Market Overview

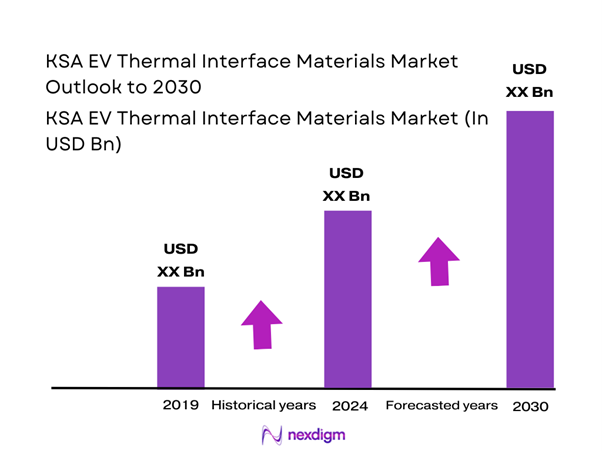

The KSA EV Thermal Interface Materials market is valued at USD ~ million in 2024, with demand being driven by the expanding electric vehicle (EV) market in Saudi Arabia and the increasing need for advanced thermal management solutions. These materials, which include thermal pads, thermal greases, and phase change materials, play a pivotal role in maintaining optimal temperature levels in EV batteries and other components. As the Kingdom of Saudi Arabia continues its Vision 2030 plan, which focuses on reducing carbon emissions and expanding sustainable energy sources, the demand for electric vehicles and associated components like thermal interface materials is set to rise.

The market is dominated by major cities like Riyadh, Jeddah, and Dammam, which are at the forefront of EV adoption and infrastructure development. Riyadh, as the capital and largest city, has a significant influence on the market due to its government initiatives and the presence of major players in the automotive industry. Jeddah’s port facilities facilitate the importation of thermal management components, while Dammam is strategically positioned near the energy sector, influencing the growth of EV manufacturing. These cities are essential in shaping the market’s future, as they contribute to both supply chain development and technological innovations.

Market Segmentation

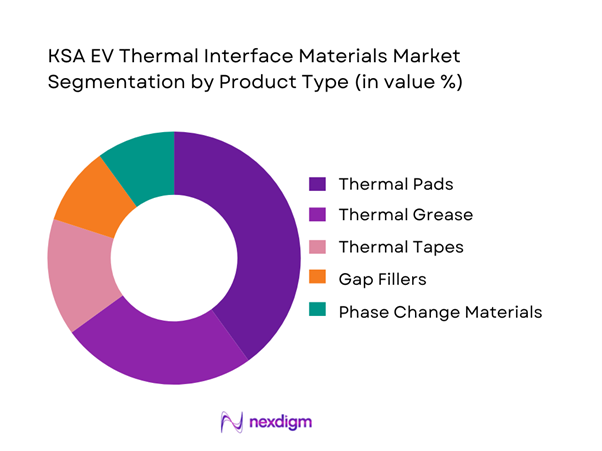

By Product Type

Thermal pads hold the largest market share in the KSA EV Thermal Interface Materials market due to their high thermal conductivity and efficiency in managing the heat generated in EV battery systems. Their widespread use in the automotive sector for temperature regulation ensures the longevity and performance of electric vehicles, which is why thermal pads are in high demand. Additionally, the growing emphasis on battery life extension and efficiency further supports the dominance of thermal pads in the market.

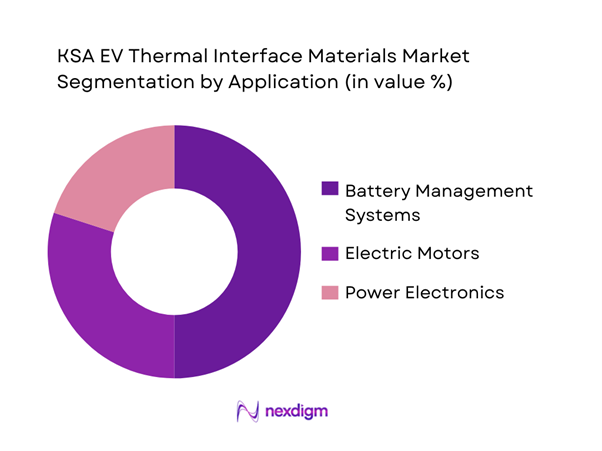

By Application

Battery management systems (BMS) dominate the market in terms of thermal interface materials usage. As EV batteries are the heart of the vehicle’s powertrain, maintaining their temperature within optimal levels is critical to safety and efficiency. The growth of electric vehicle production and the increasing focus on enhancing battery life and performance are key drivers behind the high demand for thermal management solutions in BMS. As EVs evolve, the need for efficient BMS has only amplified, cementing the role of thermal interface materials in these systems.

