Market Overview

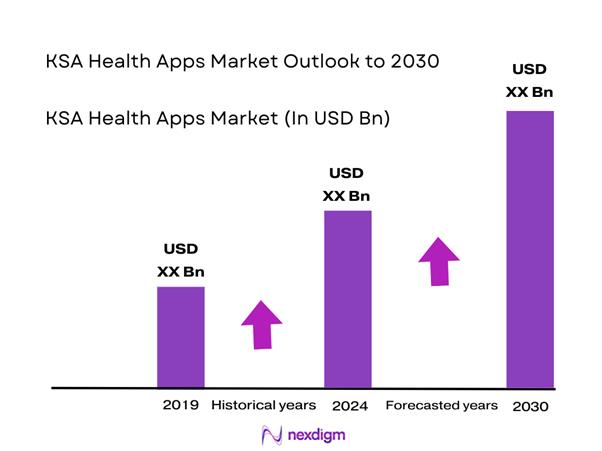

The KSA Health Apps (mHealth) market is valued at USD ~ billion, reflecting monetization across medical apps and fitness apps within the broader mHealth ecosystem. Demand has moved from “wellness tracking” to care access + care navigation, supported by government-scale digital rails—e.g., the Sehhaty super-app alone serves more than ~ beneficiaries and has enabled more than ~ remote appointments, making app-based care a mainstream access channel rather than an add-on. As a baseline comparator, a narrower-country databook scope reports USD ~ million for 2023 mHealth revenue base.

Within the Kingdom, Riyadh, Jeddah, and Dammam/Eastern Province act as demand and adoption anchors because they concentrate large hospital networks, payer/TPA decision centers, corporate employers, and digital-health startups, enabling faster onboarding of provider panels, e-prescriptions, and payments. Public-sector platforms accelerate reach: Sehhaty’s scale (~+ beneficiaries) creates a “default front door,” while appointment-routing apps like Mawid normalize digital booking and referrals, increasing repeat app usage in metro regions where provider density and digital readiness are highest.

Market Segmentation

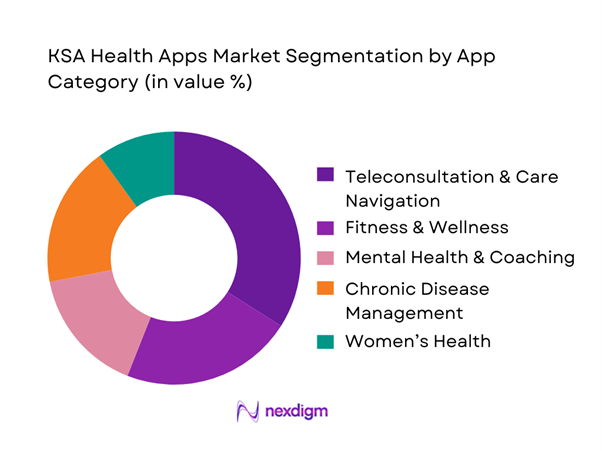

By App Category

KSA Health Apps market is segmented by app category into teleconsultation & care navigation, fitness & wellness, mental health & coaching, chronic disease management, and women’s health. Recently, teleconsultation & care navigation holds the dominant market share because Saudi users increasingly use apps as the first touchpoint for triage, appointment booking, e-prescriptions, and follow-ups, not only for tracking. Government platforms and insurer-linked telehealth models also institutionalize utilization: Sehhaty’s millions of remote appointments and broad service menu (appointments, prescriptions, instant consultations) create habitual, recurring workflows, while private telehealth apps integrate with payers for lower-friction access. This category also benefits from high provider availability in major cities and expanding digital enablement across public facilities, reducing drop-offs that are common in pure wellness apps.

