Market Overview

Saudi Arabia’s health monitoring wearables demand is expanding on the back of a fast-rising “wearable technology” spending pool. The Saudi wearable technology market generated USD ~ million in revenue in the latest year, with a projected USD ~ million by the end of the forecast window. In parallel, Saudi wearable medical devices were sized at USD ~ million in the prior year, reflecting the acceleration of clinical and semi-clinical monitoring use cases. Growth is being pulled by consumer-grade vitals tracking (HR/SpO₂/sleep), insurer and employer wellness programs, and provider-led remote monitoring pathways.

Adoption is most concentrated in Riyadh, Jeddah, and the Eastern Province (Dammam/Khobar) because these hubs combine higher disposable incomes, denser private hospital networks, stronger corporate employer bases, and deeper omnichannel electronics retail coverage. Additionally, the Kingdom’s role as a regional scale market is evident in global datasets, with Saudi Arabia accounting for ~ of global wearable technology revenue in the latest year and projected to lead the Middle East and Africa region in revenue by the end of the forecast horizon. For clinical monitoring wearables, tertiary care clusters in these metros accelerate clinician acceptance, device procurement, and integration with digital health workflows.

Market Segmentation

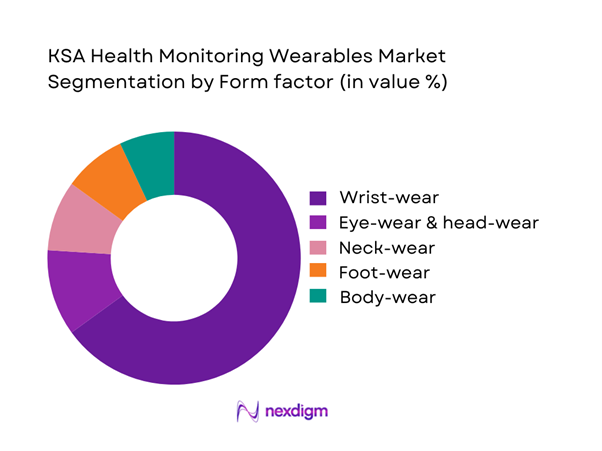

By Form Factor

Saudi Arabia’s health monitoring wearables demand is anchored in wrist wear (smartwatches and fitness trackers) because it best matches “always-on” vitals tracking, lifestyle compatibility, and telco and eSIM bundling. The Saudi wearable technology databook excerpt explicitly states that wrist-wear is the largest segment and reports a ~ revenue share in the latest year. Health monitoring features such as HR, SpO₂, sleep staging, stress and HRV indicators, fall detection, irregular rhythm notifications, and activity coaching are most mature and user-friendly in wrist form factors, while other form factors tend to be niche, including enterprise head-wear, sports specialty devices, or early-stage medical patches. This concentration is reinforced by strong retail presence, corporate gifting programs, and the cultural fit of discreet, non-invasive monitoring.

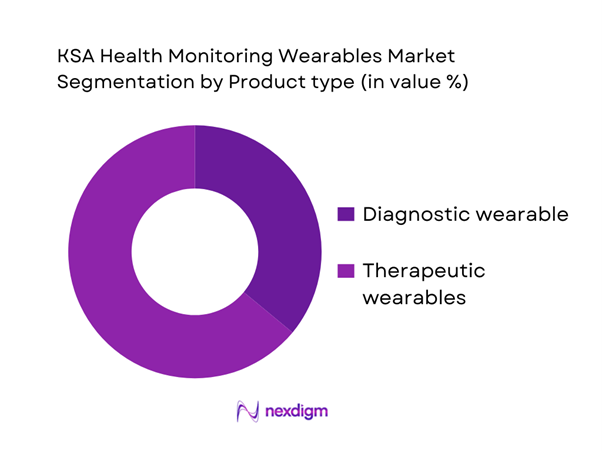

By Medical Wearables Product Type

For medical-grade health monitoring wearables, the GCC mix shows therapeutic wearables leading diagnostic wearables. The regional split categorizes wearable medical devices into diagnostic wearables and therapeutic wearables, with therapeutic devices forming the larger share. Therapeutic leadership is structurally linked to diabetes management ecosystems, cardiac therapy adjuncts, and condition-specific devices that become part of longer-duration care pathways, driving repeat sensor consumption, replenishment cycles, and stronger clinician anchoring. In Saudi Arabia specifically, chronic disease burden and the scale-up of digitally enabled care delivery, including virtual hospital models, support therapeutic monitoring depth and continuity of use. This benchmark is explicitly GCC-level rather than KSA-only, but it remains directionally relevant for the Kingdom’s medical wearables mix.

