Market Overview

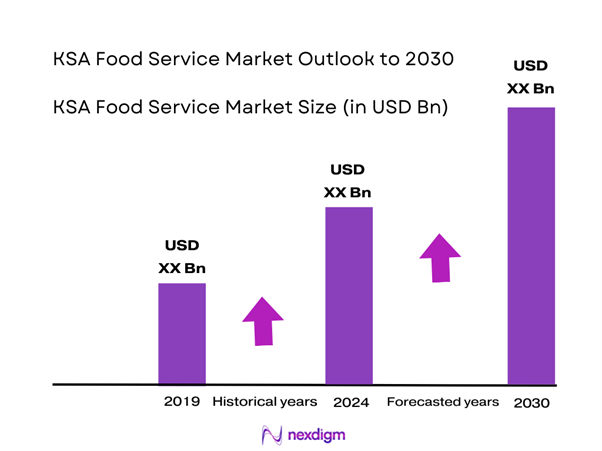

The KSA Food Service Market is valued at USD 30.12 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 8.20% from 2025-2030, supported by a growing consumer preference for dining out and a robust tourism sector. This growth can be attributed to the increasing disposable incomes along with a shift towards convenience-driven lifestyles. Moreover, the expansion of food delivery apps and globalization of cuisines have significantly influenced the market dynamics. Data from the Ministry of Commerce and Investment highlights a remarkable growth rate within the sector, driven by both domestic consumption and foreign investments.

Dominant cities in the KSA Food Service Market include Riyadh, Jeddah, and Dammam. These cities play a crucial role due to their large urban populations, economic activity, and cultural significance. Riyadh, as the capital, serves as a business and commercial hub with a diverse culinary scene that attracts both locals and tourists. Jeddah, with its strategic location along the Red Sea, witnesses a significant influx of visitors enhancing the demand for various food services. Dammam, a growing industrial center, benefits from the increasing number of corporate clients looking for catering services and dining options.

The growth in tourism significantly impacts Saudi Arabia’s food service market. As the country continues to invest in its tourism infrastructure, the number of international visitors is expected to rise dramatically. In 2023, Saudi Arabia anticipated receiving over 20 million tourists, driven by initiatives such as Vision 2030, which aims to diversify the economy.

Market Segmentation

By Type of Establishment

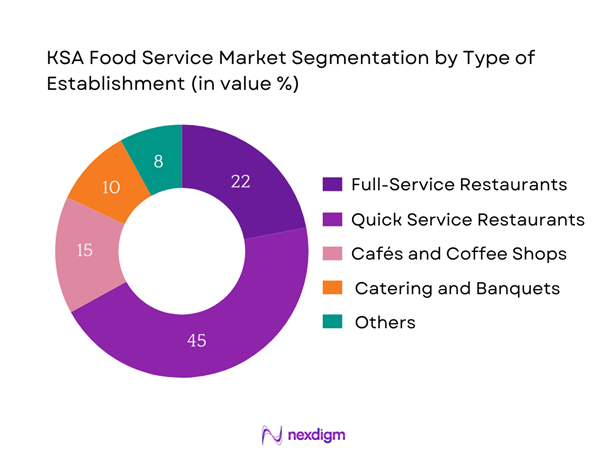

The KSA Food Service Market is segmented by type of establishment into full-service restaurants, quick service restaurants, cafés and coffee shops, catering and banquets, and others. Among these, quick service restaurants have emerged as the dominant segment. This trend is attributed to the increasing urbanization and fast-paced lifestyle of consumers who prefer convenient dining options. Brands such as McDonald’s and Kudu have established extensive networks, making them easily accessible. Their focus on innovative menu options and value meals drives customer loyalty, contributing to their leading market position.

By Cuisine Type

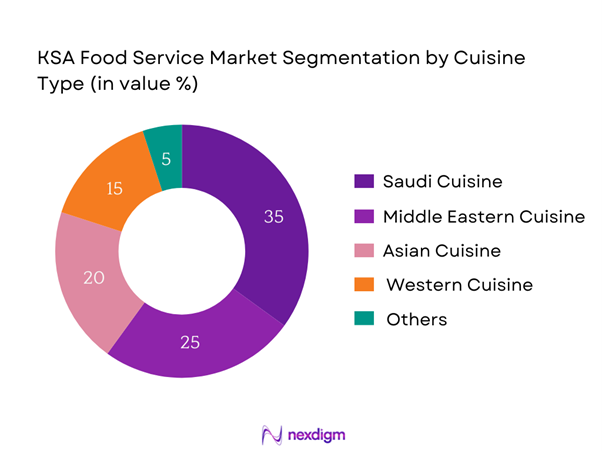

The market is further segmented by cuisine type, including Saudi cuisine, Middle Eastern cuisine, Asian cuisine, Western cuisine, and others. Among these segments, Saudi cuisine currently maintains a dominant share due to the cultural heritage and preferences among local consumers. Traditional dishes such as Kabsa and Mandi are staples in Saudi households and restaurants, making them popular choices for both locals and tourists exploring authentic experiences. The emphasis on preserving and promoting national cuisine propels its growth in the food service sectors, particularly in established markets like Riyadh and Jeddah.

