Market Overview

Based on a recent historical assessment, the KSA land based military electro optical and infrared systems market was valued at USD ~billion, supported by officially published defense budget allocations, Ministry of Defense procurement disclosures, and contract announcements released through the General Authority for Military Industries. Market expansion is driven by sustained land forces modernization, large-scale armored vehicle upgrade programs, border surveillance reinforcement, and replacement of legacy optical sights with digitally networked electro optical and infrared systems supporting intelligence, surveillance, reconnaissance, and targeting missions across desert and urban operational environments.

Based on a recent historical assessment, Riyadh dominates as the primary center for procurement and integration due to the presence of defense command authorities, acquisition agencies, and domestic military manufacturing headquarters. The Eastern Province holds strategic importance due to energy infrastructure protection requirements, while southern border regions drive deployment intensity due to persistent security operations. Internationally, technological dominance is reinforced through strong defense-industrial relationships with the United States, France, and the United Kingdom, driven by interoperability requirements, licensed production agreements, and technology transfer frameworks aligned with national localization objectives.

Market Segmentation

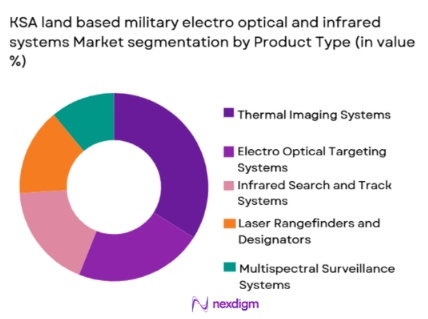

By Product Type:

KSA land based military electro optical and infrared systems market is segmented by product type into thermal imaging systems, electro optical targeting systems, infrared search and track systems, laser rangefinders and designators, and multispectral surveillance systems. Recently, thermal imaging systems have a dominant market share due to their extensive operational deployment across armored vehicles, border surveillance towers, and mobile reconnaissance platforms operating in extreme heat, dust, and low-visibility conditions. Their dominance is reinforced by proven reliability, lower integration risk, standardized procurement specifications, and compatibility with both legacy and modern land platforms. Continuous upgrades incorporating digital processing and AI-assisted image enhancement further strengthen adoption. Retrofit programs across existing fleets and infantry units also favor thermal imaging systems, ensuring sustained procurement volumes and long-term operational relevance.

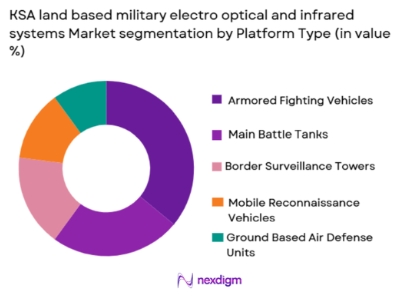

By Platform Type:

KSA land based military electro optical and infrared systems market is segmented by platform type into armored fighting vehicles, main battle tanks, border surveillance towers, mobile reconnaissance vehicles, and ground based air defense units. Recently, armored fighting vehicles have a dominant market share due to their large fleet size, continuous modernization cycles, and central role in maneuver warfare, force protection, and combined arms operations. These platforms require stabilized and ruggedized electro optical and infrared systems for detection, identification, and tracking during mobile combat. Long service life, frequent mid-life upgrades, and interoperability requirements with allied forces further reinforce sustained investment and procurement prioritization.

Competitive Landscape

The competitive landscape of the KSA land based military electro optical and infrared systems market is moderately consolidated, characterized by the presence of established global defense primes and an expanding domestic industrial base supported by localization mandates. Major players influence procurement through long-standing government relationships, certified battlefield-proven technologies, and localized assembly or manufacturing partnerships. High entry barriers related to security clearance, certification, and system integration limit new entrants, while joint ventures and offset-driven technology transfer agreements shape competitive positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Capability |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ |

KSA land based military electro optical and infrared systems Market Analysis

Growth Drivers

Border Security Reinforcement and Persistent Surveillance Requirements:

Border Security Reinforcement and Persistent Surveillance Requirements are a primary growth driver for the KSA land based military electro optical and infrared systems market as national defense priorities emphasize continuous monitoring of extended land borders and critical infrastructure zones. The operational environment requires persistent day and night surveillance capable of detecting asymmetric threats, small vehicle movements, and unmanned aerial incursions. Electro optical and infrared systems deliver real-time intelligence supporting rapid decision-making and coordinated responses. Fixed and mobile ground-based deployments expand coverage across remote terrain. Integration with command and control networks improves operational effectiveness. AI-enabled analytics enhance detection accuracy. Sustained funding allocations reinforce procurement continuity. These combined factors create long-term demand stability.

Armored Fleet Modernization and Combat Readiness Enhancement:

Armored Fleet Modernization and Combat Readiness Enhancement significantly drive market expansion as land forces upgrade platforms to extend service life and improve lethality. Modern warfare doctrine prioritizes sensor superiority and rapid target acquisition. Electro optical and infrared systems replace obsolete optics to support precision engagement. Retrofit programs generate recurring demand. Interoperability standards necessitate system upgrades. Crew survivability requirements increase adoption. Localization initiatives support supply resilience. These elements collectively sustain growth momentum.

Market Challenges

Dependence on Imported Sensor Technologies and Export Controls:

Dependence on Imported Sensor Technologies and Export Controls remains a critical challenge as advanced infrared detectors, focal plane arrays, and optical components are sourced internationally. Export restrictions can delay deliveries and limit technology transfer. Supply chain disruptions elevate program risk. Localization efforts require substantial capital and expertise. Certification processes extend timelines. Cost volatility complicates budgeting. Strategic dependency concerns persist. These issues constrain rapid scalability.

