Market Overview

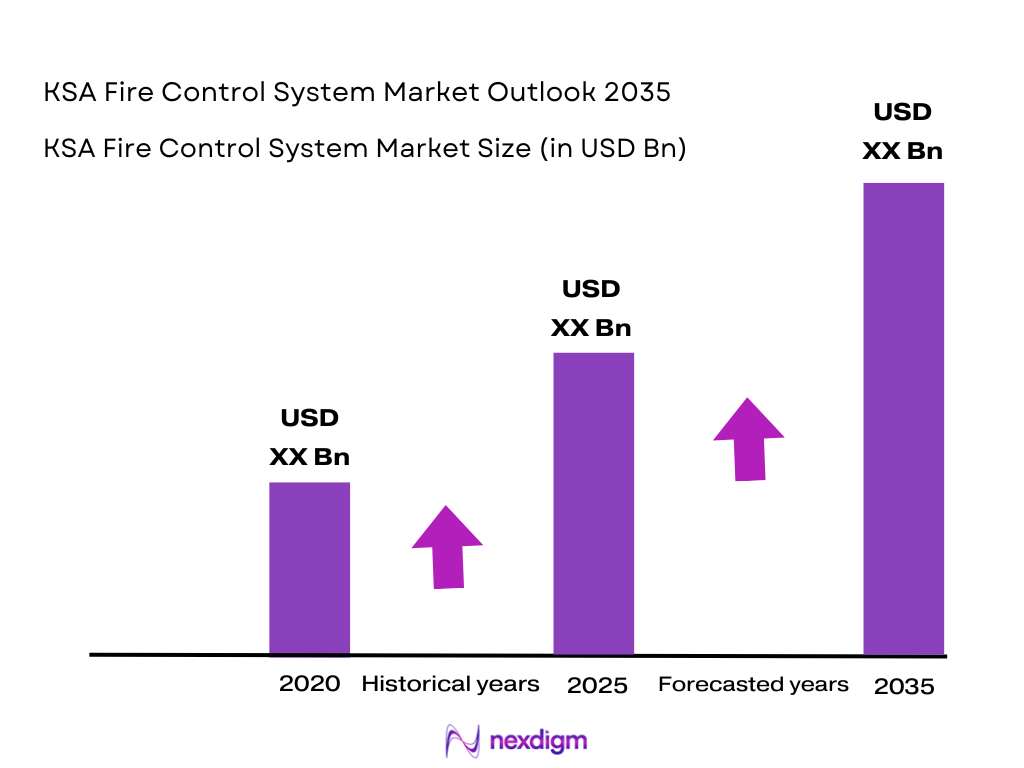

The Saudi Arabian fire control system market is valued at approximately USD ~ billion, driven by rising demand for fire safety solutions across industrial, commercial, and residential sectors. The market growth is primarily influenced by stringent government regulations, especially under the Saudi Civil Defense regulations, which enforce safety measures in construction and industrial projects. Additionally, the expansion of smart city initiatives and increased investments in critical infrastructure like healthcare, oil & gas, and manufacturing facilities are further propelling market demand. The introduction of advanced fire detection, alarm, and suppression systems to enhance safety in high-risk zones is also driving market growth.

Riyadh, Jeddah, and Dammam are the key cities leading the fire control system market in Saudi Arabia. Riyadh, the capital, hosts major government projects, commercial developments, and a growing number of high-rise buildings, boosting the demand for advanced fire safety systems. Jeddah, with its thriving port and commercial sector, is another hotspot for fire control solutions, driven by stringent regulatory standards for fire safety in residential and industrial buildings. Dammam, located in the Eastern Province, is central to the oil and gas sector, where fire protection is critical due to the volatile nature of the industry.