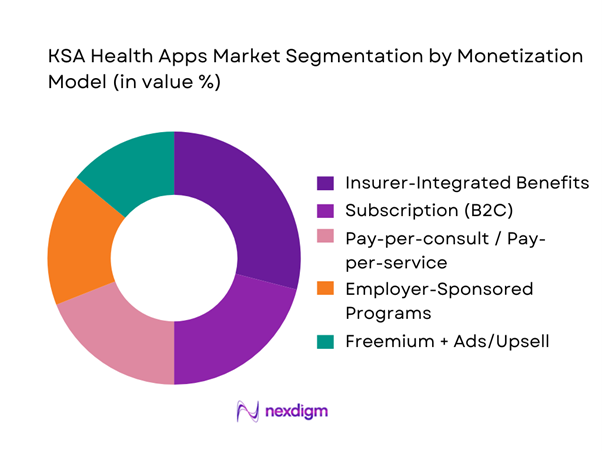

By Monetization Model

KSA Health Apps market is segmented by monetization model into insurer-integrated benefits, subscription (B2C), pay-per-consult / pay-per-service, employer-sponsored wellness/primary care, and freemium + ads/upsell. Recently, insurer-integrated benefits dominate because payer adoption reduces the biggest growth barrier in health apps—willingness to pay out-of-pocket repeatedly—and improves retention through embedded eligibility, claims alignment, and care pathways. Saudi telehealth leaders increasingly position themselves as insurer-operating partners, bundling urgent care, mental health, home labs, and medication delivery into covered pathways; this shifts apps from “consumer choice” to “covered access,” increasing utilization frequency and lowering acquisition costs. Where integration is strong, apps also capture post-consult revenue (labs, pharmacy delivery, chronic programs), improving unit economics versus standalone subscription apps that face churn after short-term goals are met.

Competitive Landscape

The KSA Health Apps market is shaped by a dual structure: public-sector super-apps that scale nationally for access/booking/prescriptions, and private platforms that compete on provider network depth, payer integration, specialty coverage (mental health, chronic care), and fulfillment (pharmacy/home labs). This creates a competitive “stack” where consumer acquisition often begins in government rails, while private players win on convenience, insurer tie-ups, and specialized service lines.

| Company / App | Established | Headquarters | KSA Focus Area | Core Proposition | Integration Depth | Provider Network Signal | Language / Localization | Trust & Compliance Posture |

| Sehhaty (MoH) | Launched Aug 2019 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Mawid (MoH) | Announced May 2019 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Cura | 2016 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Altibbi | 2011 | MENA (regional) | ~ | ~ | ~ | ~ | ~ | ~ |

| Tawakkalna Services (Health services layer) | 2020-era scale-up | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Health Apps Market Analysis

Growth Drivers

Population Digitalization

Saudi Arabia’s digital-first public service buildout is creating daily, repeatable “moments of use” that pull citizens into health apps (identity, scheduling, eRx, payments, and referrals). A strong macro base supports this shift: Saudi Arabia’s population reached ~ people and life expectancy reached ~ years, which increases the scale and continuity of healthcare interactions that can be digitized. On the healthcare operations side, government digital rails have already demonstrated high transaction throughput: the national e-prescription and medication fulfillment ecosystem (“Wasfaty”) has processed ~ prescriptions, benefiting ~ individuals, and connecting ~ pharmacies across ~ governorates—a scale that normalizes app-led workflows for refills, adherence, and follow-ups. As these platforms expand, health apps benefit from “system-to-system” interoperability (provider→payer→pharmacy), reducing user friction and enabling richer longitudinal records (medication history, chronic follow-ups, preventive reminders). For the health apps market, this creates a structural demand layer: users increasingly expect healthcare access via mobile as the default channel, and providers/payers gain stronger incentives to integrate app touchpoints for appointment routing, eRx renewal, care navigation, and claims-related documentation—all of which raise usage frequency and retention for clinically linked apps.

Smartphone Penetration

Health apps scale fastest where mobile connectivity is ubiquitous and stable across regions, because onboarding, notifications, video consults, and device pairing rely on consistent access. Saudi Arabia’s macro connectivity indicators show a high-capacity environment for app distribution and always-on engagement: mobile cellular subscriptions show ~ mobile subscriptions per ~ people, indicating that many residents maintain more than one active mobile line—useful for separating work/personal usage and enabling family-managed care (e.g., caregiver accounts for children/parents). Population scale further supports this: the country’s resident base is ~, which helps justify local investment in Arabic UX, Saudi clinical pathways, and integrations with national health platforms. For health apps specifically, high smartphone availability increases reach for: appointment marketplaces, tele-triage, chronic condition trackers, pharmacy ordering and delivery coordination, and employer wellness solutions delivered via managed devices or BYOD. It also improves the economics of iterative product improvement—more users generate more real-world feedback loops for personalization, while higher device coverage improves adoption of “peripheral-driven” experiences that feed data into apps. In short, when mobile access is near-universal at the system level, the market constraint shifts away from distribution and toward trust, clinical credibility, and reimbursement alignment—factors that mature the health apps ecosystem from “download-led” to “outcomes-led.”

Challenges

Data Localization Compliance

Data localization and cross-border transfer controls increase compliance complexity and lengthen sales cycles for health apps—especially those using foreign cloud stacks, overseas analytics, or offshore support teams. Saudi Arabia’s Personal Data Protection Law includes clear penalty exposure in riyals, which raises board-level risk awareness and forces stronger governance. Under the law, a warning or a fine not exceeding ~ Saudi Riyals can be imposed for violations in relevant cases; such headline penalty levels materially change how product teams design hosting, logging, consent, and vendor access. For health apps, the compliance burden is operational: privacy impact assessments, data mapping, role-based access, encryption, audit logs, breach response playbooks, and contracts that define processor/sub-processor responsibilities. It also affects product decisions like using third-party SDKs, advertising identifiers, and cross-app tracking—features that might be common in consumer apps but become sensitive in health contexts. The challenge is amplified by the scale of digital health transactions (eRx and appointments), where applications may process clinical, medication, and identity-linked data at national volumes; once a platform is used broadly, its governance requirements become more stringent. This can delay market entry for non-local vendors and pushes local partnership models (Saudi hosting providers, Saudi compliance teams, local legal counsel, and localized customer support).

