Market Overview

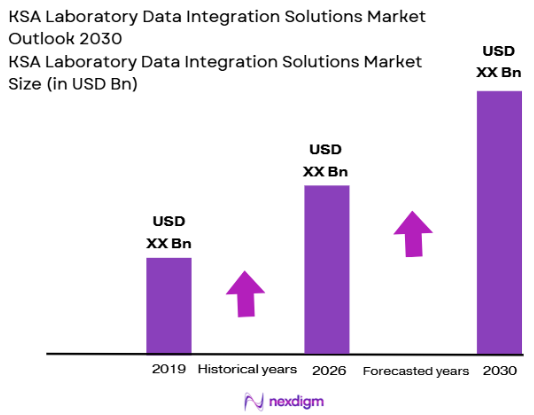

The KSA Laboratory Data Integration Solutions market is poised for significant growth in the coming years, driven by technological advancements, government support, and the increasing adoption of integrated data solutions in various sectors like healthcare, research, and manufacturing. The market size reached a valuation of USD 1.5 billion in 2024, with the growing need for real-time data analysis, automation, and regulatory compliance being key factors propelling the demand for laboratory data integration systems. Factors such as a rise in healthcare digitization, pharmaceutical R&D, and the ongoing industrial transformations in Saudi Arabia’s Vision 2030 initiative have further strengthened the market’s prospects. The emphasis on data-driven decision-making and integration of various laboratory systems to improve efficiency is expected to continue driving market growth.

The key regions driving the KSA Laboratory Data Integration Solutions market are Riyadh, Jeddah, and the Eastern Province. Riyadh is the commercial hub and capital, where most governmental initiatives related to healthcare and technological adoption are centered. Jeddah, as a major port city, sees high demand for laboratory data integration solutions in the healthcare and environmental sectors. The Eastern Province, home to several large industrial and petrochemical companies, is experiencing increased adoption of integrated solutions for operational efficiency and data management. The strategic initiatives under Saudi Arabia’s Vision 2030 have further boosted the demand for data integration technologies, positioning these cities as critical players in the market’s development.

Market Segmentation

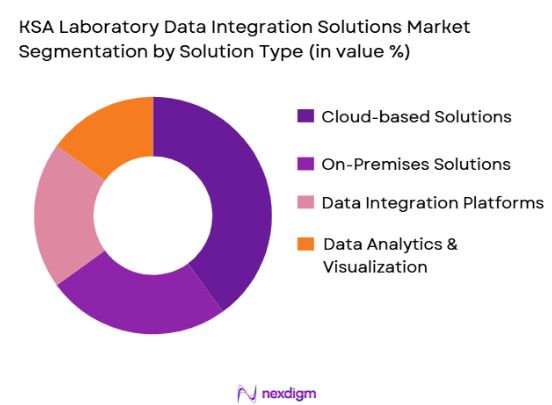

By Solution Type

The KSA Laboratory Data Integration Solutions market is segmented by solution type into data integration platforms, cloud-based solutions, on-premises solutions, and data analytics and visualization tools. Among these, cloud-based solutions hold the dominant market share, driven by their scalability, cost-effectiveness, and the growing trend of digital transformation in laboratories. Cloud solutions offer the flexibility and security that laboratory managers need to integrate vast amounts of data from various sources, reducing the need for physical infrastructure and enabling real-time access to data across multiple locations. Additionally, regulatory frameworks in the healthcare and pharmaceutical sectors encourage the adoption of cloud-based systems due to enhanced compliance features, further driving their demand.