Market Segmentation

By System Type

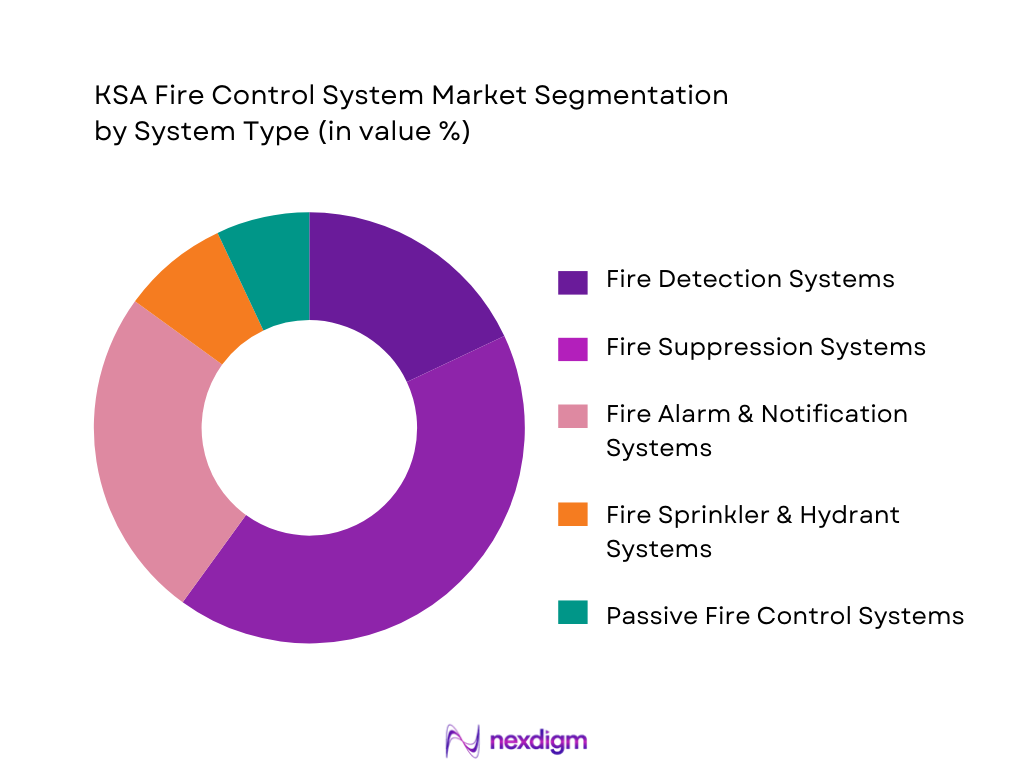

The fire control system market in Saudi Arabia is segmented by system type into fire detection systems, fire suppression systems, fire alarm & notification systems, fire sprinkler & hydrant systems, and passive fire control systems. Among these, fire suppression systems dominate the market. This dominance can be attributed to their critical role in industrial sectors like oil & gas, manufacturing, and petrochemicals, where fire risks are higher. The integration of advanced suppression systems, including clean agents and water mist systems, ensures quick response times to prevent severe damage in high-risk facilities. These systems are preferred due to their effectiveness in minimizing operational downtime and enhancing safety protocols.

