Market Overview

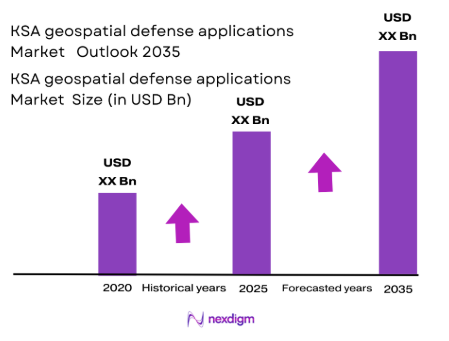

The KSA geospatial defense applications market is valued at USD ~billion as of 2025, primarily driven by the Kingdom’s continued investment in advanced geospatial intelligence and surveillance systems. The increasing demand for precise mapping, real-time data, and geospatial analytics for military operations is a significant factor in this growth. Saudi Arabia has been modernizing its defense infrastructure, focusing on integrating geospatial applications into mission-critical defense operations. Key drivers include the need for enhanced border security, sophisticated defense operations, and surveillance capabilities, contributing to a robust demand for geospatial applications in defense.

Saudi Arabia leads the KSA geospatial defense applications market, particularly in cities like Riyadh and Jeddah, which are hubs for defense and military operations. Riyadh, being the capital, hosts several defense-related government institutions and command centres, making it a critical location for geospatial technology applications. The government’s strategic investments in defense modernization and border security initiatives drive the demand for advanced geospatial solutions. Additionally, the proximity to conflict-prone regions and Saudi Arabia’s focus on enhancing its defense capabilities contribute to the country’s market dominance in this segment.

Market Segmentation

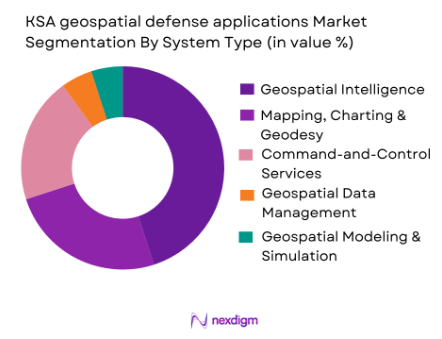

By System Type

The KSA geospatial defense applications market is segmented into system types such as geospatial intelligence analytics platforms, mapping, charting, and geodesy mission systems, and command-and-control geospatial services. Among these, geospatial intelligence analytics platforms dominate the market, driven by the increasing need for data-driven intelligence to support decision-making in military operations. These platforms enable the collection, processing, and visualization of geospatial data, which is essential for strategic operations like surveillance, reconnaissance, and border control. The integration of AI and machine learning to automate data processing and enhance situational awareness further drives the adoption of GEOINT analytics platforms in the defense sector.

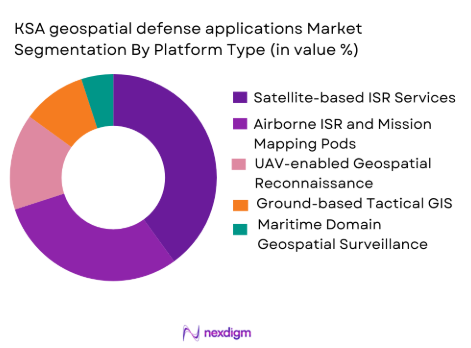

By Platform Type

In terms of platform type, the KSA market is segmented into satellite-based ISR geospatial services, airborne ISR and mission mapping pods, and UAV-enabled geospatial reconnaissance workflows. Satellite-based ISR services hold the dominant share in the market, primarily because they provide persistent, wide-area surveillance capabilities that are crucial for monitoring large and remote borders. This platform also supports military operations across land and maritime domains. Saudi Arabia’s investment in satellite technology and partnerships with international space agencies for enhanced ISR capabilities further drives the growth of satellite-based geospatial services.

