Market Overview

The KSA Gunshot Detection System market is valued at USD ~million in 2025 and is expected to grow due to increasing security concerns and advancements in technology. The market is primarily driven by the rising demand for real-time monitoring and protection in urban areas, high-profile events, and critical infrastructure. The government’s focus on enhancing public safety and the adoption of smart city initiatives contribute to market growth. The continuous evolution of gunshot detection technology, with improved accuracy and integration with existing security systems, further fuels market expansion.

In Saudi Arabia, major cities such as Riyadh, Jeddah, and Mecca dominate the KSA Gunshot Detection System market. Riyadh, being the capital city, leads the demand due to its concentration of government institutions and critical infrastructure. Jeddah and Mecca, hosting important economic activities and religious tourism, also show a growing need for enhanced security. The government’s investments in urban development and infrastructure modernization, alongside security concerns, make these cities key players in driving the demand for advanced gunshot detection systems.

Market Segmentation

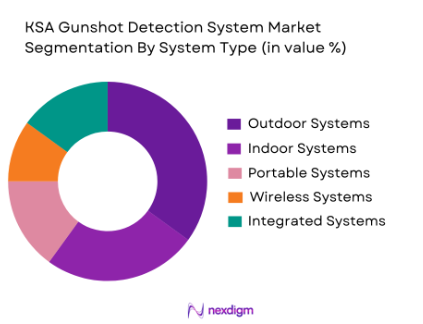

By System Type

The KSA Gunshot Detection System market is segmented into several system types, including outdoor systems, indoor systems, portable systems, wireless systems, and integrated systems. Currently, the outdoor systems segment holds the dominant market share due to the increasing focus on public space safety, especially in urban areas. The growth of smart city initiatives and the rising need for surveillance in open public areas, such as parks and transportation hubs, further strengthens the demand for outdoor systems.

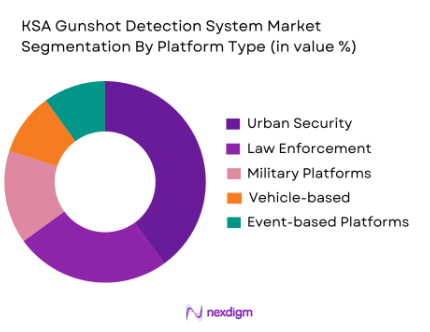

By Platform Type

The KSA Gunshot Detection System market is also segmented by platform type, including urban security platforms, law enforcement platforms, military platforms, vehicle-based platforms, and event-based platforms. Urban security platforms dominate the market, driven by the increasing implementation of smart city projects and the need for real-time surveillance and rapid response systems. These platforms are essential for managing city-wide safety, especially in densely populated areas, contributing to their leading market position.

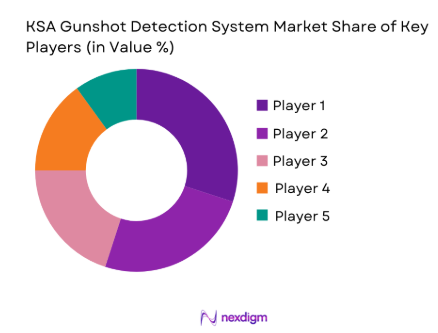

Competitive Landscape

The KSA Gunshot Detection System market is competitive, with several key players shaping the industry landscape. Companies such as ShotSpotter, Genetec, and FLIR Systems are major players in the region, owing to their advanced technologies and established market presence. The market is witnessing increasing consolidation, with local and international players offering integrated solutions for urban security. Furthermore, the introduction of AI-driven detection systems and cloud-based platforms is intensifying competition.

