Market Overview

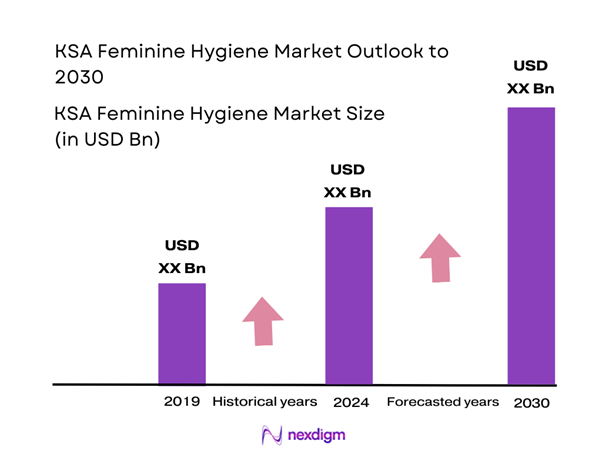

The KSA Feminine Hygiene Market is valued at USD 379.74 million in 2025 with an approximated compound annual growth rate of 4.01% from 2025-2030, based on historical analysis and current data. This growth is primarily driven by an increasing awareness around menstrual health management among women, coupled with evolving consumer preferences for high-quality and eco-friendly products. As Saudi Arabia continues to invest in women’s health education and empowerment, demand for various feminine hygiene products is expected to rise.

The market is significantly dominated by urban centers such as Riyadh and Jeddah. These cities are pivotal due to their larger populations, increased accessibility to retail outlets, and a growing inclination towards premium feminine hygiene products. The presence of multinational brands and improved distribution channels in these metropolitan areas further solidify their dominance in the market.

The regulatory framework surrounding import duties and taxes has a considerable impact on the KSA Feminine Hygiene Market. As per Saudi Arabian trade regulations, import duties for personal hygiene products range from 5% to 20%, depending on the category. These duties can significantly influence pricing strategies for international brands entering the market and may affect overall product availability. Recent trade agreements and governmental efforts to streamline regulations aim to facilitate product imports while maintaining quality standards, thus providing opportunities for foreign brands to penetrate the market more effectively.

Market Segmentation

By Product Type

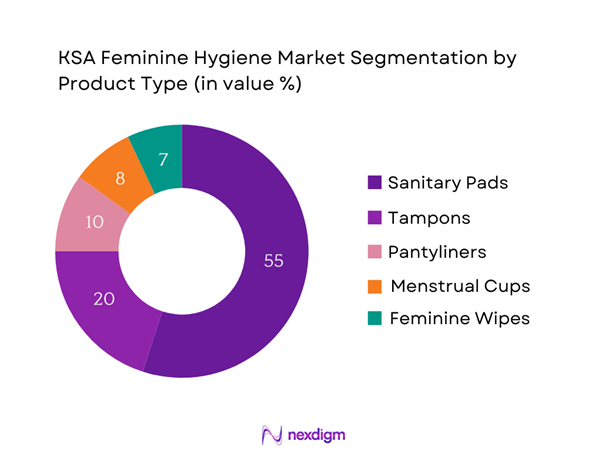

The KSA Feminine Hygiene Market is segmented by product type into sanitary pads, tampons, pantyliners, menstrual cups, and feminine wipes. Currently, sanitaryware hold a significant market share primarily due to their widespread availability, cultural acceptance, and affordability, making them the most utilized feminine hygiene product. Brands like Always and Kotex have established strong distribution networks that facilitate accessibility, further driving the demand for sanitary pads. The convenience of use and varying sizes also attract a diverse consumer base.

By Distribution Channel

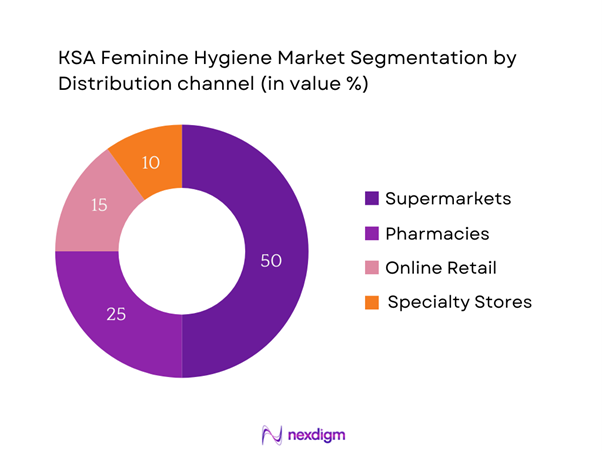

The market is segmented by distribution channel into supermarkets/hypermarkets, pharmacies, online retail, and specialty stores. Supermarkets and hypermarkets dominate this segment due to their extensive reach and ability to offer various brands and product types in one location. The convenience of shopping for hygiene products alongside grocery shopping enhances consumer purchasing behavior. Retail giants leverage promotions and bundling strategies, which further solidifies their leading position in the market.

