Market Overview

The KSA laboratory reporting systems market is valued at approximately USD ~ million in 2025, based on comprehensive research and current market conditions. The market growth is largely driven by the increasing demand for automation and digitalization in Saudi Arabia’s healthcare sector. Government initiatives, such as Vision 2030, are promoting digital healthcare adoption, boosting the demand for advanced laboratory reporting systems. Moreover, the rising burden of chronic diseases and the expanding healthcare infrastructure are key factors pushing the adoption of laboratory information systems (LIS) and reporting solutions across the nation.

The KSA laboratory reporting systems market is primarily dominated by key cities such as Riyadh, Jeddah, and Dammam. Riyadh, the capital, leads due to its concentration of high-tech hospitals and research facilities, along with significant healthcare IT investments. Jeddah, being a commercial hub, follows closely due to the presence of leading private and public healthcare institutions. Dammam also sees a growing demand due to its strategic location and increasing healthcare developments in the Eastern Province, driven by both government and private sector initiatives.

Market Segmentation

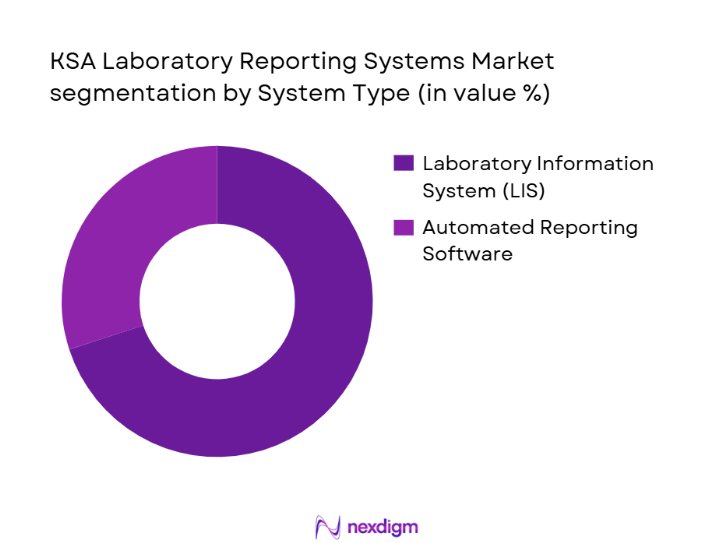

By System Type

The KSA laboratory reporting systems market is segmented by system type into LIS (Laboratory Information Systems) and automated reporting software. The LIS segment dominates the market as it provides an all-encompassing platform for managing and reporting laboratory test results, patient records, and integrated data analytics. Hospitals and diagnostic centers in Saudi Arabia prefer LIS because of its ability to streamline workflow, improve accuracy, and ensure compliance with local healthcare regulations. Additionally, the integration of LIS with electronic health records (EHR) has made it an essential tool for healthcare providers, further solidifying its dominance.

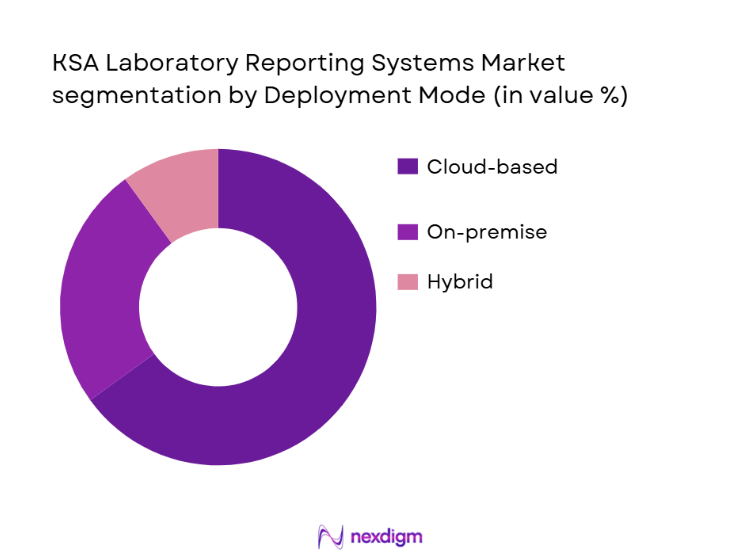

By Deployment Mode

The KSA laboratory reporting systems market is also segmented by deployment mode, with the cloud-based deployment segment leading the market share. Cloud solutions offer significant advantages, such as scalability, cost-effectiveness, and ease of remote access. These features are particularly appealing to healthcare institutions in Saudi Arabia, where the shift to digital healthcare is accelerating. Additionally, cloud deployment enables better data integration and collaboration across multiple departments, making it an optimal choice for hospitals and laboratories with multiple locations. On-premise systems follow closely, primarily in large, established healthcare facilities that prioritize data security and control.

