Market Overview

The market for injectable emulsions in Saudi Arabia is valued at approximately USD ~ million in 2024, based on extrapolation from related parenteral nutrition and injectables segments. For example, the Saudi Arabia intravenous solutions market generated USD 112.1 million in 2023. Growth is being driven by rising critical-care infrastructure investment, increasing parenteral nutrition usage, and a government push for localisation of sterile injectable manufacturing.

Major urban centres such as Riyadh, Jeddah and Dammam dominate the injectable emulsions market because they house the largest tertiary hospitals, intensive-care units and high-end pharmacy networks. Their concentration of specialist clinics, high patient footfalls and well-established hospital procurement systems favour early adoption of complex parenteral formulations such as injectable emulsions.

Market Segmentation

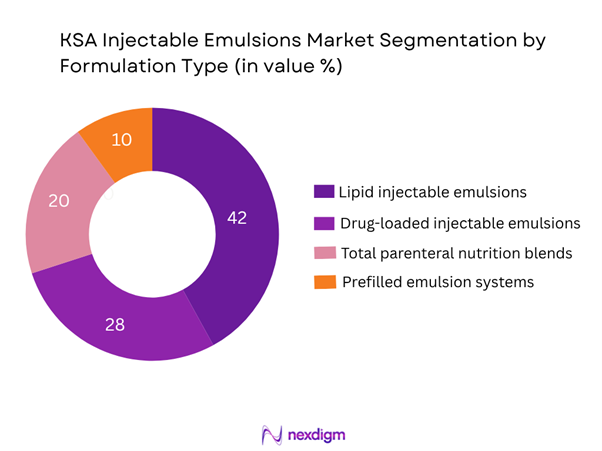

By Formulation Type

The Saudi injectable emulsions market is segmented into lipid injectable emulsions, drug-loaded injectable emulsions, TPN blends and prefilled emulsion systems. The dominant share is held by lipid injectable emulsions, owing to their widespread use in ICU settings, post-surgery and in parenteral nutrition programmes. Hospitals favour established lipid emulsion products for critical-care and nutritional support, and stakeholders emphasise reliable supply and cost containment, which supports the dominance of this sub-segment.

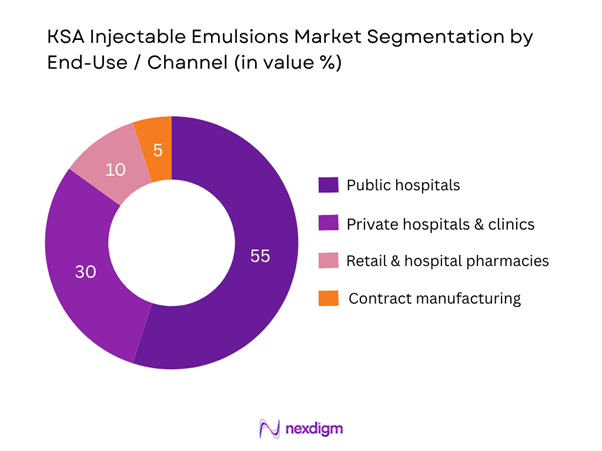

By End-Use / Channel

The market is further segmented into public hospitals, private hospitals & clinics, retail & hospital pharmacies, and contract manufacturing/third-party supply. The public hospital segment accounts for the largest share because the majority of high-complexity injectable emulsions are procured through public-tender mechanisms for large government hospital networks. These networks have centralised procurement, bulk purchasing and standardised formularies, giving them cost and logistical advantages compared to smaller private institutions.

