Market Overview

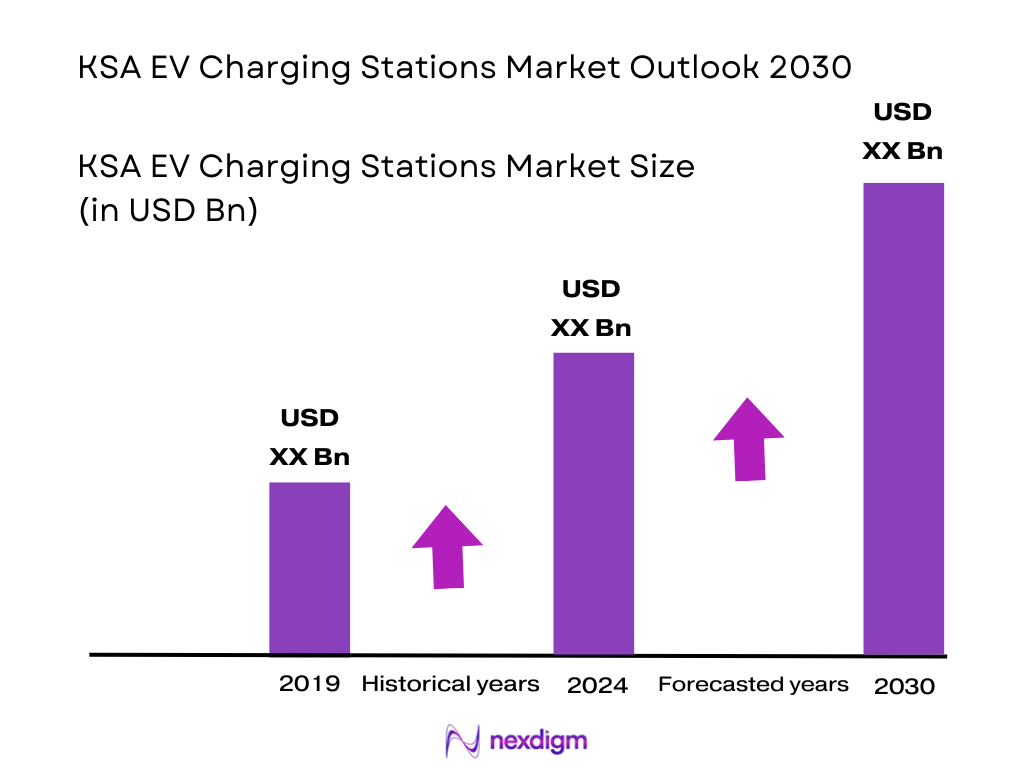

The Saudi Arabian EV charging stations market is experiencing a rapid expansion, with the market size expected to reach USD ~ billion by 2024. This growth is driven by several factors, including government incentives, rising adoption of electric vehicles (EVs), and increasing investments in green infrastructure. The Saudi government’s Vision 2030 initiative plays a pivotal role, with significant investments in sustainable mobility solutions and electric vehicle charging infrastructure. In addition, the shift towards renewable energy sources, particularly solar power, is further driving the development of EV charging stations across the kingdom.

The dominant cities in Saudi Arabia’s EV charging station market include Riyadh, Jeddah, and the Eastern Region, primarily due to their growing urbanization and heavy traffic patterns. Riyadh, being the capital and largest city, is the hub for most of the EV-related infrastructure projects and initiatives. Jeddah, with its status as a major commercial and tourist city, is also seeing rapid growth in EV adoption. The Eastern Region, including cities like Dammam and Khobar, benefits from its proximity to industrial zones and growing interest in adopting cleaner technologies. These regions are favored due to high investments in infrastructure and their importance in Saudi Arabia’s broader push towards sustainability.

