Market Overview

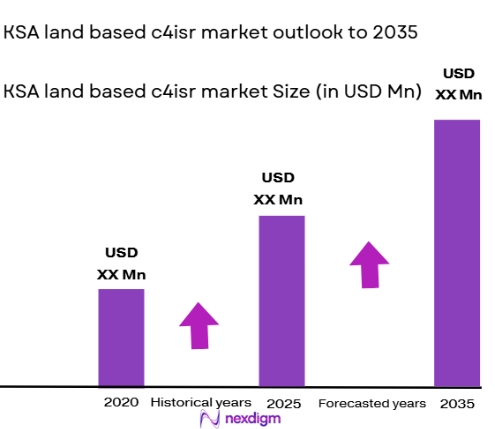

Based on a recent historical assessment, the KSA land based C4ISR market was valued at USD ~ million, reflecting strong institutional investment in integrated command, control, communications, computers, intelligence, surveillance, and reconnaissance capabilities for ground forces. Market expansion is driven by sustained defense modernization programs, heightened emphasis on network-centric warfare, and large-scale digital transformation of land force operations. Budget-backed procurement of interoperable systems, indigenous manufacturing initiatives, and demand for real-time battlefield awareness collectively reinforce spending momentum across tactical and operational C4ISR deployments.

Based on a recent historical assessment, Riyadh remains the primary center of strategic command planning and procurement activity due to the concentration of defense authorities, system integrators, and decision-making institutions. Jeddah and Dhahran play important roles through logistics coordination, industrial partnerships, and proximity to defense manufacturing clusters. National dominance is reinforced by centralized military command structures, strong state-led procurement frameworks, and long-term defense localization programs, while international partnerships with the United States and Europe continue to support advanced technology transfer and system integration.

Market Segmentation

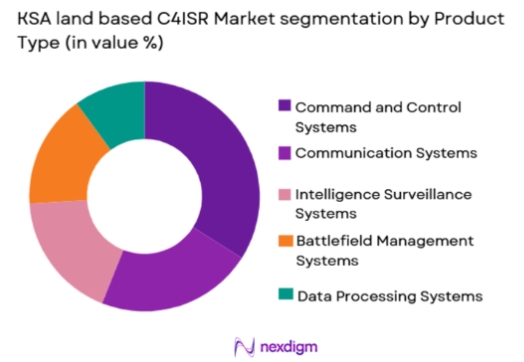

By Product Type

KSA land based C4ISR market is segmented by product type into command and control systems, communication systems, intelligence surveillance systems, battlefield management systems, and data processing systems. Recently, command and control systems have a dominant market share due to their central role in integrating sensors, communication networks, and decision-support tools across land operations. These systems are prioritized because they enable unified operational visibility, faster decision-making, and interoperability among multiple force units. High budget allocation toward centralized command infrastructure, continuous upgrades of legacy systems, and strong vendor presence supporting customization and cybersecurity have further reinforced adoption. Additionally, command and control platforms benefit from scalability, allowing integration with future technologies such as artificial intelligence and autonomous assets, which aligns with national modernization objectives and long-term defense digitalization strategies.

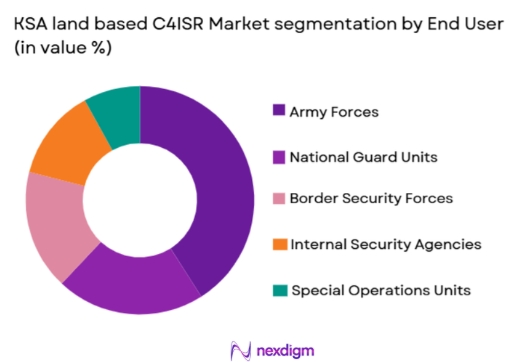

By End User

KSA land based C4ISR market is segmented by end user into army forces, national guard units, border security forces, internal security agencies, and special operations units. Recently, army forces have held a dominant market share due to their scale of operations, diversified mission requirements, and direct involvement in national defense modernization programs. Army units require comprehensive C4ISR coverage across maneuver, logistics, and command hierarchies, driving higher system volumes and complexity. Continuous training requirements, frequent system upgrades, and integration with allied forces further increase adoption. Strong institutional funding, centralized procurement authority, and priority access to advanced technologies ensure sustained demand from army forces relative to other security entities.