High Lifecycle Costs and Integration Complexity:

High Lifecycle Costs and Integration Complexity challenge adoption as electro optical and infrared systems require significant long-term investment. Platform-specific integration increases customization costs. Harsh operating environments accelerate maintenance requirements. Skilled workforce shortages elevate operational expenses. Software upgrades add recurring costs. Cybersecurity compliance increases complexity. Budget planning becomes constrained. These factors impact procurement efficiency.

Opportunities

Defense Localization and Indigenous Manufacturing Expansion:

Defense Localization and Indigenous Manufacturing Expansion present strong opportunity as national policy prioritizes domestic capability development. Joint ventures enable gradual technology absorption. Local production reduces supply risk. Domestic maintenance improves system availability. Economic diversification objectives align with defense manufacturing. Government incentives support investment. Workforce development enhances sustainability. These dynamics create long-term market upside.

Artificial Intelligence Enabled Sensor Fusion Deployment:

Artificial Intelligence Enabled Sensor Fusion Deployment offers significant opportunity through enhanced detection and classification capabilities. AI reduces operator workload. Sensor fusion improves situational awareness. Integration with autonomous systems expands applications. Software-driven upgrades generate recurring revenue. Demand for predictive surveillance is rising. Interoperability enhances platform value. These advancements attract premium contracts.

Future Outlook

The KSA land based military electro optical and infrared systems market is expected to witness steady expansion over the next five years. Growth will be supported by continued modernization, AI integration, and localization initiatives. Regulatory support and sustained defense spending will reinforce demand. Border security and platform upgrades will remain key drivers.

Major Players

- Saudi Arabian Military Industries

- Thales Group

- Leonardo

- Elbit Systems

- L3Harris Technologies

- Raytheon Technologies

- Northrop Grumman

- Rheinmetall Defence

- Safran Electronics & Defense

- Hensoldt

- ASELSAN

- BAE Systems

- FLIR Systems

- Israel Aerospace Industries

- Kongsberg Defence & Aerospace

Key Target Audience

- Defenseministries and armed forces

- Government and regulatory bodies

- Investments and venture capitalist firms

- Military procurement agencies

- Defense OEMs and system integrators

- Homeland security organizations

- Border security authorities

- Defense technology manufacturers

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, regulatory, and technology variables were identified through analysis of defense budgets, procurement programs, and modernization initiatives shaping land-based sensing requirements.

Step 2: Market Analysis and Construction

Data was compiled from government publications, defense disclosures, and company reports, then structured using triangulation across platforms, products, and procurement channels.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert consultations with defense analysts and former military officials to ensure alignment with operational realities and procurement practices.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured report, ensuring accuracy, consistency, and compliance with methodological rigor.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of land force modernization programs

Rising border security and surveillance requirements

Increased investment in indigenous defense manufacturing

Integration of EO IR systems with armored platforms

Focus on network centric and situational awareness systems - Market Challenges

High acquisition and lifecycle maintenance costs

Dependence on imported critical sensor components

Complex integration with legacy land platforms

Stringent military qualification and testing requirements

Cybersecurity and data protection concerns - Market Opportunities

Localization of EO IR production under national defense programs

Upgrades of existing armored vehicle fleets

Adoption of AI driven image analytics for land operations - Trends

Shift toward multi sensor EO IR fusion systems

Growing use of uncooled thermal imaging for mobility platforms

Increased emphasis on long range target identification

Integration with battlefield management systems

Demand for compact and lightweight EO IR payloads - Government Regulations & Defense Policy

National defense localization mandates

Offset and technology transfer requirements

Standardization of military surveillance systems - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Thermal imaging surveillance systems

Electro optical day cameras

EO IR sensor fusion systems

Laser rangefinder and designator systems

Target acquisition and tracking systems - By Platform Type (In Value%)

Main battle tanks and armored vehicles

Infantry fighting vehicles

Border surveillance towers

Mobile ground surveillance vehicles

Fixed land installations and bases - By Fitment Type (In Value%)

OEM integrated systems

Retrofit and upgrade installations

Modular mission payloads

Remote weapon station integration

Command and control integrated fitments - By EndUser Segment (In Value%)

Saudi Land Forces

Royal Saudi National Guard

Border Guard units

Special operations forces

Internal security and homeland defense units - By Procurement Channel (In Value%)

Direct government procurement

Foreign military sales programs

Local defense integrators

Strategic joint ventures

Technology transfer based contracts - By Material / Technology (in Value %)

Cooled infrared detectors

Uncooled microbolometer sensors

CMOS and CCD optical sensors

Advanced image processing electronics

AI enabled target recognition software

- Cross Comparison Parameters (sensor resolution, detection range, system weight, integration compatibility, environmental endurance, power consumption, lifecycle support, localization capability, cost efficiency)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Advanced Electronics Company

Thales Group

Leonardo S.p.A.

Rheinmetall Defence

Elbit Systems

Aselsan

Hensoldt

FLIR Systems

Safran Electronics & Defense

BAE Systems

L3Harris Technologies

Rafael Advanced Defense Systems

Kongsberg Defence & Aerospace

Raytheon Technologies

- Preference for ruggedized systems suited for desert environments

- Growing demand for interoperable and networked sensors

- Focus on rapid deployment and mobility support

- Requirement for long term sustainment and local support

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035