Competitive Landscape

The KSA Food Service Market is dominated by key players including Al Baik, Americana Group, and Savola Group, amongst others. This consolidation illustrates the significant influence of these established companies, which have created brand equity through extensive marketing and robust distribution channels. These leading players continually adapt their business strategies to cater to changing consumer preferences, thereby sustaining their competitive advantages.

| Major Players | Establishment Year | Headquarters | Market Penetration | Product Variety | Customer Outreach | Partnerships | Sustainability Initiatives |

| Al Baik | 1990 | Jeddah | – | – | – | – | – |

| Americana Group | 1964 | Riyadh | – | – | – | – | – |

| Savola Group | 1979 | Jeddah | – | – | – | – | – |

| McDonald’s KSA | 1993 | Riyadh | – | – | – | – | – |

| Kudu | 1989 | Riyadh | – | – | – | – | – |

KSA Food Service Market Analysis

Growth Drivers

Rising Disposable Income

Rising disposable income in Saudi Arabia is a key driver of growth in the food service market. As per the World Bank, the gross national income per capita increased to USD 20,000 in 2023, signifying higher spending power among consumers. Additionally, the GDP growth rate was around 4.8% in the previous year, reflecting a robust economic recovery post-pandemic. This surge in disposable income enables consumers to dine out more frequently and explore diverse culinary offerings, directly boosting the food service sector. Higher consumer confidence leads to increased spending in restaurants and cafes, which becomes a catalyst for market expansion.

Increasing Urbanization

Urbanization in Saudi Arabia is progressing rapidly, contributing significantly to the food service industry’s growth. As of 2024, approximately 83% of the population is expected to reside in urban centers, according to National Statistics Authority data. As urbanization accelerates, the number of working professionals and families in cities increases, which fuels demand for convenient dining options. Additionally, urban centers such as Riyadh and Jeddah are witnessing the emergence of shopping malls and commercial districts, further promoting restaurant openings and food chains to cater to urban lifestyles.

Market Challenges

Supply Chain Disruptions

Supply chain disruptions pose significant challenges to the KSA Food Service Market. Issues such as global shipping delays and rising costs of imported goods have resulted in increased prices for essential food items. The Saudi Arabian General Authority for Statistics reported a 5% increase in food and beverage prices in 2023 compared to the previous year due to these disruptions. Additionally, geopolitical tensions and fluctuations in oil prices can adversely affect supply chains, leading to instability in product availability for food service establishments.

High Competition Intensity

The KSA Food Service Market is characterized by intense competition among various players, ranging from international chains to local establishments. As of 2023, there are over 50,000 operating food service businesses in the kingdom, highlighting the saturation in certain sectors such as fast food and casual dining. This high level of competition can lead to price wars, negatively impacting profit margins, particularly for smaller businesses that may struggle to differentiate themselves. Companies must innovate and offer unique value propositions to remain competitive in this crowded market.

Opportunities

Health-Conscious Meals

There is a significant opportunity within the food service market to cater to the growing demand for health-conscious meals. According to the Saudi Food and Drug Authority, around 30% of the population is actively seeking healthier dining options, driven by rising health awareness and lifestyle changes. The demand for plant-based meals and organic ingredients is on the rise, prompting restaurants to innovate their offerings to meet consumer preferences. Establishments that prioritize nutrition and sustainability can capitalize on this emerging trend and potentially enhance their customer base.

Expansion into Untapped Regions

Expansion into untapped regions presents significant growth prospects for the food service market in Saudi Arabia. Smaller cities and rural areas are witnessing rapid development as part of the government’s efforts to promote regional growth and diversification from urban centers. The Saudi Arabian Ministry of Municipal and Rural Affairs indicates a rising middle-class population in these regions that seeks greater dining options. As infrastructure improves and consumer spending grows, food service businesses can establish a presence in these emerging markets, increasing their footprint and revenue opportunities.

Future Outlook

Over the next five years, the KSA Food Service Market is expected to undergo significant transformations driven by evolving consumer preferences, enhanced food delivery services, and increased investments in the sector. The rising health consciousness among consumers will likely lead to growth in healthy dining options, while government initiatives to promote tourism and hospitality aim to bolster the food service industry. These factors, combined with the integration of technology in restaurant operations, are projected to fuel market expansion and adaptability.

