Market Overview

The KSA Glucometers Equipment market current size stands at around USD ~ million, supported by steady demand from clinical and home monitoring settings and annual shipments of nearly ~ units across public and private healthcare channels. Installed base expansion has been driven by rising diagnostic volumes, wider availability of point-of-care testing, and higher adoption of self-monitoring practices. Average selling values remain within USD ~ per device range, reflecting procurement-led pricing dynamics and bundled consumables strategies. Demand concentration is strongest in hospital networks, large pharmacy chains, and organized homecare providers.

Regional dominance is led by major urban healthcare clusters where tertiary hospitals, diabetes specialty centers, and retail pharmacy networks are most concentrated. These regions benefit from advanced diagnostic infrastructure, higher density of endocrinology practices, and stronger integration with digital health ecosystems. Policy-driven screening programs and chronic disease management initiatives further reinforce demand concentration. Mature distributor networks, reliable cold-chain logistics, and streamlined regulatory pathways also strengthen ecosystem readiness, enabling faster diffusion of connected glucometers and value-added monitoring solutions across priority care corridors.

Market Segmentation

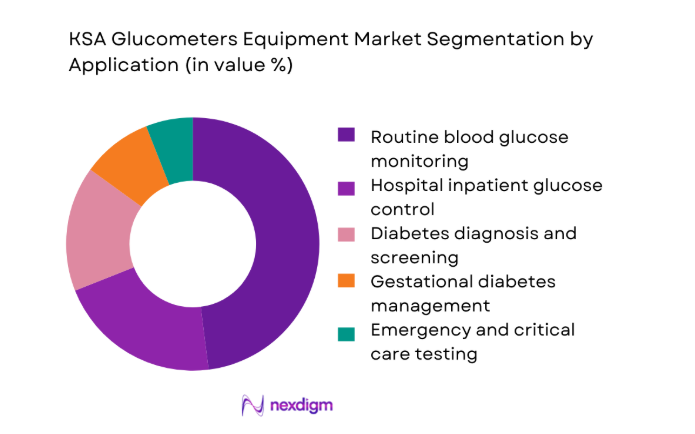

By Application

Routine blood glucose monitoring dominates the market due to its central role in daily diabetes management across homecare and outpatient settings. The segment benefits from consistent repeat demand for devices and consumables, supported by strong physician advocacy for self-monitoring and structured care pathways. Hospitals and specialty clinics continue to rely on glucometers for inpatient glucose control and emergency testing, but volume momentum remains highest in routine monitoring. Growing awareness of gestational diabetes and preventive screening has also expanded application diversity, yet regular monitoring remains the anchor for sustained equipment turnover and ecosystem stability across the Kingdom.

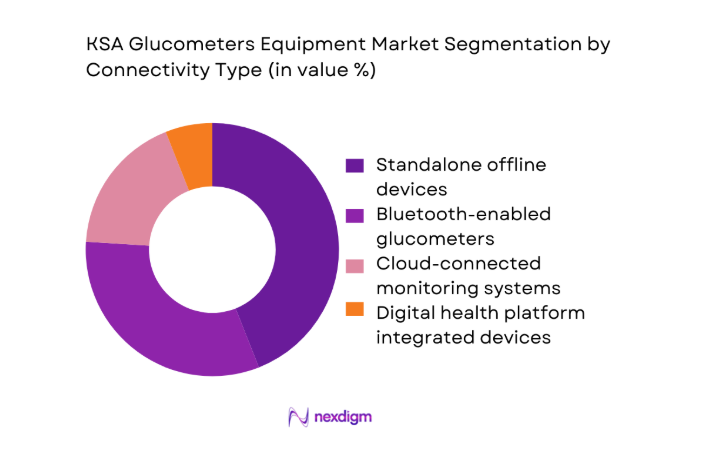

By Connectivity Type

Standalone devices continue to account for a significant share due to affordability and ease of use, especially in public tenders and rural healthcare settings. However, connected glucometers are gaining momentum as digital health integration accelerates across hospitals and homecare platforms. Bluetooth-enabled and cloud-connected devices are increasingly favored for chronic care programs, enabling data sharing between patients and clinicians. Integration with national health information systems and private telehealth platforms is further strengthening the value proposition of connected solutions. Over time, connectivity is becoming a differentiating factor in procurement decisions, particularly for large hospital groups and organized homecare providers.

