Market Overview

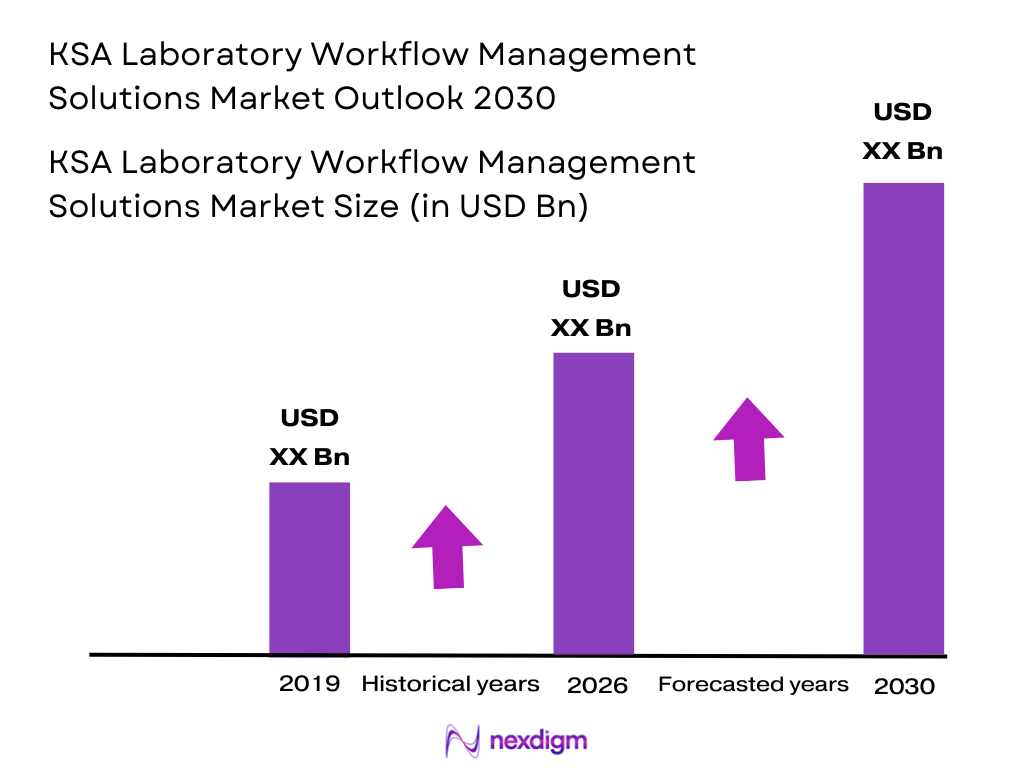

The KSA Laboratory Workflow Management Solutions Market has witnessed significant growth in recent years, driven by the increasing demand for efficient laboratory processes across various sectors such as healthcare, research, and industrial applications. The market size for 2024 is estimated at USD ~ million, and it continues to grow with a steady increase in digital transformation efforts within laboratories. Government initiatives such as Saudi Vision 2030, which focuses on healthcare modernization and the integration of technology, further fuel this market. Additionally, rising investments in automation and AI-enabled systems, especially for data management and workflow optimization, are contributing significantly to the market’s expansion.

The dominant regions in the KSA Laboratory Workflow Management Solutions Market include Riyadh, Jeddah, and the Eastern Province. Riyadh, being the capital city, is home to many government and private sector investments focused on healthcare digitization, contributing to its significant market share. Jeddah, with its strategic location as a commercial hub, also hosts a large number of research and clinical laboratories, further driving the adoption of workflow management solutions. The Eastern Province, with its industrial and petrochemical dominance, sees increased demand for laboratory automation in quality control processes. These cities are leading the market due to their high concentration of healthcare facilities, academic institutions, and corporate investments in laboratory technologies.