By Service Type

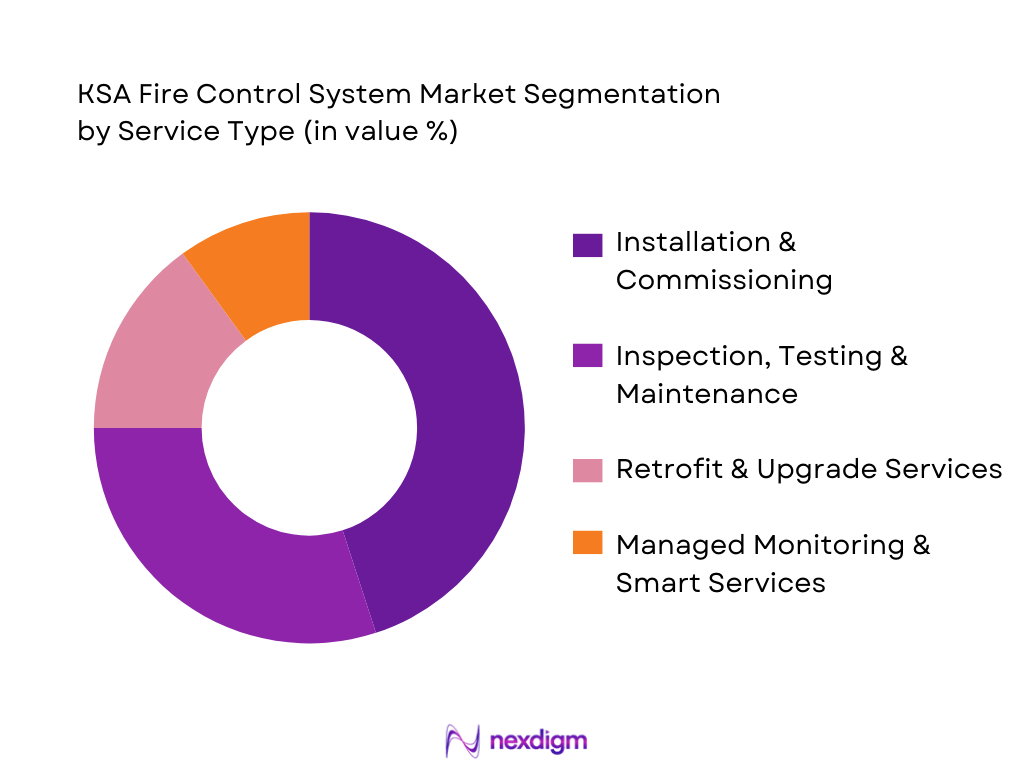

The service type segment of the market includes installation & commissioning, inspection, testing & maintenance (ITM), retrofit & upgrade services, and managed monitoring & smart services. Installation & commissioning services dominate the market share, driven by large-scale construction and infrastructure projects, which require sophisticated fire safety systems at the outset. Moreover, the growing demand for retrofitting older buildings with advanced fire protection systems is also contributing to the increase in service demand. The trend toward smart fire systems, offering remote monitoring and predictive maintenance capabilities, is enhancing the value proposition of managed monitoring services.

Competitive Landscape

The Saudi fire control system market is dominated by several global and regional players. Key players include Johnson Controls, Honeywell International, Siemens, and local companies such as SFFECO and Al Khuloud. These companies lead through their extensive portfolios, including fire detection, suppression systems, and smart fire safety solutions. The market is also influenced by the presence of regional players that cater to local compliance and regulatory requirements, such as SAS Systems Engineering and Firelink Saudi. The competition is fierce, with a strong emphasis on providing high-quality products, services, and technological innovations, particularly in integrated fire protection systems.

| Company | Establishment Year | Headquarters | Product Portfolio | Technology Adoption | R&D Capabilities | Compliance & Certifications |

| Johnson Controls | 1885 | Ireland | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ |

| Siemens AG | 1847 | Germany | ~ | ~ | ~ | ~ |

| SFFECO | 1981 | Saudi Arabia | ~ | ~ | ~ | ~ |

| SAS Systems Engineering | 1994 | Saudi Arabia | ~ | ~ | ~ | ~ |

KSA Fire Control System Market Analysis

Growth Drivers

Increasing Urbanization & Infrastructure Expansion

Saudi Arabia’s rapid urbanization and the large-scale infrastructure projects driven by Vision 2030 are significantly contributing to the growing demand for advanced fire control systems. As new commercial, residential, and industrial developments expand, particularly in high-rise buildings, malls, and factories, there is a heightened need for enhanced fire safety solutions. These projects are requiring more sophisticated and reliable fire detection, suppression, and alarm systems to protect people, assets, and properties in these increasingly dense urban environments.

Stringent Fire Safety Codes & Civil Defense Mandates

Saudi Arabia’s stringent fire safety regulations, enforced by the Saudi Civil Defense, are also a key factor driving the fire control system market. Compliance with these regulations is mandatory for both construction and operational safety. As a result, the adoption of advanced fire protection systems, including fire detection, suppression, and alarm technologies, is accelerating across various sectors. The need for compliance with these fire safety codes is pushing the market towards more sophisticated and efficient fire control solutions.