Competitive Landscape

The KSA health monitoring wearables market is concentrated around multi-ecosystem consumer leaders such as Apple, Samsung, Huawei, and Garmin, while medical-grade monitoring growth is shaped by condition-specific device ecosystems such as glucose monitoring platforms. Global datasets listing key market players in Saudi wearables consistently include Apple, Samsung, Huawei, Google and Fitbit, Garmin, and Xiaomi among major participants. In parallel, the Saudi-focused medical wearables context highlights the central role of the national medical device regulator and the growing importance of data and privacy governance for connected monitoring deployments.

| Company | Est. Year | HQ | Core KSA Health-Monitoring Proposition | Primary Form Factor Strength | Sensor Depth (Typical) | Health Platform / Data Layer | KSA Route-to-Market Strength | Clinical / Regulated Adjacency | After-Sales & Service Model |

| Apple | 1976 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Samsung | 1938 | South Korea | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Huawei | 1987 | China | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin | 1989 | Switzerland / USA operations | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott (Diabetes Wearables) | 1888 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Health Monitoring Wearables Market Analysis

Growth Drivers

Non-Communicable Disease Burden

Saudi Arabia’s wearable adoption is being pulled by a high-throughput chronic-care load that benefits from continuous, low-friction monitoring, including heart rhythm irregularities, sleep quality, glucose patterns, and activity. National NCD analysis in Saudi Arabia highlights that the four main non-communicable disease groups, including cardiovascular diseases, cancer, diabetes, and chronic respiratory diseases, account for around ~ deaths per year, with total NCD-related mortality estimated at ~ deaths annually. This creates a large addressable base for device-enabled early detection and longitudinal tracking. At the macro level, Saudi Arabia’s economy is sized at USD ~ million in GDP, giving the system fiscal room to scale prevention and digitally supported care models that improve outcomes and reduce acute episodes. Wearables act as a first-mile data layer for screening and escalation, particularly when combined with primary care and virtual specialist support that reduces geographic and appointment friction.

Preventive Healthcare Push

Preventive care in Saudi Arabia is being institutionalized through system-wide virtual access and earlier clinical intervention, conditions where wearables act as daily vital-sign feeders rather than occasional check tools. The Ministry of Health states that the SEHA Virtual Hospital supports ~ hospitals, provides ~ basic specialized services plus more than ~ sub-specialty services, employs more than ~ doctors, and has capacity for more than ~ patients annually. This national-scale capability increases the value of wearable-generated trends such as HR, SpO₂, sleep, activity, and arrhythmia alerts because there is a ready clinical path to interpret, triage, and intervene. On the macroeconomic side, Saudi Arabia’s GDP is reported at USD ~ million, supporting budget headroom for preventive care programs and digital workflows that shift demand away from late-stage, higher-acuity episodes. Wearables fit directly into this preventive push by enabling continuous measurement, earlier flags, and structured follow-up.

Challenges

Data Privacy and PDPL Compliance

Health monitoring wearables face higher compliance friction in KSA because biometric and health data sits in sensitive categories and the Personal Data Protection Law raises the execution bar for consent, processing notices, cross-border transfers, and data-subject rights. Official PDPL documentation establishes the regulatory regime, and public legal commentary describes administrative fines reaching up to SAR ~ for certain violations, with escalation in repeated cases. This compliance reality forces wearable vendors and platforms to localize hosting, tighten security controls, and redesign data flows, slowing deployments with hospitals and insurers. On the macro side, Saudi Arabia’s GDP is USD ~ million, associated with larger-scale digital ecosystems and higher scrutiny on governance. For wearables, the challenge is not demand but the operational cost and time required to achieve compliant integrations across apps, cloud infrastructure, and partners.