Competitive Landscape

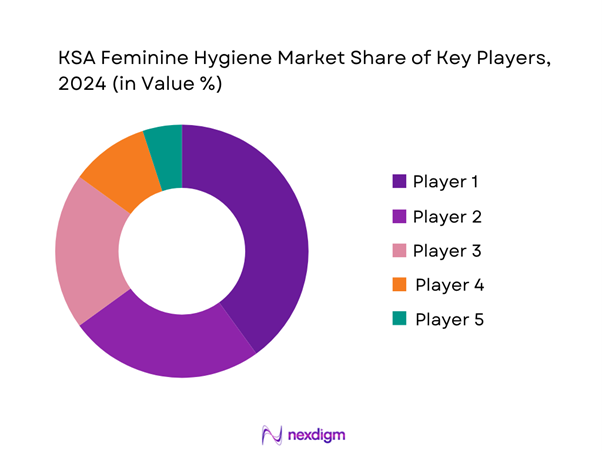

The KSA Feminine Hygiene Market is characterized by a competitive landscape dominated by several key players. The market’s structure indicates a concentration among a few leading brands, which hold significant influence over consumer choices and trends. Strong brand loyalty, extensive distribution facilities, and product innovation are determining factors in this competitive market.

| Company Name | Establishment Year | Headquarters | Product Range | Market Strategy | Annual Revenue | Market Presence |

| Procter & Gamble | 1837 | Cincinnati, USA | – | – | – | – |

| Kimberly-Clark | 1872 | Irving, USA | – | – | – | – |

| Unicharm Corporation | 1961 | Tokyo, Japan | – | – | – | – |

| Johnson & Johnson | 1886 | New Brunswick, USA | – | – | – | – |

| Edgewell Personal Care | 2016 | North Carolina, USA | – | – | – | – |

KSA Feminine Hygiene Market Analysis

Growth Drivers

Increasing Awareness and Education

The increasing awareness of menstrual hygiene management has led to significant shifts in consumer behavior within the KSA Feminine Hygiene Market. Reports indicate that over 60% of women in Saudi Arabia now recognize the importance of proper menstrual hygiene practices, a substantial improvement from previous years. Initiatives led by governmental and non-governmental organizations focused on women’s health education have been pivotal in this transformation. As of late 2022, the Government of Saudi Arabia allocated SAR 4 billion towards women’s health initiatives, reflecting a growing commitment to enhancing public awareness and education surrounding feminine hygiene.

Expanding Retail Sector

The rapid expansion of the retail sector in Saudi Arabia is set to bolster the availability of feminine hygiene products. By end of 2025, the total number of retail outlets in the country is projected to surpass 25,000, driven by a growing consumer base and urbanization. With significant investments from both global and local retail chains, consumers are gaining improved access to a diverse range of feminine hygiene products. Recent changes in regulations facilitating foreign investments have also stimulated market competition, which is expected to enhance product variety and quality for consumers.

Market Challenges

Cultural Sensitivity

Cultural sensitivity remains a significant challenge for the KSA Feminine Hygiene Market, impacting product acceptance and consumer choices. Despite progress, many women in Saudi Arabia still face social stigmas associated with discussing menstrual health openly. Reports indicate that approximately 45% of women express discomfort when purchasing feminine hygiene products due to cultural taboos. This sensitivity poses a barrier to market penetration, as many women opt for less visible purchasing channels, affecting brand visibility and market growth potential. Promoting open dialogue and education about menstrual health is crucial for overcoming these challenges.

Competition from Local Alternatives

Competition from local alternatives is intensifying within the KSA Feminine Hygiene Market, leading to challenges for established global brands. In 2022, local brands captured nearly 30% of the market share, appealing to price-sensitive consumers seeking affordable options. These local manufacturers often offer products that align closely with cultural preferences, leveraging brand loyalty. While this competition pressures pricing strategies of multinational companies, it can also push for innovation, as international players may need to adapt their products to meet local preferences and requirements effectively.

Opportunities

Innovations in Product Design

Current trends indicate a burgeoning demand for innovative product designs in the feminine hygiene market that respond to evolving consumer needs. In 2023, nearly 25% of women expressed interest in products that incorporate advanced materials and technologies, such as organic cotton and breathable fabrics. The recent launch of innovative features such as menstrual tracking apps paired with product purchases exemplifies the market’s shift toward integrating technology into traditional hygiene solutions. This inclination towards higher-quality, innovative products presents an opportunity for manufacturers to differentiate themselves and capture market share.