Market Segmentation

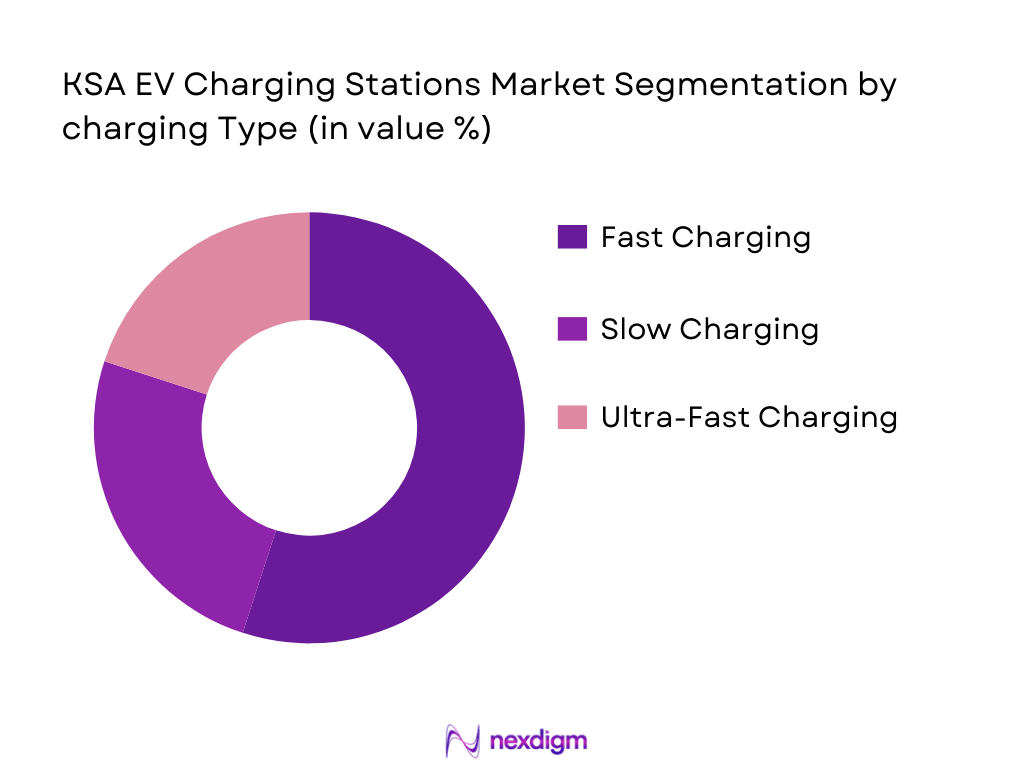

By Charging Type

The market is segmented into Fast Charging, Slow Charging, and Ultra-Fast Charging types. Among these, Fast Charging dominates the market due to its convenience for users and its ability to cater to the increasing demand for quick charging times in urban areas. Fast Charging stations are particularly favored by businesses and consumers who seek minimal downtime for their EVs. As more EVs are adopted for daily commutes, the need for faster turnaround times increases, making Fast Charging stations more popular.

