium-ion battery market stood at 42.83% in 2024 — indicating its leadership in that segment. These efforts to localize processing of cells and modules serve to shorten supply-chains, improve cost competitiveness and support sovereign industrial targets, thereby accelerating the EV-battery market.

Market Challenges

High upfront capital investments for gigafactories in KSA

Setting up battery-cell manufacturing requires massive capital expenditure: plant infrastructure, clean-rooms, production lines and automation systems. Saudi Arabia’s ambition to become a battery hub comes at a time when its real GDP growth in 2024 was only 1.3% (year-on-year) amid oil-sector drag. The relatively slow growth context means the domestic economy faces stress absorbing very large investments. This high-capex barrier remains a core hurdle for scaling production of EV batteries locally.

Charging infrastructure bottlenecks & thermal management in desert climate

A robust EV-battery market depends on a strong charging ecosystem; however, in Saudi Arabia a study estimates a requirement of 30,000 to 34,000 charging points to support projected EV growth. In the desert climate, battery-pack thermal management becomes more difficult (high ambient temperatures affect performance and lifespan). These factors slow both consumer adoption of EVs and thus demand for EV batteries, posing a bottleneck for battery-market growth.

Opportunities

Second-life EV batteries for stationary storage and grid support

As EV adoption grows in Saudi Arabia, used EV battery packs present opportunities for stationary energy storage, grid-services and renewable-energy integration. The Kingdom’s drive to build clean-energy systems supports this: for instance, the push to localise battery components emphasises circular-economy considerations. Re-using EV battery packs for stationary applications improves value per unit and opens new revenue streams in the battery ecosystem — providing a compelling growth avenue for the KSA EV batteries market.

Strategic partnerships and foreign direct investment (FDI) in battery value-chain

Saudi Arabia is actively seeking foreign partnerships to build its battery-ecosystem: for example, the state-mining company Ma’aden has explored joint ventures in lithium extraction from seawater. The availability of sovereign-fund capital (such as the Public Investment Fund) and policy incentives makes the Kingdom attractive for FDI into battery cell manufacturing, module integration and recycling. These collaborations bring technology, know-how and capital — accelerating localisation and scale-up of EV-battery production.

Future Outlook

Over the next six years the KSA EV batteries market is expected to demonstrate strong growth driven by continued government support for electrification, localisation of battery and pack manufacturing, and rising demand from EV fleets (passenger and commercial). Battery cost declines, improvements in energy density and the emergence of second-life/ recycling business models will further enhance the sector’s attractiveness. The Kingdom’s push to establish domestic supply-chains for raw materials, battery production and recycling will also make it a regional hub for EV-battery value-creation.

Major Players

- Contemporary Amperex Technology Co., Limited (CATL)

- LG Energy Solution

- Samsung SDI Co., Ltd.

- BYD Company Limited

- Panasonic Corporation

- SK On

- Envision AESC Group

- Farasis Energy Inc.

- Northvolt AB

- EVE Energy Co., Ltd.

- Gotion High-Tech Co., Ltd.

- Saft Groupe S.A.

- Toshiba Corporation

- Svolt Energy Technology Co., Ltd.

- CEER National Automotive / Battery Division

Key Target Audience

- EV battery cell and pack manufacturers (domestic & international)

- Automotive OEMs and EV assemblers operating in Saudi Arabia

- Battery-recycling & second-life services companies

- Investments and venture-capitalist firms (seeking battery ecosystem opportunities)

- Government and regulatory bodies (e.g., Ministry of Energy, Ministry of Transport, Public Investment Fund)

- Fleet operators (commercial vehicle fleets, ride-hailing services)

- Charging-infrastructure developers and battery-as-a-service providers

- Raw-material and mining companies (lithium, nickel, cobalt)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA EV batteries market. This step is underpinned by extensive desk research, utilising a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics (e.g., battery chemistry, vehicle type, manufacturing stage, localisation content).

Step 2: Market Analysis and Construction

In this phase we compile and analyse historical data pertaining to the KSA EV batteries market. This includes assessing market volumes (GWh), revenue (USD million), pack cost trends (USD/kWh), manufacturing capacity and local plant announcements. Furthermore, we evaluate service-chain statistics and infrastructure rollout to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through telephone or online interviews with industry experts representing cell/pack makers, OEMs, battery assemblers, government agencies and investment firms. These consultations provide valuable operational and financial insights directly from practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple stakeholders (battery manufacturers, EV OEMs, fleet operators) to acquire detailed insights into production segments, sales performance, pricing trends, decision-making processes and localisation strategies. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA EV batteries market.

