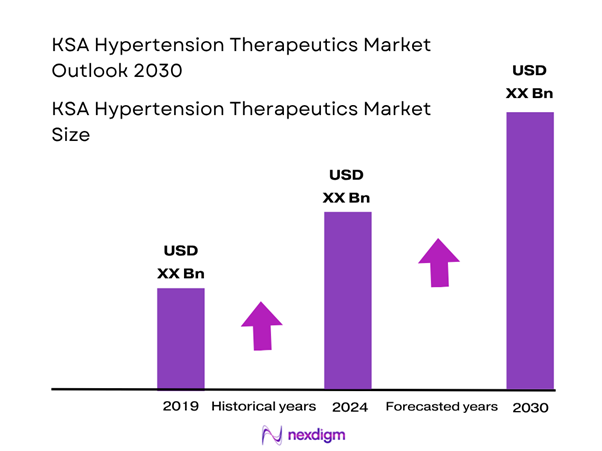

Market Overview

The hypertension therapeutics market in the Kingdom of Saudi Arabia is estimated at approximately USD ~ million in 2024, based on regional data and national drug-market sizing. This valuation reflects the prevalence of hypertension, rising healthcare expenditure, and increasing adoption of anti-hypertensive medications in the Kingdom. According to regional data for the Middle East & Africa, the anti-hypertensive drugs market for 2024 is USD 921.3 million, which provides a base context. Large treatment populations and government healthcare modernisation are driving that size.

Major cities such as Riyadh and Jeddah dominate the hypertension-therapeutics market in Saudi Arabia, largely because they host the Kingdom’s most advanced tertiary care hospitals, specialist cardiology and nephrology clinics, and affluent patient populations. The concentration of specialist physicians, advanced diagnostics and private-public healthcare investment in these urban centres accelerates both diagnosis and treatment adoption of anti-hypertensive therapies.

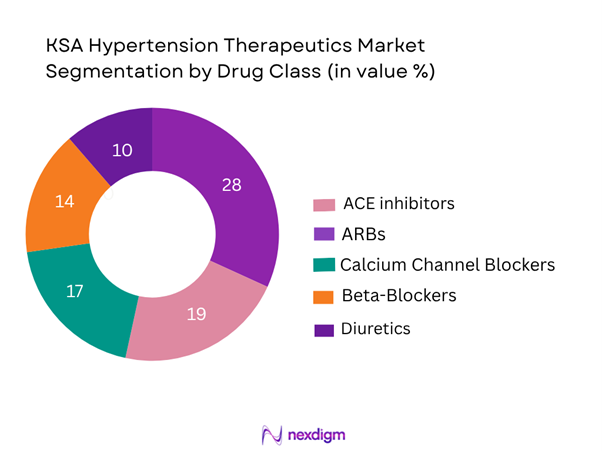

Market Segmentation

By Drug Class

The Saudi Arabia hypertension therapeutics market is segmented by major drug classes into: Angiotensin Converting Enzyme (ACE) inhibitors; Angiotensin II Receptor Blockers (ARBs); Calcium Channel Blockers (CCBs); Beta-Blockers; Diuretics; Fixed-Dose Combinations (FDCs). Among these, ARBs are currently the dominant sub-segment, driven by favourable tolerability profiles, guideline recommendations for first-line use and strong local prescriber comfort with this class. The increasing use of fixed-dose combinations is also gaining traction.

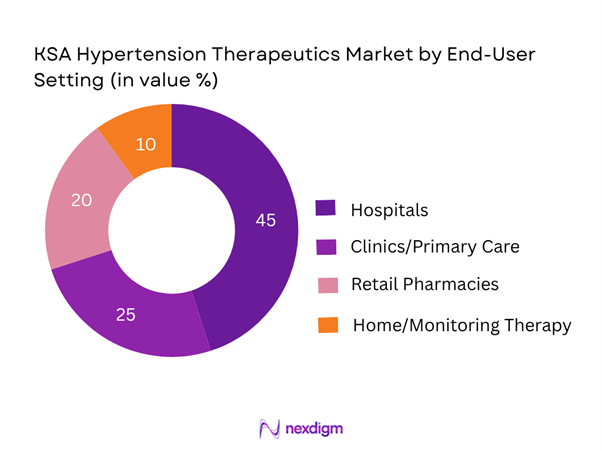

By End-User Setting

By End-User Setting: The market is also segmented by end-user setting into Hospitals (in-patient/out-patient), Clinics/primary care, Retail Pharmacies, and Home/Monitoring therapy. The Hospitals segment holds the largest share, because management of hypertension often involves specialist referral, comorbidity treatment (e.g., cardiovascular disease, diabetes) and hospital procurement of newer therapies and combinations. As a result, hospital pharmacies and specialist outpatient units lead in adoption.