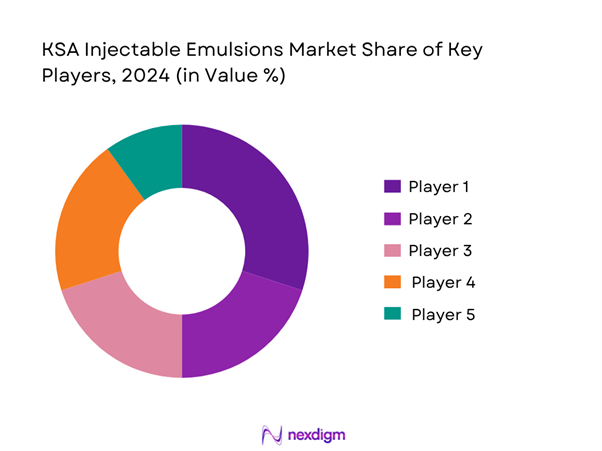

Competitive Landscape

The Saudi injectable emulsions market is characterised by a handful of major players holding strong positions, including both global multinationals and regional/local manufacturers. The competitive structure reflects significant barriers to entry (sterile manufacturing, regulatory approvals, hospital tendering) and strong emphasis on localisation, supply reliability and hospital channel access within the Kingdom’s healthcare ecosystem.

| Company | Establishment Year | Headquarters | Local Manufacturing (Y/N) | Injectable Emulsion Portfolio | Tender Win Track Record | Distribution Network Coverage |

| Hikma Pharmaceuticals | 1978 | London, UK / Jordan | – | – | – | – |

| SPIMACO | 2003 | Riyadh, Saudi Arabia | – | – | – | – |

| Jamjoom Pharmaceutical | 1991 | Jeddah, Saudi Arabia | – | – | – | – |

| Tabuk Pharma | 1995 | Tabuk, Saudi Arabia | – | – | – | – |

| Jazeera Pharma | 2001 | Riyadh, Saudi Arabia | – | – | – | – |

KSA Injectable Emulsions Market Analysis

Growth Drivers

Expansion of ICU beds & critical-care infrastructure

Saudi Arabia’s healthcare sector shows that there were 9,181 ICU beds with mechanical ventilators across the Kingdom, equivalent to about 26.4 beds per 100,000 population. Coupled with the recent statistic that there are 23.8 hospital beds per 10,000 population in the Kingdom.This upward capacity of inpatient beds and advanced critical-care units indicates greater potential demand for injectable emulsions (especially those used in ICU settings such as lipid emulsions or infusion therapies). As more tertiary hospitals expand ICU services and tertiary care increases, the infrastructure supports adoption of complex sterile injectable formulations.

Rising incidence of chronic and lifestyle diseases requiring parenteral nutrition and injectable therapies

Malnutrition in hospitalised patients in Saudi Arabia is notable: in one study at a Jeddah hospital, up to 76.6 % of elderly inpatients were malnourished or at risk. Also, a study showed that in ICU patients in some Makkah hospitals, 79 % were at high risk of malnutrition and underfed in calorie or protein intake. These figures reflect a high demand for nutritional support services including parenteral nutrition, of which lipid injectable emulsions are a core component. The prevalence of malnutrition and associated comorbidities in critical care and chronic disease contexts boost the addressable market for injectable emulsions.

Market Challenges

High regulatory barrier and complexity of injectable emulsion manufacturing

Sterile injectable emulsions require high-level GMP facilities, aseptic processing, lipid handling, cold‐chain controls and specialized packaging. In KSA, although hospital-bed expansion is documented (78,440 total beds in 2022), there is limited publicly available data on the number of local sterile injectable emulsion plants. The complexity of manufacturing and stringent regulatory oversight by the Saudi Food & Drug Authority (SFDA) pose entry barriers. This creates challenge for new entrants and limits the speed of market expansion because scalable sterile emulsion production is capital-intensive and time-consuming to qualify and certify.

Supply-chain disruption (sterile manufacturing, cold-chain, lipid raw materials)

The availability of nutrition support services in hospitals is only 48.2 % according to a survey of 114 healthcare providers in Saudi Arabia. This relatively low penetration suggests potential supply-chain issues for parenteral and injectable nutrition markets. Moreover, the evolution of ICU referrals shows significant regional disparities, for example, ICU e-referral rates of 16.64 per 10,000 in the Southern Border region. These data point to infrastructure and logistical bottlenecks, which for injectable emulsions (requiring cold-chain, lipid sourcing and sterile handling) create additional risk of supply disruption. Manufacturers must ensure robust supply-chain and distribution networks across KSA regions to avoid short‐falls.