Market Challenges

High Upfront Costs & Complex Installations

One of the major challenges facing the fire control system market in Saudi Arabia is the high upfront costs and complex installation processes. These systems require substantial investment, and businesses often face difficulties in justifying these costs, especially when retrofitting older buildings or integrating advanced systems into existing infrastructures. The complexity of installation and the need for specialized expertise make the adoption of advanced fire control systems a challenging proposition for many businesses, particularly in cost-sensitive sectors.

Skilled Workforce & Certification Gaps

The shortage of skilled professionals trained in the installation, maintenance, and certification of advanced fire control systems is another significant challenge. This gap in qualified personnel results in delayed project timelines and potentially impacts the quality of service, thereby hindering widespread adoption of modern fire safety solutions. Addressing this skills gap is crucial for the smooth implementation and efficient operation of fire control systems, especially in an environment where the demand for these systems is growing rapidly.

Market Opportunities

AI & ML‑Driven Early Detection

The integration of artificial intelligence (AI) and machine learning (ML) in fire detection systems presents a major opportunity in the Saudi market. These technologies enable smarter, more efficient early detection, predictive analytics, and faster emergency response times. AI and ML-driven systems can analyze vast amounts of data to detect fire risks before they escalate, thereby minimizing potential damage and improving safety, particularly in high-risk environments such as high-rise buildings, factories, and shopping malls. This advancement could significantly enhance the effectiveness and reliability of fire control systems.

IoT & Predictive Maintenance for Fire Control

The rise of Internet of Things (IoT)-enabled fire control systems presents a valuable opportunity for improving fire safety management in Saudi Arabia. These smart systems allow for remote monitoring, real-time data collection, and predictive maintenance. By utilizing IoT technologies, fire control systems can predict potential failures and optimize performance, reducing operational downtime and maintenance costs. This enhances the overall reliability of fire control systems and ensures a proactive approach to maintaining safety standards, particularly in large-scale infrastructure projects.

Future Outlook

Over the next 5 years, the Saudi Arabian fire control system market is expected to experience significant growth. This is driven by the country’s infrastructure boom, particularly within the commercial and industrial sectors, as well as advancements in smart and connected fire safety systems. Furthermore, increasing awareness about fire safety, coupled with stricter regulations and compliance measures, will further propel the adoption of advanced fire suppression and detection systems. In addition, the shift toward IoT-enabled and cloud-managed solutions will revolutionize the industry, creating new opportunities for innovation and service offerings.

Major Players in the Market

- Johnson Controls

- Honeywell International

- Siemens AG

- Bosch Building Technologies

- UTC Fire & Security (Carrier)

- Minimax Viking GmbH

- Hochiki Corporation

- Gentex Corporation

- Schneider Electric

- Kidde (Carrier)

- SFFECO

- Firelink Saudi

- SAS Systems Engineering

- Industrial Basic Solutions Co.

- Al Khuloud Int’l Fire & Safety Co.

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Civil Defense)

- Facility Management Companies

- Property Developers & Construction Firms

- Oil & Gas Industry Stakeholders

- Commercial & Residential Developers

- Industrial Manufacturing Units

- Health and Safety Executives in High-Risk Industries

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping out the entire ecosystem of fire control systems within Saudi Arabia. Desk research utilizing secondary sources provides critical insights into market trends, regulatory guidelines, and consumer needs.

Step 2: Market Analysis and Construction

In this phase, we consolidate data from diverse sources, analyzing market demand by product type, service offerings, and regional segmentation. Historical data on fire safety adoption rates and system penetration is crucial for building an accurate market forecast.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews with key stakeholders in the fire control system industry. These consultations refine assumptions and provide deeper operational insights into system preferences, procurement processes, and customer behavior.

