Market Overview

The KSA Hydrogen Fuel Cell Vehicles market (commercial fuel-cell trucks as the dominant monetized segment) is valued at USD ~ million in the latest year, with demand anchored in heavy-freight decarbonization pilots and government-backed hydrogen ecosystem build-out. In the prior year, domestic hydrogen availability indicators remained strong, with national hydrogen output reported at nearly ~ tonnes, supporting the long-run feasibility of transport-grade hydrogen supply and logistics. Together, early fleet trials, freight-corridor suitability, and upstream hydrogen scale are translating into revenue formation and OEM–fleet procurement pipelines.

Within KSA, Riyadh, Jeddah, and the Eastern Province logistics–industrial belt (Dammam/Khobar–Jubail) dominate early hydrogen truck use-cases because they concentrate distribution centers, port-linked freight, and large fleet operators with centralized depots (best suited for first-wave refueling economics). NEOM and the Red Sea industrial corridor matter as hydrogen production and export-linked infrastructure clusters scale. From a supplier standpoint, the technology stack is led by South Korea, Japan, Germany, China, and the U.S. due to mature fuel-cell platforms, heavy-truck OEM depth, and hydrogen drivetrain supply chains that are already commercialized globally.

Market Segmentation

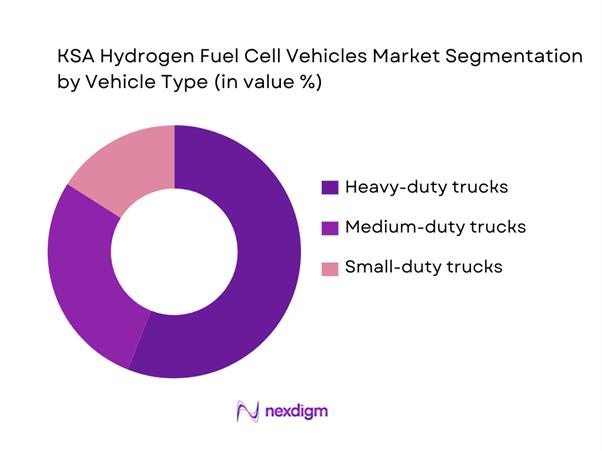

By Vehicle Type

KSA Hydrogen Fuel Cell Vehicles market is segmented by vehicle type into heavy-duty trucks, medium-duty trucks, and small-duty trucks. Recently, heavy-duty trucks have a dominant share because KSA’s early hydrogen deployments naturally fit long-haul and high-utilization freight where hydrogen’s fast refueling and payload advantages matter most. The Kingdom’s freight flows between ports, industrial cities, and major consumption hubs create predictable corridor routes, enabling depot- based refueling and higher vehicle utilization—both critical for fuel-cell TCO. Heavy-duty fleets also have stronger balance sheets and formal procurement processes, accelerating pilots into structured tenders. In contrast, medium- and small-duty adoption is slower because urban last-mile can be served by battery EVs sooner, and fragmented owner-operator structures delay capex-heavy technology shifts.

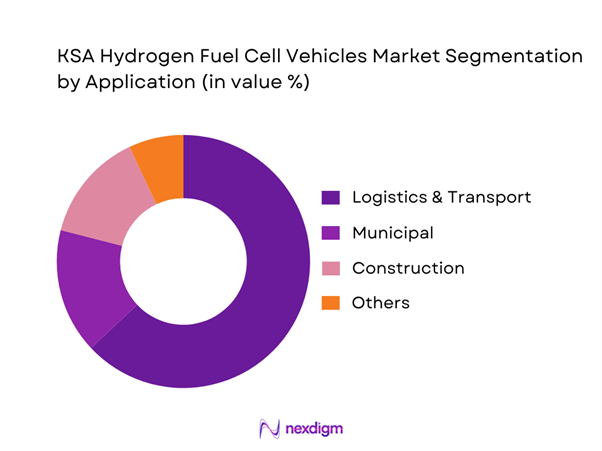

By Application

KSA Hydrogen Fuel Cell Vehicles market is segmented by application into logistics & transport, municipal fleets, construction/off-road support, and others (industrial shuttle/port drayage). Logistics & transport dominates because it concentrates the earliest “bankable” duty cycles: high daily mileage, central dispatch, and consistent routes connecting ports, industrial zones, and national distribution centers. These fleets benefit most from minimizing charging dwell time and maintaining payload, making hydrogen attractive versus large battery packs in certain routes. Additionally, procurement decisions are typically centralized among major 3PLs and large shippers, enabling structured pilots with OEMs and hydrogen suppliers. Municipal and construction segments are meaningful but more tender-driven, with longer replacement cycles and stricter local approval processes, delaying scale compared to logistics-led adoption.