Opportunities

White-space in drug-loaded injectable emulsions (emulsion antibiotics, oncology)

In Saudi Arabia, data on home nutrition support show only 48.2 % of hospitals had such services available. This under-penetration signals an unmet need for advanced formulations extending to injectable emulsions beyond lipid nutrition (for example drug-loaded emulsions, emulsion-based oncology infusions). Hospitals upgrading critical-care services and parenteral treatments indicate opportunity for players with differentiated emulsion technologies that can fulfill therapeutic and logistic gaps in KSA.

Local manufacturing and contract-manufacturing for exports (GCC hub)

The number of hospital beds in KSA was 78,440 in 2022, with an identified additional requirement of 17,062 beds to meet international benchmarks. This capacity growth sets the stage for domestic sterile-injectable manufacturing expansion. By enhancing local manufacturing of injectable emulsions, firms can serve both KSA hospital demand and act as a contract-manufacturing hub for the broader GCC region, leveraging economies of scale and regional trade. This localisation aligns with national policy frameworks and offers a structural growth lever in the injectable-emulsions domain.

Future Outlook

Over the next 5–6 years the Saudi injectable emulsions market is expected to show significant growth driven by expanding critical-care infrastructure, increasing demand for parenteral nutrition (particularly in malnutrition/ICU settings), regulatory support for localisation of sterile manufacturing, and rising hospital procurement budgets aligned with the Kingdom’s healthcare modernisation. Technological innovations in emulsion drug-delivery and ready-to-use systems will further enhance market growth.

Major Players

- Hikma Pharmaceuticals plc

- SPIMACO (Saudi Pharmaceutical Industries & Medical Appliances Corporation)

- Jamjoom Pharmaceutical Company

- Tabuk Pharmaceuticals Manufacturing Company

- Jazeera Pharmaceutical Industries

- Avalon Pharma

- Alpha Pharma (KSA)

- Dammam Pharma Co.

- Pharma Care Leading

- AJA Pharma Industries Ltd.

- Batterjee Pharmaceutical Factory

- Nahdi Medical Company

- Al-Razi Pharma Industries

- Pharmaceutical Solutions Industry Ltd.

- Riyadh Pharma

Key Target Audience

- Pharmaceutical & sterile injectable manufacturers (entering/emulsion portfolios)

- Hospital procurement departments (public & private hospitals)

- Distributors & logistics providers specialising in cold chain/sterile supply

- Investments & venture-capitalist firms (healthcare/sterile injectable manufacturing)

- Contract manufacturing organisations (CMOs) in sterile injectable domain

- Government & regulatory bodies (e.g., Saudi Food & Drug Authority (SFDA), National Unified Procurement Company (NUPCO))

- Parenteral nutrition service providers & hospital pharmacy decision-makers

- Localisation incentive programmes and industrial parks (e.g., Saudi Industrial Development Fund)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map of all stakeholders in the Saudi injectable emulsions market, including manufacturers, hospitals, tenders, regulators, and distribution channels. This was supported by desk research using secondary and proprietary databases to identify major product types, end-user segments, and market dynamics.

Step 2: Market Analysis and Construction

In this stage we compiled historical data on hospital ICU adoption rates, parenteral nutrition volumes, injectable utilisation, and unit-price trends in Saudi Arabia. We analysed procurement flows, hospital capacity expansion and sterile injectable manufacturing output to estimate market size and pricing trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (e.g., lipid emulsions growth, localisation impact) were validated through interviews with industry experts, hospital pharmacy directors and regulatory officials in the Kingdom. These qualitative insights helped refine quantitative estimates and validate assumptions.

