Market Overview

The KSA Laboratory Information Systems (LIS) market is valued at approximately USD ~ in 2024. This market is driven by the increasing adoption of healthcare IT solutions across hospitals, diagnostic centers, and laboratories in Saudi Arabia. With a growing focus on digital transformation, government initiatives like eHealth Strategy and Vision 2030, and the rising need for efficient management of laboratory workflows and patient data, LIS solutions are in high demand. The implementation of LIS is essential to improving diagnostic accuracy, reducing turnaround times, and ensuring regulatory compliance with local standards.

Saudi Arabia’s urban centers, especially Riyadh, Jeddah, and Dammam, dominate the LIS market due to their well-established healthcare infrastructure and concentration of major medical facilities. Riyadh, as the capital, leads the adoption of advanced healthcare solutions, including LIS, driven by the presence of leading hospitals, research institutions, and government health initiatives. Jeddah and Dammam follow suit with their robust healthcare ecosystems and proximity to key ports and trade routes, making them strategic locations for implementing LIS technology in the region. The government’s focus on improving healthcare services and digitalization further accelerates market growth in these regions.

Market Segmentation

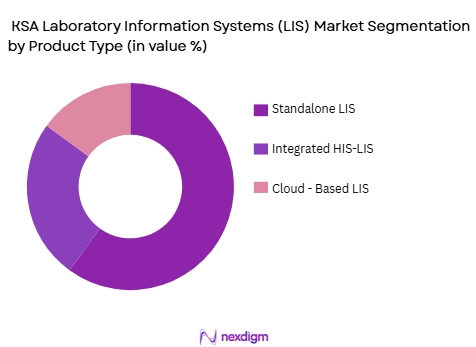

By Product Type

The KSA LIS market is segmented by product type into Standalone LIS, Integrated LIS with Hospital Information Systems (HIS), and Cloud-based LIS. Standalone LIS solutions currently dominate the market due to their high scalability and lower initial costs, making them a preferred choice for smaller and medium-sized laboratories. These systems, which operate independently of broader hospital management software, are favored for their simplicity and ease of deployment. However, as the healthcare sector moves toward more integrated solutions, Integrated LIS is gaining traction due to its ability to seamlessly interact with other HIS and EMR systems, creating a unified data ecosystem for healthcare providers.

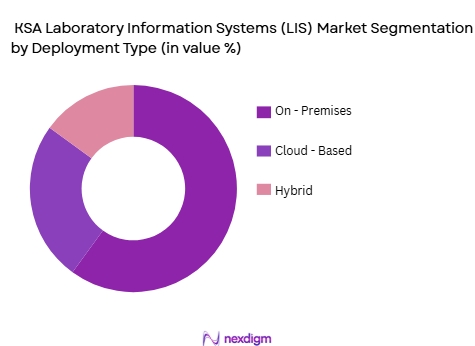

By Deployment Mode

The deployment of LIS systems is mainly categorized into On-Premise, Cloud-Based, and Hybrid models. The On-Premise LIS has a dominant share in 2024, particularly in large public and private hospitals, which prioritize data security, control, and customization over flexibility. These systems, often deployed in government institutions and major healthcare providers, allow for more tailored solutions that comply with strict local regulations. However, the Cloud-Based LIS segment is gaining popularity due to its lower upfront costs, scalability, and easier maintenance, making it an attractive choice for smaller laboratories and diagnostic centers. As the KSA healthcare system continues to digitize, the Hybrid Model is expected to see significant growth, as it combines the benefits of both on-premises and cloud-based solutions.

Competitive Landscape

The KSA LIS market is characterized by the presence of both global and regional players offering diverse solutions. Companies such as Cerner Corporation, Labware, and Thermon Fisher Scientific dominate the market with their comprehensive LIS platforms, which offer extensive functionalities from patient data management to diagnostic results processing. These players benefit from their advanced technologies and strong partnerships with hospitals and healthcare facilities across Saudi Arabia. In addition to these large multinational players, regional providers such as HealthCluster and SoftTech also play a significant role, particularly in terms of localization and customer

