Market Overview

The Saudi Arabian Fuel Cell UAV market is valued at USD ~ million, reflecting a growing demand for advanced UAV systems with sustainable and longer flight durations. This growth is driven by the integration of fuel cell technology into UAVs, offering enhanced energy efficiency and reduced environmental impact compared to traditional battery-powered drones. The increasing investment in UAV technology by the Saudi government, particularly for defense, surveillance, and agricultural applications, is a key factor in the market’s expansion. In addition, the Saudi Vision 2030 initiative plays a crucial role in promoting sustainable technologies, including fuel cell UAVs, supporting the transition to cleaner energy sources.

Saudi Arabia, particularly cities like Riyadh, Jeddah, and Dammam, is a dominant force in the Fuel Cell UAV market due to its strategic investments in defense and aerospace sectors. The Saudi government’s commitment to enhancing its defense capabilities and improving technological infrastructure has led to substantial growth in UAV applications, both military and civilian. Riyadh’s central role as the capital city is home to numerous government agencies and defense contractors that facilitate the development of UAVs, including those powered by fuel cells, making it a hub for this emerging market.

Market Segmentation

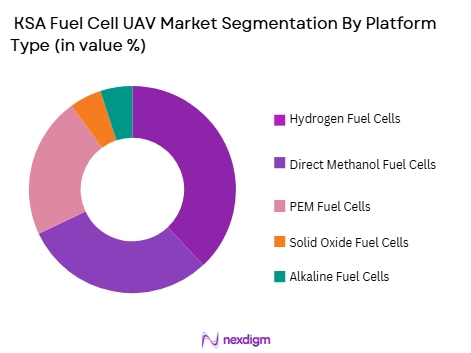

By System Type (In Value%)

The KSA Fuel Cell UAV market is segmented into Hydrogen Fuel Cells, Direct Methanol Fuel Cells, Proton Exchange Membrane (PEM) Fuel Cells, Solid Oxide Fuel Cells, and Alkaline Fuel Cells. Among these, Hydrogen Fuel Cells dominate the market due to their superior energy density, lightweight design, and long flight durations, making them ideal for UAV applications. These systems are preferred in military and surveillance sectors, where extended operational range and efficiency are critical. Saudi Arabia’s increasing focus on hydrogen fuel as a clean energy source is further boosting the demand for hydrogen-powered UAVs.

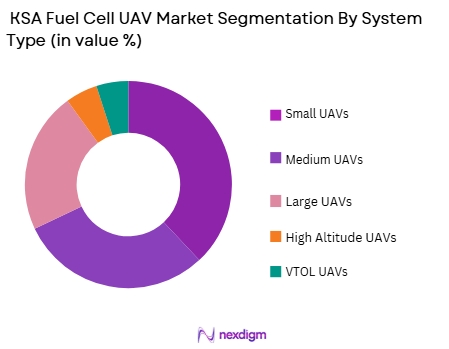

By Platform Type (In Value%)

The market is segmented into Small UAVs, Medium UAVs, Large UAVs, High Altitude UAVs, and Vertical Take-Off and Landing (VTOL) UAVs. Small UAVs have the dominant market share due to their widespread use in both military and commercial applications. These UAVs are commonly used for surveillance, reconnaissance, and monitoring missions, especially in urban and remote areas, making them ideal for integration with fuel cell systems. The demand for small UAVs is increasing because of their versatility and the need for longer flight times in various operational environments.

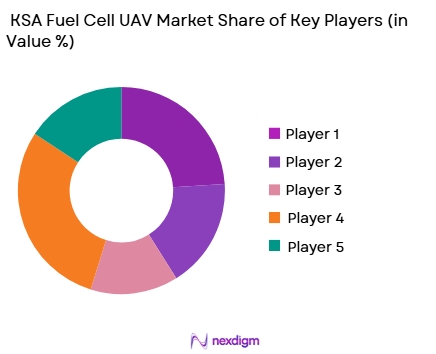

Competitive Landscape

The KSA Fuel Cell UAV market is dominated by several key players, both local and international, that are shaping the landscape with technological innovations and strategic partnerships. These companies focus on integrating fuel cell systems into UAVs to provide longer flight durations, higher energy efficiency, and lower operational costs. The market sees heavy competition from companies like Elbit Systems and Rafael Advanced Defense Systems, which are major players in Saudi Arabia’s defense and aerospace industries.