Market Segmentation

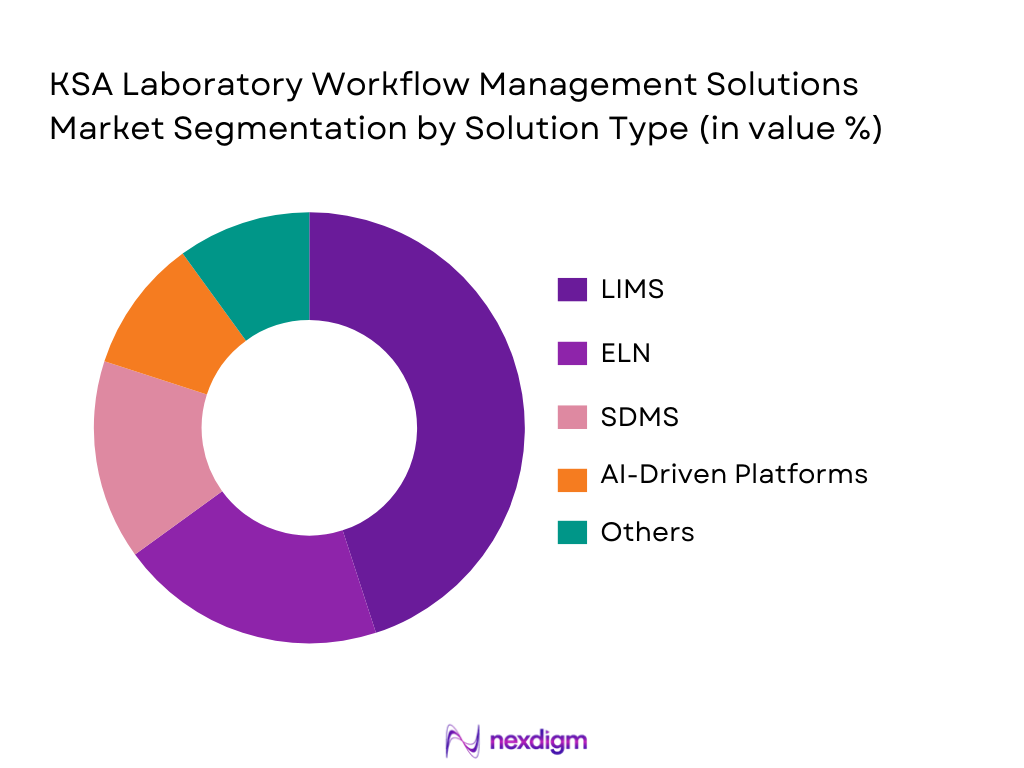

By Solution Type

The KSA Laboratory Workflow Management Solutions Market is segmented by solution type into several key categories, including Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), Scientific Data Management Software (SDMS), and AI-driven workflow platforms. Among these, LIMS holds the largest market share, driven by its crucial role in laboratory data management, tracking samples, and ensuring regulatory compliance. LIMS is highly valued in clinical, research, and industrial laboratories due to its ability to improve efficiency, reduce errors, and support audit trails. These features make LIMS the preferred solution, especially in regulated environments such as healthcare and pharmaceuticals.