| Company | Establishment Year | Headquarters | Market Reach | Technology Strength | Product Range | Partnerships |

| ShotSpotter | 1995 | California, USA | ~ | ~ | ~ | ~ |

| Genetec | 1997 | Montreal, Canada | ~ | ~ | ~ | ~ |

| FLIR Systems | 1978 | Oregon, USA | ~ | ~ | ~ | ~ |

| Safeguard Technologies | 2002 | London, UK | ~ | ~ | ~ | ~ |

| Audio Intelligence Devices | 2003 | California, USA | ~ | ~ | ~ | ~ |

KSA Gunshot Detection System Market Analysis

Growth Drivers

Government Investment in Public Safety and Infrastructure

The KSA government has significantly increased its focus on enhancing public safety, particularly in major urban areas. With initiatives like Vision 2030, which prioritizes modernization of urban infrastructure and security systems, there is a heightened demand for advanced surveillance technologies, including gunshot detection systems. Government agencies are increasingly incorporating such technologies to ensure the safety of citizens, especially during high-profile events like international conferences, religious gatherings, and public celebrations. Moreover, the push for smart city developments in cities like Riyadh and Jeddah is driving the need for integrated security solutions. This alignment of gunshot detection technology with national security priorities ensures substantial growth for the market.

Technological Advancements in Gunshot Detection Systems

Advancements in sensor technology, artificial intelligence (AI), and data analytics have been a major growth driver in the KSA gunshot detection system market. These technologies enhance the accuracy, reliability, and responsiveness of gunshot detection systems. AI algorithms can now identify gunshot sounds with greater precision, minimizing false alarms and improving real-time response times. Additionally, cloud-based systems allow for easy integration with other security platforms, providing a more cohesive security solution. As these systems become more cost-effective and efficient, their adoption across public spaces, urban centres, and critical infrastructure continues to grow, contributing to the market’s expansion.

Market Challenges

High Costs of Installation and Maintenance

One of the primary challenges in the KSA gunshot detection system market is the high cost of installation and maintenance. These systems require significant upfront investments, including hardware, software, and integration with existing infrastructure. The complexity of setting up these systems, especially in densely populated urban areas, adds to the expense. Furthermore, ongoing maintenance costs, such as system updates, sensor calibration, and repairs, can be prohibitive, particularly for smaller municipalities or private security firms. This cost barrier limits the widespread adoption of gunshot detection systems, particularly in lower-budget areas or organizations that cannot afford the high costs of installation and upkeep.

Integration with Existing Security Infrastructure

Integrating new gunshot detection systems with existing security infrastructure presents another significant challenge. Many urban centres and high-profile sites in Saudi Arabia already have established security frameworks, including CCTV surveillance systems, alarm systems, and access controls. The complexity of integrating these systems with new gunshot detection technology without disrupting operations is a technical and logistical challenge. Additionally, many systems require customization to work within specific security frameworks, increasing both time and cost for implementation. This challenge can slow down the pace at which organizations and government entities are able to deploy advanced gunshot detection solutions.

Opportunities

Expansion of Smart City Projects

With Saudi Arabia’s ambitious Vision 2035 plan emphasizing the creation of smart cities, there is a significant opportunity for the growth of gunshot detection systems. As cities like Riyadh and Jeddah become more connected and data-driven, the demand for advanced security technologies like gunshot detection systems is expected to rise. These systems can be integrated with other smart city technologies, including traffic management, emergency response, and crowd monitoring, to provide comprehensive security solutions. The growth of smart city projects offers a clear opportunity for gunshot detection companies to expand their offerings and cater to the security needs of these modern urban environments.

Military and Law Enforcement Demand for Advanced Surveillance

The demand for gunshot detection systems is also expected to rise in the military and law enforcement sectors in Saudi Arabia. As the country continues to modernize its defense and security infrastructure, advanced surveillance technologies like gunshot detection systems are being increasingly adopted. These systems enhance the ability to respond quickly to security threats, particularly in conflict zones or high-risk environments, where accurate detection and rapid response are crucial. Furthermore, the growing emphasis on border security and counter-terrorism efforts provides a significant opportunity for gunshot detection companies to secure contracts with defense agencies and law enforcement agencies, further expanding the market.