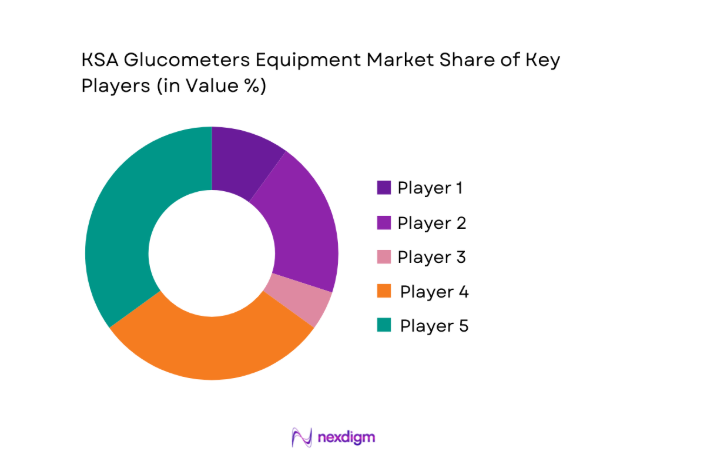

Competitive Landscape

The KSA glucometers equipment market is moderately concentrated, with a mix of global manufacturers and regional distributors shaping competitive dynamics. Established brands dominate institutional procurement, while a growing number of technology-focused players are strengthening presence in connected and homecare segments. Competition is driven by product reliability, regulatory compliance, service reach, and the ability to support large-scale tenders across public and private healthcare channels.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Abbott Diabetes Care | 1981 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Roche Diabetes Care | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Ascensia Diabetes Care | 2016 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| LifeScan | 1986 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Omron Healthcare | 1933 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Glucometers Equipment Market Analysis

Growth Drivers

Rising prevalence of diabetes and prediabetes in Saudi Arabia

The expanding base of diagnosed and undiagnosed diabetes cases has been a primary catalyst for glucometer equipment demand across clinical and homecare environments. Between 2022 and 2025, annual diagnostic volumes increased by nearly ~ cases, driving consistent procurement of point-of-care devices in hospitals and clinics. Home monitoring adoption also accelerated, with active user numbers exceeding ~ households, supported by physician-led care protocols and pharmacy-based screening programs. This sustained rise in patient monitoring needs has translated into higher equipment turnover, broader installed base growth, and deeper penetration of glucometers into routine care pathways across urban and semi-urban regions.

Government initiatives for early diagnosis and chronic disease management

National health programs focused on preventive screening and long-term disease management have significantly strengthened the demand outlook for glucometers. From 2022 to 2025, public healthcare networks expanded screening coverage to more than ~ patients annually, resulting in incremental device deployment across primary care centers. Investments in digital health platforms and remote monitoring frameworks supported the uptake of connected glucometers, with enrolled chronic care participants surpassing ~ users. These initiatives have reinforced institutional procurement cycles, encouraged standardization of monitoring protocols, and improved continuity of care, making glucometers a core component of public health delivery systems.

Challenges

Price sensitivity in large-scale public tenders

Public sector procurement remains highly price-driven, placing sustained pressure on equipment suppliers to balance affordability with quality and service commitments. During recent tender cycles between 2022 and 2025, average bid values declined to nearly USD ~ per device, limiting margin flexibility and constraining the adoption of premium or connected models. Hospitals managing annual procurement volumes of ~ units often prioritize lowest-cost compliant options, which can slow innovation diffusion. This pricing environment also affects after-sales service investments and distributor network expansion, creating operational challenges for suppliers aiming to differentiate beyond baseline product specifications.

Limited reimbursement for advanced connected devices

Despite growing interest in digital health integration, reimbursement structures for connected glucometers remain underdeveloped across much of the healthcare system. Between 2022 and 2025, only ~ programs formally covered remote monitoring solutions, restricting large-scale institutional uptake. Patients frequently bear incremental costs of advanced devices, with out-of-pocket spending reaching USD ~ annually for some user groups. This reimbursement gap dampens demand for higher-value products, delays technology refresh cycles, and reinforces continued reliance on basic standalone devices, even as clinical benefits of data-enabled monitoring become increasingly evident.

Opportunities

Expansion of digital health and remote patient monitoring programs

The rapid expansion of telemedicine and virtual care frameworks presents a strong growth avenue for glucometer equipment suppliers. From 2022 to 2025, enrollment in remote monitoring initiatives exceeded ~ patients, creating new demand for connected devices capable of real-time data sharing. Hospitals and private care networks are increasingly integrating glucometers into chronic care dashboards, enabling clinicians to manage larger patient cohorts efficiently. This shift opens opportunities for bundled offerings that combine devices, software access, and service support, positioning glucometers as integral tools within broader digital health ecosystems.

Localization of assembly and distribution under Vision 2030

Localization strategies under Vision 2030 are creating favorable conditions for domestic assembly, packaging, and distribution of medical devices. Between 2022 and 2025, localized operations in the broader medical equipment sector supported investments of USD ~ million and enabled annual production capacity of ~ units. For glucometer suppliers, local presence can enhance tender competitiveness, reduce lead times, and improve alignment with national industrial goals. These developments also support workforce development and after-sales service expansion, strengthening long-term market positioning and regulatory engagement within the Kingdom.

Future Outlook

The KSA glucometers equipment market is expected to evolve steadily toward more connected and service-oriented solutions through 2030. Policy emphasis on preventive care, combined with digital health integration, will reshape procurement priorities across hospitals and homecare providers. While affordability will remain central to public sector demand, gradual improvements in reimbursement frameworks and localization efforts are likely to enhance access to advanced monitoring technologies. Overall, the market outlook points toward deeper ecosystem integration and sustained role expansion for glucometers in chronic disease management.