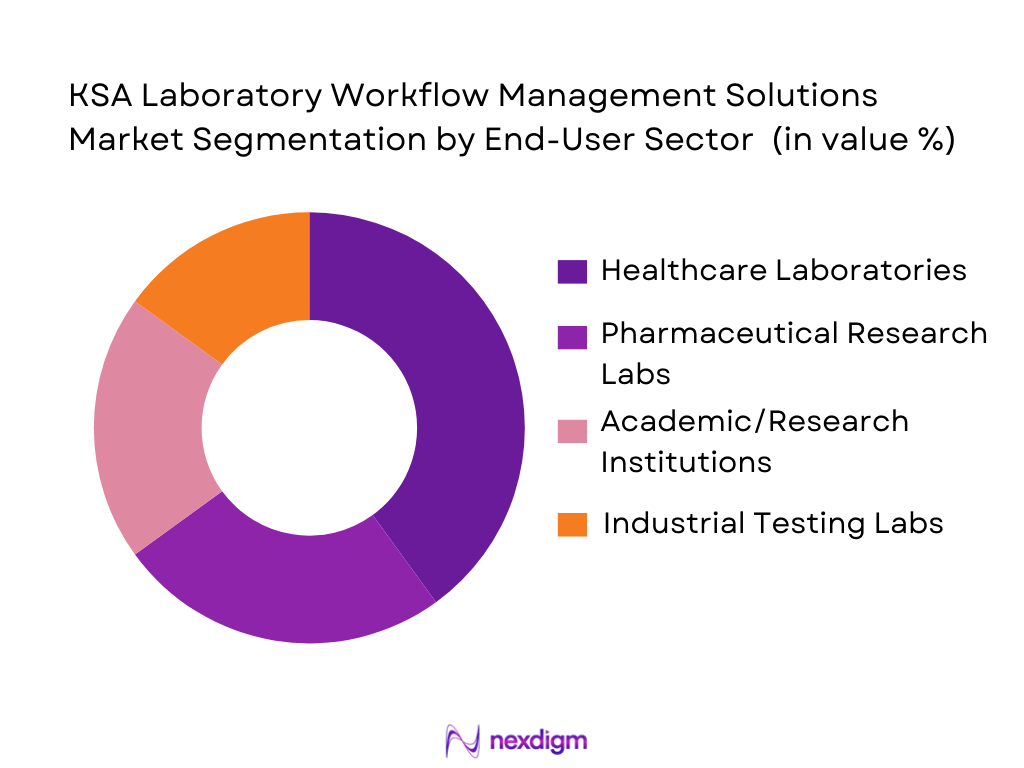

By End-User Sector

The KSA Laboratory Workflow Management Solutions Market is also segmented by end-user sector, which includes healthcare laboratories, pharmaceutical research labs, academic and research institutions, and industrial testing labs. The healthcare sector leads this market segment due to the increasing demand for digital health solutions and the need to streamline processes in clinical diagnostics, ensuring quicker results and better patient outcomes. Government-backed healthcare initiatives, such as the National Health Information Center, emphasize the integration of digital workflow systems, making healthcare laboratories the largest end-user of workflow management solutions.