Future Outlook

Over the next 5 years, the KSA Gunshot Detection System market is expected to show significant growth driven by continuous government support for security enhancements, increasing urbanization, and technological advancements. As Saudi Arabia focuses on modernizing its infrastructure and boosting public safety measures, there will be heightened demand for advanced surveillance systems. The adoption of AI-powered and cloud-integrated gunshot detection systems will play a crucial role in shaping the future market dynamics.

Major Players

- ShotSpotter

- Genetec

- FLIR Systems

- Safeguard Technologies

- Audio Intelligence Devices

- Raytheon Technologies

- Acuity Brands

- Silent Sentinel

- Truvelo Manufacturers

- Mace Security International

- Falcon Communications

- Cognizant Technology Solutions

- V4 Advanced Technologies

- Eagle Technology Systems

- Honeywell International

Key Target Audience

- Government agencies

- Law enforcement agencies

- Military defense contractors

- Private security firms

- Public safety authorities

- Urban planners

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing an ecosystem map of stakeholders within the KSA Gunshot Detection System market. We gather data from secondary research, including government reports, industry publications, and proprietary databases. This helps identify the key factors influencing market dynamics and segmentation.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data on the market. This includes evaluating adoption rates, growth in security budgets, and technological advancements in gunshot detection systems. Data validation through expert consultations ensures that the findings are reliable and comprehensive.

Step 3: Hypothesis Validation and Expert Consultation

We develop market hypotheses and validate them through consultations with industry experts via computer-assisted telephone interviews (CATIs). Experts across various sectors such as law enforcement, defense, and urban security provide insights into market trends, challenges, and growth drivers, helping refine our market estimates.

Step 4: Research Synthesis and Final Output

In the final phase, insights gathered from consultations and data analysis are synthesized to generate actionable market insights. We engage with manufacturers and system integrators to verify our findings and adjust any assumptions, ensuring a comprehensive and accurate report on the KSA Gunshot Detection System market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing public and government focus on security and surveillance

Rising adoption of smart city technologies

Enhanced security needs at high-profile events - Challenges

High installation and maintenance costs

Complexity in integrating with existing security systems

Lack of standardized regulations - Opportunities

Growing demand for AI-powered detection systems

Advancements in wireless and cloud technologies

Expanding urbanization and infrastructure development - Trends

Integration of gunshot detection systems with other public safety technologies

Shift towards more mobile and portable systems

Increased use of machine learning and data analytics

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Outdoor Systems

Indoor Systems

Portable Systems

Wireless Systems

Integrated Systems - By Platform Type (In Value%)

Urban Security Platforms

Law Enforcement Platforms

Military Platforms

Vehicle-based Platforms

Event-based Platforms - By Fitment Type (In Value%)

Standalone Systems

Integrated Solutions

Modular Systems

Mobile-based Systems

Cloud-enabled Systems - By End User Segment (In Value%)

Government & Military

Law Enforcement

Public Safety Authorities

Private Security Firms

Critical Infrastructure Operators - By Procurement Channel (In Value%)

Direct Sales

Distributors

System Integrators

Online Sales

Tender-based Procurement

- Market Share Analysis

- Cross Comparison Parameters (Product Innovation, Geographic Reach, Price Competitiveness, Customer Service, Market Penetration)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Gunshot Detection Systems Inc.

ShotSpotter, Inc.

Safeguard Technologies

Genetec Inc.

Raytheon Technologies

ACUITY Brands

Audio Intelligence Devices, Inc.

Falcon Communications

Silent Sentinel Ltd.

Truvelo Manufacturers

Cognizant Technology Solutions

Mace Security International

FLIR Systems, Inc.

Honeywell International

V4 Advanced Technologies

Eagle Technology Systems

- Government agencies looking for enhanced public safety solutions

- Military and law enforcement requiring real-time gunshot location tracking

- Private sector increasingly investing in infrastructure protection

- Growing interest in gunshot detection from critical public events and locations

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035