Market Overview

The KSA Health Monitoring Devices market is valued at USD ~ in 2024. This market is primarily driven by the increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and hypertension, which have accelerated the demand for health monitoring solutions. Additionally, advancements in wearable health technology and the growing adoption of IoT (Internet of Things) based devices have played a significant role in expanding market opportunities. The Saudi government’s commitment to digital health initiatives under Vision 2030, which promotes the integration of technology in healthcare, further supports market growth.

Riyadh, Jeddah, and Dammam are the key cities driving the health monitoring devices market in Saudi Arabia. Riyadh, being the capital, is the central hub for healthcare institutions, government initiatives, and private sector investments, contributing significantly to the demand for health devices. Jeddah’s proximity to the Red Sea and its status as a major trade port facilitates the import and distribution of health monitoring technologies, making it a critical market. Dammam’s growing healthcare infrastructure, especially in the eastern province, caters to the expanding healthcare needs of the population, further bolstering market dominance.

Market Segmentation

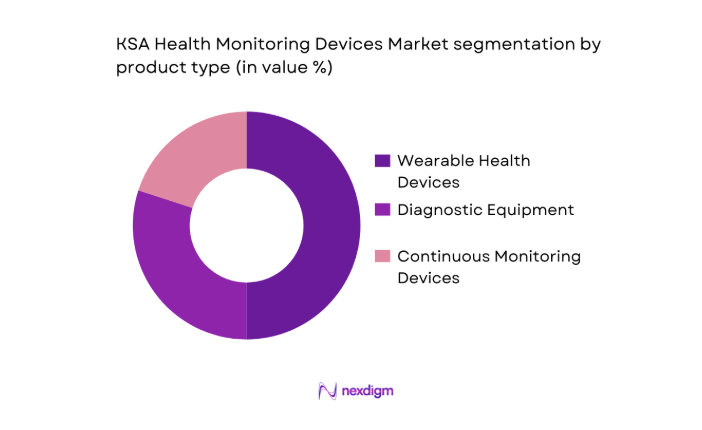

By Product Type

The KSA Health Monitoring Devices market is segmented by product type into wearable health devices, diagnostic equipment, and continuous monitoring devices. Among these, wearable health devices, particularly smartwatches and fitness trackers, dominate the market share due to their increasing popularity among the tech-savvy population. These devices, such as the Apple Watch and Fitbit, are growing in demand due to their ability to track vital health parameters like heart rate, steps, and calories. Consumers’ increasing health awareness, the rise of health-conscious individuals, and the integration of AI and machine learning in these devices have made wearables the most preferred segment.

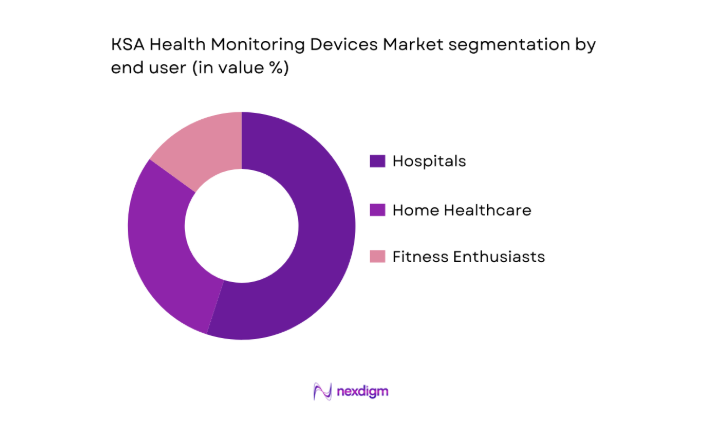

By End User

The market is segmented by end user into hospitals, home healthcare, and fitness enthusiasts. Hospitals represent the largest segment due to the growing demand for patient monitoring systems, which include ECG machines, blood pressure monitors, and other diagnostic equipment. These devices are crucial for the timely monitoring of patients’ health parameters in hospital settings. Home healthcare is also gaining traction, with the increasing preference for remote health monitoring solutions among patients with chronic conditions, which ensures better management and reduced hospital visits. Fitness enthusiasts’ growing adoption of health monitoring devices further adds to the market’s growth in this segment.

Competitive Landscape

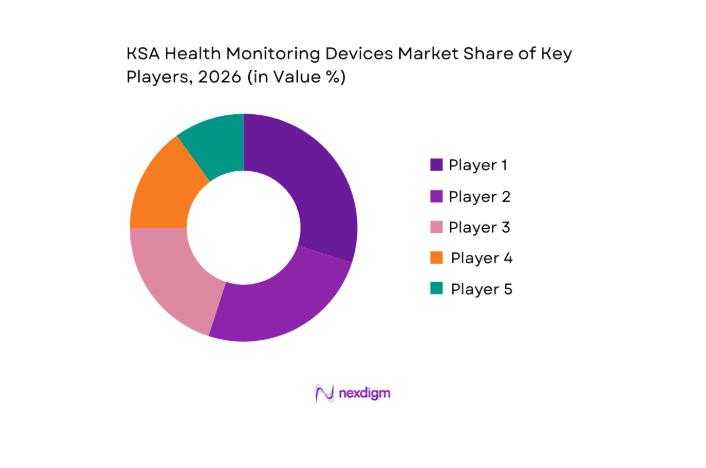

The KSA Health Monitoring Devices market is characterized by a competitive landscape dominated by both local and global players. The market has significant participation from global companies like Philips, Medtronic, and Apple, alongside regional players offering specialized devices for chronic disease management. The consolidation of a few major players in the market highlights the industry’s competitive dynamics, with companies competing based on innovation, product portfolio, and customer engagement strategies.