Competitive Landscape

The KSA Hydrogen Fuel Cell Vehicles market is emerging around a limited set of global heavy-truck OEMs, fuel-cell powertrain leaders, and industrial gas/hydrogen ecosystem developers. This structure reflects the market’s current stage: deployments are pilot-to-early-scale, and competitiveness depends less on retail presence and more on fleet partnerships, homologation readiness, service uptime capability, hydrogen supply tie-ups, and corridor refueling strategies.

| Company | Est. Year | HQ | KSA Commercial Footprint | Vehicle Class Focus | Fuel-Cell / Powertrain Strategy | Hydrogen Supply / Refueling Tie-ups | After-sales & Uptime Model | Homologation / Compliance Readiness |

| Hyundai Motor Company | 1967 | South Korea | ~ | ~ | ~ | ~ | ~ | ~ |

| Daimler Truck | 2019* | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Volvo Group | 1927 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| Nikola | 2014 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Air Products | 1940 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Hydrogen Fuel Cell Vehicles Market Analysis

Growth Drivers

Hydrogen Mega-Projects as Supply Anchor

Saudi Arabia’s hydrogen mobility momentum is increasingly anchored by domestic supply-build that reduces “fuel availability risk” for fleets considering hydrogen trucks and buses. The national macro base supports capital formation: GDP is USD ~ trillion and GDP per capita is USD ~, which underpins large-scale industrial financing capacity and public–private programs tied to Vision-led infrastructure expansion. The flagship reference point is the NEOM Green Hydrogen Project at Oxagon, which reached financial close at USD ~ billion and is designed to produce ~ tonnes per day of clean hydrogen by electrolysis. In parallel, disclosures reference green hydrogen capacity of ~ tons annually, reinforcing “local availability” narratives that fleet operators and station developers use when building corridor economics. With population at ~, freight, municipal, and intercity mobility demand pools are large enough to create clustered depot demand—critical for station utilization and hydrogen offtake stability.

Heavy-Duty Transport Decarbonization Fit

KSA’s road-freight intensity makes heavy-duty the first commercially rational FCEV beachhead because it concentrates predictable, high-utilization duty cycles where fast refueling can protect uptime. Government road-transport statistics show road freight exports through land ports at ~ tons and imports at ~ tons, reflecting large cross-border truck movements that naturally concentrate around a limited set of corridors and ports—ideal for hydrogen “node” deployment. The same publication reports registered and roadworthy vehicles at ~, indicating the scale of overall road mobility and the opportunity size for low-emission alternatives in commercial fleets. Macro capacity is supportive: GDP is USD ~ trillion and consumer inflation is ~, a stability signal that helps longer-duration fleet investment decisions and infrastructure amortization planning. For hydrogen trucks, the “fit” is strongest where fleets can anchor stations with repeatable daily offtake and where route planning reduces range anxiety—precisely the pattern implied by high land-port freight tonnage and hub-based logistics operations across Riyadh–Eastern Province–Western seaports.

Challenges

Hydrogen Refueling Station Density and Reliability

Hydrogen vehicle uptime is only as strong as refueling availability, redundancy, and maintenance response time—making station density and reliability the main operational gating factor for KSA fleets. Current logistics scale is already large: cargo throughput is reported at ~ tons, while road-freight exports are ~ tons and imports are ~ tons via land ports—yet hydrogen refueling is still in early, project-led deployment rather than “network” coverage. The most concrete publicly documented step toward heavy-duty refueling is the announcement of Saudi Arabia’s first heavy-duty hydrogen refueling station, reflecting that heavy-duty infrastructure is only now moving from concept to installations. A NEOM-linked station is designed to refuel a planned fleet of ~ buses and light vehicles, which is meaningful but still small relative to the freight flows cited above. Macro pressure for reliable infrastructure is amplified by population ~, which sustains persistent passenger and goods mobility needs that cannot tolerate refueling downtime. Until station uptime is proven across multiple nodes (not single-site pilots), fleets will remain cautious about scaling FCEVs beyond controlled routes.