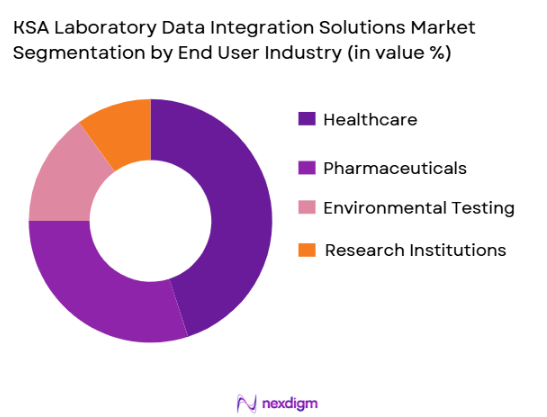

By End-User Industry

The KSA Laboratory Data Integration Solutions market is further segmented by end-user industry, including healthcare, pharmaceuticals, environmental testing, and research institutions. Healthcare is the leading segment in terms of adoption of data integration solutions. Hospitals, diagnostic centers, and research labs have increasingly adopted integrated solutions to streamline patient data management, enhance diagnostic accuracy, and comply with health regulations. These integrated solutions enable healthcare providers to seamlessly manage patient records, laboratory test results, and research data across various systems, improving both efficiency and accuracy in diagnostics and treatment. The pharmaceutical sector follows closely, with research-driven companies needing integrated data solutions for drug discovery and development processes.

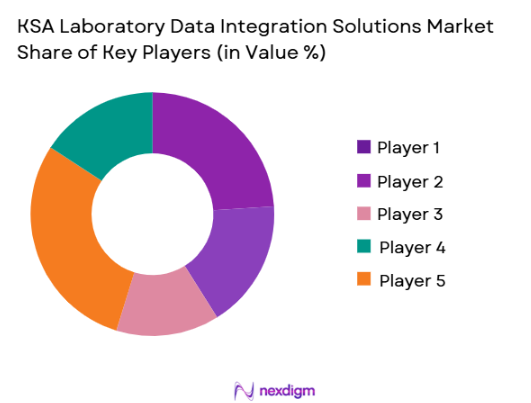

Competitive Landscape

The KSA Laboratory Data Integration Solutions market is dominated by a mix of global technology providers and local companies that specialize in healthcare and laboratory data integration. Key players include global giants like SAP SE and Oracle Corporation, which offer comprehensive solutions across industries. Local companies like Al-Jazira Oil & Gas and Saudi Arabian Oil Company (Aramco) are also significant players due to their large-scale industrial needs and adoption of data integration solutions in their laboratories. The market is seeing strong competition in terms of technological advancements, customer support, and customization capabilities, with many companies focusing on providing cloud-based solutions to meet the growing demand for real-time data integration.

| Company Name | Establishment Year | Headquarters | Product Portfolio Breadth | R&D Investment | Local Distribution Footprint | Regulatory Approvals | Manufacturing Capabilities |

| SAP SE | 1972 | Germany | ~ | ~ | ~ | ~ | ~ |

| Oracle Corporation | 1977 | USA | ~ | ~ | ~ | ~ | ~ |

| IBM Corporation | 1911 | USA | ~ | ~ | ~ | ~ | ~ |

| Al-Jazira Oil & Gas | 1974 | KSA | ~ | ~ | ~ | ~ | ~ |

| Saudi Arabian Oil Company | 1933 | KSA | ~ | ~ | ~ | ~ | ~ |

KSA Laboratory Data Integration Solutions Market Analysis

Growth Drivers

Urbanization

The rapid urbanization of Saudi Arabia has played a crucial role in the growing demand for laboratory data integration solutions. As urban areas expand, the need for efficient and real-time data management in sectors such as healthcare, research, and pharmaceuticals intensifies. With Saudi Arabia’s population projected to reach 35.5 million by 2025, urban areas are expected to see increased adoption of advanced technologies. This will drive the implementation of integrated laboratory systems to streamline healthcare services, research initiatives, and regulatory compliance. According to the World Bank, Saudi Arabia’s urban population reached ~% in 2022, marking a steady rise in urbanization and technological adoption.