Competitive Landscape Table

| Company Name | Establishment Year | Headquarters | Product Offering | Market Presence | R&D Focus | Customer Support Network |

| Cerner Corporation | 1979 | USA | ~ | ~ | ~ | ~ |

| LabWare | 1988 | USA | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | USA | ~ | ~ | ~ | ~ |

| HealthCluster | 2015 | Saudi Arabia | ~ | ~ | ~ | ~ |

| SoftTech | 2000 | Saudi Arabia | ~ | ~ | ~ | ~ |

KSA Laboratory Information Systems (LIS) Market Analysis

Growth Drivers

Urbanization

Indonesia’s urbanization is driving demand for air quality monitoring systems, with the country’s urban population surpassing ~ million in 2023, representing more than half of the total population. Cities like Jakarta and Surabaya are experiencing rapid population growth, which directly increases air pollution from vehicles, industrial activities, and construction. As the government implements initiatives to build sustainable urban environments, monitoring air quality becomes crucial. High levels of particulate matter, such as PM2.5, continue to exceed WHO’s recommended levels, propelling investments in air quality monitoring technologies across these urban regions.

Industrialization

Indonesia’s industrial sector, contributing around ~ to GDP, is a significant driver of air pollution, with heavy industries such as mining, textiles, and cement emitting harmful pollutants. In 2023, industrial zones located in West Java and Sumatra continued to expand, increasing pollution levels. As part of the country’s commitment to sustainable development, industries are being encouraged to reduce emissions through better monitoring systems. Growing awareness about the environmental and health impacts of industrial emissions is pushing for the implementation of advanced air quality monitoring technologies, especially in key industrial regions.

Restraints

High Initial Costs

The high initial costs of deploying air quality monitoring systems remain a significant barrier to widespread adoption in Indonesia. In 2023, the cost of high-quality monitoring stations, especially those meeting international standards, was a challenge for local governments and private sector entities. These systems require significant investment in equipment, installation, and ongoing maintenance. Although government incentives are available, the financial burden for smaller municipalities or rural areas makes it difficult for them to implement comprehensive monitoring solutions.

Technical Challenges

Indonesia faces technical challenges related to air quality monitoring, such as maintaining the calibration of sensors and ensuring reliable data collection. In regions with high pollution variability, like Jakarta, frequent calibration is necessary to ensure the accuracy of real-time monitoring data. The lack of skilled personnel to maintain and operate advanced monitoring systems exacerbates this issue. Furthermore, integrating data from multiple types of sensors and ensuring data consistency is a technical hurdle that requires ongoing support and innovation.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the air quality monitoring system market in Indonesia. The rise of IoT-enabled sensors and cloud-based data analytics is making air quality monitoring more affordable and scalable. These systems allow for real-time monitoring, which is crucial for responding to sudden pollution spikes in densely populated areas like Jakarta. In 2023, several government initiatives focused on the implementation of low-cost sensors have made air quality monitoring more accessible, presenting an opportunity for further growth in the sector.

International Collaborations

Indonesia’s partnerships with international organizations, such as the World Bank and UN Environment, are helping to drive the adoption of air quality monitoring systems. These collaborations often provide both financial and technical support to improve environmental monitoring infrastructure. In 2023, the Clean Air Asia Program supported the deployment of advanced air monitoring equipment in urban areas, and similar future collaborations are expected to further accelerate the development of the market. This cooperation between government agencies and international partners enhances technical expertise and accelerates the adoption of best practices.

Future Outlook

Over the next five years, the KSA LIS market is poised for substantial growth, driven by the increasing adoption of cloud-based systems, the Saudi government’s Vision 2030 health initiatives, and advancements in healthcare IT solutions. As hospitals and diagnostic centers across the Kingdom embrace digitalization, the demand for integrated and cloud-based LIS solutions is expected to rise significantly. Additionally, the growing need for advanced data analytics, AI-enabled decision support, and seamless integration with Electronic Medical Records (EMR) systems will accelerate the shift toward more sophisticated LIS platforms. The KSA government’s focus on improving healthcare infrastructure, coupled with a push for better patient outcomes and healthcare data management, will further drive market demand for innovative LIS solutions.