| Company | Year Established | Headquarters | Product Portfolio | Market Focus | Distribution Channels | R&D Investment |

| Philips | 1891 | Netherlands | ~ | ~ | Direct & Retail | ~ |

| Medtronic | 1949 | USA | ~ | ~ | Hospital Distributors | ~ |

| Apple | 1976 | USA | ~ | ~ | Retail, Online | ~ |

| Omron | 1933 | Japan | ~ | ~ | Retail, Distributors | ~ |

| Withings | 2008 | France | ~ | ~ | Online, Retail | ~ |

KSA Health Monitoring Devices Market Analytics

Growth Drivers

High Chronic Disease Burden

Saudi Arabia is facing a significant increase in chronic diseases, particularly cardiovascular diseases and diabetes, which are major drivers for the health monitoring devices market. The Saudi Health Council reports that nearly 30% of the adult population suffers from hypertension, with over ~ people affected by diabetes in 2023. As the population ages, the incidence of these diseases is expected to rise, creating a strong demand for health monitoring devices that assist in early detection and management. Chronic diseases are responsible for over 70% of the healthcare expenditures in Saudi Arabia, which drives investments in preventive technologies such as remote monitoring systems.

Rising Consumer Health Awareness

There is a growing trend among Saudi consumers to adopt health monitoring devices due to increasing health awareness. In 2023, the Saudi Ministry of Health reported that health-conscious behaviors are being promoted through the government’s campaigns for better lifestyle choices. Additionally, with healthcare spending reaching USD ~ in 2023, many consumers are seeking preventative and management solutions, particularly among younger populations and urban dwellers. Consumer health awareness is also being reinforced by a rising inclination towards fitness and wellness tracking, bolstered by the availability of wearable health technology.

Market Restraints

Regulatory Approval Lead Times (SFDA)

The Saudi Food and Drug Authority (SFDA) plays a critical role in regulating health monitoring devices in the Kingdom. However, long approval times for medical devices are a major restraint. The SFDA typically requires around 6-12 months for evaluating and approving new health devices before they can be marketed. This delay in market entry hinders innovation and the timely introduction of new technologies. The regulatory environment is under constant review, but the current approval process can slow down the pace at which the market can adopt new and innovative health monitoring devices.

High Cost of Premium Devices

Premium health monitoring devices, including advanced wearable medical technologies and continuous glucose monitors (CGMs), come with a high cost that limits accessibility. The average price of premium health monitoring devices such as advanced wearables is approximately SAR ~ to SAR ~. This high cost is a barrier for widespread adoption, particularly in the middle-income demographic. Saudi Arabia’s healthcare spending on high-tech devices is growing, but the cost-to-benefit ratio for consumers remains a critical concern. With the rising demand for affordable health solutions, the market is witnessing a gap between consumer needs and product accessibility due to pricing issues.

Opportunities

Localization of Manufacturing & R&D

The Saudi Arabian government is focusing on the localization of health technology manufacturing as part of Vision 2030. As of 2023, the Saudi government aims to reduce dependence on imports by encouraging domestic manufacturing of medical devices, including health monitoring technologies. The local manufacturing sector has grown by ~ since 2021, driven by incentives such as tax breaks and investment subsidies. The establishment of specialized health technology parks and the expansion of R&D facilities are also pivotal in enhancing local capabilities. This shift towards localization is expected to reduce the cost of high-tech medical devices, making them more affordable to the general population.

AI/ML Data Monetization & Predictive Health

Artificial Intelligence (AI) and Machine Learning (ML) technologies are increasingly being integrated into health monitoring devices for predictive health analytics. The Ministry of Health has emphasized AI’s role in revolutionizing healthcare services, particularly in chronic disease management. In 2023, the Saudi government allocated SAR ~ to foster AI-based solutions in healthcare. AI is expected to significantly reduce the cost of healthcare by enabling proactive health monitoring and predictive diagnostics. With healthcare systems increasingly using AI to manage patient data, there is a clear opportunity for health monitoring devices that integrate AI and ML to become central to preventative healthcare.

Future Outlook

Over the next six years, the KSA Health Monitoring Devices market is expected to experience substantial growth, driven by technological advancements, increasing awareness of chronic health conditions, and a higher demand for personalized health monitoring solutions. Innovations in AI, IoMT (Internet of Medical Things), and the increasing acceptance of telemedicine will further propel the demand for health monitoring devices. The government’s focus on digital health initiatives and an aging population are also key drivers for the market’s upward trajectory.