Industrialization

Saudi Arabia’s industrialization, particularly within the healthcare and pharmaceutical sectors, is a critical growth driver for laboratory data integration solutions. The country is undergoing rapid transformation under Vision 2030, with a focus on boosting non-oil industries. Industrialization has led to the creation of advanced manufacturing plants, research centers, and healthcare institutions requiring integrated laboratory data solutions. The increasing need for automation, efficiency, and data-driven decision-making within industries has pushed the demand for seamless data integration. Saudi Arabia’s industrial sector has grown steadily, with manufacturing contributing 11.3% to the GDP in 2022, showing the sector’s potential for growth and need for efficient data solutions.

Restraints

High Initial Costs

The high initial costs associated with the implementation of laboratory data integration solutions pose a challenge for many healthcare and research facilities in Saudi Arabia. While the long-term benefits of data integration are evident in improved efficiency and compliance, the upfront investments in technology infrastructure, software, and staff training are considerable. In 2023, the average cost of deploying a comprehensive data integration system for laboratories in Saudi Arabia was estimated at USD ~million. This high cost limits adoption in smaller and mid-sized laboratories, where budget constraints are more prevalent.

Technical Challenges

Despite the numerous advantages of laboratory data integration solutions, technical challenges such as system interoperability, data quality, and network security remain significant barriers. Laboratories in Saudi Arabia often face difficulties in integrating diverse systems, including legacy platforms, with new solutions, which leads to inefficiencies and data silos. The complexity of managing large datasets from various sources without a unified system also hampers the widespread adoption of integration technologies. Additionally, technical skills to manage and optimize these complex systems remain scarce, with only 40% of Saudi IT professionals trained in healthcare data management systems.

Opportunities

Technological Advancements

The continuous advancement in technology presents a significant opportunity for the expansion of laboratory data integration solutions in Saudi Arabia. The rapid development of artificial intelligence (AI), machine learning, and cloud computing has made it easier to develop and deploy highly efficient, cost-effective data integration solutions. In 2024, the adoption of AI in healthcare systems is expected to grow by 15%, as more laboratories seek to integrate AI-powered tools for data analysis and decision-making. Furthermore, advancements in cloud infrastructure are reducing operational costs, making data integration solutions more affordable and scalable. These technological innovations are expected to drive future growth in the market.

International Collaborations

International collaborations provide an immense opportunity for the growth of the laboratory data integration market in Saudi Arabia. As the country looks to position itself as a hub for healthcare innovation under its Vision 2030 goals, partnerships with global technology providers and healthcare companies can facilitate the transfer of advanced knowledge and solutions. In 2023, Saudi Arabia signed multiple agreements with international healthcare providers, such as Siemens Healthineers and IBM, to implement cutting-edge data integration technologies. These partnerships are expected to bring high-tech solutions, improve system interoperability, and further promote the country’s digital transformation in healthcare and laboratory services.

Future Outlook

Over the next five years, the KSA Laboratory Data Integration Solutions market is expected to experience significant growth, driven by the ongoing digital transformation of the healthcare and pharmaceutical sectors, and the increasing demand for real-time data integration and compliance solutions. Government initiatives, such as those under Vision 2030, are expected to support the rapid adoption of laboratory data integration technologies. As the market matures, cloud-based solutions are likely to continue dominating, while the integration of artificial intelligence and machine learning in laboratory data management systems will drive further innovation and efficiency in the sector.

Major Players in the Market

- SAP SE

- Oracle Corporation

- IBM Corporation

- Al-Jazira Oil & Gas

- Saudi Arabian Oil Company (Aramco)

- Thermo Fisher Scientific

- Medtronic PLC

- Siemens Healthineers

- Cerner Corporation

- GE Healthcare

- Dell Technologies

- Informatica

- Microsoft Corporation

- Accenture PLC

- Philips Healthcare

Key Target Audience

- Healthcare Providers (Hospitals and Diagnostic Centers)

- Pharmaceutical Companies (R&D and Production Facilities)

- Research Institutions (Universities and Private Research Labs)

- Environmental Testing Labs

- Healthcare IT Managers

- Laboratory Managers in Clinical Settings

- Government Agencies (Ministry of Health, Saudi FDA)

- Investments and Venture Capitalist Firms

- Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables that influence the KSA Laboratory Data Integration Solutions market. Extensive desk research, supported by secondary databases, will help define the critical parameters that shape market dynamics, including industry-specific standards, technological advancements, and regulatory requirements.

