Market Overview

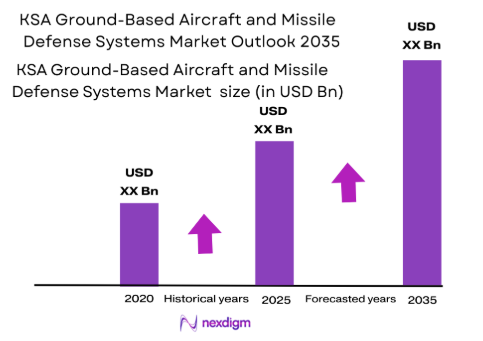

The KSA Ground-Based Aircraft and Missile Defense Systems market is poised for significant growth, with Saudi Arabia continuing to invest heavily in its defense sector. The market size has been driven by the increasing need to safeguard national airspace against emerging threats, including ballistic and cruise missiles. Saudi Arabia’s strategic location in the Middle East, coupled with its ongoing military modernization plans, has prompted large-scale investments in advanced defense systems, including ground-based missile defense. In 2025, the market is valued at approximately USD ~ billion, supported by government initiatives, defense budgets, and collaboration with leading global defense manufacturers. This growth trajectory is expected to continue, fueled by a robust demand for air and missile defense systems.

Saudi Arabia, being the dominant player in the KSA region, holds a strong position in the market due to its substantial defense spending and strategic alliances with global powers. Cities such as Riyadh and Jeddah serve as central hubs for defense activities, hosting military bases, procurement centers, and command centers for air defense systems. The kingdom’s defense spending, driven by security concerns in the region and the need for technological advancements in defense systems, solidifies its dominance in the market. The focus on regional security, particularly in addressing missile threats from neighboring countries, further boosts the demand for these systems.

Market Segmentation

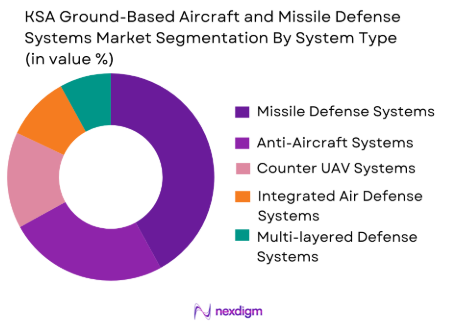

By System Type

The KSA Ground-Based Aircraft and Missile Defense Systems market is segmented into missile defense systems, anti-aircraft systems, counter UAV systems, integrated air defense systems, and multi-layered defense systems. Among these, missile defense systems are dominating the market share. The growing threat of ballistic missiles from regional adversaries, particularly Iran, has led Saudi Arabia to invest heavily in advanced missile defense systems such as the THAAD and Patriot missiles. These systems are integral to the country’s defense strategy, contributing to the dominance of the missile defense segment. The shift towards more sophisticated missile defense solutions, capable of intercepting long-range missiles and countering new threats like hypersonic missiles, is anticipated to continue driving the growth of this sub-segment.

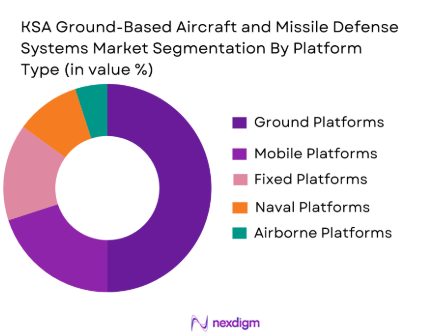

By Platform Type

In the platform type segmentation, ground platforms lead the market due to their extensive deployment across military bases and key defense facilities in Saudi Arabia. Ground-based platforms, such as mobile and fixed installations, are integral to the air defense infrastructure of the kingdom. The ease of deployment, cost-effectiveness, and scalability of ground platforms make them the most widely used in Saudi Arabia’s air and missile defense systems. Furthermore, these platforms offer flexibility in terms of upgrades and integration with other defense technologies, which enhances their adoption in the market. The demand for ground platforms is expected to increase as Saudi Arabia continues to modernize its defense forces.

