Market Overview

Based on a recent historical assessment, the KSA fenders market recorded a market size of USD ~ billion, supported by combined demand from automotive manufacturing, commercial vehicle assembly, industrial equipment fabrication, and aftermarket replacement activities across the country. This valuation is supported by production statistics and component expenditure data published by the Saudi Ministry of Industry and Mineral Resources and trade flow records from UN Comtrade expressed in USD. Market expansion is driven by localization mandates under industrial development programs, rising vehicle parc volumes, and sustained infrastructure-linked industrial output requiring durable protective fender components.

Based on a recent historical assessment, Riyadh, Jeddah, Dammam, and Jubail dominate the KSA fenders market due to their concentration of automotive assembly plants, industrial clusters, logistics hubs, and heavy manufacturing zones. Riyadh benefits from policy-driven localization initiatives and supplier parks, while Jeddah’s dominance is linked to commercial vehicle fleets and aftermarket consumption supporting logistics and trade activities. Dammam and Jubail remain critical due to petrochemical and industrial equipment manufacturing bases that require industrial-grade fender systems for machinery, transport vehicles, and material handling applications.

Market Segmentation

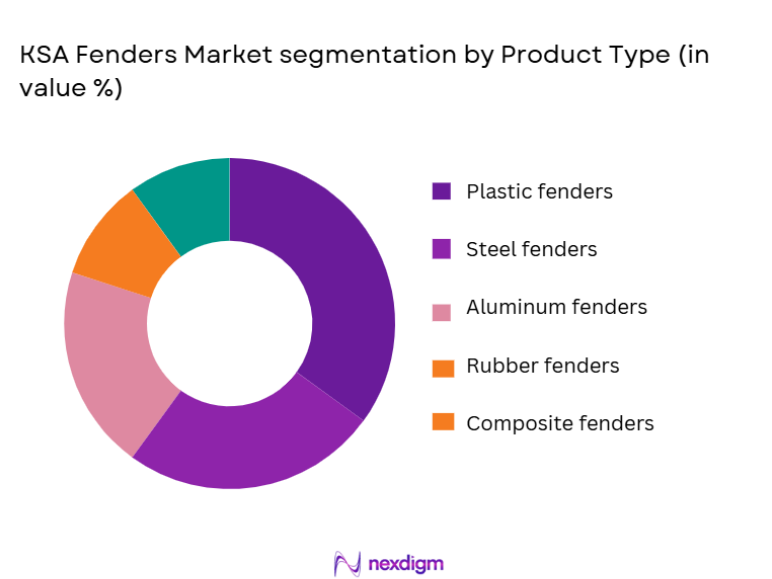

By Product Type

KSA Fenders market is segmented by product type into plastic fenders, steel fenders, aluminum fenders, rubber fenders, and composite fenders. Recently, plastic fenders have held a dominant market share due to their cost efficiency, corrosion resistance, lightweight properties, and compatibility with high-volume automotive manufacturing requirements. Plastic fenders align well with OEM design trends focused on weight reduction and fuel efficiency while enabling easier molding and customization for different vehicle platforms. Their suitability for both passenger and commercial vehicles, combined with strong local availability of polymer processing infrastructure and competitive pricing, has further reinforced adoption across OEM and aftermarket channels. Additionally, plastic fenders benefit from faster replacement cycles in the aftermarket, supporting consistent demand from fleet operators and individual vehicle owners across urban and industrial regions.