Medical Validation Gaps

A core barrier in health monitoring beyond fitness use cases is clinical validation and regulatory readiness, especially where devices are positioned for diagnosis support, monitoring under clinician supervision, or care pathway decisions. Saudi Arabia’s regulated environment means medical-claims wearables require stronger evidence and governance compared with consumer wellness devices. Operationally, the healthcare system is building digital scale, with the SEHA Virtual Hospital supporting ~ hospitals, offering ~ basic specialized services plus more than ~ sub-specialty services, and targeting more than ~ patients annually. While system capacity exists, device validation often lags device innovation cycles. On the macro side, Saudi GDP is USD ~ million, enabling rapid adoption and increasing the urgency for validated and interoperable monitoring. This gap becomes visible when enterprises and providers hesitate to rely on wearable signals without clear clinical thresholds, accountability, and integration into approved protocols.

Opportunities

Clinical Remote Patient Monitoring Expansion

Saudi Arabia already has national-scale digital clinical infrastructure that can turn wearables into clinical tools, representing a strong future growth lever by converting optional wellness tracking into care-pathway-supported monitoring. The Ministry of Health states that the SEHA Virtual Hospital supports ~ hospitals, provides ~ basic specialized services plus more than ~ sub-specialty services, employs more than ~ doctors, and has capacity for more than ~ patients annually. This operating base allows remote monitoring signals to be triaged and escalated within formal care workflows. The Health Sector Transformation Program further frames the virtual hospital as connecting over ~ hospitals with more than ~ specialized services, reinforcing national institutional commitment. With Saudi GDP at USD ~ million, the system can continue scaling digital care delivery, and wearables can embed into cardiometabolic and sleep pathways backed by clinician oversight and standardized data governance.

Insurer Backed Wearable Adoption

The payer ecosystem in Saudi Arabia is large enough to institutionalize wearable programs through benefit design, disease management, and prevention incentives, moving wearables from discretionary consumer purchases to structured covered programs. Beneficiaries reporting shows ~ million Saudis and ~ million non-Saudis under private insurance in the same snapshot, creating a large base for underwriting-driven health management programs where wearables can support adherence and early flagging. The broader insurance and provider ecosystem includes ~ insurers, ~ TPAs, and ~ provider organizations servicing about ~ million beneficiaries, indicating the scale and complexity where standardized digital workflows can amplify insurer-led monitoring adoption. With Saudi GDP at USD ~ million, employers and insurers have macro capacity to fund prevention, and the near-term opportunity lies in designing PDPL-aligned programs that use wearable data to drive proactive outreach and improve care navigation.

Future Outlook

Over the next cycle, Saudi Arabia’s health monitoring wearables market is set to deepen across three demand engines: mainstream wrist-wear upgrades with improved sensors and AI insights, medical wearables scaling through remote monitoring and chronic care pathways, and data-layer monetization via subscriptions, coaching, and insurer and employer programs. The market’s topline direction is supported by the expansion of Saudi wearable technology revenue from USD ~ million to USD ~ million across the forecast window. The most investable white spaces will be interoperability, Arabic-first engagement design, and validated clinical workflows that align with Saudi governance and medical device oversight.

Major Players

- Apple

- Samsung Electronics

- Huawei

- Garmin

- Xiaomi

- Sony

- Nike

- Adidas

- Abbott

- Dexcom

- Oura

- Polar Electro

- Withings

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Ministry of Health and public health system buyers

- Private hospital groups and integrated care networks

- Health insurers and payer organizations

- Large employers and employer benefits buyers

- Consumer electronics retail chains and e-commerce marketplaces

- Telecom operators and digital channels

Research Methodology

Step 1: Identification of Key Variables

We map the Saudi health monitoring wearables ecosystem across consumer, clinical, and payer and employer channels. Desk research compiles form factors, sensor stacks, regulatory checkpoints for medical devices, and data governance context, then defines the variables that shape adoption and monetization.

Step 2: Market Analysis and Construction

We build the market using triangulation of top-down published country market totals and bottom-up device categories, channel flow, and attach services. Published Saudi wearable technology revenue is used as the backbone market number and reconciled against medical-grade wearables sizing for healthcare-only layers.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on dominant form factors, channel dominance, and clinical adoption are validated through structured interviews with OEM channel partners, hospital digital health leaders, insurers, and large employers. The objective is to confirm buying criteria such as sensor accuracy, integration readiness, privacy requirements, and service SLAs.

