Market Overview

The KSA Ketone Testing Devices market is valued at USD ~ million, driven primarily by the growing incidence of diabetes and the increasing adoption of ketogenic diets in the country. The demand for ketone testing devices is escalating as more individuals and healthcare facilities seek accurate, real-time solutions to monitor ketone levels, primarily to prevent diabetic ketoacidosis (DKA). This growth is supported by technological advancements in blood ketone meters and non-invasive monitoring systems, enabling users to track their ketone levels at home, a convenience highly valued by diabetic patients.

Riyadh, Jeddah, and Dammam are the key cities dominating the KSA Ketone Testing Devices market, with Riyadh being the central hub of healthcare infrastructure in the country. These cities account for the majority of the demand due to their higher concentration of hospitals, clinics, and diabetes care centers. Additionally, urban areas show greater awareness and adoption of health technology, further bolstered by government health initiatives aimed at tackling the diabetes epidemic. Global leaders in the medical technology sector, such as Abbott Laboratories and Nova Biomedical, influence the supply and technological advancement in the market.

Market Segmentation

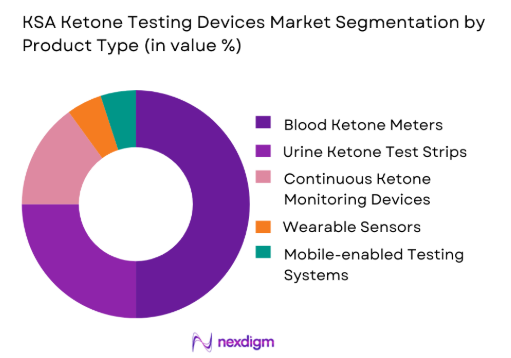

By Product Type

The KSA Ketone Testing Devices market is segmented by product type, which includes blood ketone meters, urine ketone test strips, continuous ketone monitoring devices, wearable sensors, and mobile-enabled testing systems. Blood ketone meters dominate the market in 2024 due to their high precision and growing adoption among diabetic patients for at-home monitoring. These devices offer a reliable and efficient way to track ketone levels, which is essential for preventing diabetic ketoacidosis (DKA). The accuracy and ease of use have made blood ketone meters the preferred choice in healthcare settings and for consumers. Moreover, the increasing availability of affordable models is further contributing to their market share dominance.

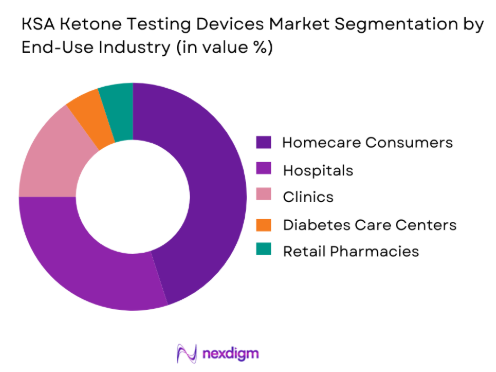

By End-Use Industry

In terms of end-use, the KSA Ketone Testing Devices market is primarily divided into homecare consumers, hospitals, clinics, diabetes care centers, and retail pharmacies. The homecare consumer segment holds the largest market share in 2024. The increasing trend toward self-monitoring of health, especially among diabetic patients and individuals following ketogenic diets, has driven the demand for at-home ketone testing devices. These devices are seen as an essential part of managing diabetes and maintaining a healthy lifestyle. With mobile-enabled testing systems and easy-to-use blood ketone meters available at affordable prices, consumers are increasingly opting for homecare solutions that enable them to manage their health more independently.

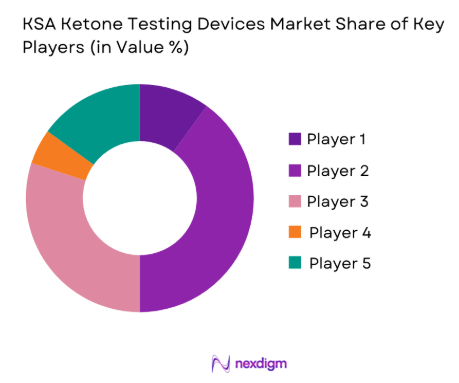

Competitive Landscape

The KSA Ketone Testing Devices market is dominated by a few major players, including Abbott Laboratories and global brands like Nova Biomedical, Foracare, LifeScan, and i-Sens. This consolidation highlights the significant influence of these key companies. These players dominate due to their strong brandrecognition, established product portfolios, and trusted market presence. Their ongoing focus on technological innovation and accessibility has enabled them to maintain a competitive edge in the growing Saudi Arabian healthcare market.