Clinical Validation Burden

Clinical validation is a major gating factor for health apps that claim medical outcomes, provide diagnostic/triage guidance, or integrate with regulated devices. In Saudi Arabia, the validation burden is not only scientific; it is operational and regulatory—teams must align with national requirements for evidence, safety, and ongoing quality management. The pressure to formalize controls is reinforced by national cybersecurity expectations for entities in scope: the Essential Cybersecurity Controls framework defines ~ cybersecurity controls across ~ main domains and ~ subdomains—a scale of requirements that affects app security architecture, vendor management, incident response, and continuous monitoring. For clinically positioned health apps, validation and security are increasingly intertwined: if an app influences clinical decisions or stores sensitive health data, buyers demand stronger proof of safety, reliability, and governance. That means clinical protocols, documented risk management, traceable updates, version control, and post-release surveillance. The challenge becomes heavier when apps operate at national scale because any failure can be systemic—leading to reputational and compliance consequences. As a result, many app vendors face longer procurement cycles, higher documentation requirements, and greater need for local clinical partnerships to produce locally relevant evidence.

Opportunities

Hospital-at-Home Enablement

Hospital-at-home models expand when systems can monitor patients remotely, coordinate medication fulfillment, and route escalations efficiently—capabilities that health apps can orchestrate at scale. Saudi Arabia already has evidence of large digital health throughput and nationwide pharmacy connectivity that can underpin hospital-at-home execution: the Wasfaty network has processed ~ prescriptions, benefited ~ individuals, and integrated ~ pharmacies across ~ governorates—critical for home-based care because medication delivery/dispensing is one of the highest-frequency post-discharge needs. On the macro side, the country’s population scale (~) creates large cohorts for post-acute monitoring and chronic home follow-up, particularly in major cities (Riyadh, Jeddah, Dammam/Khobar) while still requiring national reach for remote areas. For the health apps market, the opportunity is to become the “care coordination layer” that links: discharge plans, home vitals capture, medication adherence and refills, virtual nurse/doctor check-ins, and escalation to facilities when thresholds trigger. Importantly, the opportunity should be framed using current operational signals rather than future market forecasts: these existing numbers demonstrate that Saudi healthcare workflows can already run digitally and nationally, which reduces execution risk for scaling hospital-at-home programs.

Employer Health Platforms

Employer platforms are positioned to grow because they convert health apps from a consumer “nice-to-have” into a funded, managed benefit—driving higher activation and sustained usage. Saudi Arabia’s operational healthcare infrastructure supports this: Wasfaty has benefited ~ individuals and coordinated dispensing through ~ pharmacies across ~ governorates, which allows employer programs to wrap services around medication continuity, chronic coaching, and preventive pathways without building a parallel fulfillment network. Macroeconomic scale supports continued employer capacity to procure structured benefits—especially for large enterprises, industrial employers, and multi-site organizations where absenteeism and chronic risk translate into measurable productivity impacts. The employer channel also helps solve two market bottlenecks at once: monetization and trust, with compliance requirements that include fines up to ~ SAR in relevant cases. The practical opportunity for health apps is to provide: Arabic-first onboarding, dependent/caregiver features, integrated medication and appointment navigation, dashboards that report utilization and outcomes proxies, and security controls aligned to national baselines. With the underlying nationwide digital-health rails already handling very large transaction volumes, employer platforms can scale faster and more consistently than purely self-pay models, making this a high-potential commercialization route for KSA health apps.

Future Outlook

Over the next five years, the KSA Health Apps market is expected to expand steadily as apps become the default interface for triage, booking, remote follow-up, e-prescriptions, and chronic management. Growth is reinforced by government-backed digital health transformation, payer demand for cost-effective care access and reduced avoidable utilization, and platform evolution toward integrated care journeys. As an external benchmark, Saudi mHealth is expected to grow at a ~ CAGR. What changes the market structure most is not just more downloads, but deeper workflow embedding: insurer-integrated pathways, medication adherence loops, women’s health and chronic programs, and tighter interoperability with national digital health infrastructure. The winning players will be those that combine clinical governance + payer integration + operational fulfillment, while keeping consumer experience frictionless in Arabic-first journeys.