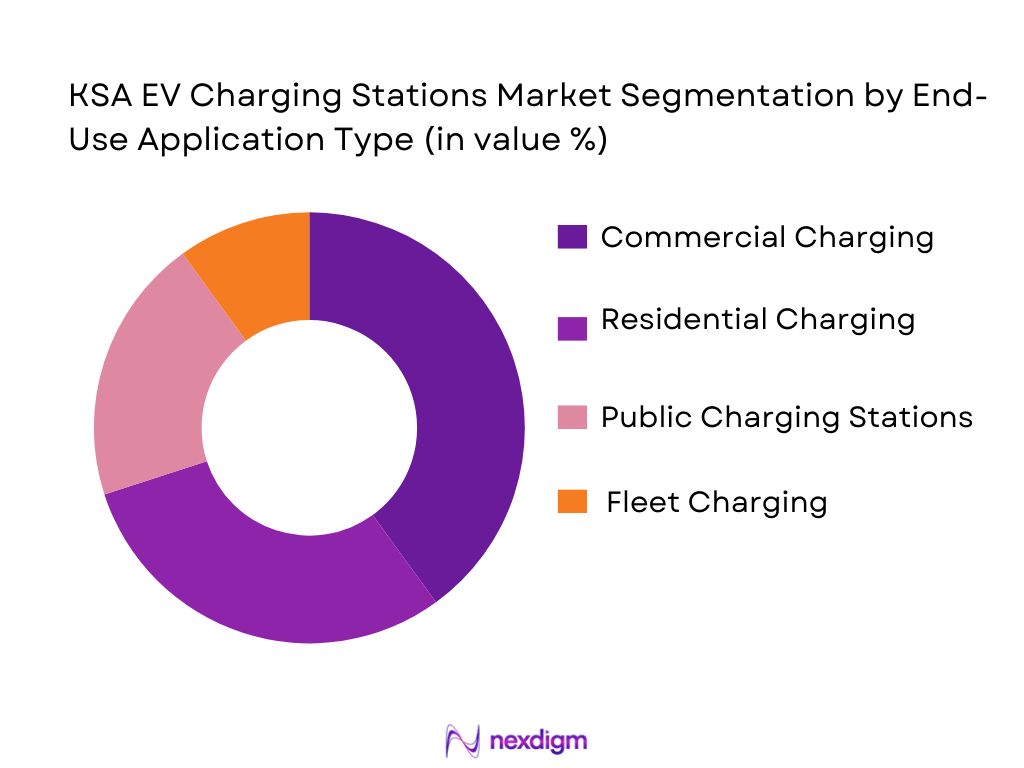

By End-Use Application

The end-use application segmentation includes Residential Charging, Commercial Charging, Public Charging Stations, and Fleet Charging. Among these, Commercial Charging stations hold the largest market share. The rise in the number of electric taxis, fleet vehicles, and commercial establishments in need of private and public charging points is fueling this demand. Businesses are increasingly integrating EV charging stations into their facilities as part of their sustainability efforts and to cater to the growing number of electric vehicle users.

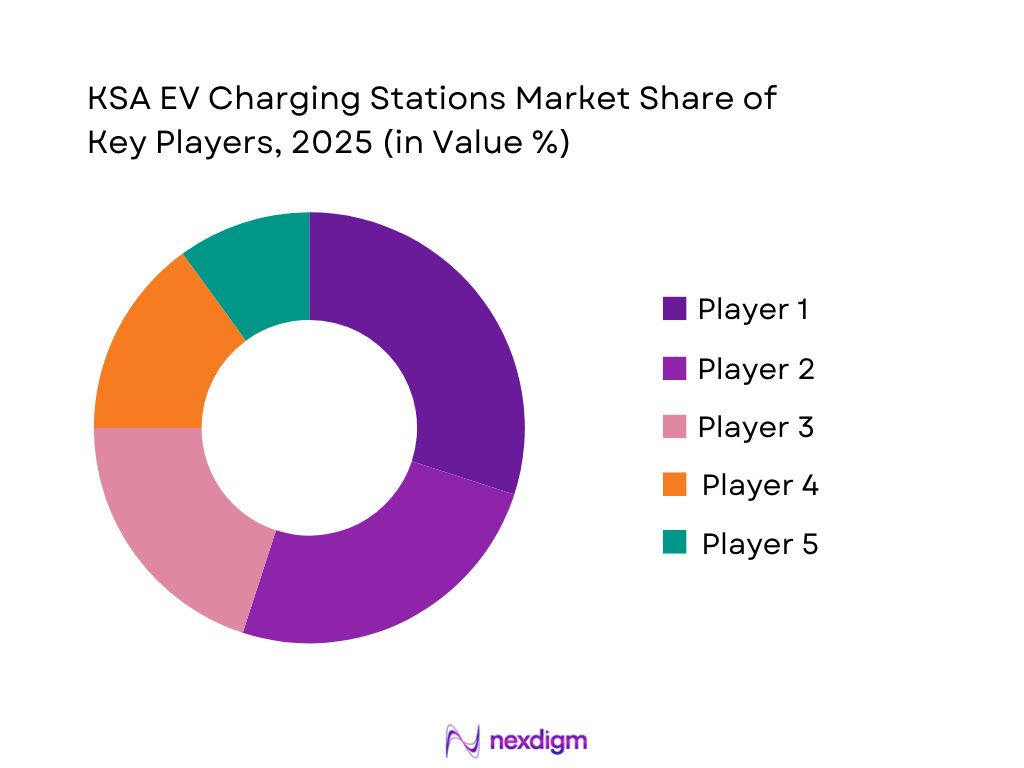

Competitive Landscape

The EV charging stations market in Saudi Arabia is characterized by a growing presence of both international and local players. The market is currently dominated by major players like ChargePoint, Siemens, and local entities like Al-Falak Electric, which are driving innovations and expanding their networks across the country. The consolidation of key players signifies their control over the market, as they are the primary stakeholders in terms of infrastructure development, strategic partnerships, and technological advancements.