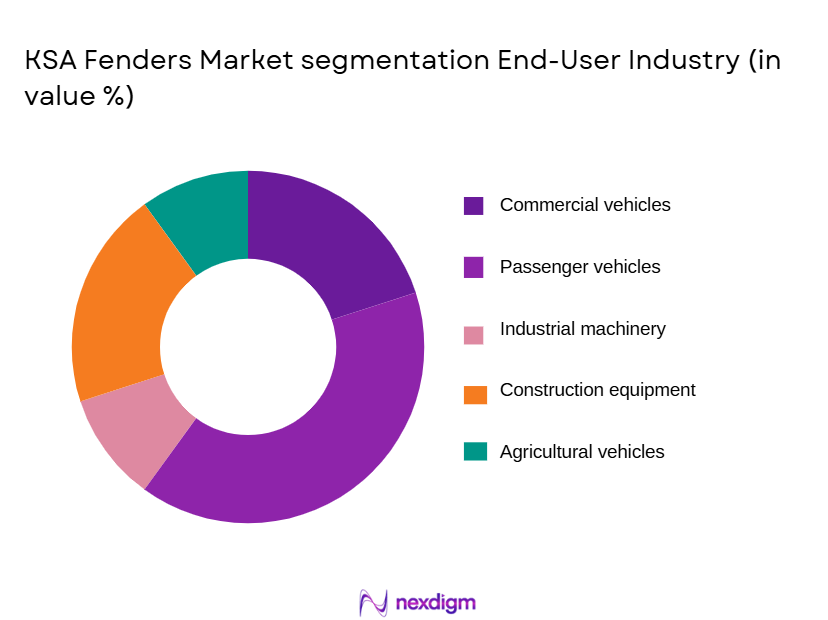

By End Use Industry

KSA Fenders market is segmented by end use industry into passenger vehicles, commercial vehicles, industrial machinery, construction equipment, and agricultural vehicles. Recently, commercial vehicles have dominated market share due to sustained logistics expansion, infrastructure development, and rising demand for fleet-based transportation supporting construction, oil and gas, and industrial supply chains. Commercial vehicles experience higher wear and tear, leading to frequent fender replacements and stronger aftermarket demand compared to passenger vehicles. Government-backed infrastructure projects, expanding warehousing activity, and increased last-mile logistics operations have further amplified commercial vehicle utilization, directly driving fender consumption. Additionally, localization of truck and bus assembly has increased domestic sourcing of body components, strengthening commercial vehicle fender demand across OEM and replacement markets.

Competitive Landscape

The KSA fenders market is moderately consolidated, with a mix of global automotive component manufacturers and strong regional suppliers supporting OEM and aftermarket demand. Large players benefit from long-term supply agreements, localized manufacturing facilities, and established distribution networks, while smaller firms focus on aftermarket customization and industrial applications. Competitive intensity is shaped by localization policies, pricing competitiveness, and material innovation.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Localization Presence |

| Toyota Boshoku | 1918 | Japan | ~ | ~

|

~

|

~

|

~

|

| Hyundai Mobis | 1977 | South Korea | ~

|

~

|

~

|

~

|

~

|

| Plastic Omnium | 1946 | France | ~

|

~

|

~

|

~

|

~

|

| Magna International | 1957 | Canada | ~

|

~

|

~

|

~

|

~

|

| SAPA Automotive | 1964 | Norway | ~

|

~

|

~

|

~

|

~

|

KSA Fenders Market Analysis

Growth Drivers

Automotive manufacturing localization and vehicle parc expansion

The KSA fenders market is strongly driven by the expansion of localized automotive manufacturing and the steady growth of the national vehicle parc, supported by industrial diversification programs. Increased domestic assembly of passenger and commercial vehicles has directly raised demand for locally sourced exterior body components, including fenders, to meet localization thresholds. Rising vehicle ownership, supported by urban population growth and improved financing access, has expanded the installed base of vehicles requiring replacement parts. Commercial fleet growth linked to construction, logistics, and oil and gas activities has accelerated wear-related replacement cycles. Localization incentives have encouraged suppliers to establish molding and fabrication facilities, reducing import dependency. This structural shift supports consistent OEM demand while strengthening aftermarket channels. Supplier integration with OEM platforms has improved cost efficiency and supply reliability. The combination of production scale and replacement demand sustains long-term volume growth across product categories.

Infrastructure-driven industrial and commercial transport demand

Large-scale infrastructure development across transport, industrial, and urban projects has increased utilization of commercial vehicles, construction equipment, and industrial machinery, directly supporting fender demand. Heavy-duty vehicles operating in harsh environments experience frequent exterior component damage, accelerating replacement frequency. Industrial zones and logistics corridors have expanded fleet operations, increasing cumulative mileage and physical exposure risks. Demand for robust fender materials suitable for high-load and high-impact applications has therefore risen. Government-backed construction programs sustain long-term equipment deployment cycles. Increased movement of goods across ports, warehouses, and industrial hubs reinforces commercial transport reliance. This operational intensity translates into steady aftermarket consumption. Industrial users prioritize durability and availability, supporting diversified fender material adoption.

Market Challenges

Volatility in raw material pricing and supply chains

The KSA fenders market faces persistent challenges from fluctuations in polymer, steel, aluminum, and rubber prices, which directly impact manufacturing costs and pricing stability. Global supply chain disruptions and commodity market volatility increase procurement uncertainty for manufacturers. Cost pressures can reduce margin visibility, particularly for suppliers operating under fixed-price OEM contracts. Smaller manufacturers face higher exposure due to limited hedging capabilities. Import reliance for specialty materials compounds lead time risks. Pricing volatility complicates long-term planning and inventory management. OEMs increasingly demand cost predictability, intensifying negotiation pressures. These factors collectively constrain profitability and operational flexibility across the value chain.

Regulatory compliance and quality standard alignment

Compliance with automotive safety, durability, and environmental standards presents a significant challenge for fender manufacturers in KSA. OEMs require adherence to global quality benchmarks, increasing testing, certification, and documentation costs. Environmental regulations related to material recyclability and emissions during production add further compliance complexity. Smaller suppliers may struggle to meet evolving standards without capital investment. Delays in certification can restrict market access. Quality non-compliance risks contract termination and reputational damage. Continuous standard updates require ongoing process upgrades. These regulatory pressures raise entry barriers and operational costs.

Opportunities

Aftermarket expansion driven by aging vehicle fleet

The growing age profile of vehicles operating in KSA presents a significant opportunity for the fenders market through increased replacement demand. Older vehicles experience higher rates of exterior wear, collision damage, and corrosion exposure, driving consistent aftermarket consumption. Expansion of independent service centers and spare part distributors improves market accessibility. Consumers increasingly prefer cost-effective replacement over full vehicle upgrades. Fleet operators prioritize rapid replacement to minimize downtime. Availability of locally manufactured fenders reduces lead times and pricing volatility. Digital marketplaces further enhance aftermarket reach. This ecosystem supports sustained demand growth beyond OEM channels.