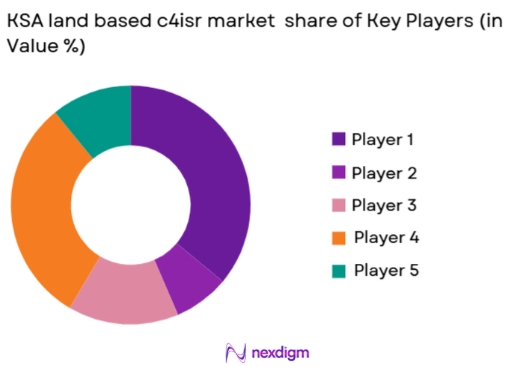

Competitive Landscape

The competitive landscape of the KSA land based C4ISR market is moderately consolidated, with a mix of domestic defense manufacturers and international primes operating through local subsidiaries and partnerships. Major players influence procurement through long-term contracts, technology transfer agreements, and system integration capabilities, while localization policies encourage joint ventures and local production.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Presence |

| Saudi Arabian Military Industries | 2017 | Riyadh | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Riyadh | ~ | ~ | ~ | ~ | ~ |

| Thales Saudi Arabia | 2007 | Riyadh | ~ | ~ | ~ | ~ | ~ |

| BAE Systems SDT | 2005 | Riyadh | ~ | ~ | ~ | ~ | ~ |

| L3Harris Arabia | 2019 | Riyadh | ~ | ~ | ~ | ~ | ~ |

KSA Land Based c4isr Market Analysis

Growth Drivers

Defense Digital Transformation and Network-Centric Warfare Adoption:

KSA land based C4ISR market is significantly driven by comprehensive defense digital transformation initiatives focused on achieving network-centric warfare capabilities across ground forces. These initiatives prioritize seamless data flow between sensors, command nodes, and combat units, enabling real-time situational awareness and faster operational decisions. Large-scale investments are directed toward replacing fragmented legacy systems with integrated digital architectures that support interoperability and scalability. The emphasis on unified command structures increases demand for advanced command and control platforms capable of aggregating intelligence from multiple sources. Strong alignment with national defense strategies ensures consistent funding and long-term procurement commitments. International military cooperation further accelerates adoption of standardized C4ISR frameworks. Growing reliance on data-driven operations elevates the importance of analytics-enabled systems. The cumulative effect is sustained demand for sophisticated land based C4ISR solutions across tactical and strategic levels.

Defense Localization and Industrial Participation Programs:

Another key growth driver is the strong policy focus on defense localization, which encourages domestic production and system integration within the Kingdom. Localization mandates incentivize global defense firms to establish manufacturing, assembly, and engineering capabilities locally. This expands the domestic supplier base and reduces procurement lead times for land based C4ISR systems. Local participation enhances customization to meet specific operational requirements of Saudi land forces. Government-backed incentives and offset programs improve project viability for large-scale deployments. Knowledge transfer initiatives build technical expertise within the local workforce. These factors collectively stimulate higher adoption rates and recurring upgrade cycles. As domestic capabilities mature, procurement confidence increases. The result is a structurally reinforced growth trajectory for the market.

Market Challenges

System Integration Complexity and Interoperability Constraints:

A major challenge facing the KSA land based C4ISR market is the complexity associated with integrating diverse systems across multiple platforms and operational units. Legacy infrastructure often lacks compatibility with modern digital architectures, increasing integration costs and timelines. Interoperability challenges arise when combining systems from different vendors with proprietary standards. Ensuring seamless data exchange across command hierarchies requires extensive customization and testing. Cybersecurity requirements further complicate integration, as secure communication protocols must be uniformly implemented. Delays in system harmonization can impact operational readiness. Skilled integration personnel are limited, increasing reliance on external expertise. These factors collectively slow deployment schedules. As system complexity grows, managing lifecycle support becomes increasingly challenging.

Dependence on Foreign Technology and Supply Chains:

Despite localization efforts, the market remains dependent on foreign technology for critical C4ISR components such as advanced sensors and encryption modules. This dependence exposes procurement programs to geopolitical risks and supply chain disruptions. Export control regulations can delay system delivery or restrict technology access. Limited domestic alternatives increase vulnerability to pricing pressures from global suppliers. Integration of imported subsystems with locally produced components adds technical risk. Maintenance and upgrades often require foreign technical support, raising lifecycle costs. Knowledge transfer gaps slow indigenous capability development. These constraints affect long-term self-sufficiency objectives. Managing foreign dependency remains a persistent structural challenge.

Opportunities

Intelligence Enabled Decision Support Systems:

Significant opportunity exists in integrating artificial intelligence into land based C4ISR platforms to enhance decision support and predictive analytics. AI-driven systems can process large volumes of battlefield data rapidly, improving threat detection and response times. Automated pattern recognition supports commanders in complex operational environments. Adoption of AI aligns with broader national digital transformation goals. Investment in AI capabilities encourages development of advanced software ecosystems. Local firms can specialize in algorithm development and system customization. Integration of AI improves operational efficiency and reduces cognitive load on personnel. Demand for such capabilities is expected to expand across all land force units. This creates strong growth potential for next-generation C4ISR solutions.