Competitive Landscape

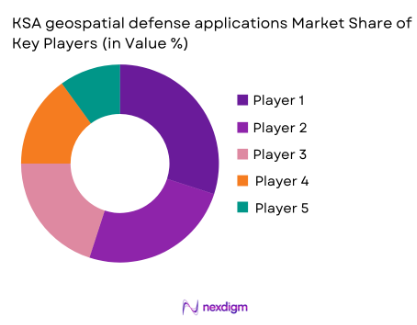

The KSA geospatial defense applications market is dominated by a few key players, including both local companies and global defense giants. These companies are crucial in providing advanced geospatial technology, systems integration, and ongoing support for defense operations. The consolidation of key players ensures high levels of innovation, performance reliability, and customer trust in the market.

| Company Name | Establishment Year | Headquarters | Key Technology | Geospatial Analytics | Platform Capabilities | Customer Segments |

| Esri | 1969 | Redlands, California | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, Maryland | ~ | ~ | ~ | ~ |

| Airbus Defence & Space | 2000 | Leiden, Netherlands | ~ | ~ | ~ | ~ |

| Thales | 1893 | Paris, France | ~ | ~ | ~ | ~ |

| Maxar Technologies | 1996 | Westminster, Colorado | ~ | ~ | ~ | ~ |

KSA geospatial defense applications Market Analysis

Growth Drivers

Strategic National Security Initiatives

Saudi Arabia’s investment in national security and defense modernization is a key driver of the geospatial defense applications market. The government’s commitment to enhancing border security, particularly along its expansive borders and maritime boundaries, has led to the increasing deployment of geospatial intelligence systems. These technologies allow for precise surveillance and situational awareness, enabling quicker decision-making in defense operations. As regional security threats evolve, the demand for advanced geospatial systems for threat detection and defense coordination will continue to rise, propelling market growth.

Technological Advancements in Geospatial Intelligence

The rapid advancement of satellite and UAV technologies is significantly driving the geospatial defense applications market in Saudi Arabia. The integration of cutting-edge sensors, AI-powered analytics, and real-time data processing into geospatial platforms has enhanced the effectiveness and accuracy of defense operations. With the ability to monitor vast territories remotely, these technologies support military operations such as reconnaissance, mapping, and surveillance, boosting the adoption of geospatial defense systems. Continuous innovation in data processing capabilities and geospatial software platforms will foster sustained market growth.

Market Challenges

Data Integration and Interoperability

One of the primary challenges facing the KSA geospatial defense applications market is the difficulty in integrating new geospatial technologies with legacy systems used by the military. As defense agencies upgrade their systems, ensuring seamless interoperability between old and new technologies becomes complex and costly. This poses a challenge to effectively utilizing the full potential of geospatial data, especially in mission-critical defense operations. The lack of standardized platforms further complicates integration efforts, leading to delays and increased operational costs, which could hinder overall market growth.

Security and Data Sovereignty Concerns

Geospatial defense applications handle sensitive data, making security and data sovereignty critical concerns. Saudi Arabia’s defense sector faces the challenge of ensuring that data collected through geospatial systems, such as satellite imagery and UAV-based reconnaissance, remains secure from cyber threats. Additionally, the need to maintain full control over data generated within the Kingdom complicates partnerships with foreign technology providers. The requirement for secure, localized data processing and storage increases the complexity and cost of deploying geospatial technologies, which may limit the scalability of certain solutions.

Opportunities

Growth of AI and Machine Learning Integration

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies into geospatial defense systems presents significant opportunities for market expansion. By leveraging AI for data processing, automated decision-making, and real-time analytics, Saudi Arabia’s defense sector can enhance its operational efficiency. AI-enabled geospatial applications allow for faster identification of potential threats, pattern recognition in surveillance data, and improved tactical decision-making, creating a growing demand for advanced systems that integrate AI with geospatial intelligence.

Local Manufacturing and Defense Sovereignty

Saudi Arabia’s Vision 2035 initiative encourages local production and the development of a robust defense manufacturing sector. This initiative presents an opportunity for geospatial defense technology providers to collaborate with local manufacturers and system integrators. By investing in the domestic production of geospatial technologies, Saudi Arabia can reduce dependency on foreign suppliers, improve supply chain resilience, and enhance its self-sufficiency in geospatial defense applications. This shift towards local sourcing and manufacturing could open new avenues for growth in the market and help meet strategic defense objectives.

Future Outlook

Over the next decade, the KSA geospatial defense applications market is poised for significant growth. The continuous advancements in satellite-based geospatial technologies, coupled with ongoing investments in border security and military modernization, will be key drivers of this expansion. As Saudi Arabia seeks to enhance its defense capabilities in response to regional security dynamics, the market for advanced geospatial applications will continue to evolve, supporting not only military operations but also strategic defense initiatives in air, land, and maritime domains.