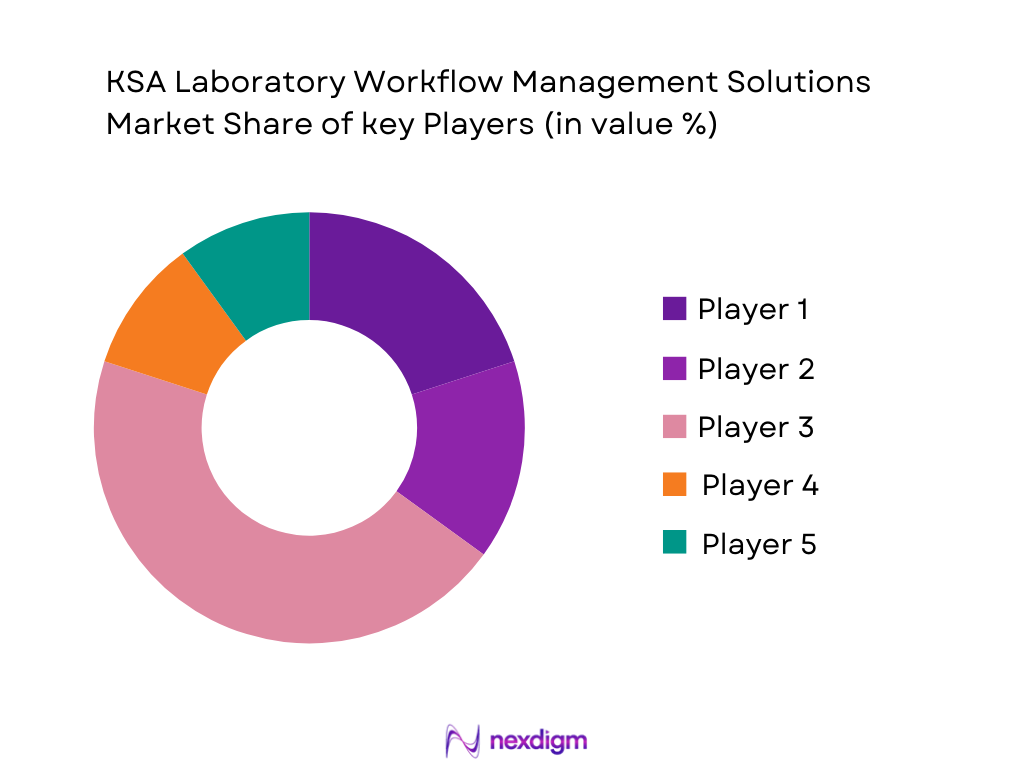

Competitive Landscape

The KSA Laboratory Workflow Management Solutions Market is characterized by a few dominant players who provide a variety of software solutions to meet the needs of different sectors. The market is highly competitive with global software providers like Thermo Fisher Scientific and PerkinElmer, as well as regional players such as LabVantage and Waters Corporation. These companies offer a wide range of solutions, from LIMS and ELNs to AI-driven analytics platforms. The competition in this space is shaped by factors such as technological innovation, service reliability, and adherence to regulatory standards, with major players continually improving their offerings to maintain market share.

| Company | Establishment Year | Headquarters | Product Portfolio | Deployment Mode | AI Integration | Customer Support | Regulatory Compliance | Market Reach |

| Thermo Fisher Scientific | 1956 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| PerkinElmer | 1937 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| LabVantage Solutions | 2000 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Waters Corporation | 1958 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Agilent Technologies | 1999 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Laboratory Workflow Management Solutions Market Analysis

Growth Drivers

Urbanization

Urbanization is a key driver of the KSA Laboratory Workflow Management Solutions Market. As of 2024, the urban population in Saudi Arabia was approximately ~ %, with major cities like Riyadh, Jeddah, and Dammam experiencing rapid urban growth. The urbanization trend is coupled with increasing infrastructure development, creating a demand for advanced laboratory workflow solutions in healthcare and research institutions. This demand is further amplified by the rising need for efficient healthcare systems and services, which are becoming essential as urban centers expand. Saudi Arabia’s growing focus on Vision 2030 aims to enhance urban healthcare capabilities and service delivery, particularly in medical research and diagnostics. This urban shift contributes significantly to the adoption of laboratory workflow solutions, pushing the market for automation and digital transformation in laboratories.

Industrialization

The ongoing industrialization in Saudi Arabia is another significant driver for the laboratory workflow management solutions market. In 2024, Saudi Arabia’s industrial sector contributed around ~ % of the country’s GDP, with a strong push towards diversification under Vision 2030. The government’s focus on petrochemical industries, manufacturing, and new sectors like biotechnology and pharmaceuticals has led to an increasing number of industrial labs requiring high-quality, automated workflow solutions for testing and R&D purposes. For instance, the industrial hubs in the Eastern Province (Dammam, Khobar) are seeing growth in demand for more efficient testing laboratories, driven by the oil and gas industry’s focus on quality control. This industrial demand is pushing the integration of automated lab solutions to streamline production and testing processes, ensuring higher standards of accuracy and compliance.

Restraints

High Initial Costs

High initial costs associated with the implementation of laboratory workflow management solutions remain a key restraint. For instance, the cost of installing a LIMS system in a laboratory can range from USD ~ to USD ~ million based on system complexity and integration. This high upfront investment can be a significant barrier for smaller laboratories and institutions in Saudi Arabia, especially given the current economic conditions. The Saudi Arabian economy, although recovering, is still navigating fiscal consolidation measures and cautious public spending as part of the broader budgetary reforms under Vision 2030. This cautious spending environment leads to slow adoption of high-cost digital solutions in some segments, limiting the widespread deployment of automated laboratory systems.