Hydrogen Transport and Storage Constraints

Even with large upstream production ambitions, moving hydrogen to fleets at the right purity, pressure, and cadence is a practical constraint—especially when demand is corridor-based and station utilization ramps unevenly. The near-term KSA logistics system is already moving massive tonnage: ~ tons of port cargo throughput and ~ tons of land-port road-freight highlight the scale of transport operations that hydrogen delivery must integrate with (trailers, storage, safety routing, and permitting). On the supply side, project design points of ~ tonnes per day of clean hydrogen indicate future bulk availability, but hydrogen still needs compression, storage, and final-mile delivery into dispensing equipment—steps that create additional operational complexity versus conventional fuels. Macro indicators matter here because they influence the cost and availability of infrastructure inputs: GDP is USD ~ trillion and inflation is ~, supporting stable procurement planning but not removing the engineering and permitting burden of hazardous-material logistics. Until transport-and-storage systems are proven at multiple sites, hydrogen mobility remains concentrated in captive or semi-captive deployments.

Opportunities

Depot-First Bus and Municipal Fleet Rollouts

The most actionable near-term growth pathway is “depot-first” deployments—buses and municipal fleets that return to base daily, allowing high station utilization without needing a nationwide network. Transport data shows strong indicators for depot-based planning: intracity accidents account for ~, implying dense urban operations where municipal fleets run repeatable routes that can be engineered around hydrogen refueling windows. The heavy-duty refueling ecosystem is also advancing in a way aligned to fleet depots: heavy-duty hydrogen refueling station milestones have been announced, and a NEOM-linked station is designed to refuel a planned fleet of ~ buses and light vehicles—a practical “fleet-backed” configuration that can be replicated for city fleets in Riyadh, Jeddah, and Dammam where operations are centralized. Macro scale supports municipal investment capacity and demand: population ~ and GDP per capita USD ~ support large transit and utility service requirements. As depot rollouts prove uptime and safety, they create templates for tender specs, training curricula, and maintenance models that can later be expanded to intercity routes.

Freight Hydrogen Corridor Development

Freight corridors are the highest-leverage opportunity because they connect the largest, most measurable demand nodes—ports, industrial clusters, and national distribution centers—where hydrogen stations can achieve high throughput quickly. The “corridor case” is already supported by hard movement data: ~ tons of road-freight exports and ~ tons of imports through land ports, plus ~ tons of port cargo throughput, indicate a freight system large enough to anchor multi-site hydrogen refueling economics across a few prioritized routes. Corridor planning benefits from KSA’s concentrated logistics geography and the fact that freight tonnage is observable and recurring, enabling station sizing against real flows rather than speculative demand. Macro capacity helps derisk the buildout: GDP is USD ~ trillion and FDI net inflows indicator value is ~, supporting the investability narrative for infrastructure-led decarbonization projects. With controlled corridor deployment, fleets can transition in batches, validate maintenance and safety operations, and then expand station networks outward from the highest-tonnage lanes—creating a practical scale pathway without requiring immediate national coverage.

Future Outlook

The KSA Hydrogen Fuel Cell Vehicles market is expected to expand as hydrogen production projects move from build to operations, and as fleet operators convert pilots into corridor-based deployments. Growth will be shaped by three execution variables: refueling reliability along priority freight routes, total delivered hydrogen cost at the pump including logistics, and homologation plus safety frameworks that reduce deployment friction for fleets. With Saudi Arabia targeting global leadership in hydrogen supply and accelerating industrial-scale projects, commercial fuel-cell trucks remain a high-visibility demand lever for domestic hydrogen utilization.

Major Players

- Hyundai Motor Company

- Daimler Truck

- Volvo Group

- Traton

- Scania

- PACCAR

- Nikola

- Dongfeng Motor Corporation

- Foton

- Zhengzhou Yutong

- Air Products

- ACWA Power

- Saudi Aramco

- Plug Power

Key Target Audience

- Fleet operators & 3PLs

- Large shippers with private fleets

- Hydrogen producers & industrial gas companies

- Refueling infrastructure developers & EPC contractors

- Truck OEMs and Tier-1 powertrain suppliers

- Project developers and industrial cluster operators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We construct a KSA hydrogen mobility ecosystem map covering truck OEMs, fuel-cell suppliers, hydrogen producers, offtakers, logistics fleets, regulators, and infrastructure developers. Desk research combines policy signals, project pipelines, and commercial fleet initiatives to define the variables that determine adoption (vehicle availability, refueling access, duty-cycle fit, safety compliance, and delivered hydrogen cost).