Major Players

- Al Baik

- Americana Group

- Savola Group

- McDonald’s KSA

- Kudu

- Herfy Food Services

- Pizza Hut Saudi Arabia

- Domino’s Pizza KSA

- Dunkin’ Donuts KSA

- Subway Saudi Arabia

- Baskin-Robbins KSA

- Hardee’s Saudi Arabia

- Aujan Group

- Tamer Group

- Al-Munajem Foods

Key Target Audience

- Restaurant and Service Operators

- Food and Beverage Distributors

- Retailers and Grocers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Commerce and Investment, Saudi Food and Drug Authority)

- Hospitality Industry Stakeholders

- Event Planners and Catering Services

- Food Technology Developers

Research Methodology

Step 1: Identification of Key Variables

In this phase, we construct an ecosystem map encompassing all major stakeholders within the KSA Food Service Market. This step relies heavily on comprehensive desk research, leveraging a mix of secondary and proprietary databases to collate thorough industry-level insights. The primary goal is to identify and define the critical variables that shape market dynamics and growth.

Step 2: Market Analysis and Construction

Here, we compile and analyze historical data pertaining to the KSA Food Service Market. This includes evaluating market penetration rates, ratio analysis of service providers, and subsequent revenue generation. Further assessments of service quality complement these findings, ensuring the reliability and accuracy of revenue estimates generated during the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and then validated through direct consultations with industry experts via computer-assisted telephone interviews (CATIs). These conversations represent a wide swath of companies and segments within the food service industry, providing critical operational insights that refine and affirm the gathered data.

Step 4: Research Synthesis and Final Output

In the final phase, we engage with multiple food service providers to garner detailed insights regarding their operations, product offerings, sales performance, consumer preferences, and other relevant factors. This direct interaction acts as a verification method for the statistics derived from the bottom-up approach, ensuring a thorough, precise, and validated analysis of the KSA Food Service Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Disposable Income

Increasing Urbanization

Growth in Tourism - Market Challenges

Supply Chain Disruptions

High Competition Intensity - Opportunities

Health-Conscious Meals

Expansion into Untapped Regions - Trends

Digitization of Services

Eco-Friendly Packaging - Government Regulation

Licensing and Permits

Import Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019–2024

- By Average Price, 2019-2024

- By Type of Establishment (In Value %)

Full-Service Restaurants

– Fine Dining

– Casual Dining

– Family Style Restaurants

Quick Service Restaurants (QSRs)

– Burgers and Fried Chicken Chains

– Pizza and Pasta Chains

– Sandwich and Wrap Outlets

Cafés and Coffee Shops

– Specialty Coffee Chains

– Local Coffee Houses

– Dessert Parlors and Bakeries

Catering and Banquets

– Event Catering

– Institutional Catering

– Corporate Catering

Others

– Food Trucks

– Pop-up Kitchens

– Cloud/Virtual Kitchens - By Cuisine Type (In Value %)

Saudi Cuisine

– Kabsa and Mandi

– Samboosa, Jareesh, Harees

Middle Eastern Cuisine

– Lebanese, Syrian, Turkish

– Grilled Kebabs and Mezze

Asian Cuisine

– Indian, Chinese, Japanese, Thai

– Ramen, Sushi, Biryani

Western Cuisine

– American Fast Food

– Italian, French, Mexican

Others

– African Fusion

– International Buffets

– Vegan and Health-focused Cuisine - By Distribution Channel (In Value %)

Online Platforms

– Proprietary Brand Apps

– Aggregator Apps

Offline Channels

– In-store Dining

– Takeaway Counters

Third-Party Delivery Services

– Aggregator Logistics Partners

– Cloud Kitchen Logistics Providers - By Region (In Value %)

Riyadh

Jeddah

Dammam

Mecca

Medina - By End User (In Value %)

Individual

– Families

– Solo Diners

– Expats and Tourists

Corporate

– Office Cafeterias

– Business Meetings and Conferences

Educational Institutions

– School Canteens

– University Food Courts

Healthcare Facilities

– Hospital Cafeterias

– Staff Dining Services

Others

– Government Buildings

– Sports Complexes

– Airports and Travel Lounges

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Establishment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Establishment, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Al Baik

Americana Group

Al Tazaj

Savola Group

Al Ahlia Restaurants Co.

Herfy Food Services

McDonald’s KSA

Kudu

Pizza Hut Saudi Arabia

Domino’s Pizza KSA

Dunkin’ Donuts KSA

Subway Saudi Arabia

Baskin-Robbins KSA

Burger King KSA

Hardee’s Saudi Arabia

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030