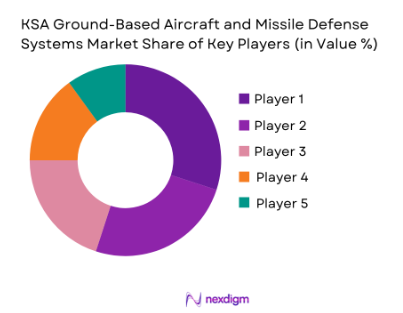

Competitive Landscape

The KSA Ground-Based Aircraft and Missile Defense Systems market is dominated by both local defense manufacturers and global giants like Raytheon, Lockheed Martin, and Saab. The competitive landscape is shaped by government collaborations, as Saudi Arabia seeks to enhance its defense capabilities through both indigenous development and international partnerships. Local manufacturers are gaining traction by tailoring systems to meet specific regional defense requirements, while global players are offering advanced technology, which is crucial in the face of emerging threats. These key players continue to influence the market’s direction through technological advancements and strategic partnerships.

| Company | Establishment Year | Headquarters | Technology Leadership | Market Focus | Product Portfolio | Defense Partnerships |

| Raytheon Technologies | 1922 | Waltham, USA | High | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | High | ~ | ~ | ~ |

| Saab AB | 1937 | Linköping, Sweden | Moderate | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | High | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | High | ~ | ~ | ~ |

KSA Ground-Based Aircraft and Missile Defense Systems Market Analysis

Growth Drivers

Geopolitical Tensions and Regional Security Threats

The KSA Ground-Based Aircraft and Missile Defense Systems market is significantly driven by the geopolitical instability in the Middle East. Saudi Arabia faces increasing missile threats from regional adversaries such as Iran, along with growing tensions from other neighboring countries. This situation has made air and missile defense a top priority for the Saudi government. As a result, the kingdom has escalated its defense investments, particularly in advanced missile defense systems like the THAAD and Patriot systems. These systems are critical in countering the growing threat of ballistic missiles, cruise missiles, and other aerial threats. The perceived need to strengthen national security is a key driver for the expansion of ground-based defense solutions, and this trend is expected to continue in the coming years as regional tensions evolve.

Defense Modernization and Technological Advancements

Saudi Arabia’s commitment to modernizing its defense sector is another key driver of the market. As part of its Vision 2035 plan, the kingdom has been investing heavily in advancing its defense capabilities, with a strong focus on improving the efficiency and sophistication of its air defense systems. Technological advancements in missile interception, radar systems, and AI-based threat detection are all contributing factors to the growth of the ground-based defense market. The increasing sophistication of missile defense systems, combined with a push towards homegrown defense technology through local partnerships, ensures that the kingdom remains competitive in countering new threats. This ongoing modernization of the defense infrastructure is expected to drive significant demand for ground-based missile defense systems, particularly as defense budgets remain robust and dedicated to security enhancements.

Market Challenges

High Cost of Advanced Systems and Infrastructure Integration

One of the primary challenges facing the KSA Ground-Based Aircraft and Missile Defense Systems market is the high cost of acquiring and maintaining advanced missile defense systems. These systems often require substantial financial investments not only in procurement but also in their integration with existing defense infrastructure. The complexity of integrating these cutting-edge technologies with older systems and infrastructures can result in significant additional costs and delays. Moreover, the operational costs for maintenance, training, and upgrades are also considerable. This makes it challenging for defense budgets to stretch across all required projects while ensuring that the systems remain operational and effective. Given that Saudi Arabia is committed to high-end technologies, this financial burden can strain the overall defense expenditure in the long term, requiring careful balancing of national security priorities and fiscal responsibility.

Limited Availability of Skilled Workforce

Another significant challenge is the limited availability of skilled personnel to operate and maintain sophisticated air and missile defense systems. The systems used in the defense industry are highly complex, requiring specialized knowledge in areas such as radar technology, missile interception, system integration, and cybersecurity. Saudi Arabia faces a shortage of these highly skilled experts, which has led to reliance on foreign personnel and training programs. However, this reliance is not always sustainable due to the high turnover rates and the long-term nature of defense contracts. The development of a local skilled workforce capable of handling the technological demands of the defense sector is a critical challenge that the country needs to overcome to ensure the long-term sustainability of its missile defense systems and to maintain operational efficiency.

Opportunities

Increasing Demand for Integrated Air Defense Systems

One of the most promising opportunities in the KSA Ground-Based Aircraft and Missile Defense Systems market is the growing demand for integrated defense solutions. The kingdom is moving toward multi-layered defense systems that combine different technologies, such as anti-aircraft missiles, radar systems, and command and control platforms, into a single, cohesive unit. These integrated systems provide more comprehensive protection against a wide range of aerial threats, including drones, ballistic missiles, and cruise missiles. The shift toward these integrated systems creates ample opportunities for both international defense companies and local manufacturers to offer advanced, scalable, and customizable solutions. As Saudi Arabia modernizes its air defense infrastructure and seeks greater technological autonomy, the demand for integrated systems that can operate in tandem with existing infrastructure is expected to rise.