Adoption of lightweight and composite materials

Increasing emphasis on vehicle efficiency and durability creates opportunities for advanced fender materials such as composites and engineered plastics. OEMs seek weight reduction to improve fuel efficiency and performance. Composite fenders offer corrosion resistance and design flexibility. Industrial machinery manufacturers value impact resistance and longevity. Local investment in advanced molding technologies supports material innovation. Technology partnerships enable skill transfer and product differentiation. Growing acceptance of non-metallic materials expands addressable market segments. These trends support premium product positioning and value-added growth.

Future Outlook

Over the next five years, the KSA fenders market is expected to benefit from sustained automotive localization, steady growth in commercial vehicle fleets, and expanding industrial activity. Advancements in lightweight materials and composite manufacturing are likely to reshape product preferences. Regulatory support for local manufacturing and supply chain resilience will strengthen domestic production capacity. Demand-side momentum from infrastructure, logistics, and aftermarket replacement is expected to remain stable.

Major Players

- Toyota Boshoku

- Hyundai Mobis

- Plastic Omnium

- Magna International

- SAPA Automotive

- Trelleborg Automotive

- Motherson Group

- Gestamp

- Yanfeng Automotive

- Faurecia

- Flex-N-Gate

- Benteler Automotive

- CIE Automotive

- ZF Friedrichshafen

- Lear Corporation

Key Target Audience

- Automotive OEMs

- Commercial fleet operators

- Industrial equipment manufacturers

- Construction companies

- Spare parts distributors

- Investments and venture capitalist firms

- Government and regulatory bodies

- Logistics and transport companies

Research Methodology

Step 1: Identification of Key Variables

Market variables including production volumes, component costs, trade flows, and end-use demand patterns were identified using government and industry databases to establish scope relevance.

Step 2: Market Analysis and Construction

Collected data was structured across product and end-use segments, integrating supply chain dynamics and localization impacts to construct the market framework.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, suppliers, and distributors were consulted to validate assumptions, confirm demand drivers, and refine segmentation accuracy.

Step 4: Research Synthesis and Final Output

All validated insights were synthesized into a coherent market model, ensuring consistency, accuracy, and alignment with observable industry trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of commercial ports under national logistics programs

Rising naval infrastructure investments for maritime security

Growth in offshore oil and gas terminal development - Market Challenges

High upfront cost of advanced fender systems

Strict compliance requirements with international standards

Long replacement cycles in mature port infrastructure - Market Opportunities

New port construction and capacity expansion projects

Demand for high energy absorption fender technologies

Retrofit and modernization of aging berthing facilities - Trends

Adoption of cone and cell fenders for large vessels

Increased use of corrosion resistant materials

Integration of monitoring systems for fender performance - Government Regulations

Compliance with international maritime safety standards

Port authority technical specifications and approvals

Defense procurement and certification requirements

- By Market Value 2019-2025

- By Installed Units 2019-2025

- By Average System Price 2019-2025

- By System Complexity Tier 2019-2025

- By System Type (In Value%)

Rubber marine fender systems

Pneumatic floating fenders

Foam filled fender systems

Cell and cone fender systems

Arch and cylindrical fenders - By Platform Type (In Value%)

Commercial port berthing platforms

Naval and coast guard bases

Offshore oil and gas terminals

Shipyards and dry docks

Inland waterways and jetties - By Fitment Type (In Value%)

Permanent quay mounted fenders

Floating and chain net fenders

Ship to ship transfer fenders

Temporary construction fenders

Retrofit fender installations - By EndUser Segment (In Value%)

Port authorities and operators

Naval and defense organizations

Oil and gas terminal operators

Shipbuilding and repair yards

Logistics and maritime service providers - By Procurement Channel (In Value%)

Direct government procurement

EPC and infrastructure contractors

Port development authorities

OEM direct supply contracts

Aftermarket and replacement suppliers

- Market Share Analysis

- CrossComparison Parameters (Energy absorption capacity, Reaction force performance, Material durability, Compliance with standards, Installation and maintenance complexity)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Trelleborg Marine Systems

Bridgestone Marine

Yokohama Rubber Marine

ShibataFenderTeam

Parker Systems

ArchFenders

IRPEN Rubber

Gulf Rubber Industries

Arabian Rubber Industries

Jebel Ali Rubber Products

Malcorp Marine

Palfinger Marine

Foreman Fabricators

Boomarine

Vikram Rubber

- Ports focus on durability and lifecycle cost efficiency

- Naval users prioritize high impact absorption and reliability

- Oil and gas terminals demand customized safety solutions

- Shipyards emphasize flexibility for varied vessel sizes

- Forecast Market Value 2026-2030

- Forecast Installed Units 2026-2030

- Price Forecast by System Tier 2026-2030

- Future Demand by Platform 2026-2030