Major Players

- Abbott Diabetes Care

- Roche Diabetes Care

- Ascensia Diabetes Care

- LifeScan

- Medtronic

- Dexcom

- AgaMatrix

- ARKRAY

- Terumo Corporation

- Omron Healthcare

- B. Braun

- Sinocare

- i-SENS

- Nipro Corporation

- Nova Biomedical

Key Target Audience

- Public and private hospital procurement departments

- Specialty diabetes and endocrinology clinics

- Home healthcare service providers

- Retail pharmacy chains and healthcare distributors

- Digital health platform operators

- Investments and venture capital firms

- Saudi Food and Drug Authority and Ministry of Health

- Corporate wellness and occupational health program managers

Research Methodology

Step 1: Identification of Key Variables

Assessment of demand drivers, care pathways, and equipment utilization patterns across hospitals and homecare settings.

Mapping of regulatory frameworks and procurement mechanisms shaping market access. Definition of core performance indicators for product adoption and service reach.

Step 2: Market Analysis and Construction

Compilation of shipment trends installed base evolution, and channel distribution structures. Evaluation of technology adoption cycles and connectivity penetration.

Structuring of segmentation lenses aligned with real-world buying behavior.

Step 3: Hypothesis Validation and Expert Consultation

Validation of demand assumptions through structured interactions with healthcare administrators and clinicians. Review of procurement dynamics with distributors and tender specialists.

Refinement of opportunity pathways based on ecosystem feedback.

Step 4: Research Synthesis and Final Output

Integration of quantitative and qualitative insights into a coherent market narrative.

Cross-validation of trends and risk factors across stakeholder groups. Finalization of strategic implications and future outlook positioning.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, glucometer equipment taxonomy across SMBG and CGM compatible devices, market sizing logic by installed base and strip consumption, revenue attribution across devices strips lancets and service, primary interview program with hospitals pharmacies and distributors, data triangulation validation assumptions and limitations)

- Definition and scope of glucometers equipment in clinical and homecare settings

- Market evolution in line with diabetes prevalence in Saudi Arabia

- Care and usage pathways across diagnosis, monitoring, and therapy adjustment

- Ecosystem structure including manufacturers, distributors, pharmacies, and hospitals

- Supply chain and channel structure across public and private healthcare systems

- Regulatory environment governed by SFDA and MOH procurement frameworks

- Growth Drivers

Rising prevalence of diabetes and prediabetes in Saudi Arabia

Government initiatives for early diagnosis and chronic disease management

Expansion of homecare and self-monitoring trends

Growing penetration of private healthcare facilities

Increased awareness of lifestyle-related health risks

Technological improvements in accuracy and ease of use - Challenges

Price sensitivity in large-scale public tenders

Limited reimbursement for advanced connected devices

User compliance issues in home monitoring

Dependence on imported devices and consumables

Regulatory approval timelines for new technologies

Data privacy concerns with connected glucometers - Opportunities

Expansion of digital health and remote patient monitoring programs

Localization of assembly and distribution under Vision 2030

Growing demand from gestational diabetes management

Integration with national health information systems

Private sector growth in chronic care management

Rising penetration in rural and semi-urban healthcare centers - Trends

Shift toward Bluetooth and app-connected glucometers

Bundling of devices with test strips and subscription models

Increased use of glucometers in pharmacies for screening

Adoption of value-based procurement in hospitals

Growing preference for compact and minimally invasive devices

Expansion of Arabic-language user interfaces and apps - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Public healthcare institutions

Private hospitals and clinics

Home healthcare users

Corporate and occupational health programs

NGO and community health initiatives - By Application (in Value %)

Diabetes diagnosis and screening

Routine blood glucose monitoring

Gestational diabetes management

Hospital inpatient glucose control

Emergency and critical care testing - By Technology Architecture (in Value %)

Electrochemical biosensor-based glucometers

Photometric glucometers

Multi-parameter glucose and ketone meters

Smartphone-integrated glucometers - By End-Use Industry (in Value %)

Hospitals and specialty clinics

Diagnostic laboratories

Homecare and self-monitoring users

Pharmacies and retail healthcare

Corporate wellness and occupational health - By Connectivity Type (in Value %)

Standalone offline devices

Bluetooth-enabled glucometers

Cloud-connected monitoring systems

Integration with digital health platforms - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (device accuracy, test strip cost, connectivity features, regulatory approvals, service network coverage, brand recognition, distribution reach, pricing tiers)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Abbott Diabetes Care

Roche Diabetes Care

Ascensia Diabetes Care

LifeScan

Medtronic

Dexcom

AgaMatrix

ARKRAY

Terumo Corporation

Omron Healthcare

B. Braun

Sinocare

i-SENS

Nipro Corporation

Nova Biomedical

- Demand and utilization drivers across hospitals and homecare users

- Procurement and tender dynamics in public and private healthcare

- Buying criteria and vendor selection processes

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service and calibration expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030