Step 4: Research Synthesis and Final Output

Finally, we engaged with manufacturers, hospital purchasers and tender aggregators within Saudi Arabia to verify our bottom-up estimates and triangulate with topo-down benchmarks. This produced a validated and robust market-size estimate and forecast for the injectable emulsions market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations and Terminology, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In-depth Industry Interviews, Primary Research Approach, Data Triangulation and Forecasting Methodology, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Product Launches & Approvals in KSA

- Supply Chain and Value Chain Analysis

- Regulatory Framework and Compliance Landscape

- Healthcare Infrastructure & Hospital Feed-through

- Pricing, Reimbursement & Tender Mechanisms

- Growth Drivers

Expansion of ICU beds & critical care infrastructure

Rising incidence of chronic and lifestyle diseases requiring parenteral nutrition and injectable therapies

Government localisation push

Technological innovation - Market Challenges

High regulatory barrier and complexity of injectable emulsion manufacturing

Supply chain disruption

Pricing pressure & reimbursement constraints

Competition from non-emulsion injectables / biosimilars - Opportunities

White-space in drug-loaded injectable emulsions

Local manufacturing and contract manufacturing-for-exports (GCC hub)

Emerging outpatient injectable market via retail pharmacies - Trends

Shift to ready-to-use emulsion infusions / prefilled systems

Strategic collaborations & licensing agreements for emulsion technologies

Regulatory harmonisation across GCC impacting KSA market - SWOT Analysis

- Stakeholder Ecosystem (manufacturers, contract Mfg, distributors, hospital pharmacies, regulators)

- Porter’s Five Forces Analysis

- By Value (USD / SAR), 2019-2024

- By Volume (litres, units, vials/ampoules), 2019-2024

- By Average Price (per unit, per therapy), 2019-2024

- By Formulation Type (in value %)

Lipid Injectable Emulsions

Drug-loaded Injectable Emulsions

Total Parenteral Nutrition (TPN) Emulsion Blends

Fixed-Dose Emulsion Prefill Systems - By Therapeutic Class (in value %)

Oncology

Critical Care / ICU Sedation

Parenteral Nutrition

Anti-infectives

Cardiovascular (emulsion based infusables) - By Container / Presentation (in value %)

Vials & Ampoules

Prefilled Syringes / Cartridges

Infusion Bags / Bottles - By End-User / Channel (in value %)

Public Hospitals

Private Hospitals & Clinics

Retail & Hospital Pharmacies

Contract Manufacturing & Third-party Supply

By Region (in value %)

Riyadh (Central)

Jeddah / Makkah (Western)

Dammam / Eastern Province

Southern & Northern Provinces - By Local Manufacturing vs Imports (in value %)

Domestic Production

Imports (MNCs, regional hubs)

- Market Share of Major Players (by value/volume)

- Cross-Comparison Parameters (Company Overview, Business Strategy, Recent Developments, Strengths, Weaknesses, Manufacturing Capacity (units/vials), Localisation Rate R&D / Emulsion Technology Portfolio, Supply-Chain Reach (hospital network coverage), Distribution Channel Footprint, Pricing Strategy (SAR/unit), Government Tender Wins, Regulatory Approvals (SFDA, GCC), Margins, Production Plant Location & Capacity, Unique Value Proposition)

- Detailed Profiles of Major Companies

Hikma Pharmaceuticals plc

Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO)

Jamjoom Pharmaceutical Company

Tabuk Pharmaceuticals Manufacturing Company

Riyadh Pharma

Jazeera Pharmaceutical Industries (JPI)

Avalon Pharma

Alpha Pharma (KSA)

Dammam Pharma Co.

Pharma Care Leading

AJA Pharma Industries Ltd.

Batterjee Pharmaceutical Factory

Nahdi Medical Company

Al‑Razi Pharma Industries

Pharmaceutical Solutions Industry Ltd.

- Hospital Demand & Utilisation

- Purchasing Power & Budget Allocations

- Regulatory & Compliance Requirements for End-Users

- Needs, Desires & Pain-Points of End-Users

- Decision-Making Process

- By Value, 2025-2030

- By Volume (units/litres), 2025-2030

- By Average Price (per unit), 2025-2030