Eco-friendly and Organic Products

The demand for eco-friendly and organic feminine hygiene products is on the rise, driven by heightened environmental consciousness among consumers. Reports indicate that sales of organic feminine hygiene products have increased by over 20% in recent years, as consumers increasingly seek sustainable alternatives. The Government of Saudi Arabia is also promoting initiatives aimed at reducing waste, aligning with the global sustainability movement. As consumers become more aware of the benefits of eco-friendly products, manufacturers have an opportunity to capitalize on this trend by introducing biodegradable options and promoting them effectively.

Future Outlook

Over the next five years, the KSA Feminine Hygiene Market is expected to show considerable growth driven by continuous engagement in women’s health initiatives, advancements in product technology, and increasing consumer preferences for sustainable and organic products. The growing awareness of menstrual hygiene management is anticipated to propel demand for innovative products, positioning the market for a significant transformation. The collaborative efforts of both governmental and non-governmental organizations to enhance education regarding feminine hygiene will play a key role in shaping the future dynamics of this market.

Major Players

- Procter & Gamble

- Kimberly-Clark

- Unicharm Corporation

- Johnson & Johnson

- Edgewell Personal Care

- Bella Hygienic Products

- Sanita

- Nana Company

- Always KSA

- Libresse

- Anion

- Fine Hygienic Holding

- Naturella

- Carefree

- Pureen

Key Target Audience

- Women’s Health Corporations

- Retail and Distribution Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health, Saudi Food and Drug Authority)

- NGOs focused on Women’s Rights and Health

- Healthcare Providers and Clinics

- Manufacturers of Feminine Hygiene Products

- E-commerce Platforms

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves creating an ecosystem map that encompasses all major stakeholders within the KSA Feminine Hygiene Market. Extensive desk research is employed using both secondary and proprietary databases to gather comprehensive industry-level information. The goal is to identify and define the critical variables that influence market dynamics, including consumer behavior, product availability, and socio-cultural factors affecting product usage.

Step 2: Market Analysis and Construction

During this phase, historical data regarding the KSA Feminine Hygiene Market is compiled and analyzed. This includes assessing market penetration rates, the proportion of various products utilized in different segments, and revenue generation patterns. A thorough evaluation of statistics related to consumer behavior and product usage is conducted to derive accurate and reliable revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and subsequently validated through extensive consultation with industry experts representing a diverse range of companies. This is executed through computer-assisted telephone interviews (CATI) and in-person discussions. These consultations offer valuable insights into operational practices and market trends, which help refine and corroborate the collected data, ensuring accuracy and relevance.

Step 4: Research Synthesis and Final Output

The final phase encompasses direct engagement with multiple manufacturers and suppliers of feminine hygiene products. Detailed insights into product segments, sales performance, consumer preferences, and market trends are obtained during these interactions. This process serves to validate and complement the statistics and insights gained from previous steps, consolidating a comprehensive, accurate, and detailed analysis of the KSA Feminine Hygiene Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, In-Depth Industry Interviews, Primary Research Approach)

- Definition and Scope

- Historical Perspective

- Timeline of Major Players

- Industry Life Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Awareness and Education

Rising Disposable Income

Expanding Retail Sector - Market Challenges

Cultural Sensitivity

Competition from Local Alternatives - Opportunities

Innovations in Product Design

Eco-friendly and Organic Products - Trends

Subscription Services

Personalized Hygiene Solutions - Regulatory Environment

Import Duties and Taxes

Quality Standards and Certifications - SWOT Analysis

- Industry Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Sanitary Pads

– Ultra-thin Pads

– Maxi Pads

– Overnight Pads

– Maternity Pads

Tampons

– Applicator Tampons

– Non-Applicator Tampons

Pantyliners

– Daily Use Liners

– Scented Liners

– Organic Liners

Menstrual Cups

– Reusable Cups

– Disposable Cups

Feminine Wipes

– Regular Use Wipes

– pH-Balanced Wipes

– Travel-Friendly Wipes - By Distribution Channel (In Value %)

Supermarkets/Hypermarkets

Pharmacies

Online Retail

Specialty Stores - By Material Type (In Value %)

Synthetic

– Conventional Plastic-based Fabrics

– SAP-based Absorbents

Natural

– Organic Cotton

– Bamboo Fiber

– Biodegradable Materials - By End User (In Value %)

Teenagers

Adults - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Feminine Hygiene Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Financial Performance, Production Capabilities, Distribution Coverage, Innovations, Brand Equity, Margins, Production Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Procter & Gamble

Kimberly-Clark

Johnson & Johnson

Edgewell Personal Care

Unicharm Corporation

Bella Hygienic Products

Sanita

Nana Company

Always KSA

Libresse

Anion

Fine Hygienic Holding

Naturella

Carefree

Pureen

- Customer Preferences and Consumption Patterns

- Purchase Influencers

- Pain Points and Solutions

- Decision-Making Criteria

- Brand Loyalty and Switching

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030