Step 2: Market Analysis and Construction

We compile historical commercialization indicators: pilot deployments, announced fleet programs, corridor suitability, and hydrogen project progress. A bottom-up model is built around addressable heavy-freight routes, depot concentration, and refueling node economics, then reconciled to published market sizing where available.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on adoption sequencing (ports → logistics corridors → broader fleets) are validated through structured interviews with fleet operators, hydrogen suppliers, and OEM/tier partners. CATI-based consultations focus on procurement criteria, uptime expectations, refueling constraints, and compliance hurdles.

Step 4: Research Synthesis and Final Output

We synthesize insights across stakeholders and triangulate with credible published benchmarks. Final outputs prioritize actionable segmentation, buyer decision logic, risk mapping (infrastructure, safety, supply), and competitive positioning to support investors and operators evaluating entry and scale pathways.

- Executive Summary

- Research Methodology (Market Definitions & Scope Boundaries, Assumptions & Exclusions, Abbreviations, Market Sizing Logic (Top-Down/Bottom-Up), Data Triangulation Framework, Primary Interview Program (OEMs/Fleets/Regulators/H₂ Suppliers), Demand Modeling Approach (Duty-Cycle Led), Supply Modeling Approach (Station & H₂ Availability Led), Scenario Design (H₂ Price/Infra/Policy), Validation Checks, Limitations & Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Technology Primer (FCEV vs BEV vs ICE; where hydrogen wins)

- KSA Hydrogen Mobility Timeline (pilots to fleet trials to corridor buildout)

- Hydrogen Mobility Value Chain (production to delivery to dispensing to vehicle operations)

- Growth Drivers

Hydrogen Mega-Projects as Supply Anchor

Heavy-Duty Transport Decarbonization Fit

Smart City and Mega-Project Deployment

Logistics Hub and Corridor Expansion

National Safety and Technology Upgradation - Challenges

Hydrogen Refueling Station Density and Reliability

Hydrogen Transport and Storage Constraints

Total Cost of Ownership Sensitivity

Hot-Climate Performance and Degradation Risks

Regulatory and Homologation Clarity - Opportunities

Depot-First Bus and Municipal Fleet Rollouts

Freight Hydrogen Corridor Development

Port and Industrial Hydrogen Mobility

Localization and Assembly Potential

Bundled Vehicle-Hydrogen-Service Offerings - Trends

Higher Durability Fuel Cell Stacks

Advanced Type IV Tank Scaling

Digital Fleet Operations and Predictive Maintenance

Modular Hydrogen Refueling Station Designs

Hydrogen Quality Assurance and Purity Management - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Vehicle Category Contribution, 2019–2024

- By Fleet Type (in Value %)

Passenger Cars (Sedan/SUV)

City and Coach Buses

Heavy-Duty Trucks (Long-haul/Regional)

Medium-Duty Trucks (Urban logistics)

Specialty and Industrial Vehicles (Ports, airports, yards) - By Application (in Value %)

Public Transit and Intercity Mobility

Logistics and Linehaul Freight

Municipal Services

Industrial and Port Operations

Mega-Projects and Smart City Mobility - By Technology Architecture (in Value %)

PEM Fuel Cell Systems

High-Power PEM Systems

Hybrid Fuel Cell plus Battery Systems

Modular Fuel Cell Stack Platforms - By Connectivity Type (in Value %)

Depot-Based Refueling Operations

Corridor-Based Refueling Operations

Captive Industrial Refueling Setups - By End-Use Industry (in Value %)

Government and Municipal Authorities

Public Transport Operators

Logistics and Fleet Operators

Industrial Operators

Corporate Campuses and Mega-Project Developers - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region

- Market Share Snapshot of Major Players

- Cross Comparison Parameters (vehicle stack power rating and power density, stack durability and warranty terms, hydrogen storage pressure and usable capacity, real-world range and hydrogen consumption by duty cycle, refueling time and protocol compatibility, after-sales footprint in KSA, total cost of ownership levers, ecosystem and hydrogen supply partnerships)

- SWOT Analysis of Major Players

- Pricing and Commercial Model Analysis

- Detailed Profiles of Major Companies

Toyota Motor Corporation

Hyundai Motor Company

Honda Motor Co., Ltd.

Mercedes-Benz

BMW Group

Robert Bosch GmbH

Ballard Power Systems

Plug Power Inc.

Cummins / Accelera

Symbio

Hexagon Purus

NEL Hydrogen

Air Liquide

Linde

Air Products

- Demand and Utilization Patterns

- Fleet Budgeting and Financing Behavior

- Safety, Training and Operating Governance

- Needs, Desires and Pain Point Analysis

- Decision-Making Journey

- Tendering and Contracting Practices

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030

- By Vehicle Category Contribution, 2025–2030