- Executive Summary

- Research Methodology (Market definitions and assumptions, Abbreviations and glossary, Market sizing approach – value (USD million) and volume (GWh), Consolidated research framework (secondary + primary), Understanding market potential through in-depth stakeholder interviews, Limitations, data triangulation and future conclusions)

- Definition and scope of EV batteries

- Industry genesis and evolution in Saudi Arabia

- Timeline of major technological, regulatory and investment milestones in KSA EV battery ecosystem

- Business cycle of EV battery value-chain in KSA

- Supply-chain & value-chain analysis

- Regional footprint & manufacturing hubs in KSA

- Growth Drivers

National electrification targets & fleet mandates

Localization of battery manufacturing (raw material processing, cell fabrication)

Cost decline in battery packs (USD/kWh) and improved energy density (Wh/kg) - Market Challenges

High upfront capital investments for gigafactories in KSA

Charging infrastructure bottlenecks & thermal management in desert climate

Supply-chain dependency (lithium, cobalt, nickel) and global trade tensions - Opportunities

Second-life EV batteries for stationary storage and grid support

Strategic partnerships and foreign direct investment (FDI) in battery value-chain

Emerging chemistries (solid-state, silicon-anode) and advanced manufacturing processes - Market Trends

Trend toward modular pack architecture and standardisation for fleet EVs

Growth of local cell production hubs in NEOM/KAEC

Recycling & circular-economy initiatives for EV battery end-of-life - Regulatory & Policy Landscape

KSA policies under Vision 2030 and NEOM battery-ecosystem support

Incentives (tax, subsidies, localisation requirements) for battery ecosystem

Safety and battery disposal/regulation frameworks - SWOT Analysis

- Stakeholder Ecosystem (raw material suppliers, cell/pack makers, OEMs, recyclers)

- Porter’s Five Forces

- By Value (USD million) and Volume (GWh), 2019-2024

- By Battery Chemistry, 2019-2024

- By Vehicle Type, 2019-2024

- By Propulsion Type (BEV, PHEV, HEV) – value & volume, 2019-2024

- By Pack Location (OEM in-vehicle vs aftermarket replacement) – value & volume, 2019-2024

- Average pack price (USD/kWh) and energy density (Wh/kg) trends, 2019-2024

- By Battery Chemistry (Value %):

Lithium-ion (LFP, NCM, NCA)

Nickel-metal hydride (NiMH)

Solid-state batteries

Other chemistries - By Vehicle Type (Value %):

Passenger Cars (BEV)

Commercial Vehicles (Light-Duty, Bus, Truck)

Two-Wheelers/Three-Wheelers EVs

Off-road and special-purpose EVs (mining, airport vehicles) - By Propulsion Type (Value %):

Battery Electric Vehicles (BEV)

Plug-in Hybrid Electric Vehicles (PHEV)

Hybrid Electric Vehicles (HEV) - By End-User Segment (Value %):

OEM fitted batteries

After-market battery replacement & retrofits

Stationary energy-storage re-use of EV batteries (second-life) - By Region within KSA (Value %):

Central Region (Riyadh)

Eastern Province (Dammam/Al-Khobar/King Abdullah Economic City)

Western Region (Jeddah/Mecca)

Northern & Southern Regions - By Manufacturing Stage (Value %):

Cell manufacturing

Module/pack integration

Recycling & remanufacturing

- Market share of major players (by value/volume) in KSA EV battery market – base year

- Cross-Comparison Parameters: (Company overview & corporate structure, Business strategy & localisation roadmap, Recent strategic developments, Technical specification/differentiation, Manufacturing capacity & timeline, Geographical footprint in KSA & GCC, Cost structure/EBITDA margins in pack fabrication, Distribution & OEM partnerships, R&D investment and roadmap, Recycling/second-life strategy, Supply-chain resilience)

- SWOT Analysis of Major Players

- Pricing Analysis – Pack level average price (USD/kWh) and contract terms in KSA

- Detailed Profiles of Major Companies

Contemporary Amperex Technology Co., Limited (CATL)

LG Energy Solution

Samsung SDI Co., Ltd.

BYD Company Limited

Panasonic Corporation

SK On

Envision AESC Group

Farasis Energy Inc.

Northvolt AB

EVE Energy Co., Ltd.

Gotion High‑Tech Co., Ltd.

Saft Groupe S.A.

Toshiba Corporation

Svolt Energy Technology Co., Ltd.

CEER Motors

- Adoption trends of EV fleets (passenger vs commercial) in KSA

- Purchasing behaviour of OEMs and battery pack suppliers (CAPEX, TCO)

- Service ecosystem & maintenance/after-market replacement dynamics

- Needs, pain-points and decision-making process of fleet operators and battery buyers

- Thermal & performance considerations for battery packs in KSA desert climate

- By Value (USD million) and Volume (GWh), 2025-2030

- By Battery Chemistry, 2025-2030

- By Vehicle Type, 2025-2030

- By Propulsion Type (BEV, PHEV, HEV) – value & volume, 2025-2030

- By Pack Location (OEM in-vehicle vs aftermarket replacement) – value & volume, 2025-2030

- Average pack price (USD/kWh) and energy density (Wh/kg) trends, 2025-2030