Major Players

- Sehhaty

- Mawid

- Tawakkalna Services

- Cura

- Altibbi

- Seha Virtual Hospital

- NPHIES-linked digital claim pathways

- Vezeeta

- Okadoc

- Teladoc Health

- Practo

- MyFitnessPal

- Headspace

- Medisafe

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Public healthcare system operators

- Private hospital groups and clinic chains

- Health insurers and TPAs

- Employers and corporate benefits managers

- Pharmacy chains and medication delivery operators

- Digital health platform vendors & app developers

Research Methodology

Step 1: Identification of Key Variables

We build a KSA health-app ecosystem map covering government platforms, private telehealth players, insurers/TPAs, provider networks, pharmacies, and fulfillment partners. Desk research is combined with structured tracking of app propositions, service menus, and integration claims to define variables such as care pathways, monetization model, and regulatory posture.

Step 2: Market Analysis and Construction

We compile historical and 2024 indicators (platform adoption signals, service breadth, payer partnerships, and government program scale). We then construct the market using a bottom-up logic across key revenue pools (consults, subscriptions, employer programs, insurer contracts, and add-on services).

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews with hospital digital leaders, payer innovation teams, and platform operators. We use structured questionnaires to confirm pricing models, utilization drivers, churn factors, and the operational constraints that determine real adoption.

Step 4: Research Synthesis and Final Output

Findings are synthesized into a consistent market model and competitor benchmarking framework. We triangulate public-sector scale metrics, platform positioning, and payer/provider feedback to finalize segmentation narratives, competitive assessments, and actionable growth white spaces.

- Executive Summary

- Research Methodology (Market Definition and Boundary Setting, Health App Classification Framework, Inclusion–Exclusion Criteria, Abbreviations, Market Sizing Logic, Top-Down Demand Estimation via Smartphone & Internet Base, Bottom-Up App Revenue & Active User Modeling, Primary Interviews with App Developers, Hospitals, Insurers & Regulators, Data Triangulation, Assumptions and Limitations)

- Definition and Scope

- Market Evolution and Digital Health Genesis

- Integration of Health Apps within Vision-Aligned Healthcare Transformation

- Stakeholder Value Chain

- Business Cycle Mapping of Health Apps

- Growth Drivers

Population Digitalization

Smartphone Penetration

Chronic Disease Load

Preventive Healthcare Push

Employer Wellness Spend - Challenges

Data Localization Compliance

Clinical Validation Burden

Engagement Drop-Off Rates

Monetization Friction

Trust & Data Privacy - Opportunities

Hospital-at-Home Enablement

Employer Health Platforms

Insurer Outcome-Based Models

Arabic-First UX Design - Trends

AI-Driven Personalization

Remote Monitoring Integration

Behavioral Health Focus

Women-Centric Apps

Super-App Health Integration - Regulatory & Policy Landscape

- Technology Architecture Assessment

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Revenue, 2019–2024

- By Paid vs Freemium Contribution, 2019–2024

- By Enterprise vs Consumer Spend, 2019–2024

- By App Category Expansion, 2019–2024

- By Fleet Type (in Value %)

Fitness & Wellness Apps

Mental Health & Behavioral Therapy Apps

Chronic Disease Management Apps

Teleconsultation & Symptom Checker Apps

Medication Adherence & Pharmacy Apps - By Application (in Value %)

Diabetes & Metabolic Disorders

Mental Health & Stress Management

Cardiovascular & Hypertension

Women’s Health

Preventive & Lifestyle Health - By Technology Architecture (in Value %)

Subscription-Based

Pay-Per-Consult / Transactional

Employer-Sponsored

Insurer-Integrated

Advertising & Data-Driven - By Connectivity Type (in Value %)

Android-Based

iOS-Based

Web-Based / Cross-Platform - By End-Use Industry (in Value %)

Individual Consumers

Employers & Corporates

Hospitals & Clinics

Insurance Providers

Government & Public Health Programs - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern & Northern Regions

- Competitive Positioning Matrix

- Cross Comparison Parameters (App Category Coverage, Monthly Active Users, Monetization Model, Regulatory Compliance Status, Data Hosting Location, AI Capability Depth, Integration with Providers/Payers, Language Localization)

- SWOT Analysis of Key Players

Pricing & Revenue Model Benchmarking - Detailed Company Profiles

Sehhaty

Mawid

Tatsh

Altibbi

Cura Health

Vezeeta

Okadoc

Practo

Babylon Health

Ada Health

MindTales

BetterHelp

Flo Health

MyFitnessPal

Apple Health

- User Adoption Behavior

- Payment Willingness and Budget Allocation

- Trust, Privacy & Data Sensitivity Expectations

- User Pain Points

- App Selection & Decision-Making Journey

- By Revenue, 2025–2030

- By Paid Users, 2025–2030

- By Enterprise Contribution, 2025–2030

- By App Category Expansion, 2025–2030