Technical Challenges

Technical challenges related to system integration and data security issues are another restraint in the market. Many Saudi laboratories still rely on legacy systems for data management, which can be incompatible with newer laboratory workflow management solutions. In addition, ensuring compliance with standards for laboratory testing is a significant hurdle for implementing automated solutions. Moreover, with increasing cybersecurity threats, laboratories need to invest in secure infrastructure to safeguard sensitive patient and research data. This, in turn, complicates the migration to digital platforms that integrate various data sources. Although Saudi Arabia is making strides in cybersecurity, concerns related to system integration with existing infrastructure and maintaining compliance remain significant obstacles.

Opportunities

Technological Advancements

The rapid advancement of technologies like Artificial Intelligence (AI), machine learning (ML), and Internet of Things (IoT) presents significant growth opportunities for the laboratory workflow management solutions market in Saudi Arabia. AI and ML are revolutionizing data analysis in laboratories by enabling predictive analysis and process automation. The implementation of IoT-enabled devices in laboratories allows for real-time monitoring of equipment and inventory, further enhancing workflow efficiency. In 2024, the number of AI-powered healthcare and laboratory systems in Saudi Arabia increased by over ~ % due to increased investments and government support for digital health initiatives. This trend is expected to continue as laboratories increasingly adopt these technologies to improve operational efficiency, reduce errors, and provide better diagnostic results.

International Collaborations

International collaborations between Saudi Arabian institutions and global technology providers offer substantial growth opportunities for the laboratory workflow management market. For example, Saudi Arabia’s partnership with global pharmaceutical companies and research institutions for joint ventures and R&D projects has led to the integration of cutting-edge laboratory automation solutions. The Saudi government has also signed agreements with international players to foster innovation in the health sector, particularly through partnerships like Aramco’s biotechnology initiatives with international universities and laboratories. These collaborations not only bring advanced technologies to the Saudi market but also help local companies adopt international standards, fostering market growth and increasing the potential for laboratory workflow solutions adoption.

Future Outlook

The KSA Laboratory Workflow Management Solutions Market is poised for substantial growth in the coming years, driven by Saudi Arabia’s emphasis on healthcare transformation as part of its Vision 2030. The integration of AI, machine learning, and cloud technologies into laboratory operations is expected to streamline workflows, improve efficiency, and meet the growing demand for faster and more accurate testing and results. Additionally, the increasing adoption of electronic health records and the growing need for regulatory compliance will continue to propel the market forward. This growth is expected to be fueled by government policies that promote digitization, as well as rising investments from both local and international stakeholders in laboratory automation and management solutions.

Major Players in the Market

- Thermo Fisher Scientific

- PerkinElmer

- LabVantage Solutions

- Waters Corporation

- Agilent Technologies

- Abbott Informatics

- LabWare

- Siemens Healthineers

- Roche Diagnostics

- Bio‑Rad Laboratories

- IDBS (Danaher)

- Autodesk (for workflow automation tools)

- Clever Systems

- Meditech

- Mettler Toledo

Key Target Audience

- Government and Regulatory Bodies (e.g., Ministry of Health – Saudi Arabia)

- Healthcare Providers & Laboratories (e.g., King Faisal Specialist Hospital)

- Pharmaceutical Companies (e.g., Al-Dawaa Pharmacies)

- Healthcare and Life Sciences Investors (e.g., Venture Capital Firms)

- Laboratory Automation System Integrators (e.g., LabTech Systems)

- Research Institutions & Universities (e.g., King Saud University)

- Healthcare & Pharmaceutical Supply Chain Managers (e.g., Saudi Pharmaceutical Distribution Co.)

- Laboratory Equipment Manufacturers (e.g., Thermo Fisher Scientific)

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping out the key drivers and barriers within the KSA Laboratory Workflow Management Solutions Market. We leverage secondary data sources, including industry reports, government publications, and proprietary databases, to identify the critical factors influencing market dynamics.

Step 2: Market Analysis and Construction

This phase includes collecting and analyzing historical data on market penetration, adoption rates of lab workflow management solutions, and associated revenue. We focus on evaluating current market conditions, potential market gaps, and technological advancements to create a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

The third phase involves validating the hypotheses generated through consultations with industry experts. These consultations provide qualitative insights into the operational and financial aspects of market players, helping to refine the accuracy of our predictions and market trends.