Step 4: Research Synthesis and Final Output

The final stage involves compiling data gathered from the previous steps and validating them with direct feedback from manufacturers, suppliers, and end-users. This synthesis results in a comprehensive report that captures the most accurate trends and projections for the Saudi market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Regional Fire Safety Standards & Codes (e.g., SBC 801/802), Primary vs Secondary Research Approach, Data Triangulation and Validation, Market Sizing & Forecasting Model, Limitations and Future Opportunities)

- Definition and Scope

- Market Genesis and Saudi Vision 2030 Infrastructure Linkages

- Regulatory Ecosystem

- Value Chain & Stakeholder Mapping

- Fire Control System Business Cycle Dynamics

- Growth Drivers

Increasing Urbanization & Infrastructure Expansion

Stringent Fire Safety Codes & Civil Defense Mandates

Rise of Smart Building Standards & Connected Fire Control

Oil & Gas & Industrial Risk Mitigation Requirements - Market Challenges

High Upfront Costs & Complex Installations

Skilled Workforce & Certification Gaps

Integration Complexity Across Legacy Building Systems - Market Opportunities

AI & ML‑Driven Early Detection

IoT & Predictive Maintenance for Fire Control

Local Manufacturing + Technology Transfer Partnerships - Market Trends

Wireless & Addressable Detection Growth

Sustainability & Energy‑Efficient Fire Systems

AI / ML Fire Pattern Recognition for Data Centers - Government Regulation & Compliance

National Fire Protection Standards Adoption

Mandatory Periodic Fire Audits

Incentives for Smart System Deployment - SWOT Analysis

- PESTEL & Macro‑economic Considerations

- Porter’s Five Forces

- Stakeholder Influence Mapping

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By System Type (In Value %)

Fire Detection Systems (Smoke, Heat, Multi‑sensor)

Fire Suppression Systems (Clean Agents, Water Mist, CO₂, Foam)

Fire Alarm & Notification Systems

Fire Sprinkler & Hydrant Systems

Passive Fire Control Solutions

Integrated and Addressable Fire Control Platforms - By Service Type (In Value %)

Engineering, Design & Consulting

Installation & Commissioning

Inspection, Testing & Maintenance (ITM)

Managed Monitoring & Smart Services

Retrofit / Upgrade Services - By Deployment Mode (In Value %)

Standalone Systems

IoT‑Enabled Smart / Connected Systems

Cloud‑Managed Fire Control Platforms - By Application Sector (In Value %)

Commercial Buildings (Retail, Office, Hospitality)

Industrial Facilities (Manufacturing, Processing Plants)

Oil & Gas & Petrochemical Installations

Residential Complexes

Critical Infrastructure (Healthcare, Data Centers, Airports)

Government & Military Facilities - By Buyer / End‑User (In Value %)

Original Equipment Manufacturers (OEMs)

System Integrators / EPC Contractors

Facility Owners / Property Developers

Government & Regulatory Bodies - By Region (In Value %)

Riyadh Metro & Central Region

Eastern Province Industrial Belt

Western Region (Jeddah / Makkah Development Zones)

Northern & Southern Growth Corridors

- Market Share by Value & Volume

- Cross‑Comparison Parameters (Company Overview (Strategic Footprint), Product / Solution Portfolio Breadth, Technology Adoption (Smart / IoT / Cloud), Certification & Compliance Credentials, Installed Base & Repeat Business Score, Service Ecosystem Strength (Design, Maintenance), Geographic Coverage & Local Partnerships, Revenue Split by System Type, R&D & Innovation Index, Price Positioning & SKU Mapping, Distribution & Channel Reach, Brand Trust & Regulatory Approvals)

- Competitor Profiles

Johnson Controls International plc (Integrated Building Safety)

Honeywell International Inc. (Advanced Detection & Suppression)

Siemens AG (Integrated Building Technologies)

Bosch Building Technologies (Alarm & Detection Platforms)

UTC Fire & Security (Carrier Global) (Alarm & Control Systems)

Minimax Viking GmbH (Suppression Systems)

Hochiki Corporation (Detection Sensors)

Gentex Corporation (Notification Devices)

Schneider Electric SE (Smart Safety Integration)

Kidde (Carrier) (Suppression & Alarm)

SFFECO – Saudi Factory for Fire Equipment Co. (Local Systems & Supplies)

Firelink Saudi (Jersey Group) (System Integration)

SAS Systems Engineering (Engineering & Deployments)

Industrial Basic Solutions Co. (EPC & Services)

Al Khuloud Int’l Fire & Safety Co.

- Demand & Utilization Profiles

- Procurement Cycles & Budget Frameworks

- Compliance Impact by Sector

- End‑User Pain Points & Decision Criteria

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035