| Company | Establishment Year | Headquarters | SFDA Regulatory Approval Status | Product Portfolio | Pricing Strategy | R&D Investment | Market Penetration |

| Abbott Laboratories | 1888 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Nova Biomedical | 1976 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Foracare | 1997 | USA | ~ | ~ | ~ | ~ | ~ |

| LifeScan | 1981 | California, USA | ~ | ~ | ~ | ~ | ~ |

| i-Sens | 2004 | Seoul, South Korea | ~ | ~ | ~ | ~ | ~ |

KSA Ketone Testing Devices Market Analysis

Growth Drivers

High Diabetes Prevalence Increasing DKA Prevention Focus

The rising prevalence of diabetes, particularly Type 1 and Type 2 diabetes, is intensifying the focus on diabetic ketoacidosis (DKA) prevention. As the number of diabetes patients continues to grow, the risk of DKA, a potentially life-threatening complication, also increases. DKA can occur when insulin levels are insufficient, leading to high blood ketones and acidity in the blood. As a result, healthcare systems are placing greater emphasis on proactive prevention strategies, such as regular ketone testing, early intervention, and proper management of insulin therapy. This increased focus on DKA prevention is driving the demand for more frequent and accessible ketone testing, both for patients and healthcare providers.

Rising Adoption of Sick Day Protocols and Patient Education

There is a growing adoption of sick day protocols and patient education aimed at preventing diabetes-related complications, particularly during illness or periods of high stress. Sick day protocols typically involve increased monitoring of blood glucose and ketone levels, especially when the body is under stress due to infection or other illnesses. Educating patients about these protocols helps them understand the importance of routine testing and how to manage their diabetes effectively during such times. This rising awareness is encouraging patients to adopt healthier self-care practices, increasing the demand for tools that allow for frequent ketone testing and improved disease management.

Challenges

Low Routine Ketone Testing Adherence Outside Acute Episodes

A significant challenge in diabetes management is the low adherence to routine ketone testing outside of acute episodes. Many patients only test for ketones when they experience symptoms or during periods of illness, rather than incorporating regular testing into their daily diabetes management routine. This inconsistent testing can lead to missed opportunities for early intervention and a higher risk of complications like DKA. Encouraging routine ketone testing requires addressing barriers such as patient education, perceived inconvenience, and the cost of testing, which currently limit widespread adherence to these practices in everyday diabetes care.

Higher Per Test Cost for Blood Ketone Strips Versus Urine Strips

The higher per-test cost of blood ketone strips compared to urine strips is another challenge. While blood ketone testing provides more accurate and real-time measurements, it is significantly more expensive than urine ketone strips, which are commonly used by patients for monitoring purposes. This price difference makes blood ketone testing less accessible for many patients, especially those with lower incomes or limited healthcare coverage. The cost barrier can result in patients opting for less accurate urine strips, which may not detect early signs of ketoacidosis as effectively as blood tests, ultimately impacting patient outcomes.

Opportunities

Bundled Diabetes Monitoring Kits Combining Glucose and Ketone Workflows

One opportunity to improve diabetes management is the development of bundled diabetes monitoring kits that integrate glucose and ketone testing workflows. By offering these tools together, patients can easily monitor both blood glucose and ketone levels as part of a comprehensive diabetes management strategy. Bundled kits would provide a more holistic approach, enabling patients to manage their condition more proactively, especially in preventing DKA. These kits could include devices for both glucose and ketone testing, along with educational materials and support tools, helping to increase adherence and improve overall diabetes care.

Retail Pharmacist-Led Diabetes Care Programs and Counseling Services

Retail pharmacist-led diabetes care programs and counseling services offer an opportunity to expand access to diabetes management support. Pharmacists are trusted healthcare providers who can play a key role in educating patients about diabetes care, including the importance of routine ketone testing and monitoring. Through diabetes care programs, pharmacies can offer personalized counseling, support for medication management, and guidance on using monitoring tools effectively. These programs can be particularly valuable in communities where access to primary care is limited, empowering patients to manage their diabetes more effectively and proactively prevent complications like DKA.

Future Outlook

The KSA Ketone Testing Devices market is expected to continue its growth trajectory over the next few years. With advancements in non-invasive technologies, increasing consumer awareness, and government health initiatives, the market is well-positioned for sustained expansion. The focus will likely shift toward enhancing user experience and making devices more accessible and affordable for consumers, particularly in the homecare segment.

Major Players

- Abbott Laboratories

- Nova Biomedical

- Foracare

- LifeScan

- i-Sens

- Dexcom

- Ascensia Diabetes Care

- Medtronic

- ACON Laboratories

- Roche Diagnostics

- Ketone–Mojo

- Nipro Corporation

- Trividia Health

- GlucoWise

- Onewellness

Key Target Audience

- Investments and venture capitalist firms

- Healthcare providers (hospitals and clinics)

- Diabetes care centers

- Retail pharmacies

- Government and regulatory bodies (Saudi Food and Drug Authority – SFDA)

- Health insurance companies

- E-commerce retailers and distributors

- Corporate healthcare organizations

Research Methodology

Step 1: Identification of Key Variables

This phase involves creating a comprehensive ecosystem map of all the major stakeholders in the KSA Ketone Testing Devices market. Data is collected from secondary sources, including industry reports and regulatory bodies, to identify the factors driving demand and market behavior.