Step 2: Market Analysis and Construction

This phase focuses on collecting historical data and analyzing market penetration. Factors such as the adoption of cloud-based technologies, integration platforms, and the expansion of data-driven solutions in healthcare and research will be evaluated to construct a robust market model.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from various sectors, including healthcare, pharmaceuticals, and industrial laboratories, will be consulted to validate market hypotheses. These consultations provide insights into current market trends, customer needs, and future demands, ensuring that the research reflects real-time industry dynamics.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesis of all gathered data to present a detailed analysis of market trends, technological advancements, and key growth drivers. In-depth engagement with stakeholders and real-world data from leading companies will refine the study, ensuring that the final output provides actionable insights.

- Executive Summary

- Research Methodology(Market Definitions and Assumptions, KSA-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across OEMs, Laboratory Data Managers, Healthcare Providers, and Government Agencies, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution Pathway

- KSA Laboratory Data Integration Solutions Industry Timeline

- Laboratory Data Integration Solutions Business Cycle

- Data Integration Supply Chain & Value Chain Analysis

- Key Growth Drivers

Government Incentives and Initiatives in Healthcare and Laboratories

Rising Adoption of Cloud Technologies

Growing Demand for Real-Time Data and Analytics in Healthcare

Advancements in Laboratory Equipment and Data Technologies - Market Opportunities

Expansion of Healthcare and Pharmaceutical Data Integration

Demand for Custom Solutions for Laboratory Data Systems

Growth of Research and Development in Emerging Sectors - Key Trends

Increased Adoption of Cloud-Based Data Integration Systems

Integration of AI and Machine Learning in Laboratory Data Systems

Focus on Cybersecurity and Data Privacy in Laboratory Data Management - Regulatory & Policy Landscape

KSA Health Regulations Impacting Data Integration

Data Protection and Compliance Regulations in Laboratories

Government Policies Supporting Digital Healthcare Transformation - SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Selling Price, 2019-2025

- By Solution Type (In Value %)

Data Integration Platforms

Cloud-based Integration Solutions

On-Premises Solutions

Data Analytics and Visualization Tools

Other Solutions (Customized Integrations, Hybrid Solutions) - By End-User Industry (In Value %)

Healthcare and Clinical Laboratories

Pharmaceutical and Biotech Companies

Environmental and Chemical Laboratories

Research Institutions

Forensic and Quality Control Labs - By Deployment Type (In Value %)

Cloud Deployment

On-Premises Deployment

Hybrid Deployment - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Data Integration Feature (In Value %)

Data Security and Compliance

Real-Time Data Synchronization

Data Analytics and Reporting

Data Visualization and Dashboard

Interoperability with Existing Systems

- Market Share Analysis

- Cross Comparison Parameters(Product Portfolio Breadth, Data Security Features, Regulatory Compliance and Certifications, Pricing Alignment with Market Demand, Local Distribution Footprint, Manufacturing & Localization Capabilities, R&D Investment and Technological Advancements, Strategic Partnerships & Collaborations)

- SWOT Analysis of Key Players

Strengths

Weaknesses

Opportunities

Threats - Pricing Analysis

Comparison of Prices Across Solution Types

Pricing Strategies for Different Consumer Segments (Healthcare vs Research Institutions) - Detailed Company Profiles

SAP SE

Oracle Corporation

IBM Corporation

Siemens Healthineers

Thermo Fisher Scientific

Medtronic PLC

Cerner Corporation

Dell Technologies

Informatica

Microsoft Corporation

GE Healthcare

Accenture PLC

SAS Institute

Philips Healthcare

Honeywell International

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles

- Compliance & Certification Expectations

- Needs, Desires & Pain-Point Mapping

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Selling Price, 2026-2030