Competitive Landscape Table

| Company Name | Establishment Year | Headquarters | Products/Services | Market Focus | Revenue (USD) | Key Technology/Innovation |

| Elbit Systems | 1966 | Haifa, Israel | Defense UAVs, Fuel Cell Systems | Military UAVs | $5.3B | Advanced fuel cell integration |

| Israel Aerospace Industries | 1953 | Lod, Israel | UAVs, Defense Systems | Defense, Commercial | $4.5B | Hydrogen-based UAV technology |

| Rafael Advanced Defense Systems | 1985 | Haifa, Israel | UAVs, Aerospace Solutions | Military Applications | $3.8B | Fuel cell-powered UAV prototypes |

| Airobotics | 2014 | Petah Tikva, Israel | Autonomous UAVs | Industrial UAVs | $100M | Fuel cell integration for drones |

| General Atomics Aeronautical Systems | 1955 | San Diego, USA | UAVs, Surveillance Systems | Military UAVs | $4.4B | UAVs powered by fuel cells for reconnaissance |

KSA Fuel Cell UAV Market Analysis

Growth Drivers

Technological Advancements in Fuel Cell Systems

Advancements in fuel cell technology, especially hydrogen fuel cells, are a key driver for the KSA Fuel Cell UAV market. These systems offer high energy efficiency, longer flight durations, and reduced environmental impact compared to conventional battery systems. The continuous research and development in fuel cell technology, aimed at increasing power output and reducing weight, make fuel cell UAVs more viable for military, surveillance, and commercial applications, aligning with Saudi Arabia’s commitment to technological innovation and sustainability.

Government Support and Vision 2030 Initiatives

Saudi Arabia’s Vision 2030, which emphasizes technological advancements and sustainability, strongly supports the adoption of fuel cell UAVs. Government investments in defense and aerospace sectors, including funding for advanced UAV technologies, are accelerating the growth of the market. These initiatives are driving the demand for long-endurance UAVs with lower emissions, boosting the integration of fuel cell systems for both military and commercial applications across Saudi Arabia.

Market Challenges

High Initial Investment and Integration Costs

A significant challenge facing the KSA Fuel Cell UAV market is the high initial cost of fuel cell systems. These systems are considerably more expensive than traditional battery-powered UAVs. Additionally, integrating fuel cells into existing UAV platforms often requires substantial modifications and specialized expertise, adding complexity and further driving up costs. The upfront financial burden remains a barrier, particularly for smaller UAV operators or commercial entities.

Limited Hydrogen Infrastructure

The lack of a widespread hydrogen refueling infrastructure poses a significant challenge to the growth of fuel cell UAVs in Saudi Arabia. Hydrogen refueling stations are limited, especially in remote or operational areas, making it difficult to fully utilize hydrogen-powered UAVs. As fuel cell UAVs require reliable access to hydrogen for refueling, the lack of infrastructure slows down market adoption and presents logistical obstacles for large-scale deployment.

Opportunities

Growing Demand for Sustainable UAV Solutions

As global demand for sustainable and eco-friendly technologies rises, fuel cell UAVs present a significant opportunity in Saudi Arabia. The increasing focus on reducing carbon emissions and transitioning to cleaner energy sources aligns well with fuel cell technology’s zero-emission benefits. This presents growth potential for the market, as both defense and commercial sectors seek UAV solutions with longer operational durations and a smaller environmental footprint.

Expansion of Military and Surveillance Applications

Saudi Arabia’s expanding defense and surveillance requirements offer strong opportunities for fuel cell UAVs. The military’s need for long-endurance drones for reconnaissance and surveillance missions, coupled with the push for sustainability, creates demand for UAVs equipped with fuel cells. Moreover, international collaborations and defense contracts further present an opportunity for growth, allowing local manufacturers to expand their market share and enhance technological capabilities in the UAV sector.