Step 4: Research Synthesis and Final Output

This final phase integrates primary research findings from expert consultations and industry observations into the final report. It ensures that the data is validated and reflects real-world market dynamics, providing actionable insights for stakeholders in the KSA Laboratory Workflow Management Solutions Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Primary & Secondary Research Approaches, Estimation & Forecast Models, Data Triangulation, Limitations)

- Definition and Scope

- Saudi Arabia Laboratory Workflow and Informatics Ecosystem

- Market Genesis & Evolution

- Origin of Lab Workflow Solutions in KSA

- Transition from Manual Processes to Digital Workflows

- Historical Market Landscape

- Timeline of Major Technological Milestones

- Early Adopters & Digital Transformation Benchmarks

- Workflow Value Chain in Laboratories

- Sample Lifecycle Management

- Market Drivers

Government Digital Health Initiatives

Regulatory Compliance & Quality Standards

Healthcare & Life Sciences Expansion (Vision 2030)

Need for Operational Efficiency & Turnaround Time Reduction - Market Challenges

High Implementation & Integration Costs

Data Security & Patient Privacy Constraints

Fragmented Lab IT Infrastructure

Skilled Workforce Shortages - Market Opportunities

Cloud‑native LIMS Adoption

AI‑Enabled Workflow Automation

Integrated Omics & Diagnostics Platforms

GCC Regional Expansion as Gateway Segment - Market Trends & Innovations

AI/ML for Predictive Quality

IoT‑Embedded Laboratory Devices

Blockchain for Data Integrity

Mobile First Workflows - Regulatory & Compliance Landscape

Ministry of Health Lab Data Standards

Saudi FDA & Accreditation Requirements

ISO/IEC 17025 & Clinical QA Standards

Interoperability Mandates

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Solution Type (In Value %)

Laboratory Information Management Systems (LIMS) (Software)

Electronic Lab Notebooks (ELN)

Scientific Data Management Software (SDMS)

Laboratory Execution Systems (LES)

Workflow Orchestration & Automation Platforms

Mobile Data Capture & Field Integration Solutions

Interoperability / Middleware Solutions

AI/Analytics & Predictive Quality Tools - By Deployment Mode (In Value %)

Cloud-Based (SaaS/Managed)

On‑Premise

Hybrid / Virtualized - By End‑User Sector (In Value %)

Clinical Diagnostics Laboratories

Pharmaceutical & Biotech R&D Labs

Academic/Research Institutions

Food, Agriculture & Environmental Testing Labs

Petrochemical, Oil & Gas Labs

Government & Public Health Labs

Contract Research Organizations (CROs) - By Workflow Module (In Value %)

Sample & Specimen Tracking

Test Ordering & Scheduling

Instrument Integration & IoT Connectivity

Quality Management & Compliance

Data Reporting & Regulatory Submission Tools

Inventory & Asset Tracking

Billing & Financial Workflow

- Market Share Analysis (by Revenue & Deployments)

- LIMS/Workflow Solutions Adoption Across Sectors

- Cross‑Comparison Parameters (Company Overview, Product Portfolio Depth, Cloud vs on‑Premise Adoption, Implementation Footprint, Pricing Strategy, Integration Capabilities, Compliance Certifications, Customer Retention, Geographic Coverage, Support & Training Infrastructure)

- Major Player SWOT Profiles

- Pricing & Feature Benchmarking

- Detailed Profiles of Key Industry Players

LabWare

Thermo Fisher Scientific

Veeva Systems

PerkinElmer

Agilent Technologies

Waters Corporation

Siemens Healthineers

Abbott Informatics (STARLIMS)

Roche Diagnostics

Bio‑Rad Laboratories

LabVantage Solutions

Autoscribe Informatics

LabLynx

IDBS (Danaher)

QIAGEN

- Technology Adoption Cycles

- Procurement Budget & Buying Behaviors

- Pain Points & Value Priorities

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030