Major Players

- Esri

- Lockheed Martin

- Airbus Defence & Space

- Thales

- Maxar Technologies

- Northrop Grumman

- BAE Systems

- Raytheon Technologies

- General Dynamics Mission Systems

- L3 Harris Technologies

- Leonardo

- Saab

- Planet Labs

- Hexagon AB

- Harris Corporation

Key Target Audience

- Ministry of Defence

- Royal Saudi Air Defense

- Royal Saudi Naval Forces

- Saudi Arabian Border Guard

- National Security Agencies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military Contractors and System Integrators

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the geospatial defense applications ecosystem, identifying all major stakeholders, including government agencies, military branches, and technology providers. Extensive desk research and secondary data from defense publications and government reports will support this process.

Step 2: Market Analysis and Construction

We will analyse historical market data, focusing on trends in technology adoption, system integration, and defense investments. This analysis helps identify how military forces in Saudi Arabia have been deploying geospatial technologies over the years and forecast future developments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through consultations with industry experts, including defense analysts and key personnel from military divisions. These interviews help validate initial findings and provide insights into emerging trends and challenges.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the data gathered through both primary and secondary research. Insights obtained from consultations with stakeholders are integrated into the final analysis to ensure a robust and accurate forecast of the KSA geospatial defense applications market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Modernization of ISR and C4I architectures requiring persistent geospatial layers for joint operations

Expansion of border security and maritime domain awareness programs increasing demand for geospatial fusion

Investment in sovereign geospatial capabilities and defense digital transformation accelerating adoption of GEOINT tools - Market Challenges

Data sovereignty, classified handling requirements, and cross-domain security constraints slowing deployments

Interoperability gaps among legacy sensors, mapping standards, and command systems increasing integration cost

Skilled workforce constraints in advanced GEOINT analytics, data engineering, and model validation limiting scale-up - Market Opportunities

Development of in-Kingdom geospatial data processing and secure cloud services aligned to localization objectives

AI-enabled change detection, target cueing, and pattern-of-life analytics for faster decision cycles

Integration of multi-sensor geospatial fusion across satellite, UAV, airborne, and ground ISR for joint COP enhancement - Trends

Shift toward real-time geospatial intelligence at the edge using onboard compute and low-latency data links

Adoption of digital twin and 3D terrain/urban modeling for mission planning and force protection

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Geospatial intelligence analytics platforms

Mapping, charting & geodesy mission systems

Command-and-control geospatial services

Geospatial data management & dissemination

Geospatial modelling & simulation for mission rehearsal - By Platform Type (In Value%)

Satellite-based ISR geospatial services

Airborne ISR and mission mapping pods

UAV-enabled geospatial reconnaissance workflows

Ground-based tactical GIS and battlefield mapping kits

Maritime domain geospatial surveillance and coastal mapping - By Fitment Type (In Value%)

New program integration for next-gen defense platforms

Retrofit/upgrades for legacy aircraft, land vehicles and vessels

Portable/deployable systems for forward operating units

Cloud/hybrid deployments within defense data centers

Edge compute fitment for real-time sensor-to-map fusion - By End User Segment (In Value%)

Ministry of Defense operational commands

Royal Saudi Air Defense and air operations centers

Royal Saudi Naval Forces and coastal surveillance units

Land forces tactical formations and border security units

Defense intelligence and joint ISR coordination entities - By Procurement Channel (In Value%)

Direct government contracting and prime awards

G2G programs and foreign military sales-type frameworks

Local content partnerships and in-Kingdom system integrators

Framework agreements and multi-year service contracts

RFP-based competitive tenders via defense procurement entities

- Market Share Analysis

- Cross Comparison Parameters (Security accreditation & classified compliance, Multi-sensor fusion capability, Interoperability with C4ISR/GIS standards, Deployment model , Localization & in-Kingdom support depth, Total cost of ownership)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Esri

Palantir Technologies

BAE Systems

Thales

Airbus Defence and Space

Lockheed Martin

Northrop Grumman

Raytheon (RTX)

Leonardo

Saab

L3Harris Technologies

General Dynamics Mission Systems

Hexagon AB

Maxar Technologies

Planet Labs PBC

- End users prioritize secure multi-level data sharing to enable joint operations without compromising classified sources.

- Operational units demand rapid update cycles for maps and terrain models, especially for border and coastal missions.

- Air and missile defense stakeholders emphasize precise georeferencing and sensor-to-shooter geospatial alignment.

- Naval and border forces require persistent maritime/coastal geospatial overlays integrating AIS, radar, EO/IR and satellite feeds.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035