Market Overview

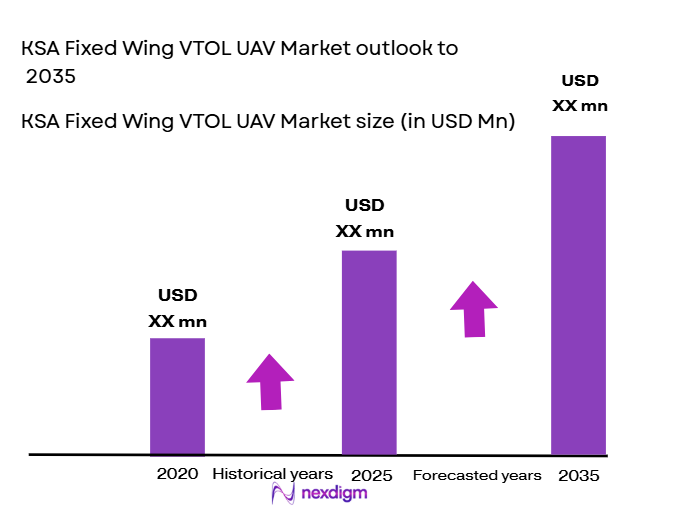

The KSA Fixed Wing VTOL UAV market is valued at approximately USD ~ billion, driven by significant investments from both the government and private sectors. The growing demand for UAVs in military applications, surveillance, and logistics, combined with technological advancements, has fueled the market’s expansion. Moreover, the Kingdom’s Vision 2030 initiative, which prioritizes defense and technological innovation, is pushing for the development of UAVs. Additionally, the increasing adoption of UAVs for military reconnaissance, surveillance, and infrastructure inspection continues to drive market demand. These factors have propelled the market’s growth trajectory in recent years, and the trend is expected to continue in the coming years.

Saudi Arabia is the primary player in the KSA Fixed Wing VTOL UAV market, with Riyadh and Jeddah serving as key hubs for defense and technology innovation. Riyadh, the capital, is home to several defense contractors and government agencies that heavily invest in UAV technology for military and civilian applications. Jeddah, located along the Red Sea, benefits from a strategic position, facilitating international trade and surveillance operations. Additionally, Saudi Arabia’s investments in technology infrastructure and defense equipment are shaping the country’s dominance in the UAV market in the region.

Market Segmentation

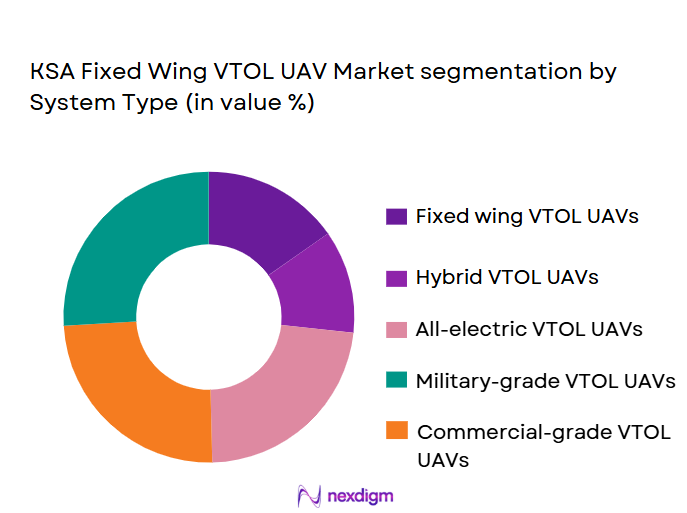

By System Type

The KSA Fixed Wing VTOL UAV market is segmented by system type into Vertical Take-Off and Landing UAVs, Hybrid UAVs, Autonomous UAVs, Electric Propulsion UAVs, and Heavy Lift UAVs. Currently, Vertical Take-Off and Landing UAVs dominate the market due to their versatility and ability to operate in confined spaces, making them ideal for both military and civilian applications. These UAVs are extensively used for surveillance, reconnaissance, and logistics in urban and remote areas, which explains their popularity. The increasing emphasis on autonomous and hybrid systems has also contributed to their growth, but VTOLs maintain a stronghold due to their superior adaptability and ease of use.