Competitive Landscape

The KSA laboratory reporting systems market is consolidated, with a few key players dominating the landscape. These include both international technology providers like Siemens Healthineers and Thermo Fisher Scientific, and local players offering tailored solutions suited to the region’s regulatory environment. The competition is driven by factors such as technological innovation, system integration capabilities, and pricing strategies. The increasing demand for AI-powered reporting systems and data analytics in laboratory reporting further fuels the competition among these major players.

| Company Name | Establishment Year | Headquarters | Technology Stack | Deployment Type | Major Clients | Market Strategy | Revenue from LIS Solutions |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | USA | ~ | ~ | ~ | ~ | ~ |

| LabWare | 1987 | USA | ~ | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Meditech | 1969 | USA | ~ | ~ | ~ | ~ | ~ |

KSA Laboratory Reporting Systems Market Analysis

Growth Drivers

Government Initiatives & Vision 2030

The Saudi government’s Vision 2030, which emphasizes the development of healthcare infrastructure and digital transformation, has significantly boosted the adoption of laboratory reporting systems. With increased investments in healthcare IT, there’s a growing demand for automated and integrated laboratory reporting solutions to streamline operations and improve patient care.

Rising Burden of Chronic Diseases

The increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer has led to a higher volume of diagnostic tests in Saudi Arabia. This rising demand for lab tests accelerates the need for efficient and accurate laboratory reporting systems that can handle large datasets and ensure timely results.

Market Challenges

High Initial Investment and Integration Costs

The implementation of advanced laboratory reporting systems involves significant capital expenditure, which can be a barrier, particularly for smaller healthcare facilities. Additionally, the integration of new LIS solutions with existing legacy systems presents challenges in terms of cost and time.

Data Security and Privacy Concerns

With the increasing digitization of healthcare data, ensuring the security and privacy of patient information remains a critical concern. Regulatory compliance requirements, such as those outlined by the Saudi Ministry of Health and SFDA, further complicate the adoption of laboratory reporting systems, particularly cloud-based solutions.

Opportunities

AI-Driven Reporting and Predictive Analytics

The integration of artificial intelligence (AI) in laboratory reporting systems presents a significant opportunity for the market. AI can enhance data analysis, improve reporting accuracy, and even predict potential health issues, providing greater value to healthcare providers and patients alike.

Shift Towards Cloud-Based Solutions

The growing preference for cloud-based laboratory reporting systems offers considerable opportunities for market expansion. Cloud solutions provide scalability, lower upfront costs, and ease of access, making them particularly attractive to healthcare facilities looking to modernize their infrastructure without substantial capital investments.

Future Outlook

Over the next few years, the KSA laboratory reporting systems market is expected to experience substantial growth, driven by the ongoing expansion of Saudi Arabia’s healthcare infrastructure and increased government funding in the healthcare IT sector. The continuous advancement of AI, machine learning, and automation technologies will further enhance the performance and efficiency of laboratory reporting systems, fostering their adoption. Furthermore, the growing emphasis on data-driven decision-making in healthcare is expected to result in more widespread use of automated reporting systems across laboratories and hospitals.

Major Players

- Siemens Healthineers

- Thermo Fisher Scientific

- LabWare

- Roche Diagnostics

- Meditech

- Cerner Corporation

- Abbott Laboratories

- Agilent Technologies

- PerkinElmer

- Veeva Systems

- STARLIMS (Abbott Informatics)

- Autoscribe Informatics

- IDBS (Danaher)

- GE Healthcare

- BioRad Laboratories

Key Target Audience

- Healthcare Providers

- Private Diagnostic Centers

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Healthcare IT Solution Providers

- Laboratory Equipment Suppliers

- System Integrators

- Pharma Companies and Contract Research Organizations

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying the key market variables that influence the KSA laboratory reporting systems market. This involves analyzing stakeholder interactions across healthcare providers, regulatory bodies, and technology solution providers. Secondary research sources, including industry reports and market data, are utilized to gather insights into these critical market drivers.