Future Outlook

Over the next decade, the KSA Fuel Cell UAV market is expected to experience robust growth driven by technological advancements in fuel cell systems, increased demand for UAVs in defense and commercial sectors, and Saudi Arabia’s continued investments in aerospace technology. The focus on sustainability and the reduction of operational costs for UAVs will further propel the adoption of fuel cell technology, making it a preferred power solution for UAV applications. The market will see an increased integration of fuel cells into a wide range of UAV platforms, from small surveillance drones to high-altitude reconnaissance UAVs.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Airobotics

- General Atomics Aeronautical Systems

- AeroVironment

- Boeing

- Northrop Grumman

- Lockheed Martin

- Honeywell Aerospace

- Raytheon Technologies

- Airbus

- Quantum Systems

- UAV Factory

- SkyX Systems

Key Target Audience

- Aerospace and Defense Manufacturers

- Military Agencies (Saudi Ministry of Defense)

- UAV Technology Developers

- Government and Regulatory Bodies (Saudi Civil Aviation Authority)

- Investors and Venture Capitalist Firms

- UAV Service Providers

- Commercial Drone Operators

- Environmental and Agricultural Agencies

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing an ecosystem map to identify key stakeholders, including UAV manufacturers, defense contractors, and fuel cell technology providers in Saudi Arabia. We use secondary research from industry reports, government databases, and proprietary data sources to gather comprehensive market insights. The objective is to determine the major variables that impact the market dynamics of the KSA Fuel Cell UAV market.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on UAV market penetration, system adoption, and fuel cell technologies. We assess the ratio of UAV system types, including military and commercial, and estimate market revenue. Service quality, operational performance, and customer feedback are also considered to refine the market size estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through computer-assisted telephone interviews (CATIs) with industry experts across various segments. These consultations provide valuable operational and financial insights directly from market participants, helping to adjust and refine the preliminary market model. Insights from experts help corroborate the initial data analysis.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with key industry players, including manufacturers, suppliers, and service providers, to obtain granular insights into product segments, market trends, and consumer preferences. These insights are used to finalize the report, ensuring an accurate, validated, and detailed analysis of the KSA Fuel Cell UAV market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing demand for longer flight endurance in UAVs

Increase in military UAV applications in Saudi Arabia

Advancements in fuel cell technology for unmanned aircraft - Market Challenges

High initial investment for fuel cell systems

Technical limitations and efficiency challenges in UAVs

Limited fuel infrastructure for hydrogen-powered UAVs - Market Opportunities

Government initiatives and funding for UAV technologies

Surge in demand for environmentally friendly UAV solutions

Partnerships between defense contractors and UAV manufacturers - Trends

Integration of artificial intelligence in fuel cell UAVs

Shift towards hybrid power systems in UAV applications

Rising adoption of fuel cell UAVs in surveillance and monitoring - Government regulations

Regulations for hydrogen fuel storage and transport

Safety standards for fuel cell integration in UAVs

Export control regulations for military UAVs - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Hydrogen Fuel Cells

Direct Methanol Fuel Cells

Proton Exchange Membrane Fuel Cells

Solid Oxide Fuel Cells

Alkaline Fuel Cells - By Platform Type (In Value%)

Small UAVs

Medium UAVs

Large UAVs

High Altitude UAVs

Vertical Take-Off and Landing (VTOL) UAVs - By Fitment Type (In Value%)

Retrofit Systems

OEM Systems

Hybrid Systems

Modular Systems

Integrated Systems - By EndUser Segment (In Value%)

Military & Defense

Commercial

Agriculture

Environmental Monitoring

Surveillance & Reconnaissance - By Procurement Channel (In Value%)

Direct Procurement

Distributors and Dealers

Online Marketplaces

OEM Partnerships

Third-Party Suppliers

- Cross Comparison Parameters (Fuel Efficiency, Flight Range, UAV Size, Integration Flexibility, Cost of Operation,)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Airobotics

Bluebird Aero Systems

General Atomics Aeronautical Systems

AeroVironment

Boeing

Northrop Grumman

Lockheed Martin

Honeywell Aerospace

Raytheon Technologies

Airbus

Quantum Systems

UAV Factory

- Defense agencies investing heavily in fuel cell UAVs

- Commercial sectors exploring UAVs for delivery and logistics

- Growing demand for agricultural UAVs powered by fuel cells

- Surveillance and environmental monitoring sectors driving fuel cell UAV adoption

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035