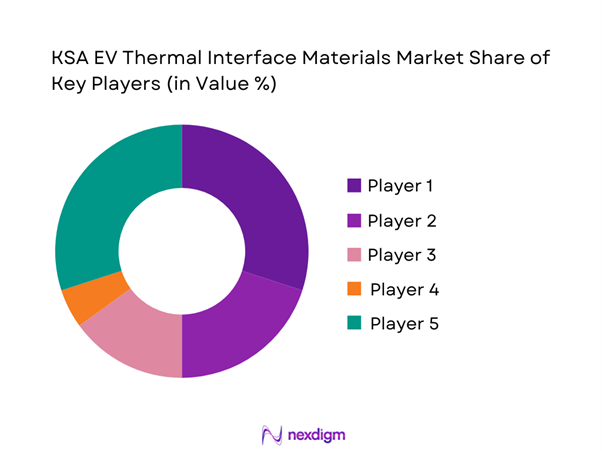

Competitive Landscape

The KSA EV Thermal Interface Materials market is dominated by a few major players, including Company 1 and global or regional brands like Company 2, Company 3, and Company 4. This consolidation highlights the significant influence of these key companies. These players lead the market by offering a wide range of advanced materials designed to meet the growing demands of the EV sector, focusing on innovations that enhance thermal efficiency, safety, and battery performance.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Revenue (2024) | Market Share (2024) | Key Strengths |

| 3M Company | 1902 | Riyadh | ~ | ~ | ~ | ~ |

| Dow Inc. | 1897 | Jeddah | ~ | ~ | ~ | ~ |

| Henkel AG & Co. KGaA | 1876 | Dammam | ~ | ~ | ~ | ~ |

| Honeywell International Inc. | 1906 | Riyadh | ~ | ~ | ~ | ~ |

| Indium Corporation | 1934 | Jeddah | ~ | ~ | ~ | ~ |

KSA EV Thermal Interface Materials Market Analysis

Growth Drivers

Growth of Electric Vehicle Production

The increasing production of electric vehicles (EVs) globally has significantly driven the demand for thermal interface materials (TIMs). As EV adoption accelerates, automakers are incorporating advanced materials to enhance battery performance, manage heat dissipation, and improve the overall efficiency of powertrains. With rising consumer demand for EVs and supportive government policies promoting clean energy, the automotive industry is undergoing a rapid transformation. This shift towards EVs is necessitating the development of more efficient thermal management systems to ensure safety, reliability, and longevity of EV batteries, thus boosting the growth of TIMs in the market.

Expansion in Renewable Energy Projects

Renewable energy projects, particularly solar and wind energy, require advanced thermal management solutions to ensure the optimal performance of energy storage systems. As the world moves towards sustainable energy solutions, the integration of thermal interface materials becomes crucial to manage the heat generated during the energy conversion and storage processes. The expansion of renewable energy projects has led to a rising demand for efficient thermal management systems, which in turn drives the market for TIMs. As these projects grow in scale and complexity, the need for high-performance materials to support energy storage and power distribution intensifies.

Market Challenges

High Material Cost

One of the primary challenges faced by the thermal interface materials (TIMs) market is the high cost of raw materials required for production. High-performance materials, such as graphite, ceramics, and specific polymers, are essential for efficient heat transfer and durability. These materials are often expensive, which in turn drives up production costs for TIM manufacturers. With growing competition and increasing demand for cost-effective EVs, automakers are seeking ways to reduce overall manufacturing costs, including those related to TIMs. The high cost of materials limits the ability of some manufacturers to scale production and make these advanced materials more affordable.

Technological Complexities in Manufacturing

The production of thermal interface materials involves complex manufacturing processes that require specialized expertise and advanced technology. Ensuring consistent quality and high performance in TIMs, especially for demanding applications like electric vehicles and electronics, requires precise control over material properties, such as thermal conductivity, viscosity, and mechanical stability. Additionally, innovations in TIMs are often hampered by the need for advanced manufacturing techniques, such as precision molding, coating, and bonding. These technical challenges can delay product development and increase the cost of production. As a result, manufacturers must continually invest in technology and skilled labor to meet market demands.

Opportunities

Increasing Demand for EV Battery Efficiency

With the growing popularity of electric vehicles, there is a heightened focus on improving battery efficiency. Thermal management plays a critical role in optimizing battery performance and extending its lifespan. Effective thermal interface materials are essential for regulating the temperature within battery systems, preventing overheating, and ensuring that batteries operate within safe thermal limits. As the demand for longer-range EVs increases, manufacturers are turning to advanced TIMs to enhance the energy density of batteries while maintaining safety. This creates significant opportunities for the development and adoption of innovative thermal solutions to meet the evolving needs of the electric vehicle industry.