Major Players

- Cerner Corporation

- LabWare

- Thermo Fisher Scientific

- HealthCluster

- SoftTech

- Sunquest Information Systems

- Epic Systems

- CompuGroup Medical

- Meditech

- Abbott Laboratories

- GE Healthcare

- Siemens Healthineers

- Orchard Software

- LabVantage Solutions

- Agfa HealthCare

Key Target Audience

- Healthcare Providers

- Healthcare IT Departments & Chief Information Officers

- Laboratory Managers and Pathologists

- Government Healthcare Agencies

- IT System Integrators & Software Providers

- Investments and Venture Capitalist Firms

- Regulatory Bodies

- Medical Equipment & Technology Distributors

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involves gathering key variables impacting the KSA LIS market, including market drivers, technological advancements, and regulatory influences. Desk research and secondary data sources are used to understand the current trends and establish a foundation for forecasting.

Step 2: Market Analysis and Construction

The research team will perform a detailed analysis of historical data, market penetration, and existing LIS solutions within Saudi Arabia’s healthcare system. This step ensures that the current demand and growth patterns are well understood.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested by consulting healthcare IT professionals, LIS vendors, and system integrators through interviews and surveys. These insights will be instrumental in validating data assumptions and confirming growth projections.

Step 4: Research Synthesis and Final Output

In the final step, the collected data will be synthesized to generate the comprehensive market outlook report. This includes cross-validation with industry experts and data triangulation from multiple data sources to ensure a complete and accurate analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing & Forecast Approach, Primary & Secondary Data Sources, Expert Interview Framework, Data Validation & Triangulation, Research Limitations)

- Definition and Scope

- Market Genesis and Adoption Drivers

- Timeline of Key Technology Milestones

- Business Cycle Dynamics

- Value Chain & Stakeholder Flow

- Growth Drivers

Healthcare Digital Transformation Initiatives

Diagnostic Testing Volume Expansion

Quality & Accuracy Focus in Lab Diagnostics

Integration Demand with EMR / SHIE Platforms - Market Challenges

Integration Complexities with Existing EMRs & HISs

Cybersecurity & Data Protection Concerns

Vendor Lock‑in & Customization Barriers

Skill Gap in Clinical IT Adoption - Opportunities

Cloud‑Native LIS Solutions

AI & Predictive Analytics Integration

SME & Private Diagnostics Growth

Value‑Added Services & Post‑Deployment Support - Trend Analysis

Shift to Cloud & SaaS Delivery Models

Mobile‑Enabled LIS Accessibility

Advanced Interfaces with POCT Devices

Interoperable Data Standards & Metadata Sharing - Government Regulation & Compliance

Saudi eHealth Interoperability Standards

Clinical Quality & Accreditation Mandates (CBAHI)

Data Privacy & Patient Records Regulations

Public Sector EHR / LIS Adoption Plans - SWOT Analysis

Stakeholder Ecosystem

Porter’s Five Forces

- By Value,2019-2024

- By Deployment Scale,2019-2024

- By Average Contract Value, 2019-2024

- By Module Adoption, 2019-2024

- By Product Type (In value%)

Standalone LIS

Integrated Hospital LIS Suites

Hybrid Cloud LIS - By Component (In value%)

Software Licenses

Implementation Services

Support & Maintenance - By Deployment Mode (In value%)

Cloud‑First LIS

On‑Premise LIS

Web‑Hosted LIS - By End User (In value%)

Hospital Laboratories

Diagnostic Center Chains

Specialty Medical Centers

Government Diagnostic Facilities

Independent Clinical Labs - By Healthcare Facility Tier (In value%)

Tertiary Hospitals

Secondary Care Facilities

Primary Care & PHC Centers

- Cross Comparison Parameters (Product Portfolio, Healthcare Integration Capabilities ,Cloud & Deployment Options, Regulatory Compliance & Certification Support, Implementation Footprint, Localization ,Service & Support Network

R&D/Innovation & AI Integration) - SWOT Analysis of Major Vendors

- Pricing & Contracting Models

- Detailed Profiles of Major Companies

Cerner Corporation

LabWare

Abbott Laboratories

Siemens Healthiness

Thermo Fisher Scientific

Epic Systems

Software AG / HealthCluster

CompuGroup Medical

LabVantage Solutions

Illumina Informatics

Hex Labs

LabLynx, Inc.

Oracle Health

Orchard Software

Clinicsys Group

- Demand & Utilization Patterns

- Technology Procurement Cycles

- Regulatory & Compliance Adoption Drivers

- Pain Points & Workflow Bottlenecks

- Decision‑Making Criteria

- By Value,2025-2030

- By Install Base ,2025-2030