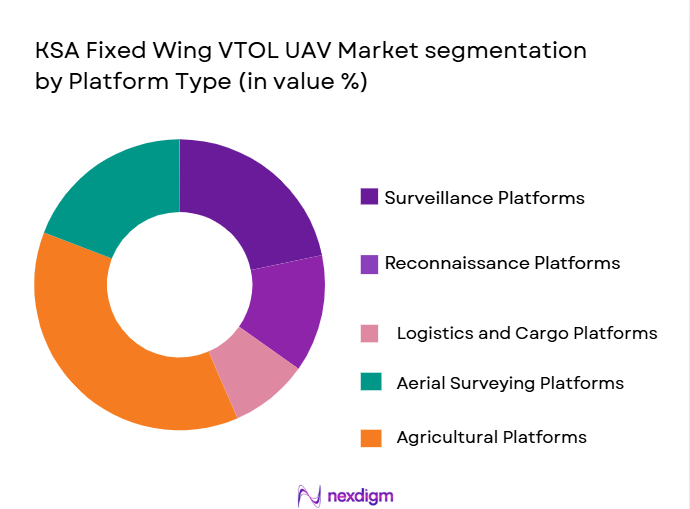

By Platform Type

The market is also segmented by platform type, which includes Military Platforms, Civilian Platforms, Commercial Platforms, Research and Development Platforms, and Surveillance Platforms. Military Platforms hold the largest share due to the rising need for advanced UAVs in defense and border surveillance operations. Saudi Arabia’s defense strategy heavily relies on unmanned systems for intelligence, surveillance, and reconnaissance (ISR) missions, contributing to the dominance of this segment. The ongoing modernization of military fleets and rising defense budgets further drive the demand for military-grade UAVs in the region.

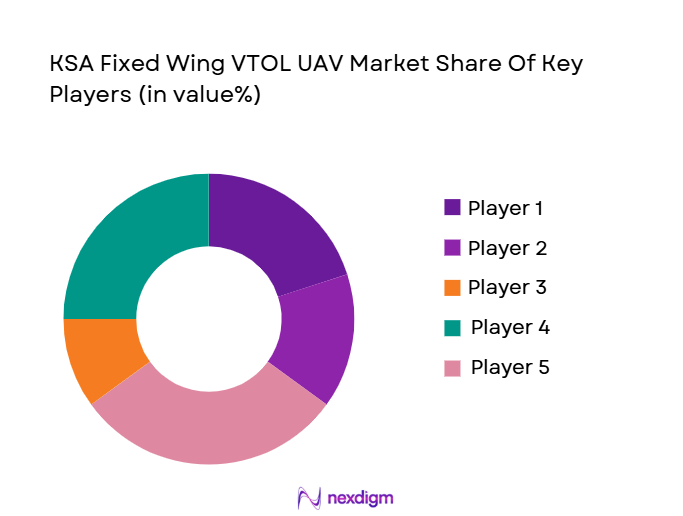

Competitive Landscape

The KSA Fixed Wing VTOL UAV market is dominated by both global and local players, with major players including Boeing, Lockheed Martin, and General Atomics. The presence of these industry giants highlights the significance of defense-related UAV technology. However, local players like the Saudi Arabian Military Industries (SAMI) and others are gradually strengthening their foothold by focusing on locally produced UAV systems, which are preferred by the government for strategic and economic reasons.

| Company Name | Establishment Year | Headquarters | Technology Focus | Product Portfolio | Key Market | Recent Development |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| General Atomics | 1955 | San Diego, USA | ~ | ~ | ~ | ~ |

| Saudi Arabian Military Industries (SAMI) | 2017 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ |

| Textron Systems | 1923 | Providence, USA | ~ | ~ | ~ | ~ |

Singapore Aircraft Sensors Market Analysis

Growth Drivers

Increasing Demand for Aircraft in Singapore Due to Growth in Air Travel and Tourism