Step 2: Market Analysis and Construction

Data related to market size, consumer behavior, and industry trends is analyzed. This includes understanding the penetration of ketone testing devices across healthcare settings and consumer segments to estimate market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews with healthcare professionals, device manufacturers, and distributors. These insights help refine the market data and confirm assumptions made during the initial analysis.

Step 4: Research Synthesis and Final Output

he final report is synthesized by integrating insights gathered from expert consultations and market analysis. This process ensures a thorough understanding of market trends, competitive dynamics, and future growth opportunities.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, ketone testing taxonomy across blood urine and breath, market sizing logic by device base and consumable consumption, revenue attribution across meters strips readers and analyzers, primary interview program with hospitals clinics pharmacies distributors and payers, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Ketone Testing in KSA

- DKA Risk Landscape and Diabetes Care Context

- Care Pathway Mapping Across Emergency Care Inpatient Settings and Home Monitoring

- Retail Pharmacy Channel Influence on OTC Ketone Testing

- Import Dependence and Authorized Distributor Ecosystem

- Growth Drivers

High diabetes prevalence increasing DKA prevention focus

Rising adoption of sick day protocols and patient education

Expansion of emergency and inpatient diabetes management programs

Growth of retail pharmacy networks and OTC access

Increasing awareness of euglycemic DKA risk in modern therapies - Challenges

Low routine ketone testing adherence outside acute episodes

Higher per test cost for blood ketone strips versus urine strips

Coverage variability and limited reimbursement for home supplies

Accuracy concerns for breath ketone devices versus blood reference

Supply continuity risk for imported strips and consumables - Opportunities

Bundled diabetes monitoring kits combining glucose and ketone workflows

Retail pharmacist led diabetes care programs and counseling services

Hospital protocols driving standardized blood ketone adoption

Local distribution scale up for faster replenishment cycles

Integration of ketone monitoring into remote diabetes care programs - Trends

Shift toward blood ketone testing for clinical decision support

Growth of dual glucose ketone ecosystems in home monitoring

Increasing use of app based logging and trend analytics

Standardization of emergency triage protocols using blood ketones

Rising consumer interest in ketogenic diet monitoring devices

Regulatory & Policy Landscape

SWOT Analysis

Stakeholder & Ecosystem Analysis

Porter’s Five Forces Analysis

Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Consumables Consumption, 2019–2024

- By Device Installed Base, 2019–2024

- By Blood vs Urine Testing Revenue Split, 2019–2024

- By Fleet Type (in Value %)

Government hospitals and emergency departments

Private hospital networks

Primary care clinics and diabetes centers

Retail pharmacies and medical stores

Home monitoring users and caregivers - By Application (in Value %)

DKA screening and monitoring

Sick day management for insulin users

Emergency department triage support

Inpatient metabolic monitoring

Consumer wellness and ketogenic diet monitoring - By Technology Architecture (in Value %)

Blood ketone meters using beta hydroxybutyrate strips

Dual glucose ketone meter ecosystems

Urine ketone dipsticks and semi quantitative readers

Breath ketone analyzers for consumer monitoring

Lab chemistry analyzers supporting ketone measurement - By Connectivity Type (in Value %)

Standalone meters with local logs

Bluetooth connected meters and mobile apps

Clinic managed remote monitoring programs

Hospital connectivity through LIS and EHR workflows

Distributor managed service and replenishment platforms - By End-Use Industry (in Value %)

Acute care hospitals and emergency services

Diabetes specialty clinics

Primary healthcare centers

Retail pharmacy operators and distributors

Home healthcare and caregiver networks - By Region (in Value %)

Riyadh Region

Makkah Region

Eastern Province

Madinah Region

Asir and Southern Regions

- Positioning driven by strip economics accuracy and retail availability

- Partnership models with hospitals pharmacy chains and payer programs

- Cross Comparison Parameters (beta hydroxybutyrate accuracy performance, strip cost per test, sample type and minimum volume, time to result, meter and strip ecosystem availability, connectivity and app analytics quality, reagent and strip storage stability, total cost of ownership)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Porter’s Five Forces

- Detailed Profiles of Companies

Abbott

Roche Diabetes Care

Ascensia Diabetes Care

LifeScan

Nova Biomedical

EKF Diagnostics

PTS Diagnostics

ARKRAY

Acon Laboratories

Trividia Health

ForaCare

Keto Mojo

TaiDoc Technology

Sinocare

i-SENS

- Clinician preferences for testing thresholds and workflow fit

- Patient willingness to pay and testing frequency behavior

- Pharmacy recommendation dynamics and brand influence

- Procurement models in government hospitals and medical cities

- Total cost of ownership drivers across meters and consumables

- By Value, 2025–2030

- By Consumables Consumption, 2025–2030

- By Device Installed Base, 2025–2030

- By Blood vs Urine Testing Revenue Split, 2025–2030