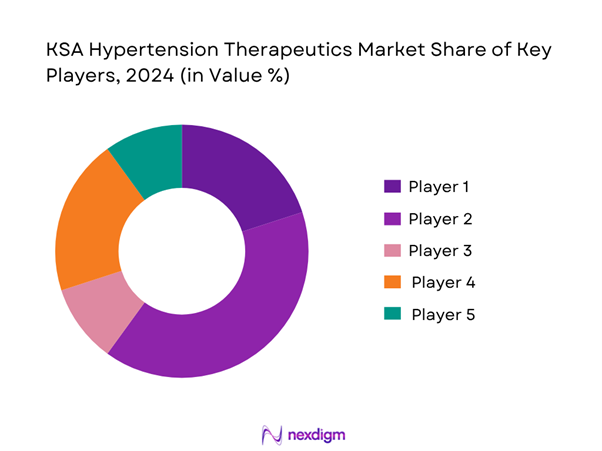

Competitive Landscape

The Saudi Arabia hypertension therapeutics market features both global pharmaceutical majors and regional/regional-specialist companies. Competitive activity includes product launches, licensing arrangements, generics roll-out and fixed-dose combination introductions.

| Company | Establishment Year | Headquarters | Key Hypertension Portfolio | Market Focus Region | Recent Strategic Move | Notes |

| Novartis AG | 1996 | Basel, Switzerland | – | – | – | – |

| Sanofi S.A. | 1973 | Paris, France | – | – | – | – |

| Pfizer Inc. | 1849 | New York, USA | – | – | – | – |

| Boehringer Ingelheim | 1885 | Ingelheim, Germany | – | – | – | – |

| Sun Pharma Industries | 1983 | Mumbai, India | – | – | – | – |

KSA Hypertension Therapeutics Market Analysis

Key Growth Drivers

Chronic Disease Trend

The prevalence of hypertension in KSA has been reported at a pooled rate of about 22.7 % among adults based on 23 studies, with a sample size of 272,378. This significant burden of hypertension, combined with rising diabetes and cardiovascular comorbidities, fuels demand for therapeutics tailored to hypertension management. The elevated chronic disease load encourages healthcare providers and payers to invest more in anti-hypertensive medications, monitoring and long-term management. This dynamic directly underpins the market for hypertension therapeutics in KSA.

Population Aging

In KSA, the population aged 65 and above as a share of total population is approximately 2.95 % in 2024. While still modest, this older cohort is growing, and an UNFPA report notes that persons aged 60+ are expected to rise from 5.9 % of the population in 2020 (about 2 million) to 23.7 % (about 10.5 million) by 2050. As hypertension prevalence escalates with age, this demographic shift supports increasing long-term therapeutics demand, medication adherence programmes and follow-up care, thus strengthening the hypertension therapeutics market in the Kingdom.

Key Market Challenges

Drug Pricing Regulation

In KSA, the pricing of pharmaceuticals is regulated by government bodies and acquisition costs are subject to central purchasing. These regulatory constraints place pricing pressure on novel hypertension treatments, which may restrict margins and delay entry of premium therapies. This regulatory environment can slow the uptake of higher-cost antihypertensive medicines and pose a barrier to market expansion.

Import Dependency

Saudi Arabia’s pharmaceutical sector still relies heavily on imports for many branded therapies. Import dependency exposes the hypertension therapeutics market to currency fluctuations (SAR vs USD), supply-chain delays and regulatory import approval lags, all of which can constrain timely availability and increase cost of imported antihypertensive drugs.

Emerging Opportunities

Personalized Medicine

With hypertension increasingly understood as a multivariate condition (genetics, comorbidities, genomics), there is opportunity in KSA for personalised antihypertensive regimens guided by biomarkers. Although exact KSA statistics are not published, the Kingdom’s drive in genomics and precision medicine under its national health programmes enables entry of tailored hypertension therapies and diagnostics—a growth space for therapeutics and monitoring solutions.

Digital Health Integration

The digital-health market in KSA has reached an estimated USD 4.4 billion in 2024. With the rise of telemedicine and remote monitoring, integration of digital blood-pressure monitoring platforms, patient adherence apps and connected devices offers significant potential for hypertension therapeutics. Pharmaceutical players can partner with digital-health providers to improve monitoring and drive therapy-uptake and adherence.

Future Outlook

Over the next six years the Saudi Arabia hypertension therapeutics market is expected to show steady growth, driven by demographic ageing, increasing hypertension prevalence, healthcare spending growth and ongoing government reforms under Vision 2030 to improve chronic-disease management. The evolution of fixed-dose combinations, treatment of resistant hypertension, improved adherence technologies and growth of private healthcare delivery in the Kingdom will further support market expansion.

Major Players

- Novartis AG

- Sanofi S.A.

- Pfizer Inc.