Step 2: Market Analysis and Construction

We conduct an in-depth analysis of historical data to assess current market conditions and growth trends. This includes evaluating the penetration of laboratory information systems across different types of healthcare establishments, as well as testing volumes and revenue generated from reporting systems.

Step 3: Hypothesis Validation and Expert Consultation

We develop hypotheses regarding market trends and validate them through consultations with industry experts. Interviews with stakeholders across healthcare facilities, LIS vendors, and technology experts provide additional clarity and help refine the final market outlook.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and expert insights. This comprehensive approach includes validating our findings through direct engagement with leading market players and compiling the resulting data into a final market report.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Data Sources Hierarchy, LIS Adoption Metrics, Market Sizing Models (Primary + Secondary), Qualitative Expert Interviews, Quantitative Forecast Models, Limitations & Validation Protocols)

- Definition and Scope

- Industry Structure and Reporting Ecosystem

- Regulatory, Healthcare IT & Data Compliance Framework

- Market Genesis & Adoption Curve

- Value Chain & Technology Integration

- Innovation Landscape

- Growth Drivers

Digital Health Transformation & Vision 2030 Healthcare IT Push

Increase in Diagnostic Volume & Chronic Disease Testing Needs

Interoperability Demand Across Healthcare Information Systems (EHR + HIS) - Market Restraints

Capital Expenditure & Operating Costs for LIS/Reporting Systems

Integration Complexities with Legacy Systems

Data Security, Privacy & Compliance Overheads - Market Opportunities

AIPowered Reporting & Predictive Lab Operations

Expansion of CloudBased LIS Platforms

Middle Tier Analytics for PointofCare Labs - Trend Analysis

Adoption Trajectory of Automated Reporting Engines

MultiCloud & SaaS Adoption Trends

RealTime Quality Control and Benchmark Reporting

- Historical Market Size 2019-2025

- Market Demand Intensity 2019-2025

- Average System License & Maintenance Pricing Trends 2019-2025

- EndUser Spend Patterns 2019-2025

- Cloud vs OnPremise Deployment Revenues 2019-2025

- Regional Adoption Variance 2019-2025

- By Component (In Value%)

Software Module

Analytics Engine

Reporting Engine - By Deployment Mode (In Value%)

Cloud-Hosted

On-Premise

Hybrid - By End-User (In Value%)

Hospital Laboratories

Private Diagnostic Centers

Research & Academic Labs

Pharma/CRO Labs - By Application (In Value%)

Clinical Diagnostics Reporting

Genomics Data Reporting

Research Reporting

Regulatory Submission Reporting - By Data Integration Level (In Value%)

Basic Reporting

Real-Time Analytics

Predictive QA Reporting

AI-Enabled Insights

- Market Share Analysis

- CrossComparison Parameters (Company Overview, System Architecture, Technology Stack, Cloud Offering, Revenue by Reporting Segment, Installed Base (# of Labs), Partner Network Scale, Deployment Speed, Regulatory Certifications, Integration Footprint)

- Competitor SWOT Assessments

- Detailed Company Profiles and Major Competitors

Cerner Corporation

LabWare

Abbott Laboratories

Siemens Healthineers

Thermo Fisher Scientific

Agilent Technologies

PerkinElmer

Roche Diagnostics

Waters Corporation

Veeva Systems

LabVantage Solutions

STARLIMS

Autoscribe Informatics

IDBS (Danaher)

Local Solutions Providers

- Hospital Lab Reporting System Adoption Barriers & Drivers

- Diagnostic Lab Adoption & Utilization Rates

- Reporting ROI & Operational Optimization Metrics

- Pain Points

- Procurement Decision Frameworks

- Forecasted Market Value 2026-2030

- Deployment Forecast 2026-2030

- EndUser Growth Forecast 2026-2030

- Complete Forecast CAGR Drivers & Inhibitors 2026-2030