Partnerships for Technology Transfer and Domestic Manufacturing

With Saudi Arabia’s Vision 2035 plan focusing on increasing local production and reducing dependence on foreign technology, there is an emerging opportunity for defense companies to enter into strategic partnerships with local firms for technology transfer. This approach is designed to build the kingdom’s domestic defense capabilities and enhance its manufacturing capacity in high-tech sectors. Through such collaborations, local firms can gain access to advanced defense technologies, while foreign companies can expand their presence in the Middle Eastern market. The focus on local manufacturing and self-reliance in defense solutions presents a lucrative opportunity for companies willing to invest in joint ventures and research and development within Saudi Arabia. This opportunity is further compounded by the growing need for tailored defense solutions that can address specific regional threats, creating demand for innovative, locally produced defense systems.

Future Outlook

Over the next decade, the KSA Ground-Based Aircraft and Missile Defense Systems market is expected to experience significant growth. Continuous investments in defense infrastructure, advancements in missile defense technologies, and increased regional security concerns will drive this expansion. Saudi Arabia’s commitment to modernization and its strategic positioning in the Middle East will further bolster the demand for sophisticated ground-based defense systems. The future outlook indicates a strong focus on multi-layered defense systems and counter-UAV technologies, with new platforms being developed to counter emerging threats. The market is anticipated to grow at a compound annual growth rate (CAGR) of 5.6% from 2026 to 2035.

Major Players

- Raytheon Technologies

- Lockheed Martin

- Saab AB

- BAE Systems

- Thales Group

- Northrop Grumman

- Leonardo

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- MBDA

- Kongsberg Gruppen

- Hanwha Defense

- L3 Technologies

- General Dynamics

- Harris Corporation

Key Target Audience

- Ministry of Defense

- Saudi Armed Forces

- Defense Contractors and OEMs

- Government and Regulatory Bodies

- Defense Investment Firms

- Defense Technology Suppliers

- Security Agencies

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

In this phase, the research team identifies key variables that affect the KSA Ground-Based Aircraft and Missile Defense Systems market. These variables include technological advancements, regional security dynamics, and defense spending trends. This process involves secondary research, reviewing industry reports, government publications, and defense budgets to identify the main drivers of the market.

Step 2: Market Analysis and Construction

This step focuses on compiling historical data and analysing the market’s growth patterns. Key factors such as defense expenditure, procurement strategies, and technological integration are examined. We analyse data on military budgets and procurements from Saudi Arabia, as well as international trade and defense contracts, to construct the market size and forecast the future trajectory.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses will be validated through consultations with industry experts, military officials, and defense manufacturers. Computer-assisted telephone interviews (CATIs) and face-to-face meetings with key decision-makers will provide insights into the evolving needs of Saudi Arabia’s defense strategy, which will help refine the market estimates and assumptions.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and validating the results through engagement with manufacturers and defense contractors. Insights from defense agencies and private contractors will complement the data, ensuring that the final output provides an accurate picture of the market dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing geopolitical tensions in the Middle East

Modernization of defense infrastructure in Saudi Arabia

Rising demand for advanced air defense solutions - Market Challenges

High initial investment costs

Complexity of system integration

Limited availability of skilled workforce - Opportunities

Growing demand for integrated defense solutions

Strategic partnerships for technology transfer

Development of cost-effective defense systems - Trends

Shift toward multi-layered defense systems

Emerging use of AI and machine learning in defense systems

Increasing emphasis on counter-UAV technologies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Missile Defense Systems

Anti-Aircraft Systems

Counter UAV Systems

Integrated Air Defense Systems

Multi-layered Defense Systems - By Platform Type (In Value%)

Ground Platforms

Mobile Platforms

Fixed Platforms

Naval Platforms

Airborne Platforms - By Fitment Type (In Value%)

Retrofit

New Installation

Upgrades

Integrated Systems

Standalone Systems - By End User Segment (In Value%)

Defense Forces

Airports and Critical Infrastructure

Government Agencies

Private Security Providers

Commercial Sectors - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Purchases

International Suppliers

OEM Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Complexity, Price Range, Market Share, Technological Advancements, Product Differentiation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Raytheon Technologies

Lockheed Martin

Saab AB

BAE Systems

Thales Group

Northrop Grumman

Leonardo

Harris Corporation

L3 Technologies

General Dynamics

Kongsberg Gruppen

Israel Aerospace Industries

Rafael Advanced Defense Systems

MBDA

Hanwha Defense

- Rising defense budgets and modernization plans in Saudi Arabia

- Shift from traditional to advanced defense solutions

- Growing reliance on advanced air defense for national security

- Emerging markets for commercial security applications

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035