Singapore’s aviation ecosystem is a key contributor to the demand for aircraft sensors, as air travel and tourism continue to expand. The country’s aerospace industry, valued at approximately USD ~billion in 2024, is reinforced by its strategic position as a global aviation hub with world‑class MRO (Maintenance, Repair and Overhaul) facilities and operations. Singapore is home to over ~ aerospace companies working across R&D, manufacturing, and services, which supports robust demand for sensor technologies used in flight control, propulsion, and safety systems. This broad aerospace footprint—driven by regional passenger traffic growth—necessitates sophisticated sensors for aircraft safety, performance monitoring, and regulatory compliance, underpinning market growth for aircraft sensors.

Technological Advancements Leading to Development of More Sophisticated and Efficient Aircraft Sensors

Innovation in sensor technologies is a major growth driver for the aircraft sensors market in Singapore. As aircraft systems become more data‑intensive and automated, the adoption of advanced sensor technologies—such as MEMS (Micro‑Electro‑Mechanical Systems), optical, and inertial sensors—is increasing rapidly. These technologies are critical for real‑time data acquisition for flight control, engine monitoring, and predictive maintenance, enhancing aircraft efficiency and safety. Singapore’s aerospace sector benefits from strong R&D capabilities and collaborations with global aerospace firms, accelerating the integration of high‑precision sensors in commercial and defense aircraft operating in and through Singapore. The sophisticated sensors developed support complex avionics systems required by modern fleets, promoting further market expansion.

Market Challenges

Need for Highly Accurate and Reliable Sensor Data in Diverse Operational Conditions

One of the biggest challenges in the Singapore aircraft sensors market is meeting stringent performance requirements under diverse operational conditions. Aircraft sensors must maintain accuracy and stability at extreme altitudes, temperature variations, turbulence, and high vibration levels. Ensuring the reliability of sensor readings under such conditions is critical for flight safety but technologically demanding. The aviation regulatory environment also requires rigorous certification and validation, which can prolong development cycles and increase costs. This complicates the introduction of new sensor innovations into aircraft platforms used by both local and international carriers operating in Singapore.

Integration Complexities and Skill Shortages in Advanced Sensor Technologies

Integrating advanced aircraft sensors into modern avionics and aircraft systems requires specialized engineering skills and systems‑level expertise. The Singapore aerospace sector faces challenges in sourcing and retaining skilled professionals trained specifically in sensor integration, testing, and certification. This shortage impacts the speed at which advanced sensor technologies can be adopted, particularly for complex platforms like autonomous aircraft and next‑generation air mobility systems. Additionally, evolving standards in data connectivity and sensor interoperability necessitate continuous upskilling, which can strain resources and delay implementation timelines for operators and manufacturers.

Market Opportunities

Growth in Aircraft Maintenance, Repair, and Overhaul (MRO) Services

Singapore is a leading MRO hub in the Asia‑Pacific, with companies such as SIA Engineering Company serving over ~ international carriers. The extensive MRO infrastructure fuels demand for aircraft sensors needed during inspection, diagnostics, and system replacements. Sensors used in propulsion systems, avionics, and hydraulic monitoring are essential components in routine maintenance and overhaul activities. As commercial air traffic resumes following global disruptions, MRO volumes in Singapore are increasing, driving opportunities for sensor vendors to supply both OEM and aftermarket components for a broad fleet of aircraft.

Strategic Position as Aerospace Innovation and Testing Hub

Singapore’s status as one of Asia’s most diverse aerospace ecosystems positions it as an attractive market for introducing and testing next‑generation sensor technologies. With initiatives to expand facilities like the Seletar Aerospace Park and strong government support for innovation, sensor manufacturers and aerospace firms can collaborate on advanced sensor deployment for avionics, autonomous systems, and next‑gen mobility platforms. The country’s pro‑business policies and established aerospace supply chain create a solid platform for pilots and trials of novel sensor solutions, unlocking long‑term opportunities that extend into regional aerospace markets.