| Company Name | Establishment Year | Headquarters | Technology | Charging Capacity | Regional Presence | Market Focus |

| ChargePoint | 2007 | California, USA | ~ | ~ | ~ | ~ |

| Siemens AG | 1847 | Germany | ~ | ~ | ~ | ~ |

| Al-Falak Electric | 1987 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ |

| ABB Ltd. | 1988 | Switzerland | ~ | ~ | ~ | ~ |

| Power Electronics | 1987 | Spain | ~ | ~ | ~ | ~ |

KSA EV Charging Stations Market Analysis

Growth Drivers

Urbanization

Saudi Arabia’s rapid urbanization is a key driver of the EV charging station market. As the country’s population grows, especially in urban areas like Riyadh and Jeddah, the demand for electric vehicles (EVs) and their associated infrastructure, including charging stations, increases. In 2025, Saudi Arabia’s urban population reached approximately ~ % of the total population, and it is projected that urbanization will continue to rise. This urban growth directly impacts transportation, with cities prioritizing cleaner transportation options like EVs, thus increasing the need for widespread EV charging

infrastructure.

Industrialization

The industrialization of Saudi Arabia, especially under its Vision 2030 initiative, is driving the EV market forward, including the need for EV charging stations. Industrial hubs like Dhahran, Jeddah, and Riyadh are growing rapidly, contributing to both the adoption of electric vehicles for industrial fleets and the demand for corresponding charging infrastructure. The country’s government investment in sustainable technologies is expected to bolster the electric vehicle market. By 2025, Saudi Arabia’s industrial production value reached SAR ~ billion (USD ~ billion), underscoring the role industrialization plays in shaping the future of clean transport.

Market Challenges

High Initial Costs

One of the major challenges facing the expansion of EV charging stations in Saudi Arabia is the high initial investment required for infrastructure development. The cost of installing charging stations, especially fast and ultra-fast chargers, can be prohibitive. According to the Saudi Ministry of Energy, the cost of installing each charging station in urban areas can range from SAR ~ (USD ~) to SAR ~ million (USD ~) depending on the location and infrastructure. These high capital expenditures are a barrier to rapid scaling of EV charging stations, despite the increasing demand for EVs.

Technical Challenges

The development and maintenance of EV charging infrastructure in Saudi Arabia face technical challenges such as the lack of standardized charging equipment, compatibility issues, and grid integration. In 2025, the country’s electric grid was stressed by increased demand, with consumption reaching ~ GWh, highlighting the existing limitations in integrating EV charging stations into the national grid. As EV adoption grows, the infrastructure’s capability to support a larger number of charging stations needs to be enhanced to avoid potential blackouts or inefficiencies in charging processes.

Opportunities

Technological Advancements

Technological advancements in charging solutions, such as ultra-fast chargers and wireless charging, present significant growth opportunities for the EV charging station market in Saudi Arabia. The introduction of cutting-edge technologies is expected to make EV charging faster, more efficient, and more accessible, encouraging broader adoption of EVs. As of 2025, a growing number of charging stations in Saudi Arabia are adopting solar-powered solutions to reduce reliance on the grid. These advancements are aligned with the country’s goals of reducing carbon emissions and integrating renewable energy.

International Collaborations

Saudi Arabia’s commitment to expanding its electric vehicle infrastructure is reinforced through international collaborations. Global companies like ABB and Siemens have entered into partnerships with local players to install and operate charging stations across major cities. In 2025, Siemens signed an agreement with the Saudi government to install over ~ EV chargers in Riyadh and Jeddah as part of the Kingdom’s move towards a more sustainable transportation system. These collaborations bring in technological expertise and help accelerate the development of EV charging infrastructure in the country.

Future Outlook

Over the next 5 years, the Saudi Arabian EV charging stations market is expected to witness substantial growth, driven by an increasing push for clean energy, rising EV adoption, and government support for sustainable infrastructure. The expansion of the charging network, coupled with advancements in ultra-fast charging technology, is expected to significantly enhance the market dynamics. Furthermore, the growing demand for EVs in both commercial fleets and personal use, alongside the government’s Vision 2030, will continue to stimulate investment in EV infrastructure, ensuring the market’s expansion.

Major Players in the Market

- ChargePoint

- Siemens AG

- Al-Falak Electric

- ABB Ltd.