Major Players

- Philips

- Medtronic

- Apple

- Omron

- Withings

- Abbott Laboratories

- Garmin

- Fitbit (Google)

- Samsung Electronics

- Huawei Technologies

- Siemens Healthineers

- BioTelemetry

- Dexcom

- AliveCor

- Polar Electro

Key Target Audience

- Healthcare Providers

- Hospital Procurement Departments

- Home Healthcare Providers

- Medical Device Manufacturers

- Government Agencies

- Healthcare Insurance Companies

- Investments and Venture Capitalist Firms

- Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This phase includes identifying the critical variables that drive market growth, such as consumer health behavior, technological adoption rates, and government regulations. Data is gathered from secondary sources, such as industry reports and government publications, and augmented by proprietary databases.

Step 2: Market Analysis and Construction

In this phase, historical market data is analyzed, with a specific focus on evaluating the market penetration of different product types and end-users. Additionally, an assessment of sales performance, consumer trends, and healthcare policies will be conducted to create a comprehensive understanding of the market.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are performed through interviews with industry experts, hospital procurement managers, and device manufacturers. This validation process ensures that hypotheses regarding market dynamics and future trends are based on accurate, real-time data.

Step 4: Research Synthesis and Final Output

In the final phase, primary data from expert consultations is integrated with secondary research insights to generate a detailed, validated market analysis. The final report includes insights into market size, competitive landscape, and consumer behavior trends in the health monitoring devices market.

- Executive Summary

- Research Methodology (Market Taxonomy & Device Definition, Abbreviations & Regulatory Terms, Market Sizing Framework, Data Source Hierarchy, Consolidated Research Approach, Estimation & Forecast Models, Research Limitations & Confidence Bands)

- Sector Definition & Scope

- Healthcare Infrastructure & Digitalization Context

- Market Genesis & Evolution

- Market Value Chain & Stakeholder Mapping

- Supply Chain Dynamics

- Pricing Matrix & Reimbursement Dynamics

- Growth Drivers

High Chronic Disease Burden

Rising Consumer Health Awareness

Government Healthcare Investment & Vision 2030 Digital Initiatives

Telehealth & Remote Patient Monitoring Expansion - Market Restraints

Regulatory Approval Lead Times (SFDA)

High Cost of Premium Devices

Data Security & Privacy Concerns - Opportunities

Localization of Manufacturing & R&D

AI/ML Data Monetization & Predictive Health

Integration with National Health Information Exchanges - Trends & Innovations

Sensor miniaturization & multi‑biomarker tracking

Tele‑ICU + Remote Chronic Disease Management

Hybrid consumer‑clinical ecosystems - Government Policies & Incentives

SFDA Device Classification & Fast‑Track Policies

Healthcare Digital Transformation Incentives

Public‑Private Partnership Models - SWOT Analysis

- Porter’s Five Forces

- By Unit Shipments, 2019-2025

- Average Selling Price, 2019-2025

- Market Evolution Indicators, 2019-2025

- By Device Category (in value %)

Wearables

Clinical Patient Monitors

Continuous Glucose Monitoring

Biosensor & Implantables

At‑home Diagnostic Devices - By Technology Stack (in value %)

IoMT & Connected Platforms

AI/ML‑Enabled Analytics

Bluetooth/Wi‑Fi/Cellular Connectivity

Non‑Invasive Sensor Technologies - By End‑User (in value %)

Hospitals & Clinics

Home Healthcare Providers

Telehealth Service Operators

Fitness & Wellness Consumers

Insurers & Managed‑Care Programs - By Distribution Channel (in value %)

Institutional Tender & Procurement

Retail Consumer Tech Channels

E‑Commerce & Direct‑to‑Consumer

Healthcare Integrator Partnerships - By Geography (in value %)

Central

Western

Eastern

- Competitive Market Share

- Cross‑Comparison Parameters(Regulatory Approvals & Local Registrations, Product Portfolio Breadth, Connectivity & Interoperability Support, Clinical Validation & Certifications, Distribution Network Reach)

- Detailed Company Profiles

Koninklijke Philips N.V.

Siemens Healthineers

GE Healthcare

Medtronic plc

Abbott Laboratories

Apple Inc.

Samsung Electronics

Huawei Technologies

Garmin Ltd.

Fitbit (Google)

Omron Healthcare

Withings S.A.

Dexcom, Inc.

BioTelemetry Inc.

AliveCor, Inc.

- End‑User Adoption Rates & Utilization Patterns

- Procurement Behavior & Budget Allocations

- Clinical & Consumer Utilization Use‑Cases

- End‑User Pain Points & Decision Criteria

- Adoption Lifecycle & Forecast

- By Device Units & Penetration Rates, 2026-2030

- ASP Evolution, 2026-2030

- Segment Growth Projections, 2026-2030