Future Outlook

Over the next decade, the KSA Fixed Wing VTOL UAV market is poised for significant growth, driven by the continuous demand for enhanced UAV technologies in both military and civilian sectors. Factors such as advancements in autonomous flight systems, increased defense spending, and the strategic focus on surveillance and reconnaissance operations will fuel this growth. Furthermore, Saudi Arabia’s Vision 2030 initiative, which encourages technological innovation and self-reliance in defense, will continue to shape the future of the UAV market. The integration of electric propulsion systems and hybrid platforms will further enhance the capabilities of these UAVs, making them more cost-effective and efficient.

Major Players

- Boeing

- Lockheed Martin

- General Atomics

- Saudi Arabian Military Industries (SAMI)

- Textron Systems

- Northrop Grumman

- Raytheon Technologies

- Elbit Systems

- Aurora Flight Sciences

- Kongsberg Gruppen

- Thales Group

- DJI Innovations

- AeroVironment

- PrecisionHawk

- UAVOS

Key Target Audience

- Government and regulatory bodies

- Military and defense contractors

- Aerospace and aviation companies

- Technology and innovation firms in UAV development

- Investments and venture capitalist firms

- UAV manufacturers and suppliers

- Defense equipment procurement agencies

- Commercial and civilian drone service providers

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing an ecosystem map of stakeholders in the KSA Fixed Wing VTOL UAV market. Secondary research sources, including industry reports and government publications, will be utilized to define key market variables.

Step 2: Market Analysis and Construction

Historical data pertaining to the KSA UAV market will be analyzed to identify trends, market demand, and supply dynamics. A detailed breakdown of market segments, such as system types and platform types, will be performed.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including UAV manufacturers, defense contractors, and government officials, will be consulted to validate initial market hypotheses. Telephone interviews and surveys will provide real-time insights into market dynamics.

Step 4: Research Synthesis and Final Output

Finally, detailed interviews with key players, such as Boeing, SAMI, and Lockheed Martin, will help to validate data, refine assumptions, and enhance market forecasts, ensuring a comprehensive and reliable report on the KSA Fixed Wing VTOL UAV market.

- Executive Summary

- KSA Fixed Wing VTOL UAV Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government investment in UAV technologies

Advancements in battery and propulsion systems

Rising demand for surveillance and reconnaissance missions - Market Challenges

Regulatory hurdles in UAV airspace management

High initial cost of systems

Technical complexity in hybrid system integration - Market Opportunities

Increasing use of UAVs in logistics and delivery

Expansion in renewable energy surveillance applications

Collaborations with commercial aviation for urban air mobility - Trends

Advances in autonomous flight technologies

Increased focus on battery efficiency and range

Integration of AI and machine learning in UAV operations

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Vertical Take-Off and Landing UAVs

Hybrid UAVs

Autonomous UAVs

Electric Propulsion UAVs

Heavy Lift UAVs - By Platform Type (In Value%)

Military Platforms

Civilian Platforms

Commercial Platforms

Research and Development Platforms

Surveillance Platforms - By Fitment Type (In Value%)

Standalone Systems

Integrated Systems

Retrofit Systems

Modular Systems

Custom Systems - By End-user Segment (In Value%)

Military & Defense

Aerospace & Aviation

Energy & Utilities

Agriculture

Logistics & Supply Chain - By Procurement Channel (In Value%)

Direct Sales

Government Contracts

Third-Party Distributors

Online Marketplaces

OEM Partnerships

- Market Share Analysis

- Cross Comparison Parameters

(Market penetration, Technological advancement, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity Cost efficiency, Regulatory approval speed, Platform versatility) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Boeing

Lockheed Martin

Northrop Grumman

General Atomics

Elbit Systems

Raytheon Technologies

Aurora Flight Sciences

Textron Systems

Saab

UAVOS

DJI Innovations

PrecisionHawk

AeroVironment

Kongsberg Gruppen

Thales Group

- Growing interest from defense forces for surveillance and combat operations

- Adoption of UAVs in large-scale agricultural monitoring

- Use of UAVs in infrastructure inspection for utilities

- Rising demand for UAVs in logistics to optimize delivery services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035