- Power Electronics

- Schneider Electric

- Tesla Superchargers

- Green Parking Solutions

- Al-Faisal Holding

- Engie Group

- United Electric Company

- Emirates National Oil Company (ENOC)

- Al-Watania Electric

- Clean Energy Technology

- Solar Electric Charging Systems

Key Target Audience

- Government Agencies (Ministry of Energy, Saudi Arabia)

- Investments and Venture Capitalist Firms

- Automobile Manufacturers (Saudi Electric Vehicle Producers)

- Energy Providers (Saudi Electricity Company)

- Infrastructure Developers

- Electric Vehicle Manufacturers (Tesla, Lucid Motors)

- Electric Vehicle Fleet Operators (Uber, Careem)

- Regulatory Bodies (Saudi Standards Organization)

Research Methodology

Step 1: Identification of Key Variables

This phase involves developing a detailed ecosystem map of the KSA EV charging stations market, identifying key players, infrastructure models, and consumer preferences. Extensive secondary research from public sources and proprietary databases is conducted to identify critical market drivers, challenges, and regulations.

Step 2: Market Analysis and Construction

Historical data on EV adoption, the ratio of charging stations, and regional growth patterns are gathered. This helps to determine the penetration of EVs across different Saudi regions and the current state of the charging infrastructure.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends, regulatory impacts, and technological advancements are validated by consulting with industry experts and stakeholders, including representatives from EV manufacturers and energy providers.

Step 4: Research Synthesis and Final Output

The final phase involves compiling insights obtained from various sources, including interviews with industry stakeholders. The data is synthesized to develop a comprehensive and accurate market report that can be utilized for strategic planning and investments.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth, Industry Interviews, Primary Research Approach )

- Definition and Scope of EV Charging Stations in KSA

- Overview Genesis of EV Adoption in KSA

- Timeline of Key Market Players and Development Business Cycle of the EV

- Charging Market in KSA

- Supply Chain and Value Chain Analysis (Charging Infrastructure, Energy Providers, OEMs)

- Growth Drivers

Government Incentives and Subsidies for EV Infrastructure

Growth in EV Adoption and Fleet Electrification

Development of Sustainable Energy Sources (e.g., Solar) - Market Challenges

High Initial Infrastructure Investment

Grid Capacity Constraints and Load Management - Opportunities

Expansion of Charging Networks

Integration of Charging Solutions with Smart Cities - Trends

Integration of Charging Stations with Renewable Energy

Rise in Multi-modal Transport and Urban EV Solutions - Government Regulation

Standards and Regulations for Charging Stations

Role of Saudi Vision 2030 in EV Infrastructure Development - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competition Ecosystem

- By Value (Market Revenues, KSA EV Charging Stations) 2019-2025

- By Volume (Number of EV Charging Stations) 2019-2025

- By Average Charging Price and Cost Dynamics 2019-2025

- By Charging Type (In Value %)

Fast Charging

Slow Charging

Ultra-Fast Charging - By End-Use Application (In Value %)

Residential Charging

Commercial Charging

Public Charging Stations

Fleet Charging - By Region (In Value %)

Riyadh

Jeddah

Eastern Region

Western Region

Southern Region - By Network Ownership (In Value %)

Private Network

Public Networks

Hybrid Networks

- Market Share of Major Players by Value/Volume

Market Share by Charging Station Provider

Market Share by Region - Cross Comparison Parameters (Company Overview, Business Strategies and Future Investments, Recent Developments and Product Launches, Strengths and Weaknesses, Organizational Structure, Revenues and Market Share by Charging Segment, Distribution Channels and Customer Touchpoints, Margins and Investment Plans)

- SWOT Analysis of Major Players

- Pricing Analysis (By SKU for KSA EV Charging Solutions)

- Detailed Profiles of Major Companies

ChargePoint KSA

Green Parking Solutions

Tesla Superchargers

Al-Falak Electric

Al-Faisal Holding

Envision Group

ABB Ltd.

Siemens AG

Shell Recharge

EDF Renewables

Schneider Electric

Dubai Electric (DEWA)

Saudi Aramco (EV Charging Initiative)

Engie Group

Power Electronics (KSA Division)

- Market Demand and Utilization by Consumer Group

- Purchasing Power and Investment Trends in Charging Stations

- Regulatory and Compliance Requirements (including standards by SAMA)

- Needs, Desires, and Pain Points of EV Users and Businesses

- Decision-Making Process for Charging Infrastructure Investments

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030