Innovations in Thermal Management Materials

The ongoing advancements in material science present exciting opportunities for the thermal interface materials market. Manufacturers are continuously developing new and improved TIMs with higher thermal conductivity, greater durability, and lower weight to meet the growing demands of industries like electric vehicles, electronics, and renewable energy. Innovations such as phase change materials, graphene-based compounds, and high-performance thermal pads are opening new avenues for better heat management solutions. As technological breakthroughs lead to the creation of more efficient and cost-effective materials, the market for TIMs will likely expand, offering manufacturers opportunities to provide cutting-edge solutions to various industries.

Future Outlook

Over the next five years, the KSA EV Thermal Interface Materials market is expected to witness steady growth driven by the increased adoption of electric vehicles and the ongoing development of advanced thermal management solutions. With the continued expansion of the EV sector in Saudi Arabia and the broader Middle East, coupled with ongoing government support, the market will likely see sustained demand for efficient thermal interface materials, particularly for battery management systems and electric motors.

Major Players

- 3M Company

- Dow Inc.

- Henkel AG & Co. KGaA

- Honeywell International Inc.

- Indium Corporation

- SaintGobain

- Parker Hannifin Corporation

- DuPont

- Elkem

- Aspen Aerogels

- Polymer Science

- JBC Technologies

- Asahi Kasei

- XD Thermal

- Hanon Systems

Key Target Audience

- Automotive OEMs

- Battery Manufacturers

- Thermal Management Solution Providers

- Electric Vehicle Component Suppliers

- Government Agencies

- Investment and Venture Capitalist Firms

- EV Infrastructure Developers

- Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the key stakeholders and variables influencing the KSA EV Thermal Interface Materials market. This involves reviewing existing literature, consulting with industry experts, and compiling data on the key factors that drive demand, including the growth of the EV sector and advancements in thermal management technology.

Step 2: Market Analysis and Construction

Historical data on the EV market’s growth, thermal interface material adoption, and demand for energy-efficient components are analyzed to construct a detailed market model. This model helps define key market drivers, barriers, and trends shaping the thermal interface materials landscape in Saudi Arabia.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses and refine the analysis, interviews with key industry players, such as automotive manufacturers, thermal solution providers, and government officials, are conducted. This expert consultation ensures that the findings are based on real-world insights and align with current market dynamics.

Step 4: Research Synthesis and Final Output

The final research synthesis involves aggregating data from various sources, including market interviews, secondary research, and expert consultations. This stage ensures that the final market report provides an accurate and validated view of the KSA EV Thermal Interface Materials market, supporting informed decision-making.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- KSA Industry / Service / Delivery Architecture

- Growth Drivers

Growth of Electric Vehicle Production

Expansion in Renewable Energy Projects

Increasing Government Incentives for EV Adoption

Rising Consumer Demand for Longer-Range EVs

Technological Advancements in Battery Design - Market Challenges

High Material Cost

Technological Complexities in Manufacturing

Supply Chain Disruptions for Raw Materials

Fluctuating Prices of Key Components (e.g., Graphite, Silicone)

Regulatory Challenges in Material Standards - Opportunities

Increasing Demand for EV Battery Efficiency

Innovations in Thermal Management Materials

Growing Trend of Sustainable and Eco-friendly Products

Partnerships between Material Suppliers and EV Manufacturers

Advancements in Recycling and Reuse of Thermal Materials - Trends

Integration of Advanced Thermal Interface Solutions in EVs

Shift Towards Sustainable Manufacturing Practices

Adoption of Phase Change Materials in EVs

Increase in Smart Thermal Management Systems

Development of Lightweight Materials for EV Components - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Price, 2019–2024

- By Product Type (in Value %)

Thermal Pads

Thermal Grease

Thermal Tapes

Gap Fillers

Phase Change Materials - By Application (in Value %)

Battery Management Systems

Electric Motors

Power Electronics - By Distribution Channel (in Value %)

Direct Sales

Distributors

Online Retail - By Region (in Value %)

Central Region

Eastern Region

Western Region

Southern Region - By End-Use Industry (in Value %)

Automotive OEMs

Aftermarket

- Competition ecosystem overview

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Material, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and others)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

3M Company

Dow Inc.

Henkel AG & Co. KGaA

Honeywell International Inc.

Indium Corporation

SaintGobain

Parker Hannifin Corporation

DuPont

Elkem

Aspen Aerogels

Polymer Science

JBC Technologies

Asahi Kasei

XD Thermal

Hanon Systems

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Price, 2025–2030