- Boehringer Ingelheim

- Sun Pharma Industries

- AstraZeneca PLC

- Bayer AG

- Takeda Pharmaceutical Co. Ltd

- Lupin Limited

- Teva Pharmaceutical Industries Ltd

- Hikma Pharmaceuticals PLC

- Tabuk Pharmaceuticals (Saudi Arabia)

- SPIMACO (Saudi Pharmaceutical Industries & Medical Appliances Corp)

- Viatris Inc.

- GlaxoSmithKline plc

Key Target Audience

- Pharmaceutical and biotechnology companies active in cardiovascular and hypertension therapies

- Hospital groups and large healthcare delivery networks in Saudi Arabia

- Retail pharmacy chains and specialty cardiovascular pharmacy divisions

- Investments and venture capitalist firms exploring cardiovascular / chronic-disease therapy markets

- Medical device companies providing hypertension monitoring/management solutions

- Health insurance providers and payers (including Saudi national insurance and private insurers)

- Government and regulatory bodies (e.g., Saudi Food & Drug Authority, Ministry of Health (Saudi Arabia))

- Large healthcare service providers and integrated care networks

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabia hypertension therapeutics market. This step is underpinned by extensive desk research, utilising a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyse historical data pertaining to the hypertension therapeutics market in Saudi Arabia. This includes assessing therapy adoption rates, numerical prescription volumes, treatment mix, and resultant revenue generation. Furthermore, an evaluation of treatment adherence statistics, pricing trends and market access will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies (pharmaceuticals, hospitals, payers). These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple pharmaceutical companies and healthcare providers to acquire detailed insights into product pipelines, sales performance, prescribing trends, patient behaviour and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabia hypertension therapeutics market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Research Approach, Expert Interviews, Primary Sources, Data Validation, Key Limitations)

- Definition and Scope

- Disease Genesis and Prevalence

- Patient Population Dynamics

- Timeline of Major Therapeutic Launches

- Business Cycle and Treatment Pathways

- Supply Chain and Value Chain Analysis

- Key Growth Drivers

Chronic Disease Trend

Population Aging

Lifestyle Risk Factors

R&D Pipeline Strength

Health Ministry Initiatives

Insurance Penetration,

Urbanization

Medical Tourism - Key Market Challenges

Drug Pricing Regulation

Import Dependency

Patient Adherence

Generic Penetration Barriers

Pharmacovigilance

Prescription Shifts

Operational cost

Distribution Logistics - Emerging Opportunities

Personalized Medicine

Digital Health Integration

E-Prescribing

Telehealth Expansion

Combination Therapy Uptake

Government Funding

Epidemiological Innovation

Compliance Solutions - Market Trends

Emergence of Novel Therapeutics

Fixed-Dose Combinations

AI-Driven Adherence

Home Delivery Solutions

Strategic Alliances

Biosimilars Roll-out

Formulation Advances

Beyond-the-Pill Services - Government Regulation

SFDA Policy

Price Controls

Reimbursement Framework

Market Entry Standards

Quality Assurance

Pharmacovigilance Compliance

Import/Export Controls

Tender Specifications - Stakeholder Ecosystem

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- Average Price Trends, 2019-2024

- By Drug Class

ACE Inhibitors

Beta Blockers

Angiotensin II Receptor Blockers (ARBs)

Calcium Channel Blockers

Diuretics - By Mode of Administration

Oral (Tablets, Capsules, Solutions)

Injectable/IV

Transdermal Patches

Combination Formulations

Extended-Release Solutions - By Distribution Channel

Hospital Pharmacies

Retail Pharmacies

Online Pharmacies

Wholesalers

Direct-to-Patient/Doctor - By Prescription Type

Branded Drugs

Generic Drugs

Over-the-Counter (OTC)

Managed Care Prescriptions

Specialty Medicines - By Region

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share of Major Players by Value/Volume

- Cross Comparison Parameters (Therapeutic Portfolio Breadth, Regulatory Filings, Patent Activity, Distribution Touchpoints, Pricing Strategy, Supply Chain Reliability, R&D Investment, Formulation Diversity, Brand Equity, Local Manufacturing, Hospital Partnerships, Digital Health Integration, Tender Wins, Compliance Rate, Disease Awareness Campaigns)

- SWOT Analysis for Each Major Player

- Detailed Profiles of Major Competitors

Novartis

Sanofi

Bayer

Boehringer Ingelheim International GmbH

Daiichi Sankyo

Takeda Pharmaceutical

Viatris Inc.

Teva Pharmaceutical Industries

Sandoz

Sun Pharmaceutical Industries

Pfizer

AstraZeneca

Merck & Co.

GSK

Hikma Pharmaceuticals

- Demand & utilisation patterns

- Patient demographics & behavioural segments

- Budget allocations & reimbursement landscape

- Key unmet needs & pain-points

- Decision-making process & procurement pathway

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030