Step 4: Research Synthesis and Final Output

We synthesize findings into segment narratives, competitive benchmarking, and opportunity maps. Conclusions are cross-checked against publicly documented market endpoints and disclosed segment shares where available, including wrist-wear dominance and GCC medical wearables splits.

- Executive Summary

- Research Methodology (Market Definitions and Scope Alignment, Abbreviations, Wearable Device Classification Logic, Market Sizing and Validation Framework, Bottom-Up Device Shipment Modelling, Top-Down Healthcare Spend Correlation, Primary Interviews with Distributors Providers and Insurers, Regulatory Mapping, Data Triangulation, Assumptions and Limitations)

- Definition and Scope

- Market Genesis and Evolution in Saudi Arabia

- Adoption Timeline Across Consumer Clinical and Enterprise Segments

- Market Maturity Curve and Innovation Cycles

- Healthcare Consumer Electronics Convergence in KSA

- Growth Drivers

Non Communicable Disease Burden

Preventive Healthcare Push

Vision 2030 Digital Health Mandates

Smartphone Penetration

Rising Health Aware Population - Challenges

Data Privacy and PDPL Compliance

Medical Validation Gaps

Device Interoperability Issues

User Engagement Drop Off

Reimbursement Constraints - Opportunities

Clinical Remote Patient Monitoring Expansion

Insurer Backed Wearable Adoption

AI Driven Early Risk Detection

Enterprise Wellness Platforms

Local Assembly and Customization - Trends

Medical Grade Sensor Integration

Subscription Based Health Insights

Employer Led Wearable Deployment

Arabic Health UX Localization

AI Driven Predictive Analytics - Regulatory & Policy Landscape

- Value Chain and Ecosystem Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Units Shipped, 2019–2024

- By Active Installed Base, 2019–2024

- By Average Device ASP, 2019–2024

- By Product Type (in Value %)

Smartwatches with Health Sensors

Fitness and Health Bands

Medical Grade Wearables

Smart Rings and Form Factor Devices

Wearable Patches and Biosensors - By Health Parameter Monitored (in Value %)

Heart Rate and ECG

Blood Oxygen SpO₂

Blood Pressure

Glucose and Metabolic Indicators

Sleep Stress and Activity Metrics - By Technology Architecture (in Value %)

Bluetooth Only Devices

LTE Cellular Enabled Wearables

Cloud Integrated Wearables

EHR Linked Clinical Wearables

AI Enabled Predictive Monitoring Devices - By End-Use Industry (in Value %)

Individual Consumers

Hospitals and Clinics

Home Healthcare Providers

Employers and Corporate Wellness Programs

Insurers and Population Health Managers - By Application (in Value %)

Lifestyle and Fitness Monitoring

Chronic Disease Management

Preventive Health Screening

Post Acute and Remote Patient Monitoring

Occupational and Enterprise Health - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share of Major Players by Value and Units

- Cross Comparison Parameters (Product Portfolio Breadth, Sensor Accuracy and Certification, Health Parameter Coverage, Data Security and PDPL Readiness, Ecosystem and App Maturity, Clinical Integration Capability, Distribution Reach in KSA, Pricing and Monetization Model)

- Competitive Benchmarking Matrix

- SWOT Analysis of Key Players

- Pricing and ASP Analysis by Device Category

- Detailed Company Profiles

Apple

Samsung Electronics

Huawei

Garmin

Xiaomi

Fitbit Google

Oura Health

Withings

Polar Electro

Omron Healthcare

Abbott FreeStyle Libre

Medtronic

Masimo

BioIntelliSense

- Usage Patterns and Device Stickiness

- Budget Allocation and Procurement Logic

- Clinical versus Lifestyle Adoption Drivers

- Pain Points and Unmet Needs

- Decision Making and Buying Triggers

- By Value, 2025–2030

- By Units Shipped, 2025–2030

- By Active Installed Base, 2025–2030

- By Average Device ASP, 2025–2030