Upgrading Legacy Land Platforms with Modular C4ISR Suites:

Another major opportunity lies in upgrading existing land platforms with modular C4ISR suites rather than complete platform replacement. Modular systems reduce upgrade costs and deployment time. They allow phased integration aligned with budget cycles. Compatibility with multiple vehicle types enhances flexibility. Vendors offering scalable solutions gain competitive advantage. This approach supports gradual modernization without operational disruption. Domestic integrators can play a central role in retrofit programs. Continuous upgrades create recurring revenue streams. The retrofit opportunity significantly expands addressable market scope.

Future Outlook

The KSA land based C4ISR market is expected to experience sustained expansion over the next five years, supported by ongoing defense modernization, digital integration, and localization policies. Technological advancements in AI, secure networking, and data analytics will shape system evolution. Regulatory support for domestic manufacturing will strengthen supply chains. Rising operational complexity will continue to drive demand for advanced land based C4ISR capabilities.

Major Players

- Saudi Arabian Military Industries

- Advanced Electronics Company

- Thales Saudi Arabia

- BAE Systems Saudi Development and Training

- L3Harris Arabia

- Lockheed Martin Saudi Arabia

- Raytheon Saudi Arabia

- Northrop Grumman Saudi Arabia

- Leonardo Saudi Arabia

- Elbit Systems Arabia

- Rheinmetall Denel Munitions Saudi Arabia

- Aselsan Middle East

- Honeywell Saudi Arabia

- Indra Sistemas Saudi Arabia

- Boeing Saudi Arabia

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Homeland security organizations

- Border security authorities

- Defense system integrators

- Military modernization offices

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Core market variables, demand drivers, technology trends, and regulatory factors were identified through secondary research and expert inputs.

Step 2: Market Analysis and Construction

Data was structured by segment, end user, and competitive landscape to build a comprehensive market framework.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through discussions with defense industry professionals and regional experts.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a coherent report with qualitative and quantitative validation.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Modernization of ground force command infrastructure

Rising emphasis on network centric warfare capabilities

Integration of real time intelligence and surveillance systems

Expansion of domestic defense manufacturing capabilities

Increased focus on border and internal security digitization - Market Challenges

High system integration and interoperability complexity

Dependence on foreign technology for critical subsystems

Cybersecurity vulnerabilities in networked battlefield systems

Lengthy procurement and approval cycles

Skilled workforce limitations for advanced C4ISR operations - Market Opportunities

Localization of C4ISR software and system integration

Adoption of AI driven decision support tools

Upgrade of legacy land platforms with modular C4ISR suites - Trends

Shift toward open architecture and modular systems

Increased use of AI and machine learning in command systems

Growth of secure tactical data links

Emphasis on interoperability across allied forces

Expansion of simulation and digital twin technologies - Government Regulations & Defense Policy

Defense localization and offset compliance requirements

National cybersecurity and data sovereignty mandates

Standardization of military communication protocols - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Systems

Communications Systems

Computers and Data Processing Units

Intelligence Surveillance and Reconnaissance Systems

Integrated Battlefield Management Systems - By Platform Type (In Value%)

Armored Vehicle Mounted Systems

Mobile Command Post Systems

Fixed Land Command Centers

Man Portable C4ISR Systems

Unmanned Ground Vehicle Integrated Systems - By Fitment Type (In Value%)

New Platform Fitment

Retrofit and Upgrade Programs

Modular Mission Kits

Temporary Deployment Fitment

Permanent Installation Fitment - By EndUser Segment (In Value%)

Army and Ground Forces

National Guard Units

Border Security Forces

Internal Security Forces

Special Operations Units - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Offset Programs

Local Defense Integrators

Foreign Military Sales

Public Private Partnership Contracts - By Material / Technology (in Value %)

Software Defined Architectures

Secure Tactical Networking Hardware

AI Enabled Data Analytics

Sensor Fusion Technologies

Encrypted Communication Modules

- Cross Comparison Parameters (System Integration Capability, Local Manufacturing Presence, Technology Maturity, Cybersecurity Strength, Platform Compatibility, Lifecycle Support, Customization Flexibility, Compliance with Defense Standards, Cost Efficiency)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Advanced Electronics Company

Middle East Propulsion Company

Thales Saudi Arabia

BAE Systems Saudi Development and Training

Lockheed Martin Saudi Arabia

Raytheon Saudi Arabia

Northrop Grumman Saudi Arabia

L3Harris Arabia

Leonardo Saudi Arabia

Elbit Systems Arabia

Rheinmetall Denel Munitions Saudi Arabia

Aselsan Middle East

Honeywell Saudi Arabia

Indra Sistemas Saudi Arabia

- Operational demand for real time battlefield awareness

- Need for interoperable systems across land force units

- Focus on mobility and rapid deployment capabilities

- Requirement for secure and resilient communication networks

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035